Federal Reserve And Interest Rates: Reasons For Delayed Cuts

Table of Contents

Persistent Inflation as a Primary Obstacle

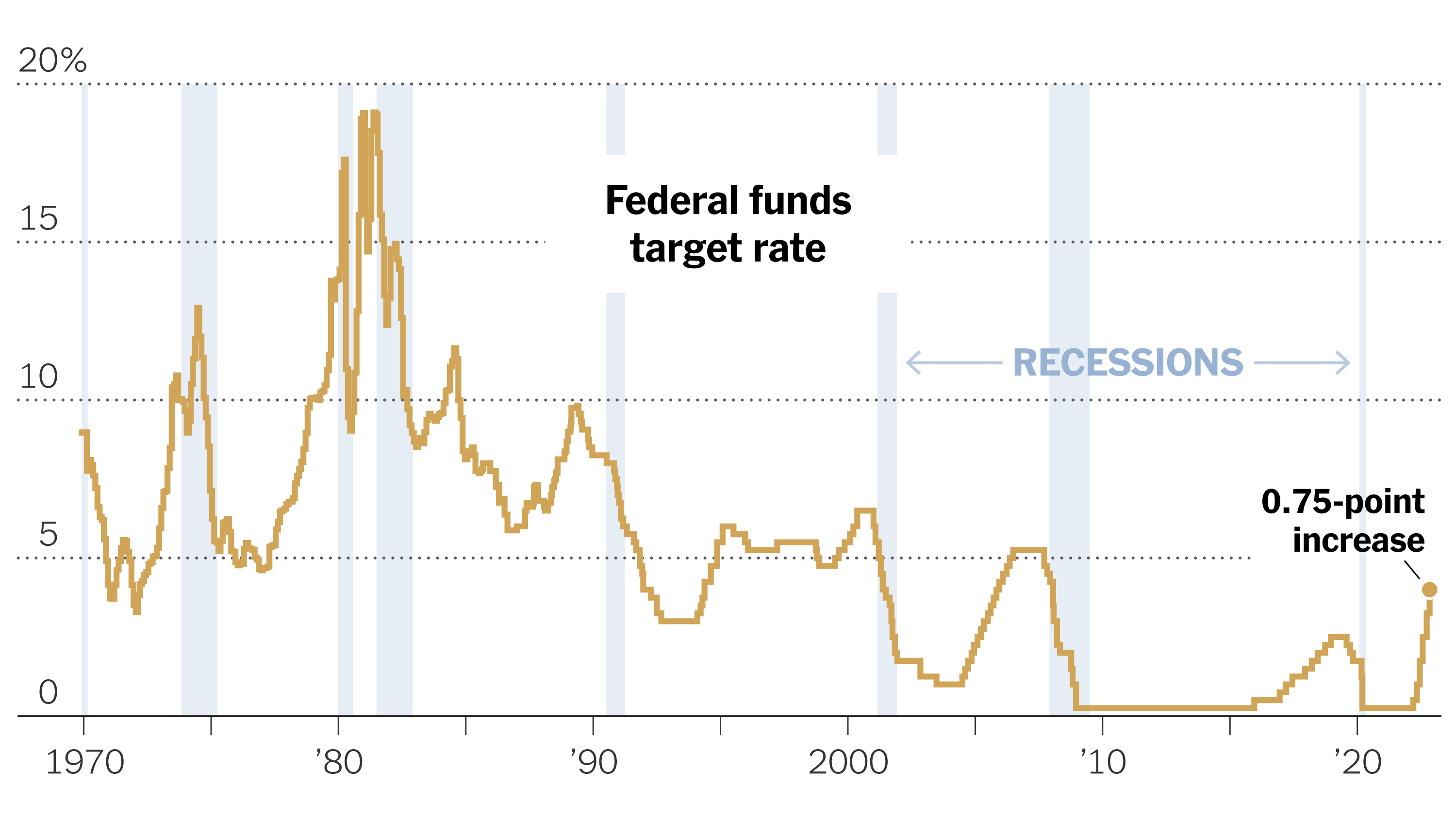

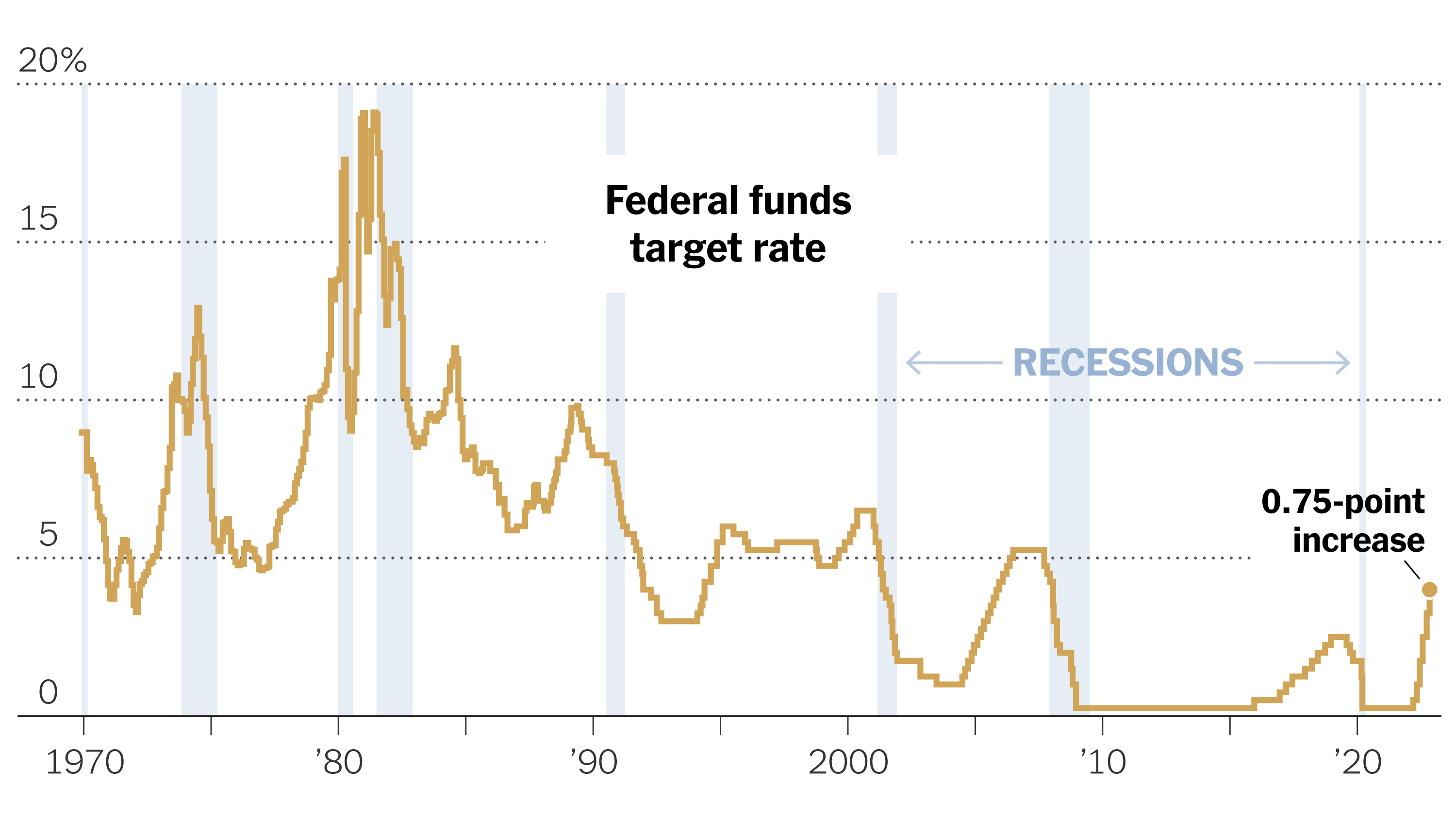

Even with headline inflation easing, the Federal Reserve's primary concern remains the persistent threat of inflation. A deeper dive into the data reveals why interest rate cuts remain unlikely in the near future.

Core Inflation Remains Elevated

Even as headline inflation figures show some improvement, core inflation – a measure that excludes volatile food and energy prices – continues to stubbornly resist downward pressure. This is a major red flag for the Fed.

- Core inflation excludes volatile food and energy prices, providing a clearer picture of long-term inflationary pressures within the economy. Understanding this distinction is key to interpreting Federal Reserve interest rate decisions.

- The Fed aims to achieve its 2% inflation target. Deviations from this goal, particularly the persistent elevation of core inflation, significantly impact their decision-making regarding interest rate adjustments.

- Sticky wages and strong consumer demand contribute to the continued elevation of core inflation. This means that underlying inflationary pressures are still present, necessitating a cautious approach to monetary policy and Federal Reserve interest rates.

Inflation Expectations: A Self-Fulfilling Prophecy?

The Federal Reserve also closely monitors inflation expectations – what consumers and businesses anticipate future inflation will be. These expectations can significantly influence actual inflation.

- If people expect higher prices, they'll demand higher wages, leading to a wage-price spiral. This makes managing inflation even more challenging and underscores the importance of managing Federal Reserve interest rates effectively.

- The Fed's actions aim to anchor inflation expectations to their 2% target. By managing expectations, the Fed hopes to prevent a self-fulfilling prophecy of persistently high inflation, influencing the future trajectory of Federal Reserve interest rates.

Strong Labor Market and Tight Employment

Another key factor contributing to the delay in interest rate cuts is the remarkably strong US labor market. While positive for the economy overall, this strength presents a challenge for the Fed.

Low Unemployment Rates and Wage Pressures

The current low unemployment rates contribute to wage pressures and inflationary pressures, making it difficult for the Fed to justify lowering interest rates.

- Tight labor markets give workers more bargaining power, leading to higher wage demands. This increase in labor costs is directly passed on to consumers in the form of higher prices.

- Higher wages, in turn, contribute to increased consumer spending and fuel inflation. This creates a challenging cycle for the Federal Reserve to manage through adjustments to interest rates.

Robust Job Growth: A Double-Edged Sword

Consistent job growth is a positive indicator of a healthy economy, but it also contributes to upward pressure on wages and prices. The Fed must tread carefully.

- The Fed needs to carefully balance controlling inflation with protecting the economy from a downturn. Premature interest rate cuts could reignite inflation and undo progress made in cooling the economy. Understanding this delicate balancing act is crucial when analyzing Federal Reserve interest rates.

- Premature interest rate cuts could reignite inflation and undo progress made in cooling the economy. This cautious approach is a key reason behind the Fed's current stance on Federal Reserve interest rates.

Geopolitical Uncertainty and Supply Chain Disruptions

Global economic instability and persistent supply chain disruptions add further complexity to the Federal Reserve's decision-making process regarding interest rates.

Global Economic Instability

The war in Ukraine and other global events create uncertainty and inflationary pressures, making it difficult for the Fed to accurately predict future economic trends.

- These external shocks can unexpectedly impact inflation and the Fed's ability to predict economic trends. This unpredictability makes it crucial for the Fed to remain cautious with Federal Reserve interest rate adjustments.

- The Fed must factor in these global uncertainties when setting monetary policy. This underscores the complexity of managing Federal Reserve interest rates in a globally interconnected economy.

Energy Prices and Commodity Costs

Fluctuations in energy and commodity prices further complicate the inflation outlook, adding another layer of uncertainty.

- Changes in global energy markets can significantly affect inflation both domestically and globally. This factor adds further weight to the cautious approach of the Federal Reserve regarding interest rates.

- These factors require a careful and adaptive approach from the Fed. The dynamic nature of global commodity markets necessitates a flexible approach to setting Federal Reserve interest rates.

Conclusion

The Federal Reserve's cautious approach to cutting interest rates is rooted in a complex interplay of persistent inflation, a robust labor market, and significant geopolitical uncertainty. While a reduction in interest rates might be anticipated by some, the Fed's priority remains in achieving its 2% inflation target without triggering a recession. Staying informed about the latest developments concerning Federal Reserve interest rates and the economic indicators influencing their decisions is crucial for navigating the current economic climate. Understanding the factors discussed in this article will empower you to make more informed decisions regarding your financial planning and investments. Keep a close watch on announcements regarding Federal Reserve interest rates to make the best choices for your financial future.

Featured Posts

-

Predstoyasch Rimeyk Na Stivn King Ot Netflix

May 10, 2025

Predstoyasch Rimeyk Na Stivn King Ot Netflix

May 10, 2025 -

168 Million Whats App Spyware Judgment Impact On Meta And Future Of Messaging Security

May 10, 2025

168 Million Whats App Spyware Judgment Impact On Meta And Future Of Messaging Security

May 10, 2025 -

Chuyen Tinh Ngot Ngao Cua Lynk Lee Va Ban Trai Sau Khi Chuyen Gioi

May 10, 2025

Chuyen Tinh Ngot Ngao Cua Lynk Lee Va Ban Trai Sau Khi Chuyen Gioi

May 10, 2025 -

Otsutstvie Starmera Makrona Mertsa I Tuska V Kieve 9 Maya

May 10, 2025

Otsutstvie Starmera Makrona Mertsa I Tuska V Kieve 9 Maya

May 10, 2025 -

Nyt Spelling Bee April 1 2025 Pangram And Word List

May 10, 2025

Nyt Spelling Bee April 1 2025 Pangram And Word List

May 10, 2025