Front-Loading Strategies Mitigate Malaysian Ringgit (MYR) Risks For Exporters

Table of Contents

Understanding MYR Volatility and its Impact on Exporters

Factors Influencing MYR Exchange Rates

The MYR exchange rate is influenced by a complex interplay of factors, including:

- Global economic conditions: International trade imbalances, global economic growth, and shifts in investor sentiment significantly impact the MYR. A strong US dollar, for example, often weakens the MYR.

- Domestic policies: Monetary policy decisions by Bank Negara Malaysia (BNM), government fiscal policies, and political stability all affect the MYR's value.

- Commodity prices: As a significant exporter of commodities, Malaysia's currency is sensitive to price fluctuations in palm oil, rubber, and petroleum.

- Geopolitical events: Global conflicts and regional uncertainties can trigger sudden shifts in the MYR exchange rate.

How MYR fluctuations affect exporters:

- Reduced export revenue: A weakening MYR reduces the value of export earnings when converted back into Malaysian Ringgit.

- Decreased profitability: Fluctuating exchange rates make it difficult to accurately predict profit margins, leading to potential losses.

- Reduced competitiveness: Unpredictable exchange rates can make Malaysian products less competitive in the global market compared to those from countries with more stable currencies.

Relying solely on post-transaction hedging strategies, such as using futures or options contracts after the sale is finalized, leaves exporters vulnerable to unexpected MYR movements during the sales cycle. The graph below illustrates the MYR's volatility over the past [insert timeframe, e.g., five years]: [Insert graph/chart of MYR volatility].

Key Front-Loading Strategies for MYR Risk Mitigation

Negotiating Contracts with Upfront Payments or Advance Payments

- Advantages: Upfront payments significantly reduce exposure to MYR fluctuations. A larger portion of the revenue is secured before exchange rate changes can negatively impact the final amount received.

- Disadvantages: Demanding upfront payments can strain customer relationships, particularly with new clients. It might also decrease your competitiveness compared to competitors offering more flexible payment terms.

- Negotiation Strategies: Offer early payment discounts to incentivize upfront payments. Structure payment schedules with a substantial initial payment followed by installments. Clearly outline the exchange rate used for each payment in the contract. Example contract clause: "10% advance payment upon signing the contract, with the remaining 90% payable upon delivery. The exchange rate for all payments will be the MYR/USD mid-rate as published by [ reputable source] on the date of payment."

Invoicing in a Stable Foreign Currency

- Benefits: Invoicing in a stable currency, such as USD or EUR, eliminates the risk of MYR fluctuations affecting your revenue.

- Challenges: Securing customer agreement to invoice in a foreign currency can be challenging, especially if they are not accustomed to this practice. It also might affect pricing competitiveness.

- Conversion Strategies: Once you receive payment in a foreign currency, carefully strategize when to convert it back to MYR, considering predicted exchange rate movements. Consider using a spot transaction or a forward contract to lock in a favorable exchange rate.

Utilizing Forward Contracts and Other Hedging Instruments

- Forward Contracts: A forward contract locks in a future exchange rate, eliminating uncertainty.

- Options Contracts: Options offer the right, but not the obligation, to buy or sell currency at a specific rate, providing flexibility.

- Other Hedging Tools: Other hedging instruments, like currency swaps, can also be used to manage MYR risk, depending on the specific circumstances.

- Foreign Exchange Specialist: A foreign exchange specialist can advise on the optimal hedging strategy based on your specific needs and risk tolerance. Accurate forecasting of future exchange rates is vital for effective hedging.

Strategic Pricing Adjustments to Incorporate Potential Exchange Rate Movements

- Cost-Plus Pricing: Add a margin to the cost of goods to account for potential MYR depreciation.

- Value-Based Pricing: Set prices based on the perceived value of the product, adjusting for anticipated exchange rate movements.

- Market Analysis: Closely monitor competitor pricing and market trends to ensure your pricing strategy remains competitive. Adjust pricing to offset potential MYR volatility while remaining competitive.

Best Practices for Implementing Front-Loading Strategies

Developing a Comprehensive Foreign Exchange Risk Management Plan

- Risk Identification: Identify all potential foreign exchange risks your business faces.

- Impact Assessment: Assess the potential impact of different exchange rate scenarios on your profitability.

- Mitigation Strategies: Develop strategies to mitigate those risks, including front-loading techniques and hedging instruments.

- Regular Review: Regularly review and update your risk management plan to adapt to changing market conditions.

Seeking Professional Advice from Financial Experts

- Foreign Exchange Specialists: Foreign exchange specialists possess in-depth knowledge of currency markets and hedging strategies.

- Financial Advisors: Financial advisors can help you develop a comprehensive risk management plan tailored to your specific needs.

- Expertise and Support: Utilizing their expertise can save you from potential losses and enhance your financial stability.

Monitoring Market Conditions and Adjusting Strategies Accordingly

- Economic Trends: Stay informed about global and domestic economic trends that may affect the MYR.

- Exchange Rate Tracking: Use online tools and resources to track exchange rate fluctuations.

- Adaptability: Be prepared to adapt your strategies based on market conditions; flexibility is essential in a volatile market.

Conclusion: Protecting Your Bottom Line with Effective Front-Loading Strategies

This article has outlined key front-loading strategies for mitigating MYR risks: negotiating upfront payments, invoicing in stable currencies, employing hedging instruments, and strategically adjusting prices. Proactive risk management is crucial for Malaysian exporters to navigate the challenges of MYR volatility. Implementing these strategies can improve profitability, enhance financial stability, and provide a competitive edge in the global market. We strongly encourage you to proactively implement these front-loading strategies and consult with financial experts for personalized solutions to safeguard your business against MYR exchange rate risks. The long-term advantages of effective front-loading strategies for Malaysian exporters are undeniable.

Featured Posts

-

Isabela Merced On Playing Hawkgirl A Positive Shift From Madame Web

May 07, 2025

Isabela Merced On Playing Hawkgirl A Positive Shift From Madame Web

May 07, 2025 -

Rihanna Expecting Baby Number Three The Pregnancy Journey

May 07, 2025

Rihanna Expecting Baby Number Three The Pregnancy Journey

May 07, 2025 -

Cleveland Cavaliers Secure 1 Seed In East

May 07, 2025

Cleveland Cavaliers Secure 1 Seed In East

May 07, 2025 -

Knicks Overwhelmed Cavs 61 Shooting Leads To Blowout Win

May 07, 2025

Knicks Overwhelmed Cavs 61 Shooting Leads To Blowout Win

May 07, 2025 -

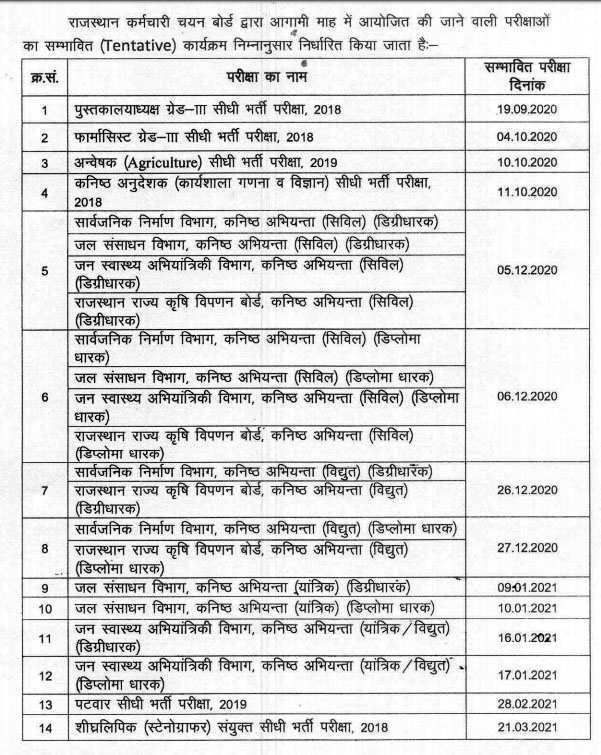

Your Guide To The Rsmssb Exam Calendar 2025 26

May 07, 2025

Your Guide To The Rsmssb Exam Calendar 2025 26

May 07, 2025

Latest Posts

-

Ka Zar Needs A Hero Rogue The Savage Land 2 Sneak Peek

May 08, 2025

Ka Zar Needs A Hero Rogue The Savage Land 2 Sneak Peek

May 08, 2025 -

Path Of Exile 2 A Guide To Rogue Exiles

May 08, 2025

Path Of Exile 2 A Guide To Rogue Exiles

May 08, 2025 -

The Untold Story A Rogue One Heros Journey In The New Star Wars Show

May 08, 2025

The Untold Story A Rogue One Heros Journey In The New Star Wars Show

May 08, 2025 -

Rogues Team Affiliation A Marvel Fans Dilemma

May 08, 2025

Rogues Team Affiliation A Marvel Fans Dilemma

May 08, 2025 -

New Star Wars Series Explores The Past Of A Beloved Rogue One Character

May 08, 2025

New Star Wars Series Explores The Past Of A Beloved Rogue One Character

May 08, 2025