Federal Reserve Maintains Rates: Balancing Inflation And Unemployment

Table of Contents

The Federal Reserve maintains rates – this seemingly simple statement carries immense weight for the US economy. The recent decision to hold interest rates steady represents a carefully considered approach, a delicate balancing act between taming persistent inflation and fostering continued job growth. This complex decision has significant implications for consumers, businesses, and the global market, and understanding its nuances is crucial.

The Current Economic Landscape: Inflation and Unemployment Data

The Federal Reserve's decision comes against a backdrop of persistent, albeit moderating, inflation and a robust, though potentially cooling, job market. Analyzing the current economic landscape requires examining key indicators such as the inflation rate, unemployment figures, and GDP growth.

-

Inflation: The Consumer Price Index (CPI), a key measure of inflation, has shown signs of slowing but remains elevated above the Federal Reserve's 2% target. Recent data from the Bureau of Labor Statistics (BLS) shows a CPI increase of [Insert latest CPI data]% year-over-year. The Producer Price Index (PPI), which measures inflation at the wholesale level, also provides valuable insights into price pressures in the economy.

-

Unemployment: Unemployment figures remain low, indicating a healthy job market. The BLS reported an unemployment rate of [Insert latest unemployment rate]% in [Insert month, year], suggesting continued strength in the labor market. However, wage growth, while strong, is also a factor considered by the Fed as it relates to inflationary pressures.

-

GDP Growth: The current state of GDP growth provides additional context. A robust GDP signals economic expansion, but excessively rapid growth can contribute to inflationary pressures. The latest estimates put GDP growth at [Insert latest GDP growth data]%, [Add context – e.g., reflecting a slowdown from previous quarters].

Reasons Behind the Federal Reserve's Decision to Maintain Rates

The Federal Reserve's decision to maintain interest rates reflects a strategic assessment of the current economic situation and the potential risks associated with altering monetary policy. The Federal Open Market Committee (FOMC), the body responsible for setting interest rates, likely considered several crucial factors:

-

Risk Assessment: The FOMC carefully weighed the risks of both raising and lowering rates. Raising rates could stifle economic growth and potentially lead to job losses, while lowering rates might fuel inflation further.

-

Inflation Trajectory: While inflation is moderating, it is still above the Fed's target. Maintaining rates provides time to assess whether the current disinflationary trend will continue without further intervention.

-

Data Dependency: The FOMC’s statement likely emphasized a data-dependent approach, suggesting that future decisions will be guided by incoming economic data on inflation, unemployment, and other key indicators. They are likely waiting for clearer signals before taking further action.

-

The “Soft Landing”: The Fed aims for a "soft landing"—slowing economic growth enough to tame inflation without triggering a recession. Maintaining rates allows the Fed to pursue this delicate goal.

Potential Impacts of Maintaining Interest Rates

The Federal Reserve's decision to hold interest rates steady carries a range of potential impacts on the US economy and beyond:

-

Positive Impacts: Maintaining rates could support continued job growth and bolster consumer spending, particularly if inflation continues to moderate as predicted. Stable interest rates might also provide a degree of certainty for businesses, encouraging investment.

-

Negative Impacts: The primary risk is that persistent inflation could continue, eroding purchasing power. If inflation remains stubbornly high, the Fed might eventually need to raise rates more aggressively in the future, potentially triggering a more severe economic slowdown.

Impact on the Housing Market

Maintaining rates, at least temporarily, should provide some relief to the housing market. While mortgage rates are influenced by a range of factors beyond the Fed's direct control, a pause in interest rate hikes should help to stabilize mortgage rates and potentially prevent further declines in housing prices.

Impact on Consumer Spending

Consumer spending is a significant driver of economic growth. Maintaining rates could bolster consumer confidence, which might lead to increased spending. However, the impact will depend on factors such as inflation and wage growth. If inflation outpaces wage growth, consumer spending may remain subdued despite stable interest rates. Retail sales figures will be closely watched to assess the impact.

Conclusion

The Federal Reserve's decision to maintain rates reflects a calculated approach to navigate the current economic landscape, balancing the need to control inflation with the desire to support robust employment. The potential impacts are complex and multifaceted, affecting the housing market, consumer spending, and the broader global economy. The decision highlights the complexities of monetary policy and the significant challenges involved in achieving a "soft landing." Monitoring the Federal Reserve's monetary policy for further insights is critical for understanding the trajectory of the US economy. Stay updated on future Federal Reserve interest rate announcements and learn more about how the Federal Reserve maintains rates and its effect on the economy by visiting the Federal Reserve's website [link to Federal Reserve website] and following reputable financial news sources.

Featured Posts

-

Bajaj Twins Drag On Market Sensex And Nifty 50 End Day Flat Amidst India Pakistan Tensions

May 09, 2025

Bajaj Twins Drag On Market Sensex And Nifty 50 End Day Flat Amidst India Pakistan Tensions

May 09, 2025 -

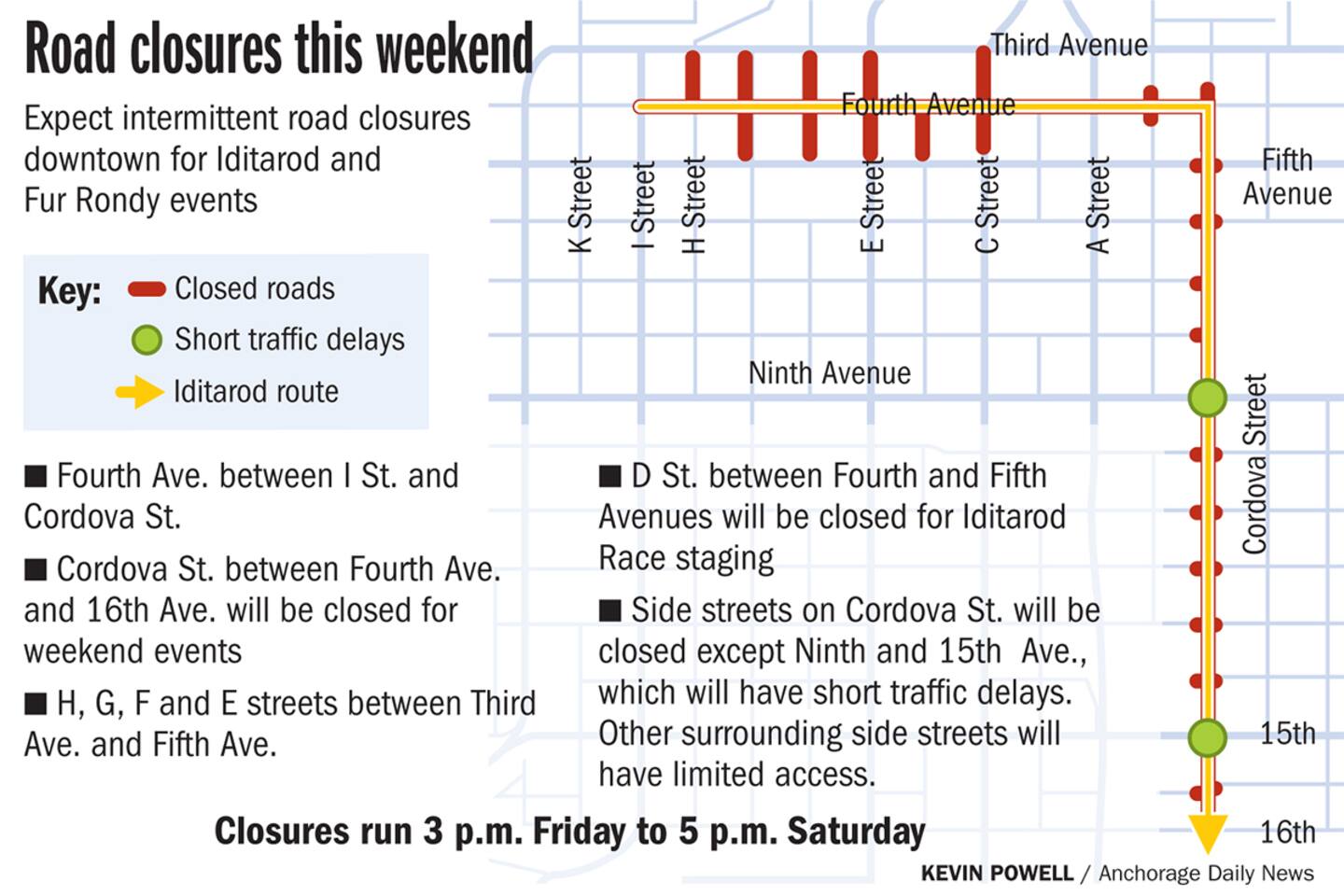

2025 Iditarod Ceremonial Start Downtown Anchorage Thronged With Spectators

May 09, 2025

2025 Iditarod Ceremonial Start Downtown Anchorage Thronged With Spectators

May 09, 2025 -

Elizabeth Arden Skincare On A Budget Walmart Guide

May 09, 2025

Elizabeth Arden Skincare On A Budget Walmart Guide

May 09, 2025 -

Uk Government Considers Visa Restrictions For Certain Nationalities

May 09, 2025

Uk Government Considers Visa Restrictions For Certain Nationalities

May 09, 2025 -

Nhl Prediction Oilers Vs Sharks Betting Analysis And Odds

May 09, 2025

Nhl Prediction Oilers Vs Sharks Betting Analysis And Odds

May 09, 2025