Find The Best Personal Loan Interest Rate For You Today

Table of Contents

Understanding Personal Loan Interest Rates

Before you start searching for the best personal loan interest rate, it's crucial to understand what influences it. Several factors play a significant role in determining the interest rate you'll qualify for.

Factors Affecting Your Interest Rate

- Credit Score: Your credit score is the most significant factor. Lenders use your credit score (often a FICO score) and credit report to assess your creditworthiness. A higher credit score (generally above 700) translates to lower interest rates. A lower score means higher rates, or even loan denial.

- Debt-to-Income Ratio (DTI): Your DTI ratio is the percentage of your monthly income that goes towards debt repayment. A lower DTI indicates you have more capacity to handle additional debt, making you a less risky borrower and potentially securing you a better personal loan rate.

- Loan Amount and Term: Larger loan amounts and longer repayment terms generally come with higher interest rates. This is because there's a higher risk for the lender over a longer period.

- Loan Type: Secured personal loans (backed by collateral) usually offer lower interest rates than unsecured personal loans (without collateral). If you can offer collateral like a car or savings account, you might be able to get a more favorable rate.

- Lender Type: Different lenders offer varying interest rates. Banks often have stricter lending requirements but may offer competitive rates. Credit unions typically offer lower rates to their members. Online lenders provide convenience but may have higher rates or less transparency.

Decoding APR (Annual Percentage Rate)

The APR is the annual cost of borrowing money, including the interest rate and any fees. It's crucial to compare APRs when evaluating different loan offers, not just the stated interest rate. For example, one lender might advertise a lower interest rate, but higher fees could result in a higher overall APR compared to another lender with a slightly higher interest rate but lower fees. Understanding the APR gives you a true picture of the loan's cost. Always look for the lowest APR possible to get the best personal loan interest rate.

How to Find the Best Personal Loan Interest Rate

Now that you understand the factors affecting your rate, let's explore strategies for securing the best possible terms.

Check Your Credit Score

Before applying for any loan, check your credit score. Free services such as Credit Karma or AnnualCreditReport.com can provide access to your score. Knowing your credit score will help you understand what kind of rates you're likely to qualify for and identify areas for improvement if needed.

Shop Around and Compare Rates

Don't settle for the first offer you receive. Use online comparison tools to compare rates from multiple lenders, both traditional banks, credit unions and online lenders. Pre-qualification allows you to check rates without impacting your credit score.

Negotiate with Lenders

Once you've identified lenders with potentially favorable rates, don't hesitate to negotiate. If you have a strong credit history, a high income, or a substantial down payment, you may be able to negotiate a lower interest rate.

Consider Secured Loans for Lower Rates

Secured personal loans, which require collateral, often come with lower interest rates than unsecured loans. However, understand the risk of losing your collateral if you default on the loan.

Avoiding Personal Loan Scams

Unfortunately, the personal loan market has its share of scams. Protect yourself by being aware of potential red flags.

Identifying Red Flags

- Upfront fees: Legitimate lenders rarely require upfront fees to process loan applications.

- Overly aggressive marketing: Be wary of lenders who pressure you into making quick decisions.

- Lack of transparency: Avoid lenders who are vague about fees, terms, and conditions.

- Unrealistic promises: Promises of guaranteed approval or extremely low interest rates should raise suspicion.

Protecting Your Information

- Secure websites and applications: Only use secure websites and applications when applying for a loan.

- Verify lender legitimacy: Research the lender through official sources before sharing any sensitive information.

Conclusion

Finding the best personal loan interest rate requires careful planning and research. By checking your credit score, comparing rates from multiple lenders, negotiating effectively, and being vigilant against scams, you can significantly reduce the cost of your loan. Don't wait! Start finding the best personal loan interest rate for you today. Use our resources to compare offers and secure the lowest rate possible, saving you money in the long run. Remember to focus on the APR, considering all fees and interest, to get the best personal loan interest rate deal.

Featured Posts

-

Al Nassr Cristiano Ronaldo Ile 2 Yillik Soezlesme Imzalayacak

May 28, 2025

Al Nassr Cristiano Ronaldo Ile 2 Yillik Soezlesme Imzalayacak

May 28, 2025 -

U Turn On Short Term Rental Ban

May 28, 2025

U Turn On Short Term Rental Ban

May 28, 2025 -

Todays Mlb Matchup Brewers Vs Diamondbacks Predictions And Betting Analysis

May 28, 2025

Todays Mlb Matchup Brewers Vs Diamondbacks Predictions And Betting Analysis

May 28, 2025 -

Exploring Googles Veo 3 Ai Benefits And Drawbacks For Video Makers

May 28, 2025

Exploring Googles Veo 3 Ai Benefits And Drawbacks For Video Makers

May 28, 2025 -

Rayan Cherki Transfer Liverpool And Man Utds Renewed Pursuit Of Lyon Star

May 28, 2025

Rayan Cherki Transfer Liverpool And Man Utds Renewed Pursuit Of Lyon Star

May 28, 2025

Latest Posts

-

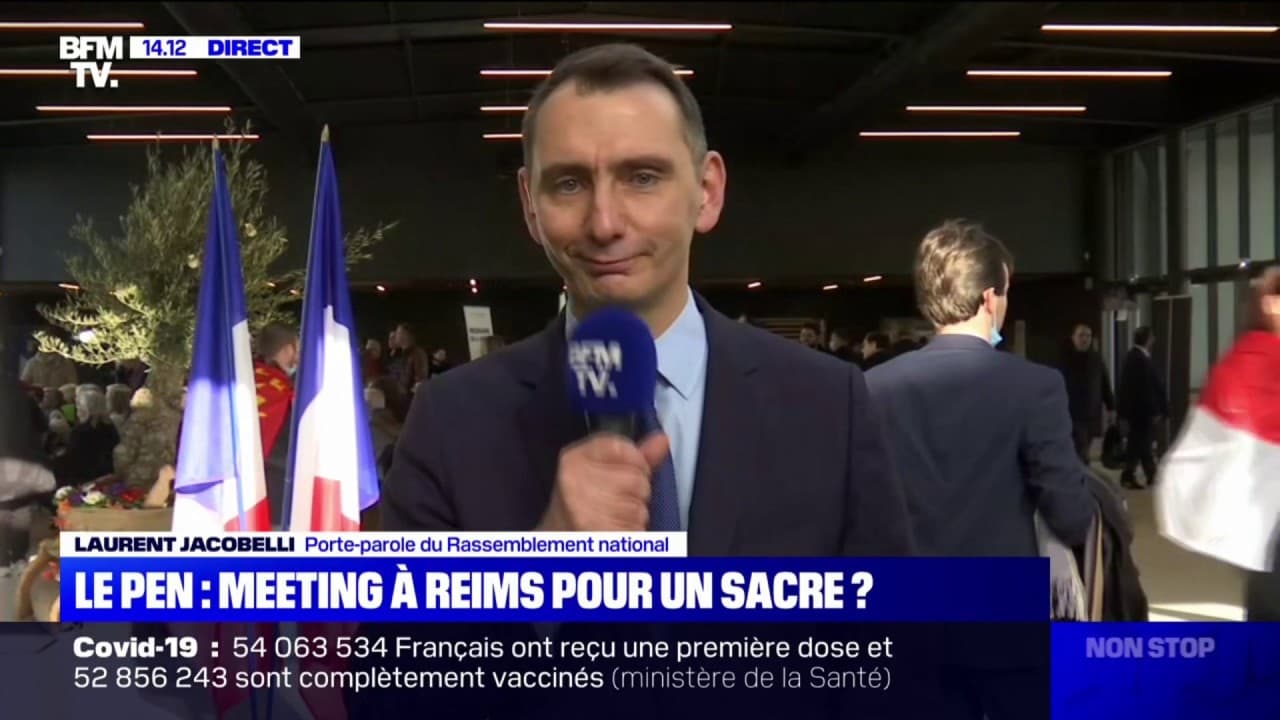

Depute Rn Marine Le Pen N Est Ni Au Dessus Ni En Dessous Des Lois

May 30, 2025

Depute Rn Marine Le Pen N Est Ni Au Dessus Ni En Dessous Des Lois

May 30, 2025 -

Hbo To Adapt Gisele Pelicots Memoir A French Rape Survivors Story

May 30, 2025

Hbo To Adapt Gisele Pelicots Memoir A French Rape Survivors Story

May 30, 2025 -

Marine Le Pen Et La Justice Jacobelli Defend Une Immunite Implicite

May 30, 2025

Marine Le Pen Et La Justice Jacobelli Defend Une Immunite Implicite

May 30, 2025 -

Grand Est Subvention Pour Concert De Medine Vives Reactions Politiques

May 30, 2025

Grand Est Subvention Pour Concert De Medine Vives Reactions Politiques

May 30, 2025 -

Concert De Medine Subventionne En Grand Est La Colere Du Rn

May 30, 2025

Concert De Medine Subventionne En Grand Est La Colere Du Rn

May 30, 2025