Financial Planning's Future: CFP Board CEO To Retire In Early 2026

Table of Contents

The Legacy of the Retiring CEO and its Impact on the CFP Board

The retiring CEO's tenure has been marked by both significant accomplishments and considerable challenges. Their leadership has shaped the CFP Board's trajectory, leaving a lasting impact on the financial planning profession. Understanding this legacy is crucial to assessing the implications of their departure.

- Increased focus on ethical standards within the CFP profession: The CEO championed initiatives to strengthen ethical conduct among CFP professionals, resulting in stricter enforcement of the CFP Board's Code of Ethics and Professional Responsibility. This has led to increased consumer trust and confidence in the CFP designation.

- Initiatives to enhance CFP professional development and continuing education: Under their leadership, the CFP Board expanded its professional development offerings, providing CFP professionals with access to cutting-edge resources and training to keep pace with evolving industry trends. This commitment to ongoing learning ensures that CFPs remain highly competent and capable of serving their clients' needs.

- Navigating regulatory changes and challenges impacting the financial planning landscape: The CEO successfully guided the CFP Board through periods of significant regulatory upheaval, advocating for the interests of CFP professionals and working to maintain a clear regulatory framework for the profession. This experience is invaluable in a constantly evolving regulatory environment.

- Growth and expansion of the CFP certification globally: The CFP certification has expanded its global reach under the CEO's leadership, increasing the recognition and value of the designation worldwide. This expansion reflects a commitment to providing globally consistent, high-quality financial planning expertise.

The transition period following the CEO's retirement may lead to some short-term impacts, such as potential delays in the implementation of new initiatives or a slight slowdown in the pace of change.

The Search for a New CEO and the Future Direction of the CFP Board

The search for a new CEO will be a critical process for the CFP Board. The ideal candidate will possess a unique blend of skills and experience to effectively lead the organization into the future.

- Deep understanding of financial planning and its regulatory environment: The next CEO needs to be deeply familiar with the intricacies of financial planning, including its regulatory complexities and compliance requirements.

- Proven leadership and management skills in a large, complex organization: The CFP Board is a substantial organization; the new CEO must possess significant leadership experience to manage its diverse operations effectively.

- Ability to foster collaboration and innovation within the CFP professional community: The new leader should be able to cultivate a collaborative environment among CFP professionals, encouraging innovation and collaboration to advance the profession.

- Commitment to maintaining and enhancing the integrity and value of the CFP certification: Protecting and enhancing the reputation of the CFP certification will be a top priority for the new CEO.

The incoming CEO's priorities could shift the CFP Board's strategic focus. We might see increased emphasis on specific areas such as technology integration, enhanced consumer protection initiatives, or international expansion.

Implications for CFP Professionals and Consumers

The CFP Board CEO retirement will have wide-ranging implications for both CFP professionals and the consumers they serve.

- Potential changes to the CFP exam and renewal requirements: The new leadership might introduce adjustments to the CFP exam or renewal requirements to reflect evolving industry practices and knowledge.

- Impact on the ongoing professional development programs offered by the CFP Board: Changes in leadership could influence the type and availability of professional development opportunities available to CFP professionals.

- Effects on the credibility and prestige of the CFP certification: Maintaining the high standards and prestige associated with the CFP certification will be paramount during this transition.

For consumers, this means increased vigilance in selecting a CFP professional. It is essential to verify the CFP professional's credentials and confirm that they are in good standing with the CFP Board. The potential for increased scrutiny of CFP professionals following a leadership change could lead to a more rigorous adherence to ethical standards.

The Broader Context: Trends Shaping the Future of Financial Planning

Several overarching trends will shape the future of financial planning, regardless of the leadership changes at the CFP Board.

- Growing demand for financial planning services: An aging population and increasing financial complexity are driving demand for qualified financial planners.

- The increasing use of technology in financial planning: Fintech and robo-advisors are changing how financial planning is delivered, requiring CFP professionals to adapt and integrate technology into their practices.

- The evolving regulatory environment for financial advisors: The regulatory landscape is constantly evolving, requiring continuous adaptation and compliance from CFP professionals.

- The importance of financial literacy and education: Improving financial literacy among the general population will be crucial in ensuring people make informed financial decisions.

Conclusion

The upcoming retirement of the CFP Board CEO presents both challenges and opportunities for the financial planning profession. The transition period will be crucial in maintaining the integrity and value of the CFP certification while adapting to the evolving financial landscape. Finding a successor who can effectively navigate the complexities of the industry and lead the CFP Board into a successful future will be paramount. Consumers seeking financial advice should remain diligent in selecting qualified and ethical CFP professionals. Stay informed about the developments surrounding the CFP Board CEO retirement and its implications for the future of financial planning. Understanding the implications of this CFP Board CEO retirement is crucial for both professionals and consumers in the financial planning field. Make sure to regularly check the CFP Board website for updates.

Featured Posts

-

The Passing Of A Dallas Star A Tribute To The 80s Era

May 02, 2025

The Passing Of A Dallas Star A Tribute To The 80s Era

May 02, 2025 -

Fortnite Chapter 6 Season 2 Release Date Time Downtime Pre Load And Battle Pass Skins

May 02, 2025

Fortnite Chapter 6 Season 2 Release Date Time Downtime Pre Load And Battle Pass Skins

May 02, 2025 -

Tulsa Residents Report Storm Damage To Aid National Weather Service

May 02, 2025

Tulsa Residents Report Storm Damage To Aid National Weather Service

May 02, 2025 -

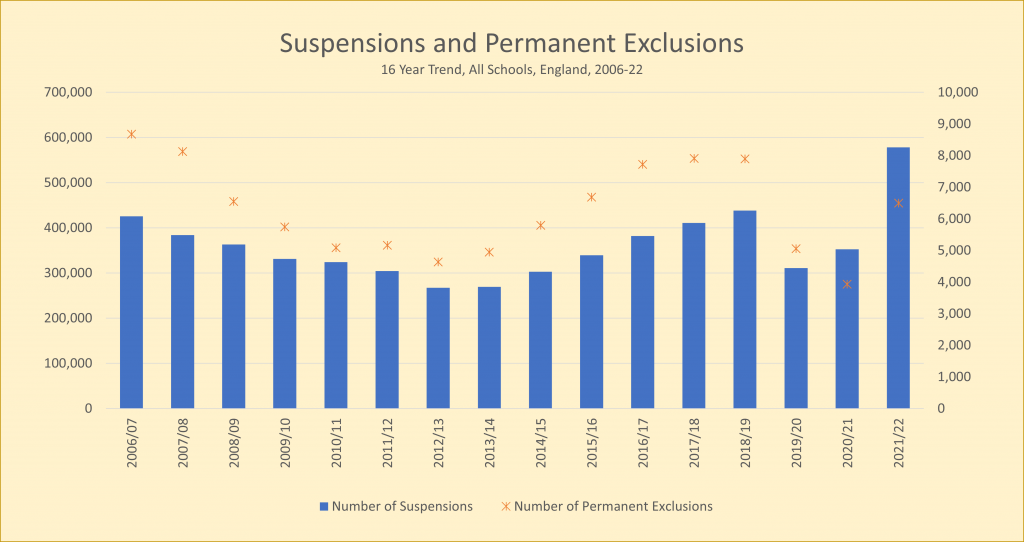

The Case Against School Suspensions Why They Fail

May 02, 2025

The Case Against School Suspensions Why They Fail

May 02, 2025 -

Fortnite Chapter 6 Season 2 Downtime Server Status And Lawless Update

May 02, 2025

Fortnite Chapter 6 Season 2 Downtime Server Status And Lawless Update

May 02, 2025