Federal Student Loan Refinancing: Should You Use A Private Lender?

Table of Contents

Understanding Federal Student Loan Programs and Their Benefits

Before diving into private student loan refinancing, it's crucial to understand the benefits of your current federal student loans. These loans offer protections not typically found with private loans.

- Income-Driven Repayment Plans: These plans adjust your monthly payments based on your income and family size, making repayment more manageable during challenging financial periods.

- Deferment and Forbearance Options: Federal loans provide options to temporarily suspend or reduce your payments during times of hardship, such as unemployment or illness.

- Loan Forgiveness Programs: Certain professions, like teaching or public service, may qualify for partial or complete loan forgiveness after meeting specific requirements. Programs like Public Service Loan Forgiveness (PSLF) offer significant debt relief.

Common federal student loan programs include:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- PLUS Loans (for parents and graduate students)

The critical consideration: Refinancing your federal student loans with a private lender typically means losing these valuable benefits. You'll forfeit the safety net provided by the federal government, potentially leaving you vulnerable during financial difficulties. This is a significant trade-off that needs careful evaluation as part of your student loan refinancing strategy. Understanding the federal loan forgiveness options you may be giving up is paramount. Consider your eligibility for income-driven repayment and other student loan repayment plans before making any decision.

The Allure of Private Student Loan Refinancing

Private student loan refinancing holds significant appeal for some borrowers. The primary draw is the potential for:

- Lower Interest Rates: Private lenders may offer lower interest rates than your current federal loans, especially if you have a strong credit score. This can lead to significant savings over the life of your loan. A lower interest rate directly translates into less money paid overall in student loan refinancing.

- Shorter Repayment Terms: Refinancing can allow you to shorten your repayment period. While this increases your monthly payment, you'll pay off your debt faster and potentially save on interest in the long run. This is a major aspect to weigh in your student loan refinancing considerations.

- Student Loan Consolidation: If you have multiple federal student loans, refinancing can simplify your payments into a single monthly payment. This streamlining can improve financial organization.

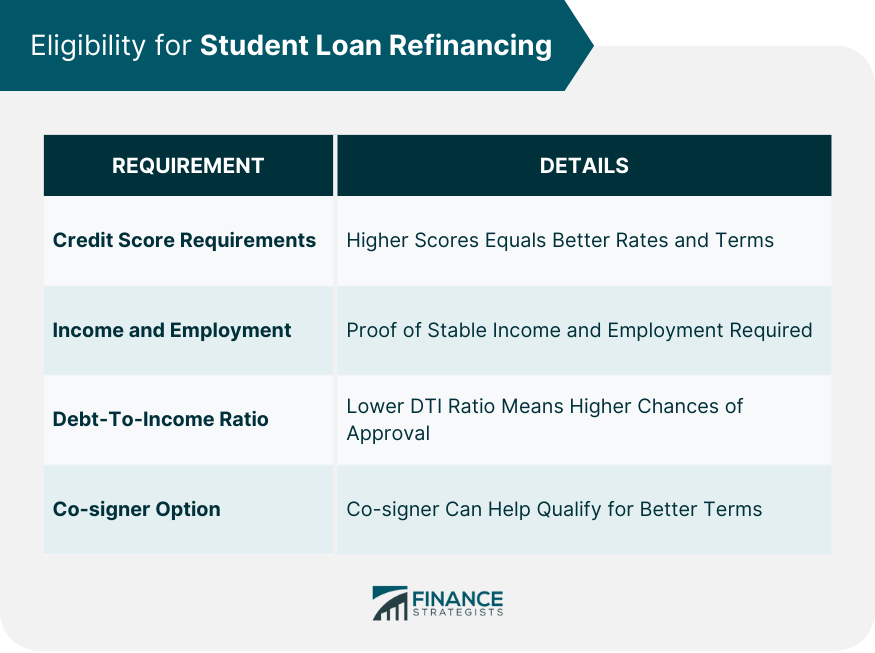

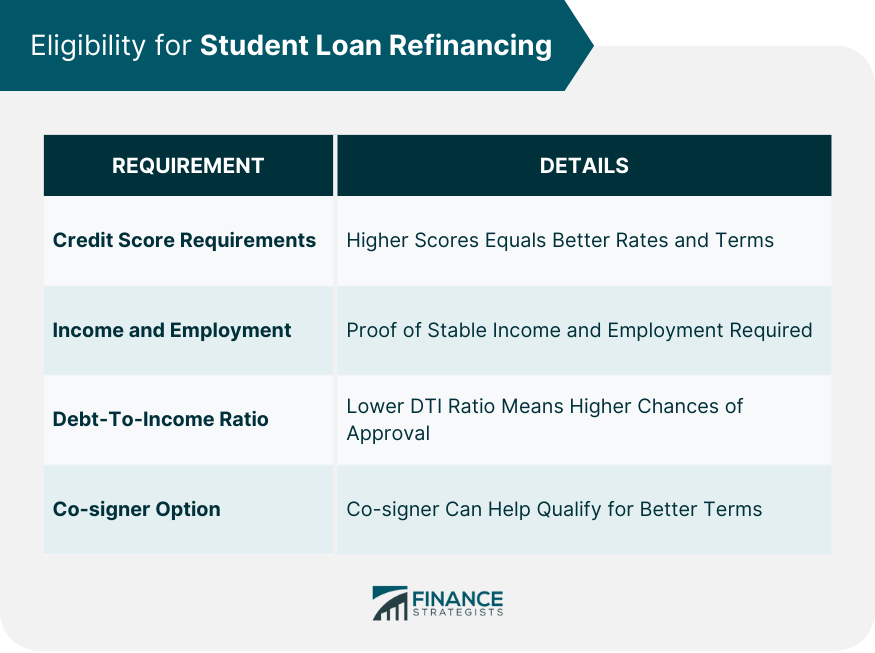

Factors to Consider Before Refinancing with a Private Lender

Before jumping into private private student loan refinancing, carefully consider these factors:

- Credit Score: Your credit score heavily influences the interest rate you'll receive. A higher credit score means a better chance of securing a lower rate.

- Interest Rate Comparison: Don't settle for the first offer. Compare interest rates and fees from multiple private lenders to ensure you're getting the best deal. A thorough interest rate comparison is crucial for successful student loan refinancing.

- Loss of Federal Benefits: Refinancing with a private lender means losing access to federal benefits like income-driven repayment plans, deferment, and forbearance. This is a significant risk.

- Credit Score Volatility: Your interest rate may change if your credit score deteriorates after refinancing. This could negate any initial savings from student loan refinancing. Therefore, carefully consider your ability to maintain a good credit history.

- Fees: Be aware of any origination fees or prepayment penalties associated with private student loans. These can impact your overall cost.

Comparing Federal and Private Refinancing Options

To make an informed decision, compare federal and private refinancing options side-by-side. This table illustrates key differences:

| Feature | Federal Refinancing | Private Refinancing |

|---|---|---|

| Interest Rates | Generally higher | Potentially lower, dependent on credit score |

| Fees | Typically lower | Potentially higher, including origination fees |

| Repayment Terms | Flexible, including income-driven repayment plans | Typically shorter, potentially higher monthly payments |

| Benefits | Income-driven repayment, deferment, forgiveness | None of the above |

| Risk | Lower risk due to federal protections | Higher risk due to potential loss of federal benefits |

Remember to factor in the long-term cost implications. A slightly lower interest rate might not be worth sacrificing the protections afforded by federal loans. A detailed refinancing cost comparison is essential for your student loan refinancing decision.

Steps to Take Before Refinancing Your Federal Student Loans

Before refinancing, take these crucial steps:

- Check Your Credit Report and Score: Knowing your credit score will help you understand the rates you're likely to qualify for.

- Shop Around and Compare Offers: Don't settle for the first offer you receive. Compare offers from multiple lenders to find the best terms.

- Carefully Read the Loan Agreement: Understand all the terms and conditions before signing anything. A thorough review of your student loan agreement is vital.

- Understand the Implications of Losing Federal Loan Protections: Weigh the potential benefits against the risks of losing valuable federal protections.

Conclusion: Making the Right Choice for Your Federal Student Loan Refinancing

Refinancing federal student loans with a private lender can offer advantages like lower interest rates and simplified payments. However, it’s crucial to carefully weigh these benefits against the potential loss of valuable federal protections. Thorough research and comparison shopping are paramount. Consider your individual circumstances, credit score, and long-term financial goals before making a decision. Carefully analyze the refinancing cost comparison, and remember to utilize the resources available to compare lenders and fully understand the implications of your student loan refinancing decision. Make an informed choice that aligns with your financial well-being. Use online resources and consult with a financial advisor to help navigate the complexities of federal student loan refinancing.

Featured Posts

-

Warner Bros Pictures At Cinema Con 2025 Film Announcements And More

May 17, 2025

Warner Bros Pictures At Cinema Con 2025 Film Announcements And More

May 17, 2025 -

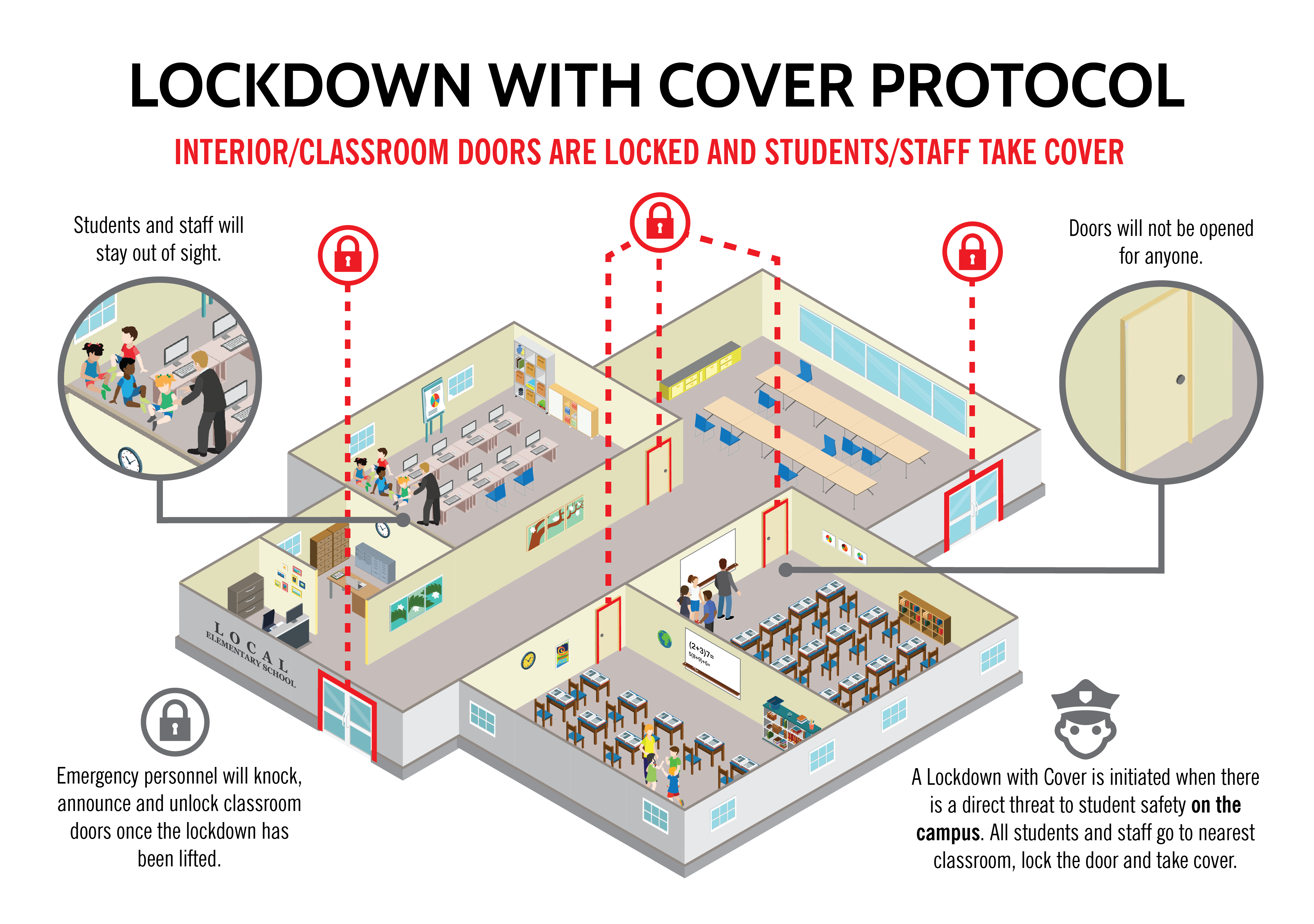

Understanding Florida School Shooter Lockdown Procedures A Generations Challenge

May 17, 2025

Understanding Florida School Shooter Lockdown Procedures A Generations Challenge

May 17, 2025 -

Japans Economy Q1 Contraction And The Looming Threat Of Tariffs

May 17, 2025

Japans Economy Q1 Contraction And The Looming Threat Of Tariffs

May 17, 2025 -

Securing Rare Earth Minerals Avoiding A New Cold War

May 17, 2025

Securing Rare Earth Minerals Avoiding A New Cold War

May 17, 2025 -

Analyzing The Role Of Sexual Misconduct And Affair Allegations In Donald Trumps Election

May 17, 2025

Analyzing The Role Of Sexual Misconduct And Affair Allegations In Donald Trumps Election

May 17, 2025

Latest Posts

-

Report Doctor Who Christmas Special Cancelled For 2024

May 17, 2025

Report Doctor Who Christmas Special Cancelled For 2024

May 17, 2025 -

Doctor Who Christmas Special Production Halt And Future Uncertain

May 17, 2025

Doctor Who Christmas Special Production Halt And Future Uncertain

May 17, 2025 -

Spanish Townhouse Renovation By Alan Carr And Amanda Holden E245 000

May 17, 2025

Spanish Townhouse Renovation By Alan Carr And Amanda Holden E245 000

May 17, 2025 -

No Doctor Who Christmas Special This Year Fans React To Rumours

May 17, 2025

No Doctor Who Christmas Special This Year Fans React To Rumours

May 17, 2025 -

Alan Carr And Amanda Holdens Renovated Spanish Townhouse On Sale For E245 K

May 17, 2025

Alan Carr And Amanda Holdens Renovated Spanish Townhouse On Sale For E245 K

May 17, 2025