Financial Planning Strategies For Student Loan Borrowers

Table of Contents

Understanding Your Student Loan Debt

Before you can strategize for repayment, you need a clear understanding of your student loan debt. This includes knowing the types of loans you have, their terms, and your total debt burden.

Types of Student Loans

Understanding the nuances of your student loans is the first step towards effective student loan management. There are primarily two types: federal and private.

-

Federal Student Loans: These loans are offered by the U.S. government and often come with more favorable repayment options and protections for borrowers. They are further categorized into subsidized and unsubsidized loans. Subsidized loans don't accrue interest while you're in school, whereas unsubsidized loans do.

-

Private Student Loans: These loans are offered by banks and other private lenders. They generally have higher interest rates and less flexible repayment options compared to federal loans. Understanding the interest capitalization on both types is crucial; this is when accrued interest is added to the principal loan balance, increasing the total amount owed.

-

Key Considerations: Knowing whether your loans are subsidized or unsubsidized, and understanding the implications of loan deferment and forbearance (temporary pauses in repayment) are vital aspects of effective student loan repayment planning.

Consolidating Your Student Loans

Consolidating your student loans means combining multiple loans into a single loan. This can simplify repayment by reducing the number of monthly payments and potentially lowering your monthly payment amount. However, it's crucial to carefully weigh the pros and cons.

-

Potential Benefits: Simplified repayment, potentially lower monthly payments (though not always), and a single point of contact for loan servicing.

-

Potential Drawbacks: You may end up paying more interest over the life of the loan, depending on the interest rate offered on the consolidated loan and the interest rates on your existing loans. You might also lose access to certain repayment plans or forgiveness programs available for specific federal loan types.

-

Consolidation Options: Explore different consolidation options, such as the federal Direct Consolidation Loan program or private loan consolidation options, before making a decision. Carefully compare the terms and conditions of each option.

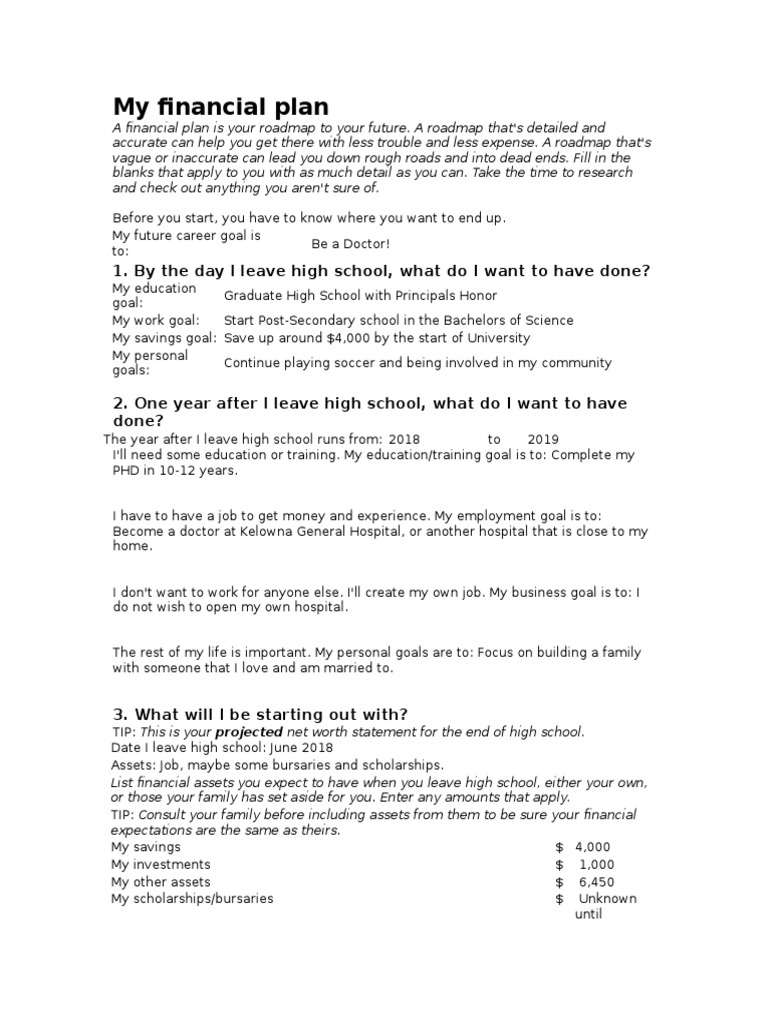

Creating a Realistic Budget

A realistic budget is essential for successful student loan repayment. This involves carefully tracking your income and expenses, identifying areas where you can save, and prioritizing essential expenses.

-

Budgeting Tools: Utilize budgeting apps like Mint, YNAB (You Need A Budget), or Personal Capital to track your spending and create a clear picture of your financial situation.

-

Needs vs. Wants: Differentiate between essential expenses (housing, food, transportation) and non-essential spending (entertainment, dining out). Prioritize needs and carefully evaluate discretionary spending.

-

Expense Categories: Track expenses across various categories like housing, food, transportation, utilities, debt payments (including student loans!), entertainment, and savings.

Exploring Student Loan Repayment Options

Several repayment options are available to help you manage your student loans effectively. Choosing the right plan can significantly impact your monthly payments and overall repayment period.

Standard Repayment Plan

The standard repayment plan is the most basic option. It typically involves fixed monthly payments over a 10-year period.

-

Understanding the Plan: Your monthly payment amount will depend on your loan balance and interest rate. You can use a student loan repayment calculator (many are available online) to estimate your payments. [Insert link to a reliable repayment calculator here].

-

Repayment Time: While a 10-year repayment period might seem manageable, it's important to consider the total interest you'll pay.

-

Credit Score Impact: Consistent on-time payments under any repayment plan, including the standard plan, positively impact your credit score.

Income-Driven Repayment Plans (IDR)

Income-Driven Repayment (IDR) plans tie your monthly payment to your income and family size. Several IDR plans exist, including IBR (Income-Based Repayment), PAYE (Pay As You Earn), and REPAYE (Revised Pay As You Earn).

-

Eligibility Requirements: Eligibility requirements vary for each plan, so research which plan best suits your circumstances.

-

Income Verification: You'll need to provide documentation of your income to determine your monthly payment.

-

Loan Forgiveness Potential: Some IDR plans offer the possibility of loan forgiveness after a certain number of years of payments, though eligibility requirements are stringent. This forgiveness is often taxed as income.

Deferment and Forbearance

Deferment and forbearance are temporary pauses in your student loan payments. However, they are not ideal long-term solutions.

-

Key Differences: Deferment generally requires demonstrating financial hardship or enrollment in school, while forbearance often requires less stringent criteria but may lead to accruing more interest.

-

Impact on Interest: Interest may or may not accrue during deferment or forbearance, depending on your loan type. Understanding this aspect is crucial to understanding the true cost.

-

When to Consider: These options are best used sparingly and only when facing genuine short-term financial hardship.

Building a Strong Financial Foundation

Managing student loan repayment is only part of building a secure financial future. You must also focus on building a strong financial foundation through savings, investments, and responsible credit management.

Emergency Fund

Having an emergency fund is crucial, irrespective of your student loan debt. This fund acts as a safety net for unexpected expenses like medical bills or job loss.

-

Target Savings: Aim to save 3-6 months' worth of living expenses in an easily accessible account.

-

Saving Strategies: Consider automating your savings through regular transfers from your checking account to your savings account. Even small, consistent contributions add up over time.

Investing for the Future

Investing early, even small amounts, is key to long-term financial growth. This could involve retirement planning or other investment vehicles.

-

Starting Early: The power of compounding means that earlier investments grow exponentially over time.

-

Investment Options: Consider contributing to a 401(k) or Roth IRA, depending on your tax bracket and financial goals. Diversify your portfolio across different asset classes (stocks, bonds, etc.) to mitigate risk.

Credit Score Management

A good credit score is essential for securing favorable terms on future loans, mortgages, and credit cards.

-

Credit Score Calculation: Your credit score is calculated based on your payment history, credit utilization, length of credit history, and credit mix.

-

Improving Your Credit: Pay bills on time, keep credit utilization low (ideally below 30% of your available credit), and maintain a diverse credit history without opening too many new accounts at once.

Conclusion

Effective student loan repayment requires a comprehensive financial plan. By understanding your loan debt, exploring repayment options, and building a strong financial foundation, you can successfully manage your student loans and achieve long-term financial security. Don't delay – start strategizing your student loan repayment plan today. Take control of your financial future by exploring the resources available and developing a personalized student loan repayment strategy. Remember, proactive student loan management is key to financial success.

Featured Posts

-

Invest Smart A Guide To The Countrys Newest Business Hotspots

May 17, 2025

Invest Smart A Guide To The Countrys Newest Business Hotspots

May 17, 2025 -

Your Guide To Austintown And Boardman News Police Blotter And More

May 17, 2025

Your Guide To Austintown And Boardman News Police Blotter And More

May 17, 2025 -

Knicks Star Asks Coach To Limit Playing Time

May 17, 2025

Knicks Star Asks Coach To Limit Playing Time

May 17, 2025 -

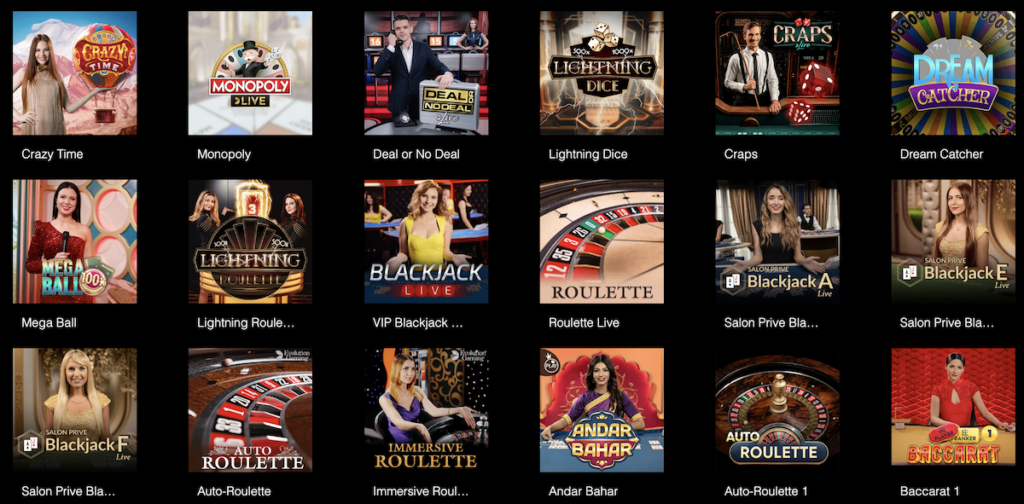

Ontario Online Casino Comparison Mirax Casinos Top Ranking For 2025

May 17, 2025

Ontario Online Casino Comparison Mirax Casinos Top Ranking For 2025

May 17, 2025 -

Fortnite Players Revolt Over Music Change Backwards Audio Update Criticized

May 17, 2025

Fortnite Players Revolt Over Music Change Backwards Audio Update Criticized

May 17, 2025

Latest Posts

-

Mati Donalda Trampa Khto Bula Meri Enn Maklaud

May 17, 2025

Mati Donalda Trampa Khto Bula Meri Enn Maklaud

May 17, 2025 -

Meri Enn Maklaud Mati Donalda Trampa Zhittya Kar Yera Ta Foto

May 17, 2025

Meri Enn Maklaud Mati Donalda Trampa Zhittya Kar Yera Ta Foto

May 17, 2025 -

Tracing The Trump Family Tree The Arrival Of Alexander Boulos

May 17, 2025

Tracing The Trump Family Tree The Arrival Of Alexander Boulos

May 17, 2025 -

Donald Trumps Expanding Family Tiffany And Michaels Son Alexander

May 17, 2025

Donald Trumps Expanding Family Tiffany And Michaels Son Alexander

May 17, 2025 -

Alexander Boulos The Newest Addition To The Trump Family Tree

May 17, 2025

Alexander Boulos The Newest Addition To The Trump Family Tree

May 17, 2025