Finding The Real Safe Bet: A Step-by-Step Approach To Smart Investing

Table of Contents

Understanding Your Risk Tolerance

Before diving into specific investment options, it's crucial to understand your risk tolerance. This involves honestly assessing your financial situation and comfort level with potential losses.

Assessing Your Financial Goals

What are your short-term and long-term financial objectives? Are you saving for retirement, a down payment on a house, your children's education, or something else? Your goals significantly impact your investment strategy.

- Retirement: Long-term investments with a higher growth potential are often suitable.

- Home Purchase: A more conservative approach might be preferred, focusing on capital preservation closer to your purchase date.

- Education: A balance between growth and safety is important, depending on the child's age.

How much risk are you willing to accept to achieve these goals? Are you comfortable with the possibility of short-term losses if it means potentially higher returns in the long run? Consider using online risk tolerance questionnaires to get a clearer picture. Many reputable financial websites offer these free assessments.

Identifying Your Investment Timeline

Your investment timeline is directly related to your risk tolerance.

- Short-term investments (less than 5 years): Focus on liquidity and capital preservation. You need easy access to your money, so higher-risk investments are generally avoided. Examples include high-yield savings accounts and money market funds. These offer relatively safe returns, though often lower than other options.

- Long-term investments (5+ years): Allow for more risk-taking potential for greater returns. With a longer timeframe, you can weather potential market downturns. Examples include index funds and diversified stock portfolios. These can offer higher returns over the long term but come with greater volatility.

Diversification Strategies for Safe Investing

Diversification is a cornerstone of safe investing. It's the practice of spreading your investments across different asset classes to reduce your overall risk.

- Don't put all your eggs in one basket! Spread your investments across stocks, bonds, real estate, and other asset classes. This helps to mitigate losses if one sector performs poorly.

- Consider using ETFs (Exchange Traded Funds): ETFs offer diversified exposure to various market sectors, making diversification simpler and more cost-effective.

- Regularly rebalance your portfolio: Market fluctuations can shift your asset allocation. Regularly rebalancing ensures you maintain your desired risk level.

Exploring Low-Risk Investment Options

Several low-risk investment options offer a balance between safety and reasonable returns.

High-Yield Savings Accounts and Money Market Accounts

- Pros: FDIC insured (up to $250,000 in the US), highly liquid (easy access to funds), low risk.

- Cons: Lower returns compared to other investment options. Interest rates are typically tied to prevailing market rates.

Certificates of Deposit (CDs)

- Pros: Fixed interest rate, FDIC insured, predictable returns. You lock in a specific interest rate for a set period.

- Cons: Lower returns than stocks, penalties for early withdrawal. You’ll typically face penalties if you withdraw funds before the CD matures.

Government Bonds

- Pros: Considered very safe, low risk, potential for steady income. Government bonds are backed by the government, making them relatively secure.

- Cons: Lower returns than stocks, interest rates can fluctuate. Returns are typically lower than those offered by more volatile investments.

Index Funds and ETFs

- Pros: Diversification, lower expense ratios than actively managed funds. They passively track a specific market index, offering broad diversification at a low cost.

- Cons: Returns are tied to the market performance. They won't outperform the market, but they offer a low-cost way to gain exposure to a broad range of assets.

Building a Smart Investment Plan

Creating a robust investment plan is key to achieving your financial goals.

Setting Realistic Financial Goals

Define clear, measurable, achievable, relevant, and time-bound (SMART) goals.

- Create a detailed budget to track your income and expenses.

- Automate your savings and investments to ensure consistent contributions.

Seeking Professional Financial Advice

Consider consulting with a financial advisor to create a personalized investment strategy.

- Discuss your risk tolerance, financial goals, and investment timeline.

- Regularly review and adjust your investment plan as your circumstances change.

Monitoring and Adjusting Your Portfolio

Regularly review your investment performance and make necessary adjustments.

- Rebalance your portfolio to maintain your desired asset allocation.

- Stay informed about market trends and economic conditions.

Conclusion

Finding the real safe bet in investing requires a thoughtful and strategic approach. By understanding your risk tolerance, exploring low-risk investment options, and building a smart investment plan, you can build a strong financial foundation and secure your financial future. Remember that diversification, consistent saving, and seeking professional advice are key components of successful long-term investing. Start building your safe bet portfolio today! Don't wait any longer to begin your journey towards secure financial independence. Take control of your financial future and start investing wisely. Find your safe bet and start building a secure financial future.

Featured Posts

-

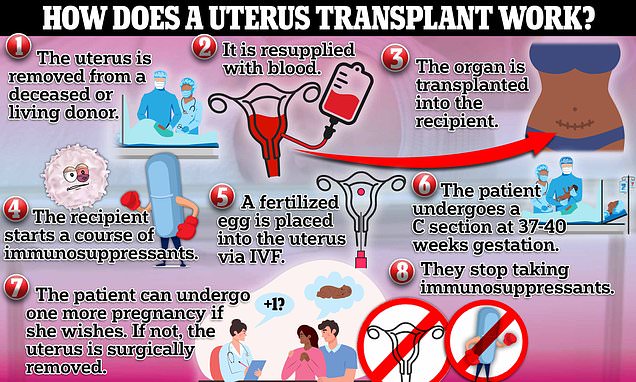

Community Activist Suggests Live Womb Transplants For Transgender Mothers

May 10, 2025

Community Activist Suggests Live Womb Transplants For Transgender Mothers

May 10, 2025 -

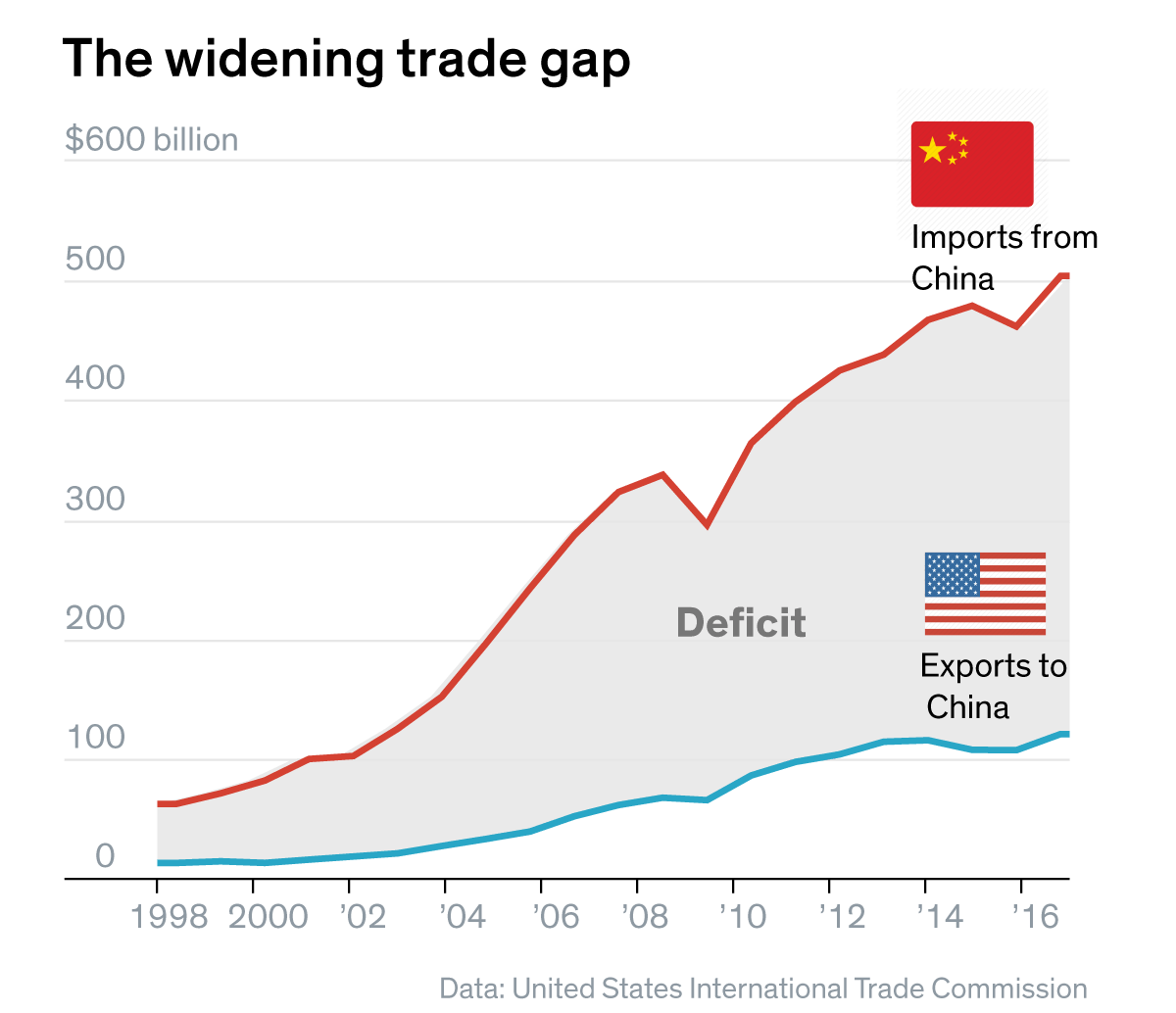

De Escalation At The Forefront A Report On U S China Trade Talks

May 10, 2025

De Escalation At The Forefront A Report On U S China Trade Talks

May 10, 2025 -

The Rise Of Elon Musk A Deep Dive Into His Wealth And Business Ventures

May 10, 2025

The Rise Of Elon Musk A Deep Dive Into His Wealth And Business Ventures

May 10, 2025 -

New Business Hotspots A Map Of The Countrys Fastest Growing Areas

May 10, 2025

New Business Hotspots A Map Of The Countrys Fastest Growing Areas

May 10, 2025 -

Dakota Johnson Y Sus Bolsos Hereu El Favorito De Las It Girls

May 10, 2025

Dakota Johnson Y Sus Bolsos Hereu El Favorito De Las It Girls

May 10, 2025