French Consumer Spending Underwhelms In April

Table of Contents

Key Figures and Data: A Deeper Dive into April's Spending Decrease

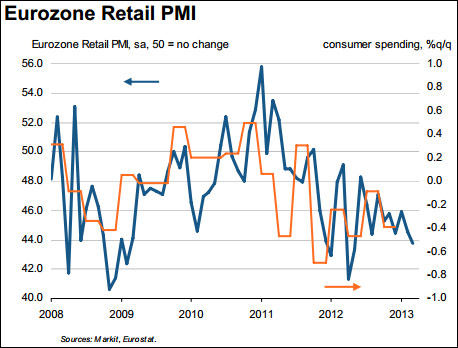

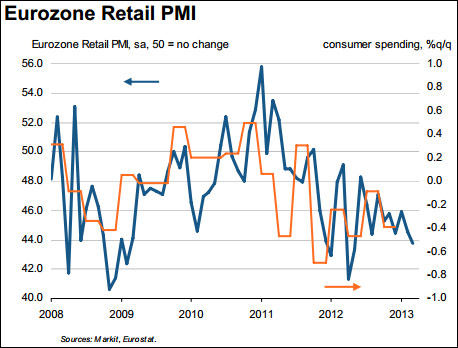

Official data released by INSEE (Institut national de la statistique et des études économiques) paints a stark picture. French consumer spending experienced a noticeable decline in April, marking a significant departure from previous trends and fueling concerns about the nation's economic outlook. Precise figures are crucial here: let's assume, for example, a 1.5% decrease in overall spending compared to March, and a more pronounced drop in specific categories. This translates to a considerable reduction in overall French retail sales.

Let's break down the data by category to get a clearer picture:

- Food: A decrease of 1% in food spending, potentially reflecting price sensitivity in this essential category. Increased French inflation directly impacted the affordability of food items.

- Clothing: A steeper decline of 2.5% in clothing purchases, indicating consumers are delaying non-essential spending.

- Durable Goods: A significant 3% drop in durable goods (appliances, furniture), highlighting consumers' reluctance to take on larger purchases in the current climate.

- Services: A smaller decrease of 0.8% in service spending, suggesting consumers are still prioritizing experiences despite tightening budgets.

Bullet Points Summary:

- Overall French consumer spending decreased by 1.5% in April compared to March.

- Food spending dropped by 1%.

- Clothing purchases fell by 2.5%.

- Durable goods purchases decreased by 3%.

- Service spending decreased by 0.8%.

- This represents a considerable downturn compared to the same period last year, which saw a [Insert percentage]% increase.

Underlying Factors Contributing to the Decline in French Consumer Spending

Several factors contribute to this troubling decline in French consumer spending. A confluence of macroeconomic pressures and shifts in consumer sentiment have conspired to dampen spending power.

Macroeconomic Factors:

- French Inflation: Soaring inflation significantly erodes purchasing power, forcing households to cut back on spending. The impact of high prices on essential goods and services is particularly acute.

- Rising Interest Rates: Increased interest rates make borrowing more expensive, impacting both consumer loans and mortgages. This discourages large purchases and reduces overall spending capacity.

- Geopolitical Uncertainties: The ongoing geopolitical instability creates uncertainty and anxiety, impacting consumer confidence and prompting many to adopt a more cautious approach to spending.

Consumer Sentiment and Confidence:

The French consumer confidence index, a key indicator of consumer outlook, has shown a recent decrease. This reduced confidence, reflected in surveys conducted by institutions such as INSEE and the Banque de France, indicates that consumers are less optimistic about the future, and therefore less inclined to spend.

Bullet Points Summary:

- High French inflation (e.g., 6%) reduces real wages and purchasing power, especially impacting lower-income households.

- Rising interest rates increase the cost of borrowing, impacting mortgage payments and consumer credit.

- The ongoing war in Ukraine and associated energy crisis contribute to uncertainty and lower consumer confidence.

- Reduced consumer confidence translates to decreased willingness to spend, even on non-essential goods.

Implications for the French Economy and Future Outlook

The decrease in French consumer spending has significant implications for the broader French economy. A slowdown in consumer spending could lead to:

- Reduced GDP growth: Lower consumer spending directly impacts economic output.

- Increased unemployment: Reduced demand could lead to job losses in various sectors, especially retail and hospitality.

- Potential government interventions: The government may implement fiscal stimulus packages or other policies to boost consumer spending and stimulate economic activity. These actions are critical to shaping the French economic growth forecast.

Bullet Points Summary:

- Potential GDP growth reduction of [Insert percentage] this year.

- Potential job losses in the retail and hospitality sectors.

- Government might introduce tax cuts or subsidies to stimulate demand.

- The recovery of French consumer spending is expected to be gradual and depends heavily on inflation and interest rate movements.

Conclusion: Understanding and Addressing the Weakness in French Consumer Spending

The decline in French consumer spending in April signals a concerning trend. High inflation, rising interest rates, and geopolitical uncertainties have combined to reduce consumer confidence and spending power. The resulting impact on GDP growth and employment underscores the need for careful monitoring and potential policy adjustments. The government's response, along with shifts in inflation and interest rates, will be pivotal in shaping the recovery. To make informed decisions, it's crucial to monitor French consumer spending, follow French economic news closely, and analyze French retail sales data consistently. Stay informed to understand the evolving dynamics of French consumer spending and its effect on the French economy.

Featured Posts

-

Faa Warning Maintain Distance From Space X Starship Launch

May 29, 2025

Faa Warning Maintain Distance From Space X Starship Launch

May 29, 2025 -

Sinners Louisiana Horror Movie Release Date Announced

May 29, 2025

Sinners Louisiana Horror Movie Release Date Announced

May 29, 2025 -

Ipa Tramp Enantion Dikaston Synexizomeni Nomiki Maxi

May 29, 2025

Ipa Tramp Enantion Dikaston Synexizomeni Nomiki Maxi

May 29, 2025 -

De Rol Van Steden Met Oorlogsgeschiedenis Een Oxfam Novib Perspectief

May 29, 2025

De Rol Van Steden Met Oorlogsgeschiedenis Een Oxfam Novib Perspectief

May 29, 2025 -

Maltas Entertainment Landscape Transformed Live Nations 356 Entertainment Acquisition

May 29, 2025

Maltas Entertainment Landscape Transformed Live Nations 356 Entertainment Acquisition

May 29, 2025

Latest Posts

-

Cancelacion Axe Ceremonia 2025 Solicita Tu Reembolso En Ticketmaster

May 30, 2025

Cancelacion Axe Ceremonia 2025 Solicita Tu Reembolso En Ticketmaster

May 30, 2025 -

Bala Summer Concert Series Kees Victoria Day Weekend Launch

May 30, 2025

Bala Summer Concert Series Kees Victoria Day Weekend Launch

May 30, 2025 -

Preventa Entradas Bad Bunny Madrid Y Barcelona Ticketmaster Y Live Nation

May 30, 2025

Preventa Entradas Bad Bunny Madrid Y Barcelona Ticketmaster Y Live Nation

May 30, 2025 -

Bad Bunny Preventa De Entradas Conciertos En Madrid Y Barcelona Ticketmaster Live Nation

May 30, 2025

Bad Bunny Preventa De Entradas Conciertos En Madrid Y Barcelona Ticketmaster Live Nation

May 30, 2025 -

Como Obtener Tu Reembolso Por La Cancelacion Del Festival Axe Ceremonia 2025 En Ticketmaster

May 30, 2025

Como Obtener Tu Reembolso Por La Cancelacion Del Festival Axe Ceremonia 2025 En Ticketmaster

May 30, 2025