Four Books Exposing The Power Of Private Equity

Table of Contents

Understanding the Private Equity Landscape: Essential Foundational Texts

To grasp the power of private equity, a strong foundation is necessary. These foundational texts offer invaluable insights into the mechanics and strategies of this dynamic sector:

Book 1: "Venture Deals: Be Smarter Than Your Lawyer and Venture Capitalist" by Brad Feld and Jason Mendelson – Focus on the Deal-Making Process

- Key Takeaways: This book provides a practical guide to navigating the complexities of venture capital and private equity deals from the entrepreneur's perspective. It covers crucial aspects of deal structuring, term sheets, and negotiations.

- Author's Expertise: Brad Feld and Jason Mendelson are prominent figures in the venture capital industry, bringing years of experience and practical knowledge to the table.

- Target Audience: Entrepreneurs, startups, and those seeking to understand the deal-making process from the perspective of the company seeking funding.

- Importance: Understanding the deal-making process is vital for anyone involved in private equity investments, whether as an investor or a company seeking funding. Key concepts like leveraged buyouts and the importance of thorough due diligence are clearly explained.

Book 2: "Private Equity Performance: A Practitioner's Guide to Value Creation" by Stephen N. Kaplan and Per Stromberg – Focus on Fund Management and Performance

- Key Takeaways: This book delves into the critical aspects of private equity firm performance, providing a framework for evaluating investment strategies and analyzing fund performance. It explores how successful firms create value and manage risk.

- Author's Expertise: Kaplan and Stromberg are renowned academics with extensive experience in researching and analyzing the private equity industry, offering data-driven insights into portfolio management.

- Target Audience: Investors, private equity firms, and those interested in the performance measurement and valuation aspects of private equity.

- Importance: Understanding fund performance and the key drivers of success in private equity is crucial for making informed investment decisions and assessing the overall power of private equity in generating returns.

The Impact of Private Equity: Analyzing its Influence on Businesses and Economies

The influence of private equity extends far beyond individual deals, impacting businesses, economies, and society as a whole. These books explore these broader consequences:

Book 3: "Private Equity at the Crossroads: The Promise and Peril of a Powerful Industry" by Bain & Company – Focus on the Social and Economic Impact

- Key Takeaways: This book examines the social and economic impacts of private equity, exploring both the positive contributions and potential downsides. It delves into topics like job creation, innovation, and corporate governance.

- Author's Expertise: Bain & Company is a leading global management consulting firm with deep industry expertise and a wealth of data on private equity's impact.

- Target Audience: Policymakers, investors, researchers, and anyone interested in the broader societal implications of private equity, including the growing focus on ESG investing.

- Importance: Understanding the private equity impact on various stakeholders, including employees, communities, and the environment, is crucial for responsible investing and policymaking. The role of corporate governance within PE-backed companies is particularly important.

Book 4: "Barbarians at the Gate: The Fall of RJR Nabisco" by Bryan Burrough and John Helyar – Focus on Critical Analysis and Potential Downsides

- Key Takeaways: This classic work chronicles the leveraged buyout of RJR Nabisco, offering a compelling narrative that highlights both the potential and the pitfalls of private equity. It offers a critical perspective on deal-making practices and their consequences.

- Author's Expertise: Burrough and Helyar are acclaimed investigative journalists known for their in-depth reporting on business and finance.

- Target Audience: Anyone interested in a detailed case study of a high-profile private equity deal, as well as those seeking a critical perspective on the industry and its potential risks.

- Importance: "Barbarians at the Gate" offers a cautionary tale, illuminating potential downsides and regulatory challenges associated with private equity criticism and the inherent financial risks involved in highly leveraged transactions.

Unlocking the Power of Private Equity Knowledge

These four books offer diverse perspectives on the power of private equity, revealing its intricate mechanisms, its impact on businesses and economies, and its potential benefits and risks. Understanding this influential industry is vital for investors, business professionals, and anyone seeking to navigate the increasingly complex world of finance. We encourage you to explore these titles and further your knowledge in this dynamic field. For additional resources, consider searching for reputable financial publications and industry reports that provide further insights into the ever-evolving landscape of private equity.

Featured Posts

-

Dois Policiais Feridos Em Troca De Tiros Com Bandidos

May 27, 2025

Dois Policiais Feridos Em Troca De Tiros Com Bandidos

May 27, 2025 -

Rekor Penyelamatan Damkar Bandar Lampung 334 Kasus Non Kebakaran Mei 2025

May 27, 2025

Rekor Penyelamatan Damkar Bandar Lampung 334 Kasus Non Kebakaran Mei 2025

May 27, 2025 -

Avrupa Merkez Bankasi Nin Trump In Ekonomik Politikalarina Tepkisi

May 27, 2025

Avrupa Merkez Bankasi Nin Trump In Ekonomik Politikalarina Tepkisi

May 27, 2025 -

Andrey Sibiga Kak Nemetskaya Pomosch Spasaet Zhizni V Ukraine

May 27, 2025

Andrey Sibiga Kak Nemetskaya Pomosch Spasaet Zhizni V Ukraine

May 27, 2025 -

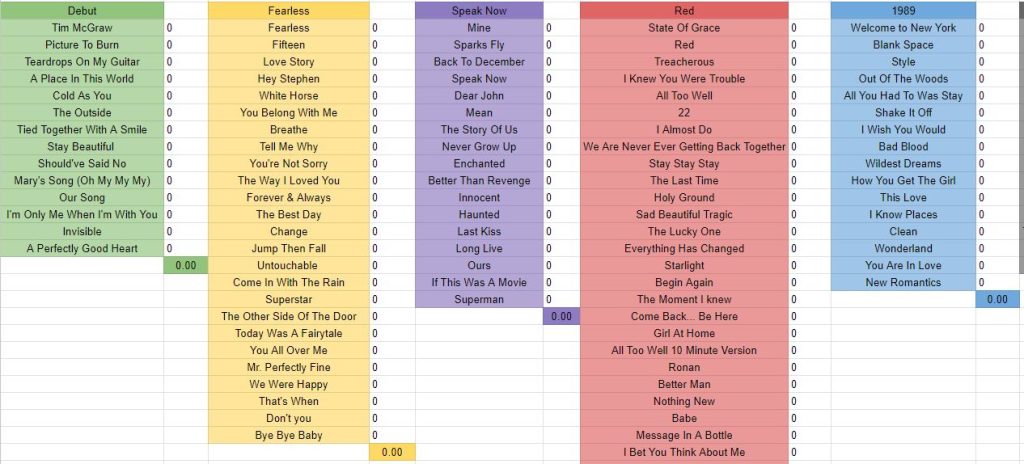

The Ultimate Ranking Of All 11 Taylor Swift Albums

May 27, 2025

The Ultimate Ranking Of All 11 Taylor Swift Albums

May 27, 2025

Latest Posts

-

Air Jordan Releases Your May 2025 Sneaker Preview

May 29, 2025

Air Jordan Releases Your May 2025 Sneaker Preview

May 29, 2025 -

Air Jordan May 2025 Release Dates Must Know Information

May 29, 2025

Air Jordan May 2025 Release Dates Must Know Information

May 29, 2025 -

Air Jordans Launching In June 2025 A Sneakerheads Guide

May 29, 2025

Air Jordans Launching In June 2025 A Sneakerheads Guide

May 29, 2025 -

Upcoming Air Jordan Releases June 2025 Preview

May 29, 2025

Upcoming Air Jordan Releases June 2025 Preview

May 29, 2025 -

Klmat Alshykh Fysl Alhmwd Bmnasbt Eyd Astqlal Almmlkt Alardnyt Alhashmyt

May 29, 2025

Klmat Alshykh Fysl Alhmwd Bmnasbt Eyd Astqlal Almmlkt Alardnyt Alhashmyt

May 29, 2025