Five Key Charts To Watch In Global Commodity Markets This Week

Table of Contents

Navigating the complex world of global commodity markets requires keen observation and insightful analysis. This week, several key indicators will shape price trends across various sectors. This article highlights five crucial charts that every trader and investor should monitor to stay ahead of the curve in these dynamic markets. Understanding these charts will help you make informed decisions and potentially capitalize on emerging opportunities in the global commodity markets.

<h2>1. Crude Oil Price Chart: Assessing Geopolitical Risk and Demand</h2>

Understanding the crude oil price is paramount for navigating the global commodity markets. Fluctuations in oil prices significantly impact various sectors, from transportation and manufacturing to energy production and inflation. This week, carefully analyzing the crude oil price chart is crucial. Key factors to consider include:

-

Geopolitical Risk: Analyze the impact of geopolitical events such as OPEC+ production cuts, sanctions on oil-producing nations, and geopolitical instability in key oil-producing regions on oil prices. Tensions in the Middle East, for example, can dramatically affect the global supply and, consequently, the price of WTI crude and Brent crude.

-

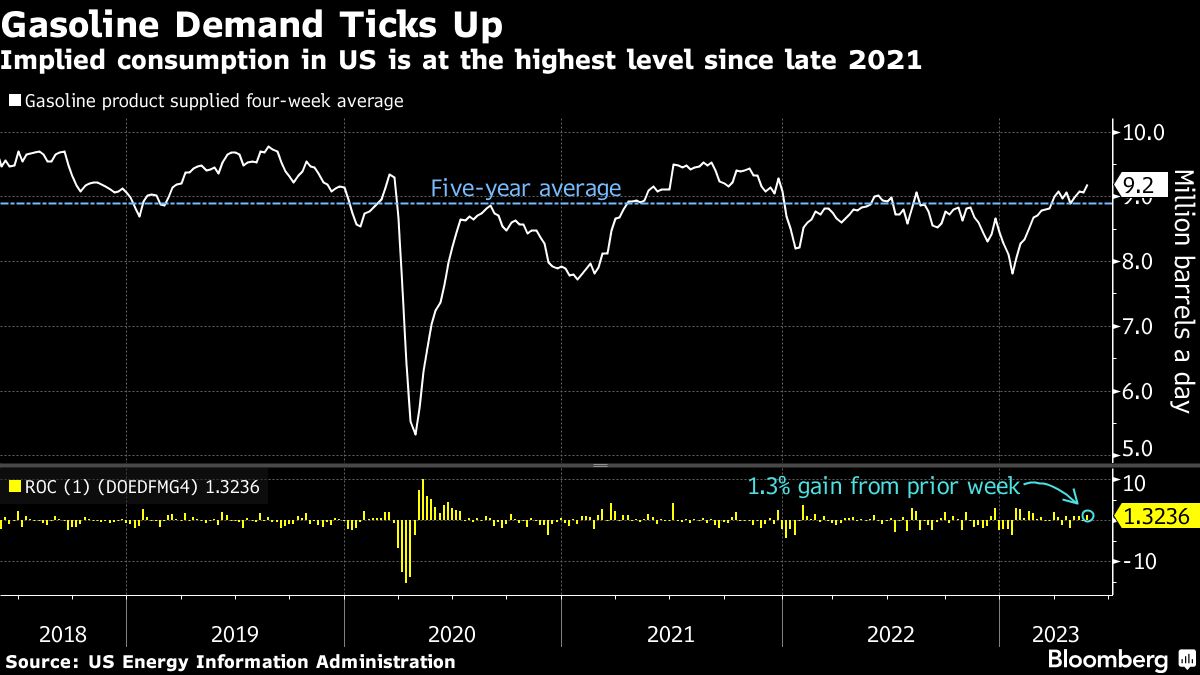

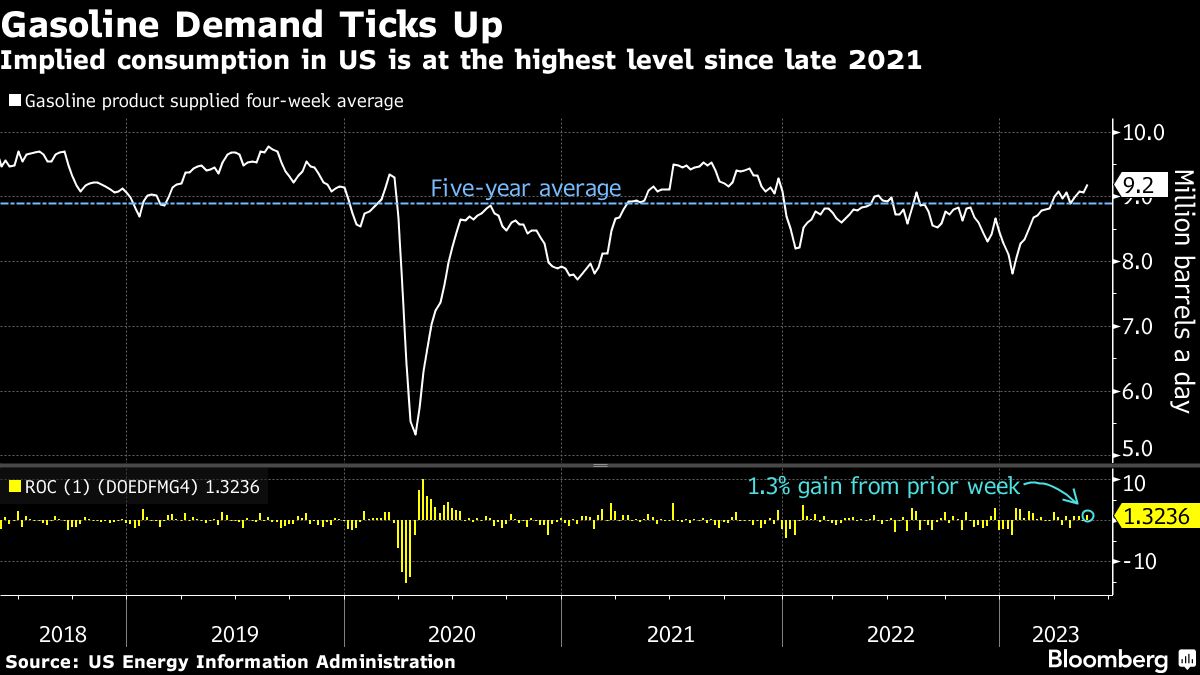

Energy Demand: Track the correlation between global economic growth and energy demand. Strong economic growth typically translates to higher oil consumption, pushing prices upward. Conversely, economic slowdowns or recessions can lead to decreased demand and lower prices.

-

WTI vs. Brent Crude: Compare WTI (West Texas Intermediate) and Brent crude prices to identify potential price discrepancies and arbitrage opportunities. These two benchmarks often show slight variations, offering opportunities for savvy traders.

-

Seasonal Factors: Observe the influence of seasonal factors on oil consumption patterns. For instance, increased driving during summer months can boost demand, impacting price.

-

Alternative Energy: Consider the long-term impact of alternative energy sources, such as solar and wind power, on future oil demand. The transition to cleaner energy could eventually decrease reliance on oil, impacting future price trends.

<h2>2. Natural Gas Price Chart: Monitoring Weather Patterns and Storage Levels</h2>

Natural gas prices are heavily influenced by weather patterns and storage levels, making the natural gas price chart a crucial indicator within the broader global commodity markets. Sharp price swings are common, driven by seasonal changes and unexpected events. Here's what to watch:

-

Weather Patterns: Monitor the impact of seasonal weather patterns. Harsh winters increase heating demand, driving up prices, while mild winters can lead to lower prices. Similarly, hot summers increase cooling demand through air conditioning.

-

Storage Levels: Analyze natural gas storage levels in major consuming regions. Low storage levels indicate potential supply shortages, which can push prices higher. High storage levels usually suggest ample supply, potentially leading to lower prices.

-

Production Levels: Track the production levels of key natural gas producing countries. Any disruptions to production, whether due to geopolitical events or technical issues, can significantly impact prices.

-

Supply Chain Dynamics: Observe any significant shifts in natural gas supply chain dynamics. Pipeline issues, for instance, can constrict supply and influence prices.

-

Renewable Energy: Consider the role of renewable energy sources in displacing natural gas demand. Increased adoption of renewable energy could lead to decreased demand for natural gas in the long run.

<h2>3. Agricultural Commodity Index Chart: Evaluating Crop Yields and Global Food Security</h2>

The agricultural commodity index, encompassing key crops like corn, wheat, and soybeans, is another vital chart to watch in the global commodity markets. Factors impacting crop yields directly influence food security and global prices.

-

Commodity Prices: Monitor the price movements of key agricultural commodities. Changes in these prices ripple through the global food system, impacting food affordability and availability.

-

Weather Conditions: Track the impact of global weather patterns on crop yields. Droughts, floods, and extreme temperatures can significantly reduce harvests and lead to price spikes.

-

Fertilizer Prices: Analyze the influence of fertilizer prices on agricultural production costs. High fertilizer prices can increase the cost of production, resulting in higher food prices.

-

Trade Policies: Assess the impact of global trade policies on agricultural commodity markets. Trade restrictions or tariffs can significantly disrupt supply chains and impact prices.

-

Food Security: Evaluate the implications of rising food prices for global food security, particularly in vulnerable regions.

<h2>4. Precious Metals Price Chart: Gauging Investor Sentiment and Safe-Haven Demand</h2>

Precious metals, primarily gold and silver, often serve as safe-haven assets during times of economic uncertainty. Monitoring their price movements offers insights into investor sentiment and market volatility within the global commodity markets.

-

Inflation: Analyze the relationship between gold prices and inflation rates. Gold is often seen as a hedge against inflation, with its price typically rising during inflationary periods.

-

Interest Rates: Observe the correlation between gold prices and interest rate movements. Higher interest rates generally increase the opportunity cost of holding gold, potentially lowering its price.

-

Investor Sentiment: Monitor investor sentiment towards gold as a safe-haven asset. Increased demand for safe-haven assets during times of crisis often boosts gold prices.

-

Currency Fluctuations: Track the impact of currency fluctuations on precious metals prices. A weaker US dollar typically strengthens the price of gold, denominated in USD.

-

Technological Demand: Consider the influence of technological advancements on silver demand, especially in areas like electronics and solar energy.

<h2>5. Industrial Metals Price Chart: Assessing Global Manufacturing Activity</h2>

Industrial metals like copper and aluminum are vital components in manufacturing and construction. Their price movements are closely tied to global economic growth and manufacturing activity, making them significant components of the global commodity markets.

-

Metal Prices: Track the price movements of key industrial metals. Copper price, for instance, is often seen as an indicator of global economic health.

-

Manufacturing Activity: Monitor the correlation between industrial metal prices and global manufacturing activity. Strong manufacturing activity typically boosts demand for industrial metals, pushing prices higher.

-

Supply Chain Disruptions: Analyze the impact of supply chain disruptions on industrial metal availability. Disruptions can lead to shortages and price increases.

-

Government Regulations: Observe the influence of government regulations on industrial metal production. Environmental regulations, for example, can impact production costs and prices.

-

Technological Advancements: Consider the role of technological advancements in the demand for industrial metals. New technologies may increase or decrease the demand for specific metals.

<h2>Conclusion</h2>

This week, keeping a close watch on these five key charts is crucial for understanding the pulse of the global commodity markets. By carefully analyzing the price trends, factors influencing these markets, and interpreting the data presented, you can gain valuable insights to improve your trading strategies and investment decisions. Don't miss out on the opportunities presented by these dynamic markets. Stay informed and continue to monitor these global commodity markets to make the most informed choices!

Featured Posts

-

Former Ufc Champions May 3rd Fight The Last Hurrah

May 05, 2025

Former Ufc Champions May 3rd Fight The Last Hurrah

May 05, 2025 -

Britains Got Talent News On Teddy Magics Rescheduled Act

May 05, 2025

Britains Got Talent News On Teddy Magics Rescheduled Act

May 05, 2025 -

Revolutionizing Voice Assistant Creation Open Ais 2024 Update

May 05, 2025

Revolutionizing Voice Assistant Creation Open Ais 2024 Update

May 05, 2025 -

Bradley Cooper And Will Arnett Behind The Scenes Nyc Photos From Is This Thing On

May 05, 2025

Bradley Cooper And Will Arnett Behind The Scenes Nyc Photos From Is This Thing On

May 05, 2025 -

Analyzing Fleetwood Macs Biggest Singles And Their Continued Success

May 05, 2025

Analyzing Fleetwood Macs Biggest Singles And Their Continued Success

May 05, 2025

Latest Posts

-

Halle Bailey And Ddg Feud Heats Up New Diss Track Dont Take My Son

May 06, 2025

Halle Bailey And Ddg Feud Heats Up New Diss Track Dont Take My Son

May 06, 2025 -

The Controversy Surrounding Ddgs Dont Take My Son Diss Track

May 06, 2025

The Controversy Surrounding Ddgs Dont Take My Son Diss Track

May 06, 2025 -

Ddgs Dont Take My Son A Line By Line Breakdown Of The Halle Bailey Diss

May 06, 2025

Ddgs Dont Take My Son A Line By Line Breakdown Of The Halle Bailey Diss

May 06, 2025 -

The Lyrics And Meaning Behind Ddgs Dont Take My Son Diss Track

May 06, 2025

The Lyrics And Meaning Behind Ddgs Dont Take My Son Diss Track

May 06, 2025 -

Dont Take My Son Ddgs Scathing Diss Track Against Halle Bailey

May 06, 2025

Dont Take My Son Ddgs Scathing Diss Track Against Halle Bailey

May 06, 2025