Finance Loan Application: A Practical Guide To Interest Rates And Repayment Terms

Table of Contents

Understanding Interest Rates in Your Finance Loan Application

Interest rates are the cost of borrowing money. Understanding them is crucial for a successful finance loan application. The interest rate significantly impacts the total cost of your loan, so careful consideration is essential.

Types of Interest Rates (Fixed vs. Variable)

- Fixed Interest Rates: With a fixed interest rate, your monthly payments remain consistent throughout the loan term. This predictability makes budgeting easier. However, you might miss out on potential savings if interest rates drop.

- Variable Interest Rates: Variable interest rates fluctuate based on market conditions. This means your monthly payments could increase or decrease over time. While you might benefit from lower payments if rates fall, you also risk higher payments if rates rise.

- Impact on Overall Loan Cost: A higher interest rate translates to a higher total loan cost, meaning you'll pay significantly more in interest over the life of the loan. Choosing between fixed and variable rates depends on your risk tolerance and financial predictions.

Factors Influencing Interest Rates on Your Finance Loan Application

Several factors influence the interest rate you'll receive on your finance loan application:

- Credit Score: A higher credit score demonstrates your creditworthiness, leading to lower interest rates. Lenders view borrowers with excellent credit as less risky.

- Loan Amount: Larger loan amounts often come with higher interest rates because they represent a greater risk for lenders.

- Loan Term: Longer loan terms typically result in lower monthly payments, but you'll pay more interest overall because you're borrowing the money for a longer period.

- Type of Loan: Different loan types, such as personal loans, auto loans, and mortgages, carry varying interest rates due to differing risk assessments.

Calculating the Total Cost of Your Loan

Calculating the total cost of your loan, including the principal amount and total interest paid, is crucial. Don't just focus on the monthly payment; understand the overall expense.

- Importance of Total Interest Paid: The total interest paid can significantly exceed the principal amount, especially with longer loan terms and higher interest rates.

- Using Loan Calculators: Many online loan calculators can help you estimate the total cost of your loan based on different interest rates and loan terms. Using these tools empowers you to make informed decisions.

Decoding Repayment Terms in Your Finance Loan Application

Repayment terms define how you'll repay the loan, including the loan term length, payment frequency, and potential penalties. Understanding these terms is as critical as understanding interest rates.

Loan Term Length and Its Impact

The loan term length directly impacts your monthly payment amount.

- Shorter Terms: Shorter loan terms mean higher monthly payments but less interest paid overall.

- Longer Terms: Longer loan terms mean lower monthly payments, but you'll pay significantly more interest over the life of the loan.

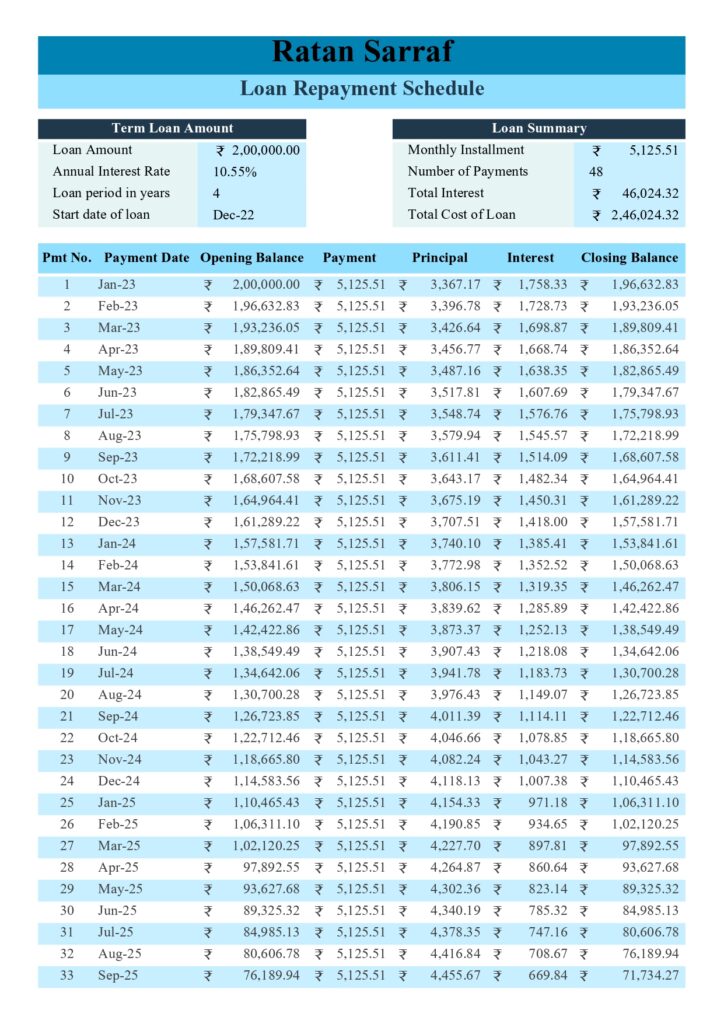

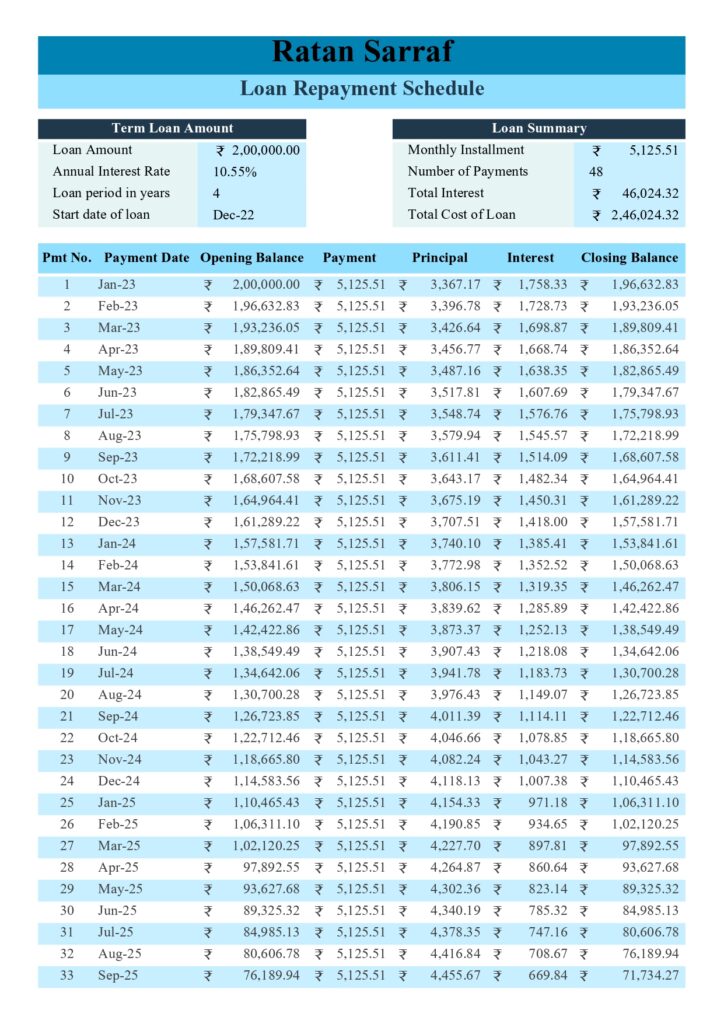

Understanding Amortization Schedules

An amortization schedule details each payment's breakdown of principal and interest over the loan's life. It's a valuable tool for visualizing your repayment journey.

- Example: An amortization schedule typically shows the payment number, payment amount, interest paid, principal paid, and remaining balance for each payment.

Potential Penalties for Early Repayment or Late Payments

Always be aware of potential penalties associated with your loan.

- Prepayment Penalties: Some loans charge penalties for paying off the loan early. Read your loan agreement carefully.

- Late Payment Fees: Late payments can result in significant fees and negatively impact your credit score.

Tips for a Successful Finance Loan Application

Applying for a finance loan strategically can significantly impact the terms you secure.

Improving Your Credit Score Before Applying

Improving your credit score before applying for a loan can significantly lower your interest rate.

- Actionable Advice: Pay bills on time, keep credit utilization low, and monitor your credit report regularly.

Comparing Loan Offers from Different Lenders

Don't settle for the first offer you receive.

- Comparison Shopping: Compare interest rates, fees, and repayment terms from multiple lenders to find the best deal.

Negotiating Loan Terms

Negotiating loan terms might seem daunting, but it's often possible to secure better conditions.

- Negotiation Strategies: Research competing offers and use them as leverage during negotiations.

Understanding the Fine Print

Carefully reading the loan agreement before signing is paramount.

- Importance of Thorough Review: Understand all fees, penalties, and terms before committing to the loan.

Conclusion: Mastering Your Finance Loan Application

Understanding interest rates and repayment terms is crucial for a successful finance loan application. By carefully comparing loan offers, negotiating favorable terms, and thoroughly understanding the fine print, you can secure the best possible loan for your financial needs. Now that you understand the intricacies of interest rates and repayment terms, you're ready to confidently apply for your finance loan. Start comparing offers today and secure the best terms for your financial needs!

Featured Posts

-

Nintendos Future Balancing Risk And Reward In Game Development

May 28, 2025

Nintendos Future Balancing Risk And Reward In Game Development

May 28, 2025 -

Activision Blizzard Acquisition Ftc Launches Appeal

May 28, 2025

Activision Blizzard Acquisition Ftc Launches Appeal

May 28, 2025 -

Ipswich Town Fc Enciso Phillips And Woolfenden Arrive At Portman Road

May 28, 2025

Ipswich Town Fc Enciso Phillips And Woolfenden Arrive At Portman Road

May 28, 2025 -

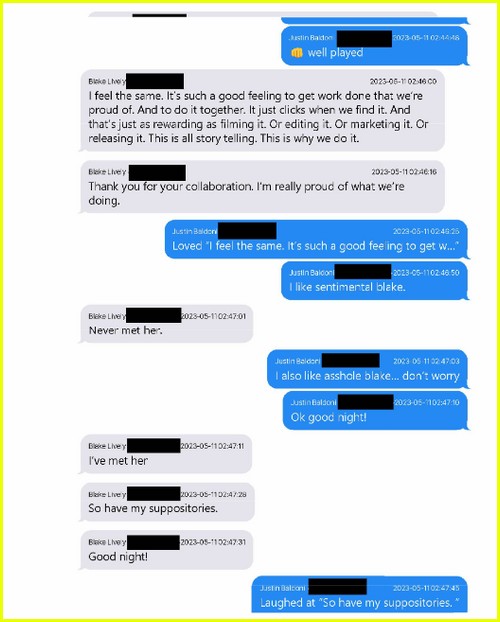

Dispute Between Ryan Reynolds And Justin Baldoni Examining The Allegations

May 28, 2025

Dispute Between Ryan Reynolds And Justin Baldoni Examining The Allegations

May 28, 2025 -

The Impending Newark Airport Crisis Impact And Solutions

May 28, 2025

The Impending Newark Airport Crisis Impact And Solutions

May 28, 2025

Latest Posts

-

Andre Agassi Prima Partida Profesionala De Pickleball

May 30, 2025

Andre Agassi Prima Partida Profesionala De Pickleball

May 30, 2025 -

Andre Agassi Revine In Competitie Debutul In Pickleball

May 30, 2025

Andre Agassi Revine In Competitie Debutul In Pickleball

May 30, 2025 -

Marcelo Rios La Historia Detras De Su Iconica Frase Como Ex Numero 3 Del Mundo

May 30, 2025

Marcelo Rios La Historia Detras De Su Iconica Frase Como Ex Numero 3 Del Mundo

May 30, 2025 -

Agassis Pickleball Debut What We Learned

May 30, 2025

Agassis Pickleball Debut What We Learned

May 30, 2025 -

El Impacto De La Frase De Marcelo Rios Un Analisis Del Ex Numero 3 Del Mundo

May 30, 2025

El Impacto De La Frase De Marcelo Rios Un Analisis Del Ex Numero 3 Del Mundo

May 30, 2025