Finding A Dream Home In The Countryside: Budget-Friendly Options Under £1m

Table of Contents

Identifying Affordable Countryside Locations

Finding a charming country property within your budget requires strategic location scouting. Don't limit yourself to the most popular areas; exploring lesser-known locations can unlock significant savings.

Exploring Lesser-Known Areas

Focusing on areas slightly further from major cities or popular countryside hotspots often yields better value for money. These hidden gems offer the peace and quiet of rural life without the inflated price tags.

- Research counties with lower average property prices: Utilize online property portals and government statistics to identify counties with more affordable average house prices compared to national averages.

- Consider villages and smaller towns instead of larger market towns: Smaller settlements often offer a more intimate community feel and more affordable properties than bustling market towns.

- Utilize online property portals to filter by price and location: Websites like Rightmove and Zoopla allow you to refine your search with specific criteria, including price range and location, to quickly identify potential properties.

- Explore areas with good transport links (although potentially less frequent): Balancing rural life with accessibility is key. Consider areas with bus routes or train lines, even if they are less frequent than in urban areas. This ensures you retain some connectivity while enjoying the peace of the countryside.

Considering Property Types

Don't limit your search to traditional country houses. Exploring alternative property types can significantly increase your chances of finding a dream home within your £1m budget.

- Cottages and converted barns often offer character and charm at lower prices: These properties often boast unique features and architectural details not found in modern builds, adding significant character to your countryside home.

- Detached houses on smaller plots can be more affordable than larger estates: A smaller garden requires less maintenance and can translate into significant cost savings, both initially and in the long run.

- Look at fixer-upper properties – they often require renovation but present significant savings: Purchasing a property needing renovation can offer a considerable discount compared to move-in-ready homes. This allows you to personalize your home while staying within budget, but remember to factor in renovation costs.

- Consider apartments or flats in converted farm buildings – a unique countryside living experience: This offers a blend of rural living with lower maintenance compared to a detached house, and often adds a unique character to the property.

Securing a Mortgage for a Countryside Property

Securing the right mortgage is crucial for your countryside home purchase. Rural lending often has specific requirements, so careful planning is essential.

Understanding Rural Lending

Mortgages for rural properties might have different criteria than those for urban properties. Be prepared for a more in-depth application process.

- Research lenders specializing in rural mortgages: Some lenders have expertise and experience in providing mortgages for properties in rural locations.

- Prepare a comprehensive financial plan and demonstrate affordability: Lenders will scrutinize your financial stability. Present a clear picture of your income, expenses, and savings.

- Be prepared to offer a larger deposit to secure a favorable interest rate: A larger deposit often translates to better interest rates and more favorable lending terms.

- Factor in potential additional costs such as renovation or maintenance: Include these costs in your overall budget to avoid financial surprises after securing the mortgage.

Exploring Alternative Financing Options

Beyond traditional mortgages, other options can assist in purchasing your dream country home.

- Explore government schemes supporting rural housing: Various government initiatives might offer grants or subsidies for rural housing projects. Research what is available in your target area.

- Inquire about shared ownership opportunities: This allows you to buy a share of the property and pay rent on the remaining share, reducing the initial financial outlay.

- Consider a part-exchange option if you have a property to sell: This can streamline the process and potentially simplify the transaction.

Essential Considerations Before Buying a Country Home

Beyond the financial aspects, several crucial factors must be considered before committing to a countryside purchase.

Broadband and Connectivity

Reliable internet access is vital in today's digital age, even in rural areas.

- Check the availability of broadband and mobile signal strength in the area: Before making an offer, thoroughly investigate the internet and mobile signal quality in the target location.

- Inquire about potential future upgrades or alternative solutions (e.g., satellite internet): If the current connectivity is insufficient, explore potential upgrades or alternative solutions to ensure reliable access.

Commuting and Transport

Evaluate transportation options to work, schools, and other necessities.

- Assess public transport links or consider the daily commute by car: Be realistic about travel times and the costs associated with commuting.

- Factor in the increased travel time compared to city living: Countryside living often involves longer commutes, which needs to be factored into your daily routine.

Local Amenities and Services

Assess the availability of essential services and amenities.

- Research local schools and healthcare providers: If you have children or require regular healthcare, investigate the quality and accessibility of these services.

- Check the availability of essential services and amenities within a reasonable distance: Ensure access to supermarkets, shops, and other vital amenities is convenient.

Conclusion

Finding your dream home in the countryside under £1m is achievable with careful planning and research. By exploring lesser-known locations, considering diverse property types, and securing appropriate financing, you can transform your rural living dreams into a reality. Remember to factor in essential considerations like broadband, transport, and local amenities to ensure a smooth transition. Start your search today and discover the perfect budget-friendly country home awaiting you! Begin your journey to finding your ideal countryside escape by utilizing online property portals and exploring the tips outlined above for finding your dream home in the countryside.

Featured Posts

-

Shop Owners Death Previously Bailed Teenager Arrested

May 25, 2025

Shop Owners Death Previously Bailed Teenager Arrested

May 25, 2025 -

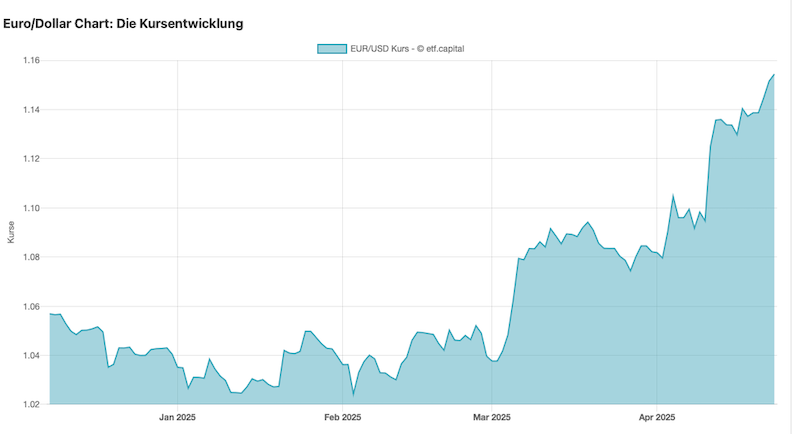

Dax Verfall Auswirkungen Auf Aktien In Frankfurt Am 21 Maerz 2025

May 25, 2025

Dax Verfall Auswirkungen Auf Aktien In Frankfurt Am 21 Maerz 2025

May 25, 2025 -

Live M56 Traffic Updates Motorway Closed Following Serious Accident

May 25, 2025

Live M56 Traffic Updates Motorway Closed Following Serious Accident

May 25, 2025 -

M56 Crash Live Traffic Updates And Long Queues

May 25, 2025

M56 Crash Live Traffic Updates And Long Queues

May 25, 2025 -

Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf A Comprehensive Guide

May 25, 2025

Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf A Comprehensive Guide

May 25, 2025

Latest Posts

-

Brazilian Banking Reshaped Brb And Banco Master Combine Forces

May 25, 2025

Brazilian Banking Reshaped Brb And Banco Master Combine Forces

May 25, 2025 -

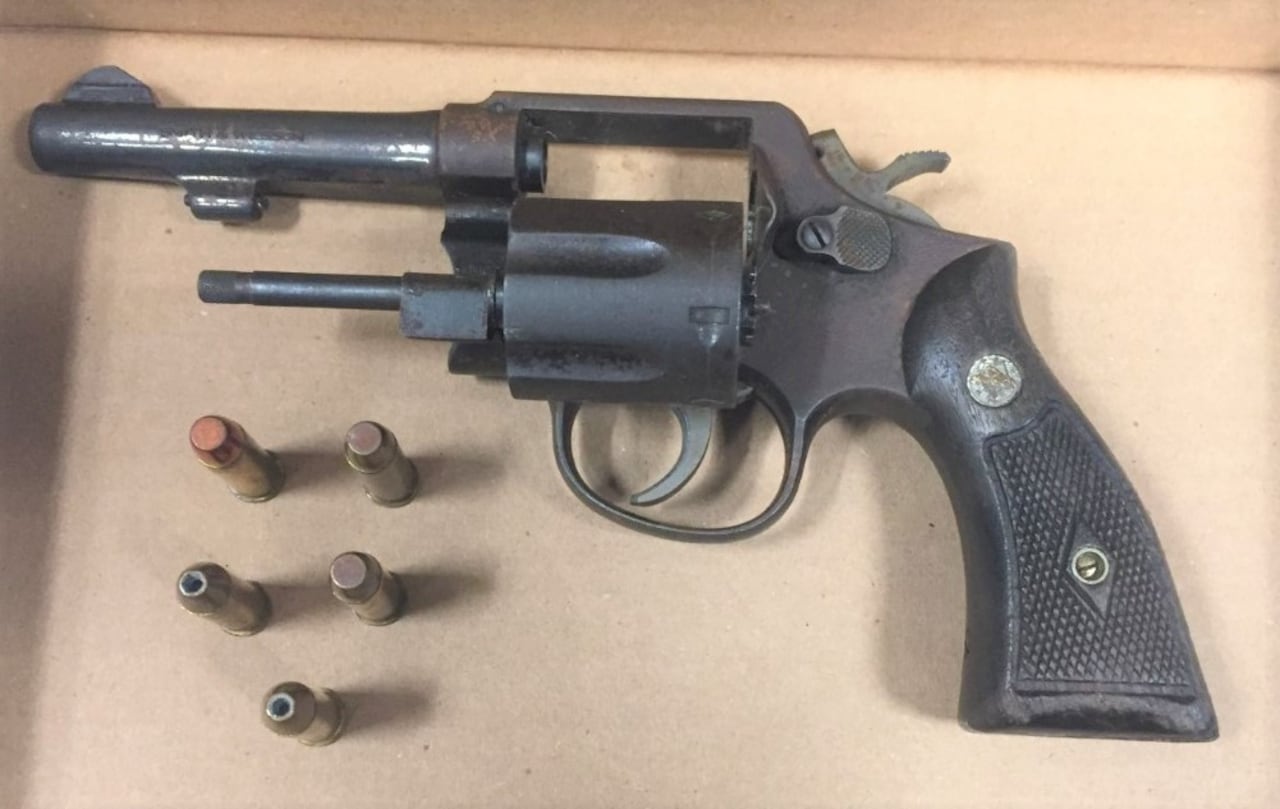

Extensive Gun Trafficking Investigation Leads To 18 Arrests In Massachusetts

May 25, 2025

Extensive Gun Trafficking Investigation Leads To 18 Arrests In Massachusetts

May 25, 2025 -

Public Private Merger Brb Expands With Banco Master Acquisition In Brazil

May 25, 2025

Public Private Merger Brb Expands With Banco Master Acquisition In Brazil

May 25, 2025 -

Massachusetts Authorities Seize Over 100 Firearms Arrest 18 In Gun Trafficking Case

May 25, 2025

Massachusetts Authorities Seize Over 100 Firearms Arrest 18 In Gun Trafficking Case

May 25, 2025 -

Brbs Banco Master Acquisition A Challenge To Brazilian Banking Giants

May 25, 2025

Brbs Banco Master Acquisition A Challenge To Brazilian Banking Giants

May 25, 2025