Florida Condo Market Decline: Reasons Behind The Desperate Sales

Table of Contents

Rising Interest Rates and Mortgage Costs

Impact on Affordability

Higher interest rates have a direct and substantial impact on the affordability of Florida condos. Increased borrowing costs make it significantly more expensive for potential buyers to finance a purchase, leading to a decrease in overall demand.

- Increased monthly payments: Even a small percentage increase in interest rates translates to hundreds of dollars more in monthly mortgage payments.

- Reduced borrowing power: Higher rates mean buyers can borrow less money, limiting the price range of condos they can afford.

- Decreased buyer demand: The combination of higher payments and reduced borrowing power significantly dampens buyer enthusiasm, resulting in fewer offers and slower sales.

The mechanics are straightforward: a higher interest rate increases the total amount paid over the life of the loan. For example, a 1% increase on a $300,000 mortgage could add thousands of dollars to the total cost and hundreds to the monthly payment. Data from the Federal Reserve shows a sharp increase in interest rates throughout 2022 and into 2023, directly correlating with the slowdown in Florida condo sales.

Increased Property Insurance Premiums and Availability

The Insurance Crisis in Florida

The escalating cost and dwindling availability of property insurance in Florida are major obstacles for both buyers and sellers. This "insurance crisis" is significantly impacting the Florida condo market decline.

- Skyrocketing premiums: Insurance premiums have increased dramatically, adding substantial expense to condo ownership.

- Difficulty securing coverage: Many condo owners struggle to find insurers willing to offer coverage at any price, leaving them vulnerable.

- Impact on property values: The uncertainty and high cost of insurance directly affect property values, making Florida condos less attractive to potential buyers.

The Florida insurance crisis is fueled by a number of factors, including a high frequency of hurricanes, excessive litigation, and several insurer insolvencies. This instability makes it challenging for condo associations to secure affordable and reliable coverage, impacting the overall desirability and value of the properties.

Oversupply of Condos in Certain Markets

Construction Boom and Market Saturation

A recent surge in condo construction in certain Florida areas has led to a market oversaturation, exceeding current buyer demand and contributing to the Florida condo market decline.

- Increased inventory: Many markets now have a significant surplus of available condos.

- Longer time on market: Condos are staying on the market for considerably longer periods, indicating reduced buyer interest.

- Price reductions to attract buyers: Sellers are increasingly forced to lower prices to compete in the oversaturated market.

Areas like South Florida, once known for their robust condo markets, are now experiencing significant oversupply, with a substantial increase in inventory compared to previous years. This glut of available properties is putting downward pressure on prices and extending the time it takes to sell.

Economic Uncertainty and Inflation

Impact on Consumer Confidence and Spending

Broader economic concerns, high inflation, and fears of a potential recession are impacting consumer confidence and reducing discretionary spending on big-ticket items like Florida condos.

- Reduced buyer confidence: Uncertainty about the economy makes potential buyers hesitant to commit to large financial investments.

- Decreased purchasing power: Inflation erodes buying power, making it harder for consumers to afford even moderately priced condos.

- Shift in consumer priorities: Consumers are prioritizing essential expenses, leading to a decrease in demand for luxury goods such as Florida condos.

Current inflation rates remain stubbornly high, and economic forecasts vary. This uncertainty makes potential buyers more cautious, impacting their willingness to invest in a Florida condo.

Increased Property Taxes

Tax Burden on Condo Owners

Rising property taxes add to the overall cost of condo ownership in Florida, making them less appealing to potential buyers and further contributing to the Florida condo market decline.

- Increased tax assessments: Property tax assessments are increasing, leading to higher tax bills.

- Higher annual property tax bills: Condo owners are facing significantly larger annual tax payments.

- Impact on affordability: The added tax burden further reduces the affordability of condo ownership.

Property tax assessments are often based on the property's market value. As property values fluctuate, so do tax assessments, adding another layer of financial complexity for condo buyers and owners.

Conclusion

The Florida condo market decline is multifaceted, driven by a convergence of factors: rising interest rates, the property insurance crisis, oversupply in specific markets, economic uncertainty, and increased property taxes. Understanding these interconnected elements is vital for navigating this challenging market. Whether you're a buyer or seller, careful analysis of these factors is paramount to making informed decisions. Stay informed about the Florida condo market decline, research current market trends, explore different areas of Florida, and consult with experienced real estate professionals to capitalize on the opportunities presented by this dynamic market. The Florida condo market decline, while presenting challenges, also offers potential for those who understand the nuances of the current landscape.

Featured Posts

-

Supreme Court Weighs In Parental Rights Vs Lgbtq Inclusive Curriculum In Elementary Schools

Apr 23, 2025

Supreme Court Weighs In Parental Rights Vs Lgbtq Inclusive Curriculum In Elementary Schools

Apr 23, 2025 -

High Winds Cause Widespread Power Outages In Lehigh Valley

Apr 23, 2025

High Winds Cause Widespread Power Outages In Lehigh Valley

Apr 23, 2025 -

Blue Origin Postpones Launch Details On Subsystem Malfunction

Apr 23, 2025

Blue Origin Postpones Launch Details On Subsystem Malfunction

Apr 23, 2025 -

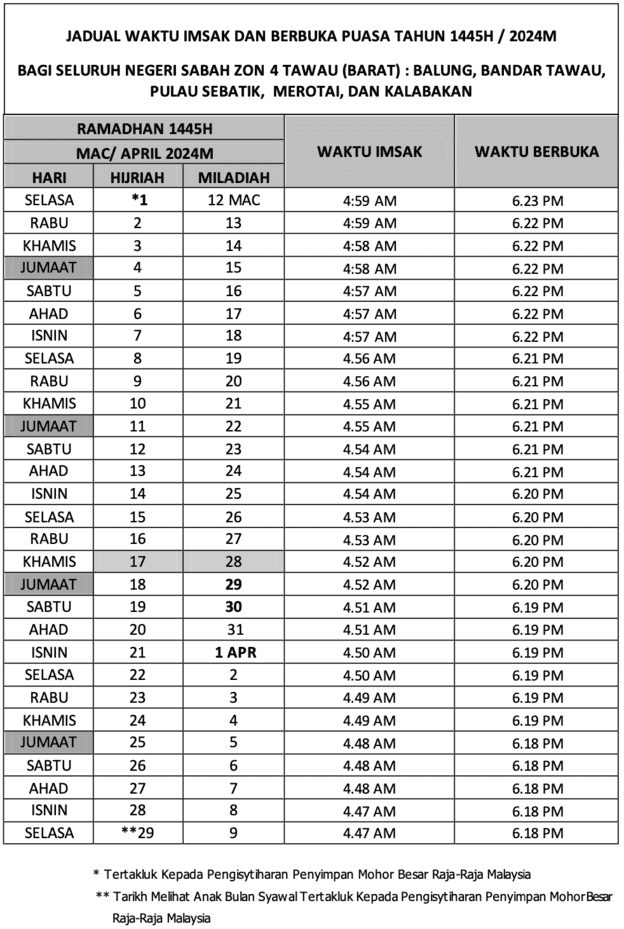

Acara Tv Menarik Di Bulan Ramadan 2025 Menemani Waktu Berbuka Dan Sahur

Apr 23, 2025

Acara Tv Menarik Di Bulan Ramadan 2025 Menemani Waktu Berbuka Dan Sahur

Apr 23, 2025 -

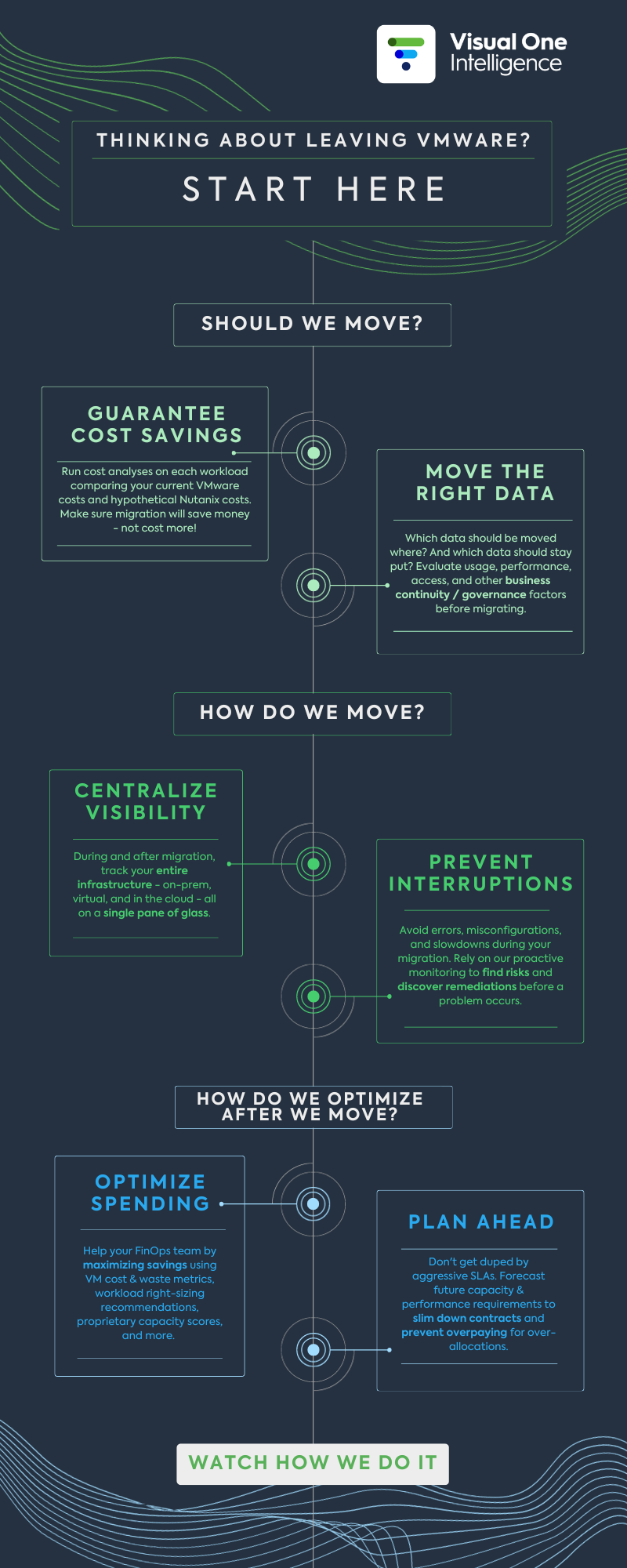

At And T Slams Broadcoms V Mware Price Hike A 1 050 Increase

Apr 23, 2025

At And T Slams Broadcoms V Mware Price Hike A 1 050 Increase

Apr 23, 2025