Financial Times: BP Chief Targets Valuation Doubling, Rejects US Listing

Table of Contents

The Financial Times recently reported that BP's Chief Executive, Bernard Looney, has set an ambitious goal: to double the company's valuation. This bold strategy, however, explicitly excludes a US listing, keeping BP firmly rooted on the London Stock Exchange. This article will delve into the details of this significant announcement and analyze its potential implications for BP stock, the broader energy sector, and the London Stock Exchange itself.

Looney's Vision: Doubling BP's Valuation

Keywords: BP growth strategy, energy transition, renewable energy, oil and gas prices, profitability, investment strategy

Looney's plan to double BP's valuation is a multifaceted strategy hinging on several key pillars. It's not simply about increasing oil and gas production; it's about a comprehensive transformation.

- Aggressive Investment in Renewables: A significant portion of BP's investment will be channeled into renewable energy sources, such as wind, solar, and hydrogen. This reflects the growing global demand for sustainable energy solutions and aligns BP with the broader energy transition.

- Capitalizing on Sustainable Energy Demand: The shift towards a greener economy presents a lucrative opportunity for BP. By strategically positioning itself as a leader in renewable energy, the company aims to capture a substantial share of this burgeoning market.

- Operational Efficiency and Profitability: Improving operational efficiency across all sectors – from oil and gas extraction to renewable energy production – is crucial for achieving profitability and maximizing shareholder value. This involves streamlining processes, optimizing resource allocation, and embracing technological advancements.

- Market Dependency: While the strategy focuses on renewable energy, success is intrinsically linked to the performance of the oil and gas market. Favorable oil and gas prices will contribute significantly to profitability, enabling further investment in renewable energy initiatives. Conversely, volatile prices pose a considerable risk.

- Analyst Opinions: Financial analysts are divided on the feasibility of Looney's ambitious target. Some express optimism about BP's potential to capitalize on the energy transition, while others highlight the challenges and risks involved in such a significant transformation.

Rejection of a US Listing: Why London?

Keywords: London Stock Exchange, US stock market, regulatory environment, tax implications, investor base, Brexit

BP's decision to remain solely listed on the London Stock Exchange, rather than pursuing a US listing, is a strategic choice with several potential underlying factors.

- Regulatory Landscape: Navigating the complexities of the US regulatory environment, including Sarbanes-Oxley compliance, can be a significant undertaking for any company. This regulatory burden might outweigh the perceived benefits of a US listing.

- Tax Advantages: The UK's tax system may offer advantages compared to the US tax system, making it more attractive for BP to remain listed in London.

- Existing Investor Base: BP already has a well-established investor base in London and Europe. Relocating to the US would require cultivating a new investor base, which takes time and resources.

- Brexit Considerations: While Brexit has presented challenges, remaining on the London Stock Exchange might offer better access to European markets than a US listing, considering ongoing trade relations.

- Synergy with London Stock Exchange: The established relationship with the London Stock Exchange, including familiarity with regulations and established communication channels, may offer greater operational efficiency compared to setting up a new listing on a different exchange.

Analyzing the Potential Impacts of this Strategy

Keywords: shareholder value, stock market performance, investment opportunities, risk assessment, competitor analysis, energy sector outlook

Looney's strategy presents both significant opportunities and substantial risks for BP and its stakeholders.

- Impact on Shareholder Value: The success or failure of this strategy will directly impact BP's share price and shareholder value. Investors will be closely scrutinizing the company's progress.

- Renewable Energy Transition Progress: Investors will be monitoring BP's investment in renewable energy and its progress in developing this sector of the business.

- Risk Assessment: A comprehensive risk assessment is crucial, considering potential volatility in oil and gas prices, increased competition in the renewable energy sector, and possible changes in energy policy and regulations.

- Competitive Landscape: The energy sector is highly competitive. BP needs to effectively compete with both established players and emerging companies in both the traditional energy and renewable energy markets.

- Energy Sector Outlook: The broader outlook for the energy sector, including the pace of the energy transition and government policies, will significantly influence the success of BP's strategy.

Conclusion

BP's CEO, Bernard Looney, has outlined an ambitious plan to double the company's valuation, explicitly rejecting a US listing in favor of remaining on the London Stock Exchange. This bold strategy involves significant investments in renewable energy, aiming to capitalize on the growing demand for sustainable solutions while maintaining profitability in traditional energy sectors. While the potential rewards are significant, the risks are considerable, demanding close monitoring of market conditions, regulatory changes, and the success of its renewable energy ventures. The impact on BP valuation will be a key indicator of the plan's success.

Call to Action: Stay informed about the progress of BP's ambitious valuation-doubling strategy. Follow our updates to understand the ongoing implications of this significant decision for BP stock, the energy sector, and the London Stock Exchange. Keep an eye on BP valuation updates for further insight.

Featured Posts

-

Abn Amro Florius And Moneyou Benoemen Karin Polman Als Directeur Hypotheken Intermediair

May 22, 2025

Abn Amro Florius And Moneyou Benoemen Karin Polman Als Directeur Hypotheken Intermediair

May 22, 2025 -

Dexter Revival Two Classic Villains Return

May 22, 2025

Dexter Revival Two Classic Villains Return

May 22, 2025 -

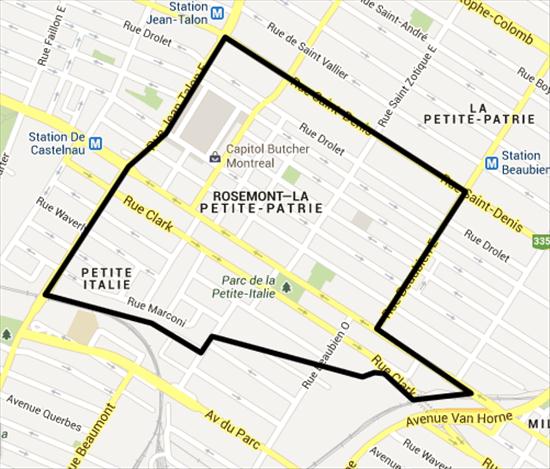

C Est La Petite Italie De L Ouest Architecture Toscane A Nom De La Ville

May 22, 2025

C Est La Petite Italie De L Ouest Architecture Toscane A Nom De La Ville

May 22, 2025 -

Swiss Chinese Call For De Escalation Through Tariff Negotiations

May 22, 2025

Swiss Chinese Call For De Escalation Through Tariff Negotiations

May 22, 2025 -

Loire Atlantique Un Quiz Pour Explorer Son Histoire Sa Gastronomie Et Sa Culture

May 22, 2025

Loire Atlantique Un Quiz Pour Explorer Son Histoire Sa Gastronomie Et Sa Culture

May 22, 2025

Latest Posts

-

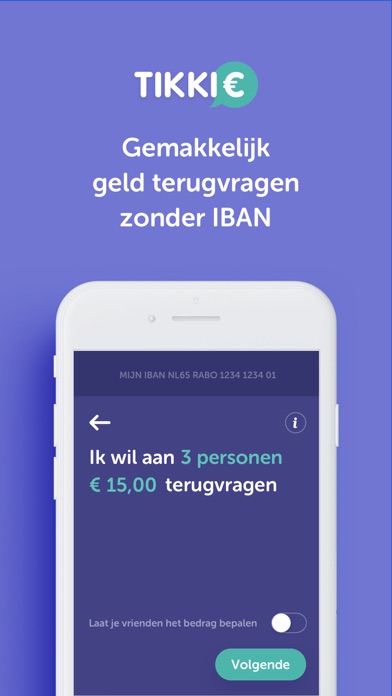

Van Rekening Naar Tikkie Eenvoudig En Snel Geld Overmaken In Nederland

May 22, 2025

Van Rekening Naar Tikkie Eenvoudig En Snel Geld Overmaken In Nederland

May 22, 2025 -

Australian Trans Influencers Record Breaking Success Why The Skepticism

May 22, 2025

Australian Trans Influencers Record Breaking Success Why The Skepticism

May 22, 2025 -

Betalingen Doen Met Tikkie De Ultieme Gids Voor Nederland

May 22, 2025

Betalingen Doen Met Tikkie De Ultieme Gids Voor Nederland

May 22, 2025 -

Nederlandse Bankieren Vereenvoudigd Een Handleiding Voor Tikkie

May 22, 2025

Nederlandse Bankieren Vereenvoudigd Een Handleiding Voor Tikkie

May 22, 2025 -

Tikkie Gebruiken Een Gids Voor Nederlandse Bankieren

May 22, 2025

Tikkie Gebruiken Een Gids Voor Nederlandse Bankieren

May 22, 2025