From $TRUMP Short Sell To White House Dinner: The Full Story

Table of Contents

The Risky Gamble: Understanding the $TRUMP Short Sell Strategy

A short sell, in the context of political markets, involves betting against a political figure's success. In this case, a "$TRUMP Short Sell" would entail the belief that Donald Trump's political capital or business ventures would decline, allowing the investor to profit from this predicted downturn. This isn't about traditional stocks; it's about speculating on the future trajectory of a powerful individual's influence and fortunes.

This strategy, however, is inherently risky. The political climate is notoriously unpredictable. Public opinion can shift dramatically, economic indicators can fluctuate wildly, and sudden policy changes can completely derail even the most meticulously planned investment. The potential for significant financial losses is very real.

-

Definition of a short sell in relation to political figures: Essentially, it's a bet against their continued success or influence. This could involve various financial instruments, from derivatives tied to their businesses to more complex, less regulated investments.

-

Factors influencing the success/failure of a $TRUMP short sell: These factors are numerous and complex, including public approval ratings, economic performance under his administration, media coverage, international relations, and even unexpected events like pandemics or social movements.

-

Potential downsides and high-risk nature of this investment strategy: The potential for substantial losses far outweighs the potential for gains, particularly given the volatility inherent in political markets. Unlike traditional stock markets, there's no clear regulatory framework for many types of political investments.

The Road to the White House: Tracking the Investment's Trajectory

Let's assume our hypothetical investor initiated a $TRUMP Short Sell strategy early in Trump's political career. The initial phase might have shown some promising returns as various controversies and polls suggested declining public support. However, this is where the unpredictability comes in.

Unexpected events, such as significant policy changes or unforeseen economic shifts, could have impacted the investment negatively. Our investor may have had to adjust their strategy, perhaps hedging their bets or even partially covering their short position to mitigate losses. The investor's decision-making process would have been crucial at various junctures, requiring careful analysis of real-time political and economic data.

-

Timeline of key events impacting the $TRUMP short sell investment: This timeline would include major policy announcements, election results, economic data releases, and significant media events influencing public perception of Trump.

-

Analysis of the investor's decision-making process at critical junctures: Did they stick to their original plan, or did they adapt their strategy based on changing circumstances? Their ability to analyze complex data and respond quickly to unforeseen events would have played a vital role.

-

External factors (e.g., media coverage, competitor actions) that influenced the investment's performance: Media narratives and the actions of political opponents would have created significant noise and influenced investor sentiment.

The Unexpected Twist: From Short Seller to White House Guest

Now, for the surprising twist. Despite the inherent risks, imagine our investor receiving an invitation to a White House dinner. This unexpected turn of events raises many questions. Was it purely coincidental? Did the investor's earlier actions somehow influence this invitation, perhaps through networking opportunities or a shift in political landscape that created unexpected business opportunities? The reasons could range from pure chance to a more calculated strategy of political reconciliation or leveraging a newfound connection.

-

The story of the White House dinner invitation and its context: This section would delve into the specific circumstances surrounding the invitation, adding details to create a more compelling narrative.

-

Potential explanations for the invitation: This section would explore the different plausible reasons for the invitation, balancing speculation with factual information.

-

The investor's reflections on the experience and its implications: What did the investor learn from this unique experience? How did it change their perspective on political investing and risk management?

Lessons Learned from the $TRUMP Short Sell Experience

This extraordinary tale offers several valuable lessons about political investing, risk management, and the unexpected turns life can take. It underscores the extreme volatility of political markets, making it clear that even the most well-researched predictions can be overturned by unexpected events.

-

Key takeaways regarding the unpredictability of political markets: Political investments are notoriously volatile, and significant losses are always a possibility.

-

Practical advice on risk management in high-stakes investments: Diversification, thorough research, and a willingness to adapt to changing circumstances are critical for mitigating risk.

-

The importance of adapting to changing circumstances and unexpected outcomes: The investor's journey shows that even the best-laid plans can fail, and flexibility is key to navigating the unpredictable nature of political events.

Conclusion

This incredible story recounts a journey from a risky $TRUMP short sell to a White House dinner—a testament to both the unpredictable nature of political markets and the surprising twists of fate. The high-stakes nature of such investments and the potential for significant losses were clearly demonstrated. Yet, the unexpected outcome also highlights the importance of adaptability and risk management.

This incredible story serves as a cautionary tale and a fascinating insight into the unpredictable world of political investing. Learn more about navigating the complexities of political markets and minimizing risk in your investment strategies. Research the intricacies of short selling and assess the potential of similar $TRUMP-related investments (carefully!). Understand the risks involved in $TRUMP short sells before embarking on such a volatile venture.

Featured Posts

-

Jwnathan Tah Yqtrb Mn Alandmam Ila Bayrn Mywnykh

May 29, 2025

Jwnathan Tah Yqtrb Mn Alandmam Ila Bayrn Mywnykh

May 29, 2025 -

Building On Arcanes Success The Future Of Runeterra In Spinoffs

May 29, 2025

Building On Arcanes Success The Future Of Runeterra In Spinoffs

May 29, 2025 -

Aanhouding In Venlo Update Schietincident Met Pasen

May 29, 2025

Aanhouding In Venlo Update Schietincident Met Pasen

May 29, 2025 -

How To Get Shiny Pokemon In Pokemon Tcg Pocket

May 29, 2025

How To Get Shiny Pokemon In Pokemon Tcg Pocket

May 29, 2025 -

Royal Bath And West Show Half Term Fun Thrill Rides And Family Activities

May 29, 2025

Royal Bath And West Show Half Term Fun Thrill Rides And Family Activities

May 29, 2025

Latest Posts

-

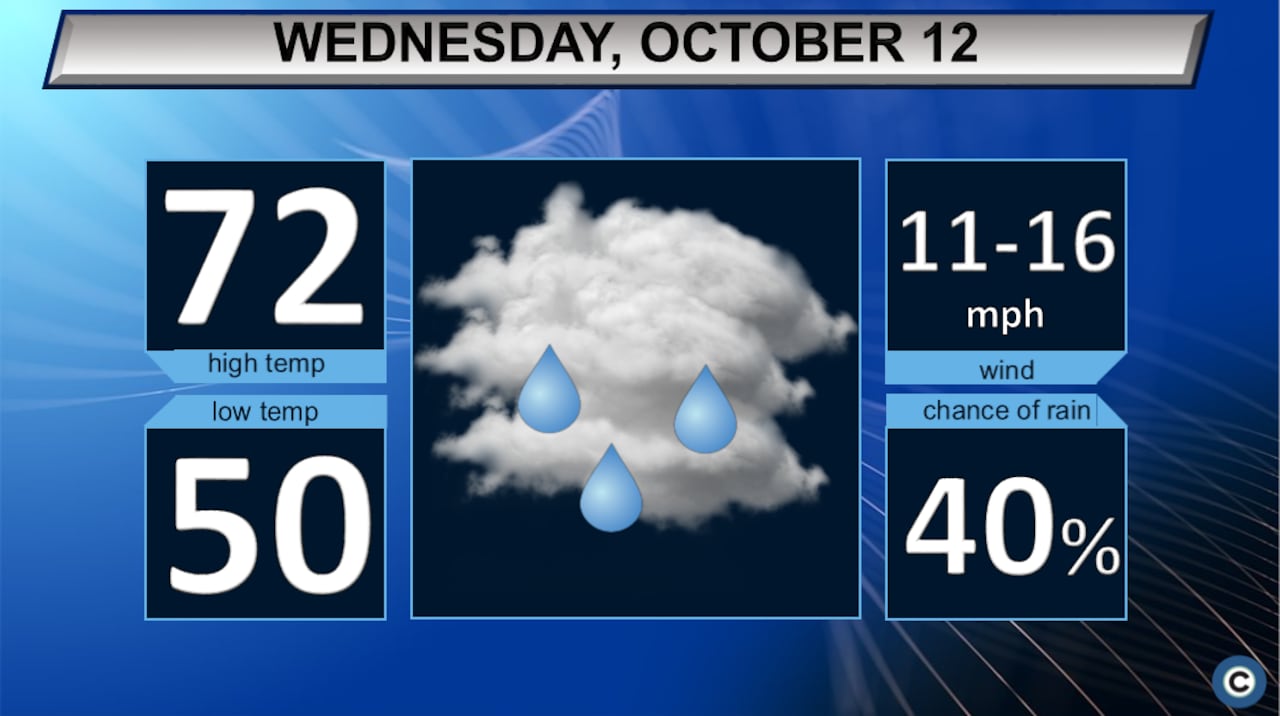

Northeast Ohio Weather Forecast Rain Expected Thursday

May 31, 2025

Northeast Ohio Weather Forecast Rain Expected Thursday

May 31, 2025 -

Bi Annual Skywarn Class Hosted By Meteorologist Tom Atkins

May 31, 2025

Bi Annual Skywarn Class Hosted By Meteorologist Tom Atkins

May 31, 2025 -

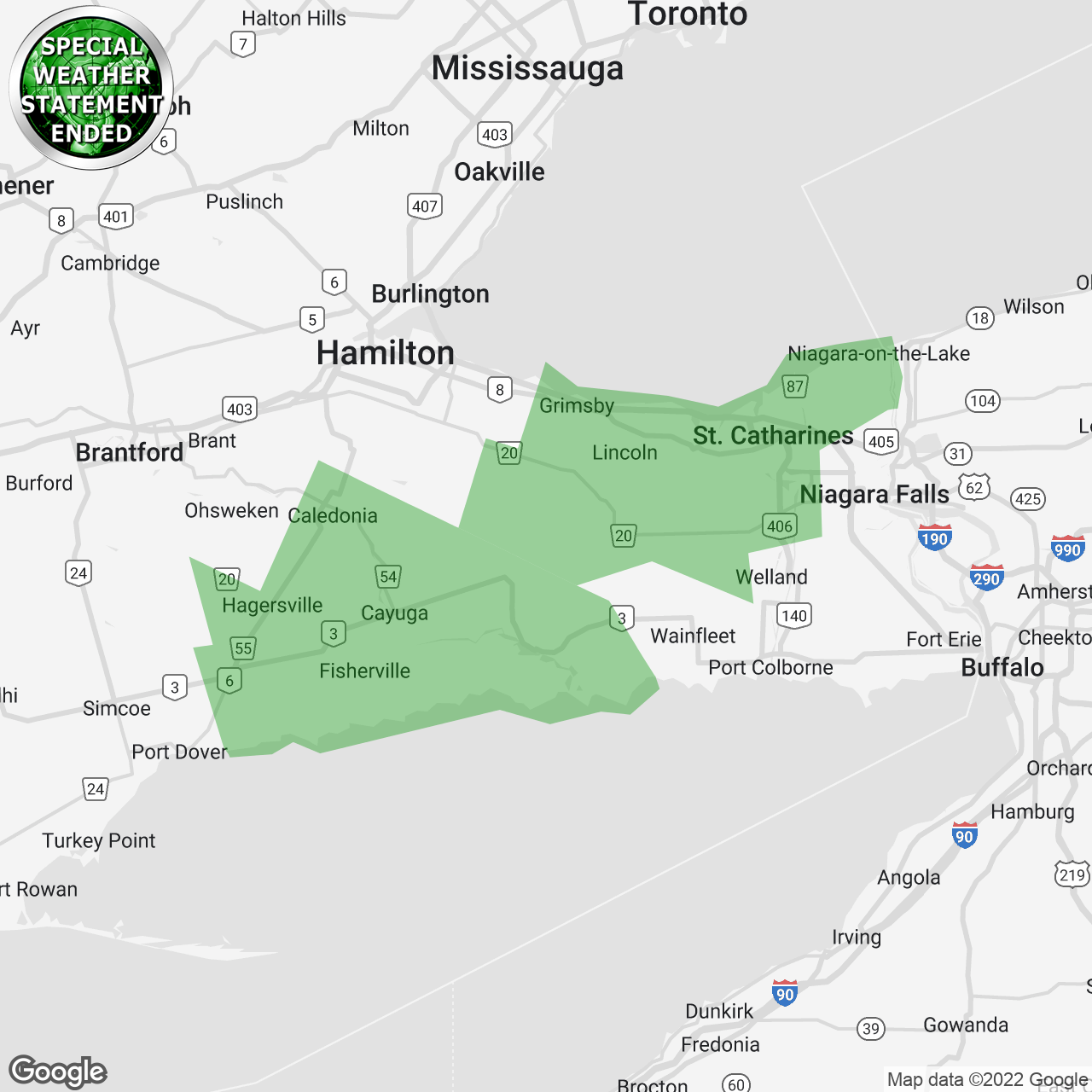

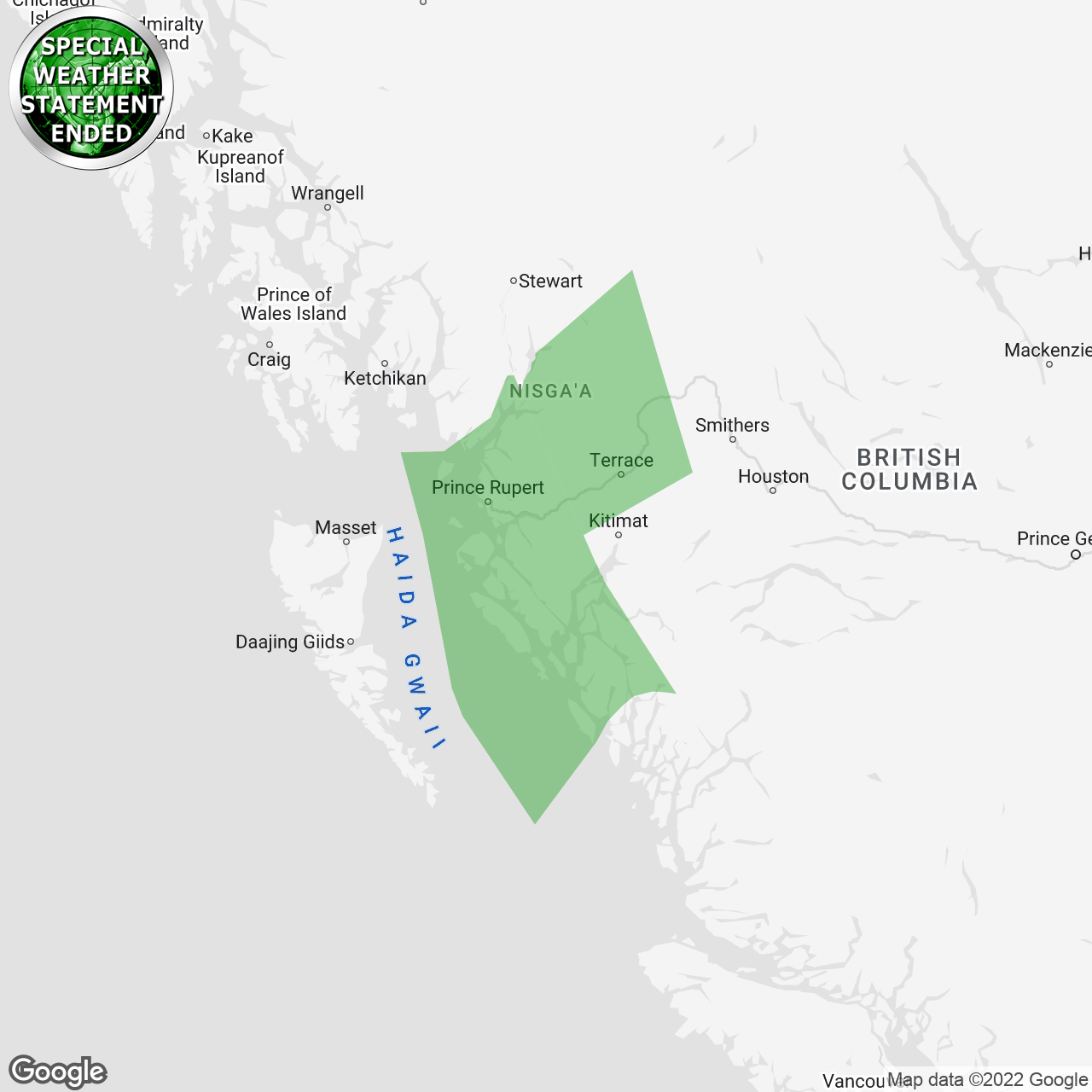

Increased Fire Risk Prompts Special Weather Statement For Cleveland Akron

May 31, 2025

Increased Fire Risk Prompts Special Weather Statement For Cleveland Akron

May 31, 2025 -

Upcoming Skywarn Class With Meteorologist Tom Atkins

May 31, 2025

Upcoming Skywarn Class With Meteorologist Tom Atkins

May 31, 2025 -

Akron Cleveland Area Under Special Weather Statement Due To Fire Risk

May 31, 2025

Akron Cleveland Area Under Special Weather Statement Due To Fire Risk

May 31, 2025