Federal Debt Crisis: What It Means For Homebuyers

Table of Contents

Rising Interest Rates and Mortgage Costs

The federal debt crisis often leads to increased government borrowing, which puts upward pressure on interest rates. Higher interest rates directly translate to higher mortgage payments, making homeownership less affordable for many. This is because increased government borrowing competes with private sector borrowing, driving up the cost of borrowing across the board. The Federal Reserve, in an attempt to manage inflation, may also raise the federal funds rate, impacting mortgage rates.

- Increased borrowing by the government: This competition for funds increases demand and thus pushes interest rates higher.

- Higher mortgage rates: A 1% increase in interest rates can significantly increase the monthly mortgage payment, potentially pricing some buyers out of the market. This effect is magnified on larger loans.

- Impact on affordability: The impact on affordability is especially pronounced for first-time homebuyers with smaller down payments, as they often rely more heavily on financing.

- Predicting future rates: While predicting future interest rate hikes is difficult, staying informed about economic indicators and Federal Reserve announcements is vital for homebuyers. Tracking the 10-year Treasury yield can offer insights into future mortgage rate trends.

Inflation and Housing Prices

A growing federal debt can contribute to inflation, eroding the purchasing power of consumers. This means that the same amount of money buys less, leading to higher housing prices and further straining affordability for homebuyers. This inflationary pressure can be exacerbated by supply chain issues and other economic factors.

- Inflation reduces purchasing power: As inflation rises, your money buys less, making even existing homes more expensive.

- Increased demand, limited supply: High inflation can lead to increased demand for real estate as people seek a hedge against inflation, but limited supply can push prices even higher.

- Long-term housing costs: It's crucial to consider how inflation could affect your long-term housing costs, including property taxes and maintenance expenses.

- Budgeting for inflation: Understanding inflation rates and their potential impact on your budget is vital for navigating the home-buying process. Building inflation into your financial projections is a crucial aspect of responsible home buying.

Economic Uncertainty and Market Volatility

The federal debt crisis creates economic uncertainty, impacting investor confidence and potentially leading to volatility in the housing market. This uncertainty can make it difficult to predict future housing prices and mortgage rates, making home buying a riskier proposition.

- Decreased investor confidence: Economic uncertainty can cause investors to pull back from the real estate market, potentially leading to price corrections.

- Market volatility: Fluctuations in interest rates and housing prices make it harder for homebuyers to secure financing or accurately predict future home values.

- Investment risk assessment: Consult with financial professionals to understand the risks associated with buying a home in uncertain economic times. A thorough risk assessment is vital before making a large financial commitment.

- Personal financial situation: Carefully assess your personal financial situation and risk tolerance before making a decision. Ensure you have a financial safety net to weather potential market downturns.

Strategies for Homebuyers During a Federal Debt Crisis

Despite the challenges, there are strategies homebuyers can employ to navigate the current climate. Proactive planning and financial prudence are key to success.

- Improve your credit score: A higher credit score will qualify you for better mortgage rates, saving you money over the life of the loan.

- Save for a larger down payment: A larger down payment reduces your loan amount and monthly payments, making your mortgage more manageable.

- Explore mortgage options: Shop around and compare different mortgage options, including fixed-rate and adjustable-rate mortgages (ARMs), to find the best terms and interest rates.

- Get pre-approved for a mortgage: Getting pre-approved gives you a clear understanding of your buying power and strengthens your negotiating position.

- Seek professional advice: Consult with a qualified financial advisor to create a comprehensive financial plan that accounts for the current economic climate.

Conclusion

The federal debt crisis presents significant challenges for homebuyers, primarily through rising interest rates, inflation-driven price increases, and overall economic uncertainty. However, by understanding these impacts and implementing proactive strategies, prospective homebuyers can better navigate this complex market. Careful financial planning, diligent saving, and seeking expert advice are crucial steps in achieving your homeownership goals even during a federal debt crisis. Don't let the federal debt crisis deter your dreams – take control of your financial future and start planning your path to homeownership today. Begin by assessing your financial health and exploring your options for navigating the current economic environment. The federal debt crisis is a complex issue, but with careful planning, your dream of homeownership remains within reach.

Featured Posts

-

Khtt Qablt Lltnfydh Liemar Ghzt Ajtmae Nqyb Almhndsyn

May 19, 2025

Khtt Qablt Lltnfydh Liemar Ghzt Ajtmae Nqyb Almhndsyn

May 19, 2025 -

Svt Redo Att Arrangera Eurovision Om Kaj Vinner I Basel

May 19, 2025

Svt Redo Att Arrangera Eurovision Om Kaj Vinner I Basel

May 19, 2025 -

March 13 Nyt Mini Crossword Answers Solve The Puzzle Today

May 19, 2025

March 13 Nyt Mini Crossword Answers Solve The Puzzle Today

May 19, 2025 -

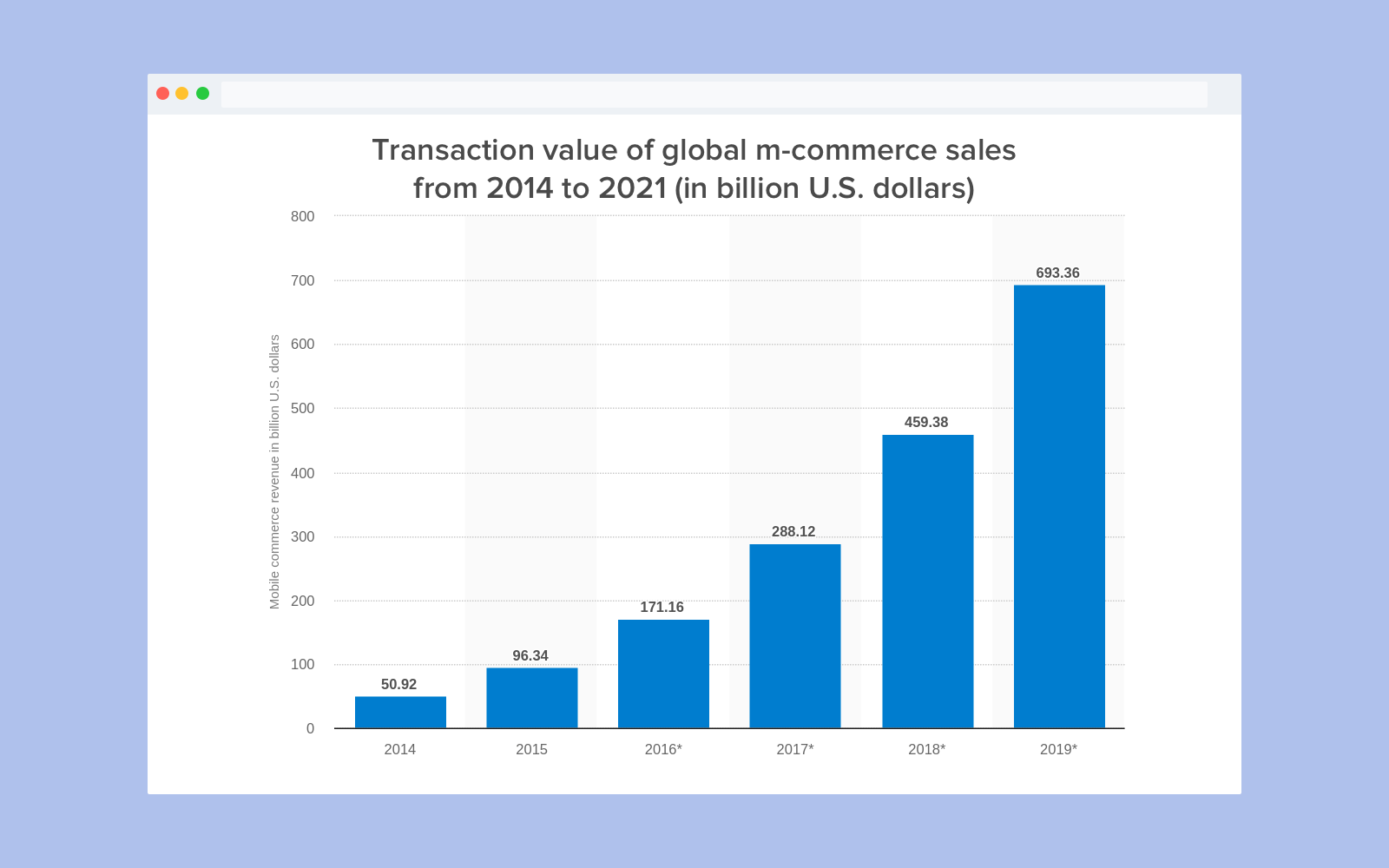

Is Mobile Marketing The Future Of E Commerce A Comprehensive Analysis

May 19, 2025

Is Mobile Marketing The Future Of E Commerce A Comprehensive Analysis

May 19, 2025 -

Johnny Mathis Retires From Live Performances The End Of An Era

May 19, 2025

Johnny Mathis Retires From Live Performances The End Of An Era

May 19, 2025