Foreign Airlines Acquire 25% Of WestJet, Marking Onex Investment Exit

Table of Contents

Details of the Acquisition

This acquisition marks a pivotal moment for WestJet and the Canadian airline industry. Understanding the specifics of the deal is crucial to grasping its potential impact.

Participating Airlines:

While the specific names of the foreign airlines involved may not be publicly disclosed immediately for strategic or regulatory reasons, we can speculate based on market trends and previous expressions of interest in the Canadian market. It's likely that established international carriers with significant global reach and a strategic interest in North American expansion are behind this investment. [Link to a relevant news source discussing potential investors would go here, if available]. The involvement of these airlines could significantly alter the competitive dynamics within Canada and beyond.

Acquisition Value and Terms:

The financial details surrounding the acquisition remain largely undisclosed, pending official announcements. However, given the size of WestJet and the 25% stake acquired, the total investment is likely to be in the billions of dollars. The payment structure may involve a combination of cash and potentially other assets, such as frequent flyer program shares or route rights. The final deal structure would be subject to regulatory approvals. Comparing this acquisition to recent deals in the airline industry, such as [Example: Delta's acquisition of a stake in another airline], provides valuable context and helps assess the financial implications for all parties involved.

Onex Corporation's Exit Strategy:

Onex Corporation's decision to divest its WestJet stake reflects a strategic shift in its investment portfolio. While Onex has had successes in various sectors, their experience in the airline industry has had its ups and downs. Their exit suggests a successful exit strategy with a considerable return on investment, albeit likely not the initially projected ROI. The timeline of the acquisition process, from initial negotiations to final agreement, likely spanned several months, demonstrating a meticulously planned exit by Onex.

- Percentage of WestJet acquired: 25%

- Expected ROI for Onex: [Insert estimated ROI if available, otherwise state "undisclosed but likely significant"]

- Timeline of the acquisition process: [Insert timeline if available, otherwise state "several months"]

Impact on WestJet's Operations and Future

The acquisition will undoubtedly shape WestJet's future trajectory. Several key aspects of its operations are poised for change.

Strategic Partnerships and Alliances:

This acquisition opens up opportunities for WestJet to forge strategic partnerships and alliances with the acquiring airlines. We could see new code-sharing agreements, joint ventures on specific routes, and increased coordination of flight schedules, significantly enhancing WestJet's network reach and customer offerings. This could result in improved connectivity for passengers and more efficient resource utilization for WestJet.

Route Expansion and International Growth:

The infusion of capital and the expertise of the foreign airlines involved could accelerate WestJet's international expansion plans. We might see the airline venturing into new geographic regions, particularly those where the acquiring airlines have a strong presence. This could include increased transatlantic flights or deeper penetration into other international markets. The potential for increased access to new aircraft and maintenance facilities is also high.

Impact on WestJet's Employees and Customers:

While the short-term implications remain uncertain, the acquisition could bring about changes impacting both employees and customers. Job security might be initially questioned, although the acquisition might lead to new opportunities and expansion plans. Customer experience may also be affected – potentially through altered fare structures or changes to frequent flyer programs.

- Potential changes to WestJet's fleet: Possible introduction of new aircraft types.

- Anticipated impact on ticket prices: Potential for both increases and decreases in fares depending on route and competition.

- Expected changes to frequent flyer programs: Potential integration with the frequent flyer programs of the acquiring airlines.

Implications for the Canadian Airline Industry

The acquisition's impact extends beyond WestJet, influencing the broader Canadian airline industry significantly.

Increased Competition:

The acquisition will undoubtedly intensify competition within the Canadian airline market. WestJet's market share will shift, potentially leading to a reshuffling of the competitive landscape. Air Canada, WestJet's primary competitor, will likely respond strategically to this increased competition.

Regulatory Considerations:

The acquisition must navigate the regulatory landscape within Canada. The Canadian Transportation Agency (CTA) will scrutinize the deal to ensure it doesn't impede competition or harm consumers. Securing regulatory approvals is a crucial step for the acquisition to proceed successfully. Thorough reviews and potential investigations will be required before the deal is fully finalized.

Impact on Airfares and Consumer Choice:

The long-term impact on airfares and consumer choices is complex and will depend on various factors. While increased competition could lead to lower prices on certain routes, it could also result in price wars or strategic alliances that ultimately lead to price increases on others. Consumer choice could also be affected positively or negatively depending on the nature of any new alliances and route expansions.

- Potential market consolidation scenarios: Possibility of further mergers or acquisitions in the Canadian aviation sector.

- Effect on Air Canada and other competitors: Air Canada and other players may be forced to adopt new strategies to maintain their competitiveness.

- Long-term impact on the Canadian economy: Potential for increased tourism and economic activity due to improved air connectivity.

Conclusion

The acquisition of a 25% stake in WestJet by foreign airlines, marking Onex's investment exit, represents a watershed moment in Canadian aviation. This deal holds significant implications, affecting WestJet's strategic direction, the competitive dynamics within the Canadian market, and potentially airfares for consumers. While the long-term effects remain to be seen, this acquisition undoubtedly ushers in a new era for WestJet and the broader Canadian airline landscape. For further updates and in-depth analysis on this crucial development in the WestJet story and the Canadian airline market, continue to follow reputable news sources and industry reports on the impact of foreign airlines on the future of WestJet. Stay informed on the ongoing developments surrounding this significant WestJet acquisition.

Featured Posts

-

Pandemic Fraud Lab Owner Pleads Guilty To False Covid Test Reports

May 12, 2025

Pandemic Fraud Lab Owner Pleads Guilty To False Covid Test Reports

May 12, 2025 -

Injury Updates Yankees Vs Giants April 11th 13th

May 12, 2025

Injury Updates Yankees Vs Giants April 11th 13th

May 12, 2025 -

Jessica Simpson And Eric Johnson Spotted Together Amidst Separation Rumors

May 12, 2025

Jessica Simpson And Eric Johnson Spotted Together Amidst Separation Rumors

May 12, 2025 -

Mc Gregors Reaction To Bkfc Fighter Recreating Infamous Aldo Confrontation

May 12, 2025

Mc Gregors Reaction To Bkfc Fighter Recreating Infamous Aldo Confrontation

May 12, 2025 -

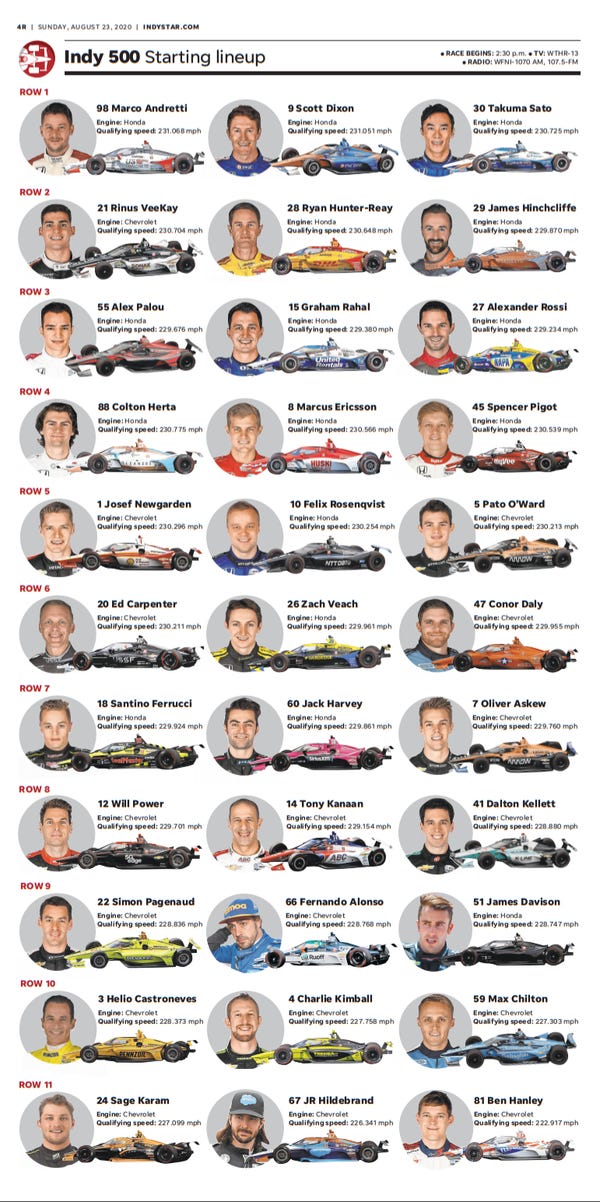

2025 Indy 500 Driver Safety Concerns Following Latest Announcement

May 12, 2025

2025 Indy 500 Driver Safety Concerns Following Latest Announcement

May 12, 2025

Latest Posts

-

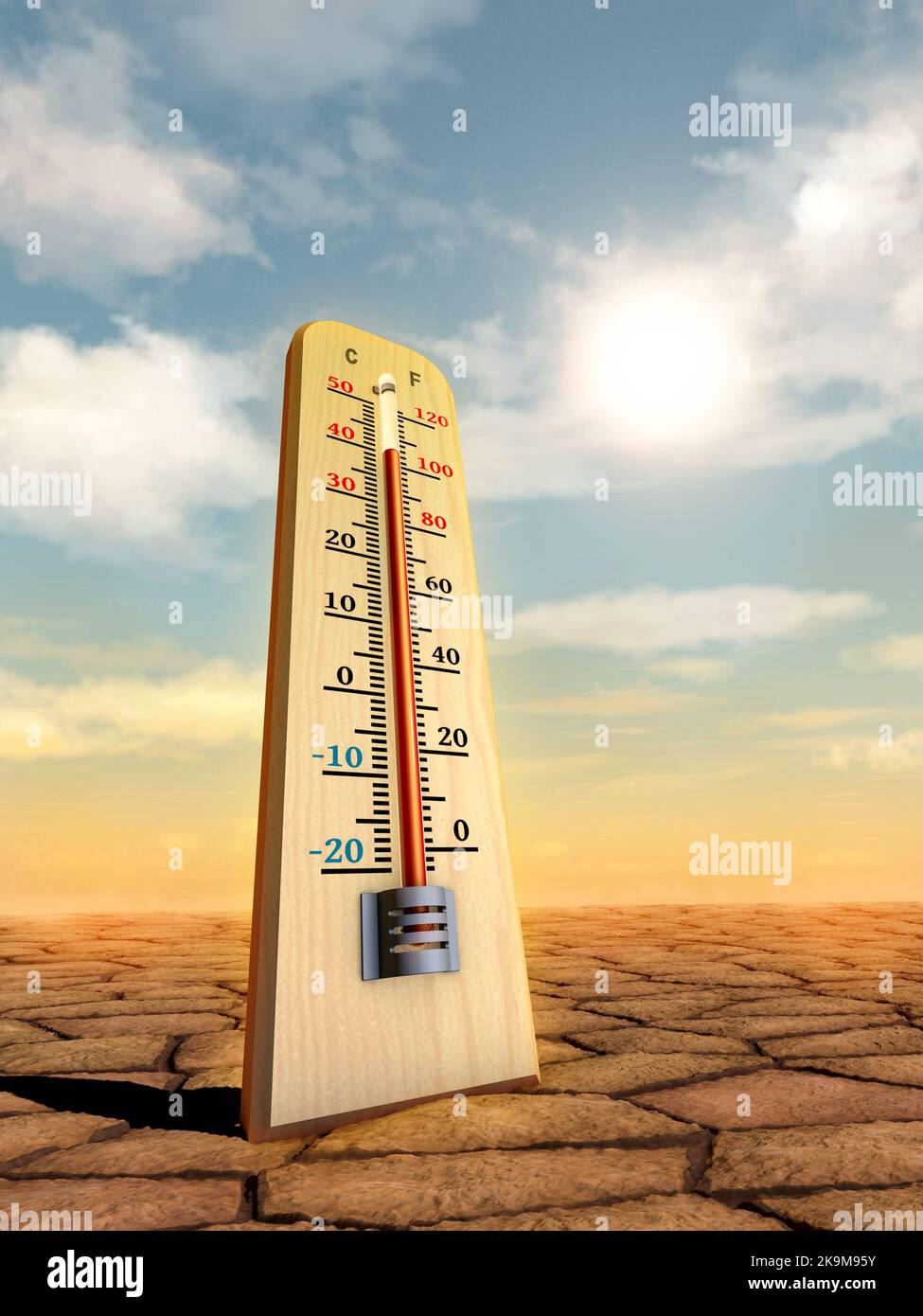

Rising Temperatures Health Department Issues Important Safety Advisory

May 13, 2025

Rising Temperatures Health Department Issues Important Safety Advisory

May 13, 2025 -

Heat Advisory Issued Health Departments Response To Extreme Temperatures

May 13, 2025

Heat Advisory Issued Health Departments Response To Extreme Temperatures

May 13, 2025 -

Health Advisory Department Urges Precautions Amidst Rising Temperatures

May 13, 2025

Health Advisory Department Urges Precautions Amidst Rising Temperatures

May 13, 2025 -

Health Department Issues Heat Advisory Rising Temperatures Prompt Urgent Warning

May 13, 2025

Health Department Issues Heat Advisory Rising Temperatures Prompt Urgent Warning

May 13, 2025 -

Romska Gromada Ukrayini Rozmir Geografiya Ta Istoriya

May 13, 2025

Romska Gromada Ukrayini Rozmir Geografiya Ta Istoriya

May 13, 2025