Fed's Rate Hike Pause: Why A Cut Isn't On The Horizon

Table of Contents

Persistent Inflation Remains a Major Concern

Core inflation, which excludes volatile food and energy prices, remains stubbornly high. Recent data reveals a persistent upward trend, defying expectations of a swift return to the Fed's 2% inflation target. This persistent inflation significantly impacts consumer spending and the broader economy. High inflation erodes purchasing power, forcing consumers to curtail spending, potentially leading to slower economic growth.

- High wage growth contributing to inflation: Strong wage growth, while positive for workers, contributes to inflationary pressures as businesses pass increased labor costs onto consumers.

- Supply chain issues still impacting prices: While supply chain disruptions have eased somewhat, lingering bottlenecks continue to exert upward pressure on prices for certain goods.

- Strong consumer demand fueling price increases: Robust consumer demand, fueled by factors such as pent-up savings and a strong labor market, continues to support higher prices. This robust demand puts pressure on businesses to raise prices further, creating a feedback loop that fuels ongoing inflation.

The Labor Market Remains Tight

A strong labor market is a double-edged sword. While low unemployment signifies economic health, it also contributes to inflationary pressures. The current low unemployment rates and high number of job openings indicate a tight labor market, putting upward pressure on wages. This tight labor market makes it less likely the Fed will consider cutting interest rates. Easing monetary policy at this juncture could exacerbate inflation without providing significant relief to unemployment.

- Low unemployment figures: Persistently low unemployment rates signal a strong economy but also contribute to wage pressures and inflation.

- High job openings: The abundance of job openings further fuels competition for talent, driving up wages and potentially leading to higher prices for goods and services.

- Wage pressures persisting: Continued wage growth, though beneficial for workers, adds to the inflationary pressures the Fed is attempting to curb.

The Fed's Commitment to Price Stability

The Fed operates under a dual mandate: price stability and maximum employment. However, the current economic situation necessitates a prioritization of price stability. The risks associated with prematurely cutting interest rates are significant. Restarting inflationary pressures after a period of hard-won progress would severely damage the Fed's credibility and further complicate its already challenging task.

- Fed's commitment to 2% inflation target: The Fed has reiterated its commitment to achieving and maintaining its 2% inflation target. Any deviation from this target will dictate its actions.

- Risks of triggering renewed inflationary pressures: Premature rate cuts risk reigniting inflationary pressures, undoing the progress made thus far and potentially leading to a more volatile and unpredictable economic environment.

- Maintaining credibility in monetary policy: The Fed's actions are closely scrutinized, and maintaining credibility in its monetary policy is crucial for long-term economic stability.

Potential Future Rate Hikes Remain a Possibility

The Fed's decision to pause rate hikes is strategic, not a signal of impending rate cuts. Future rate hikes remain a distinct possibility if inflation does not cool down sufficiently. The Fed's approach remains data-dependent, meaning that future decisions will be based on the incoming economic data, including inflation figures, employment numbers, and other key economic indicators.

- Data-driven approach to future rate decisions: The Fed's future decisions will be based on a careful assessment of incoming economic data.

- Future rate hikes contingent on economic indicators: If inflation remains stubbornly high or if other key indicators suggest continued inflationary pressures, the Fed is prepared to resume rate hikes.

- Uncertainty regarding future inflation trajectory: The uncertainty surrounding the future trajectory of inflation necessitates a cautious and data-driven approach by the Fed.

Conclusion: Understanding the Fed's Rate Hike Pause Strategy

In conclusion, a rate cut is unlikely in the near future due to persistent inflation, a tight labor market, and the Fed's unwavering commitment to price stability. The pause in rate hikes should not be misinterpreted as a shift toward easing monetary policy. The Fed's data-driven approach suggests that future decisions will hinge on the evolving economic landscape. To make informed financial decisions, stay informed about the Fed's interest rate decisions and the evolving economic outlook. Regularly check for updates on the Fed rate hike pause and its implications. Understanding the Fed's monetary policy is crucial for navigating the current economic landscape.

Featured Posts

-

Android Vs I Phone Gen Zs Smartphone Preferences And The New Android Design

May 10, 2025

Android Vs I Phone Gen Zs Smartphone Preferences And The New Android Design

May 10, 2025 -

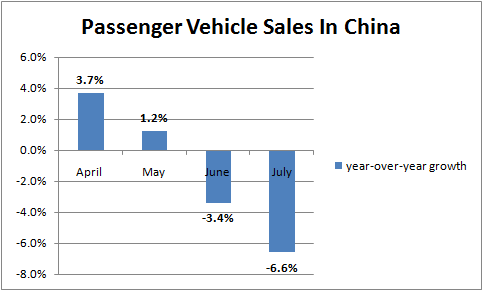

The China Factor Why Premium Automakers Face Headwinds In The Chinese Market

May 10, 2025

The China Factor Why Premium Automakers Face Headwinds In The Chinese Market

May 10, 2025 -

Live Sensex And Nifty Updates Market Trends And Key Indicators

May 10, 2025

Live Sensex And Nifty Updates Market Trends And Key Indicators

May 10, 2025 -

Judge Orders Release Of Detained Tufts Student Rumeysa Ozturk

May 10, 2025

Judge Orders Release Of Detained Tufts Student Rumeysa Ozturk

May 10, 2025 -

Adae Fyraty Me Nady Alerby Thlyl Bed Antqalh Mn Alahly Almsry

May 10, 2025

Adae Fyraty Me Nady Alerby Thlyl Bed Antqalh Mn Alahly Almsry

May 10, 2025