Five-Year Bitcoin Forecast: 1,500% Potential Gains

Table of Contents

Macroeconomic Factors Influencing Bitcoin's Future Price

The current macroeconomic landscape presents a fertile ground for Bitcoin's growth. Two key factors stand out: inflation and the weakening US dollar.

Inflation and the Weakening Dollar

Rampant inflation erodes the purchasing power of fiat currencies. As the value of the dollar declines, investors are increasingly seeking alternative assets to preserve their wealth. Bitcoin, with its fixed supply of 21 million coins, is often viewed as a hedge against inflation, a "Bitcoin inflation hedge".

- Historical Correlation: Historically, there's been a notable correlation between periods of high inflation and Bitcoin's price appreciation. As fiat currencies lose value, investors flock to Bitcoin as a store of value.

- Government Policies: Government policies aimed at combating inflation, such as quantitative easing, can indirectly boost Bitcoin's appeal. These policies often lead to increased money supply and further devalue fiat currencies, strengthening the "Bitcoin dollar correlation".

- Fiat Currency Devaluation: The ongoing devaluation of numerous fiat currencies globally further strengthens Bitcoin's position as a potential safe haven asset.

Global Adoption and Institutional Investment

The growing acceptance of Bitcoin by institutional investors and even some governments is a significant catalyst for its price appreciation. "Bitcoin institutional adoption" is no longer a niche phenomenon.

- Corporate Adoption: Several large corporations, including MicroStrategy and Tesla, have already adopted Bitcoin as a reserve asset, signaling a shift in mainstream acceptance.

- Regulatory Clarity: Increased regulatory clarity in certain jurisdictions is fostering greater institutional confidence in Bitcoin. The potential approval of a Bitcoin exchange-traded fund (Bitcoin ETF) could further accelerate institutional investment.

- Government Involvement: While regulatory uncertainty remains a concern (discussed later), some governments are exploring the potential of Bitcoin and other cryptocurrencies, paving the way for greater integration into the global financial system.

Technological Advancements Driving Bitcoin's Growth

Bitcoin's underlying technology is constantly evolving, addressing previous limitations and enhancing its functionality.

Layer-2 Scaling Solutions

One of the biggest challenges facing Bitcoin has been scalability. "Layer-2 solutions" like the Lightning Network are designed to overcome this hurdle.

- Improved Scalability: The Lightning Network allows for faster and cheaper transactions off the main Bitcoin blockchain, significantly improving its scalability and user experience.

- Reduced Transaction Fees: By processing transactions off-chain, the Lightning Network drastically reduces transaction fees, making Bitcoin more accessible to a wider range of users.

- Enhanced Usability: These improvements in speed and cost make Bitcoin a more practical payment option for everyday use, driving further adoption. "Bitcoin scalability" is no longer the barrier it once was.

Taproot and Future Upgrades

Bitcoin's ongoing development ensures its continued relevance and security. Upgrades like Taproot significantly enhance its capabilities.

- Enhanced Privacy: Taproot improves transaction privacy and makes it more difficult to track Bitcoin transactions.

- Smart Contract Capabilities: Taproot lays the groundwork for more sophisticated smart contracts on the Bitcoin network, opening up new possibilities for decentralized applications (dApps).

- Future Upgrades: Ongoing development and planned upgrades promise further enhancements to Bitcoin's security, functionality, and overall efficiency. "Bitcoin upgrades" are crucial for maintaining its competitive edge.

Potential Risks and Challenges to the 1500% Forecast

While the potential gains are significant, it's crucial to acknowledge the inherent risks associated with Bitcoin investment.

Regulatory Uncertainty

The regulatory landscape surrounding Bitcoin varies significantly across different countries. "Bitcoin regulation risks" are a real concern.

- Varying Approaches: Some countries embrace Bitcoin, while others impose strict regulations or outright bans. This creates uncertainty and potential volatility in the market.

- Government Intervention: The potential for future government crackdowns or stricter regulations remains a significant risk. This uncertainty can impact investor confidence and Bitcoin's price.

- Cryptocurrency Regulation: The evolving nature of cryptocurrency regulation globally makes accurate forecasting difficult.

Market Volatility and Price Corrections

Bitcoin is notoriously volatile, and significant price corrections are a regular occurrence. "Bitcoin price volatility" is an inherent characteristic of the cryptocurrency market.

- Historical Volatility: Bitcoin's history is marked by dramatic price swings, both upward and downward. Understanding this volatility is crucial for any investor.

- Market Corrections: Sharp price drops ("Bitcoin market correction") are a normal part of the market cycle and can significantly impact investment returns.

- Cryptocurrency Risk: Investing in Bitcoin involves substantial risk. Only invest what you can afford to lose.

Investment Strategies for Capitalizing on Potential Gains

Successfully navigating the Bitcoin market requires a strategic approach.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging ("Bitcoin DCA") is a risk-mitigation strategy that involves investing a fixed amount of money at regular intervals, regardless of price.

- Reduced Risk: DCA reduces the impact of market volatility by averaging out the purchase price over time.

- Long-Term Strategy: It's a long-term strategy best suited for those with a long-term investment horizon.

- Bitcoin Investment Strategy: This is a particularly suitable strategy for navigating the volatility inherent in the cryptocurrency market.

Diversification within Crypto and Traditional Assets

Diversification is key to managing risk. "Bitcoin portfolio diversification" is crucial.

- Cryptocurrency Diversification: Don't put all your eggs in one basket. Diversify your holdings across different cryptocurrencies.

- Asset Allocation: Integrate Bitcoin into a well-diversified portfolio that also includes traditional assets like stocks, bonds, and real estate.

- "Cryptocurrency diversification" and careful asset allocation are crucial for minimizing risk.

Conclusion: Investing in the Future of Bitcoin

The "Five-Year Bitcoin Forecast: 1,500% Potential Gains" is ambitious, but not entirely without foundation. Macroeconomic factors, technological advancements, and growing institutional adoption all point towards a potential for substantial growth. However, significant risks, primarily regulatory uncertainty and market volatility, must be carefully considered. Thorough research and a well-defined risk management strategy are crucial before investing in Bitcoin. Remember, this is a highly volatile asset, and any investment should be made only after careful consideration and with funds you can afford to lose. Conduct further research using reputable sources to make informed decisions about your investment strategy. Consider the potential of a Bitcoin investment as part of a diversified portfolio, keeping in mind the potential for substantial gains outlined in our "Five-Year Bitcoin Forecast".

Featured Posts

-

Inter Milan Eliminate Feyenoord Secure Place In Last Eight

May 08, 2025

Inter Milan Eliminate Feyenoord Secure Place In Last Eight

May 08, 2025 -

Colin Cowherds Unwavering Criticism Of Jayson Tatum Is He Underrated

May 08, 2025

Colin Cowherds Unwavering Criticism Of Jayson Tatum Is He Underrated

May 08, 2025 -

Giorgian De Arrascaeta O Heroi Da Vitoria Do Flamengo No Brasileirao

May 08, 2025

Giorgian De Arrascaeta O Heroi Da Vitoria Do Flamengo No Brasileirao

May 08, 2025 -

Sermaye Piyasasi Kurulu Ndan Kripto Duezenlemesi Platformlar Icin Yeni Sartlar

May 08, 2025

Sermaye Piyasasi Kurulu Ndan Kripto Duezenlemesi Platformlar Icin Yeni Sartlar

May 08, 2025 -

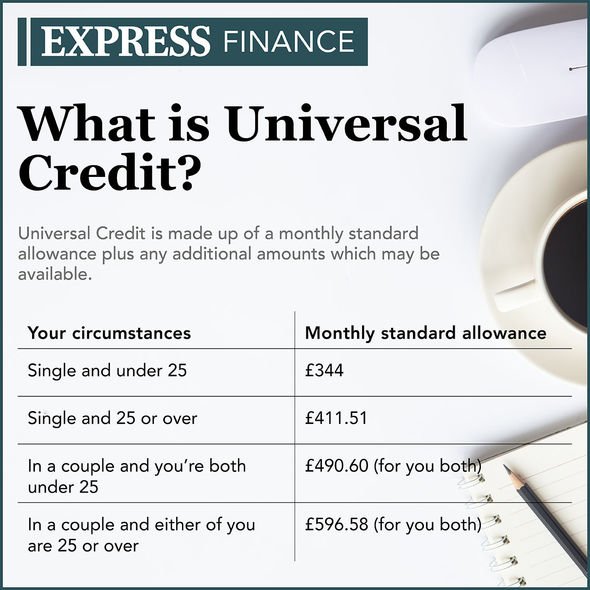

Universal Credit Overpayments Could You Be Owed Money

May 08, 2025

Universal Credit Overpayments Could You Be Owed Money

May 08, 2025