FTC Challenges Microsoft's Activision Blizzard Buyout: Legal Battle Ahead

Table of Contents

H2: The FTC's Concerns Regarding Competition

The FTC's challenge to the Microsoft Activision Blizzard buyout centers on antitrust concerns and the potential for reduced competition within the gaming market. The keywords here are antitrust, competition, market dominance, gaming consoles, Call of Duty, game subscription services, and Xbox Game Pass. The commission argues that the merger would create an unfair competitive advantage for Microsoft, potentially stifling innovation and harming consumers.

-

Market Dominance: The FTC worries that the acquisition would give Microsoft undue control over key gaming titles and technologies. The acquisition of Activision Blizzard would add enormously to Microsoft’s already significant gaming portfolio.

-

Call of Duty Exclusivity: A primary concern revolves around Call of Duty, one of the world's most popular gaming franchises. The FTC fears Microsoft could make Call of Duty exclusive to its Xbox ecosystem, significantly harming competitors like Sony PlayStation, which relies heavily on the game's cross-platform availability. This move could potentially lock players into the Xbox ecosystem, reducing choice and competition.

-

Game Subscription Services: The burgeoning market for game subscription services, such as Xbox Game Pass, is another area of concern. The FTC argues that integrating Activision Blizzard's popular titles into Xbox Game Pass would give Microsoft an insurmountable advantage over competitors, further limiting choice and stifling innovation within the subscription service landscape.

H2: Microsoft's Defense Strategy

Microsoft, naturally, disputes the FTC's claims. Their defense strategy focuses on counterarguments, remedies, market share, and consumer benefits. The core of their argument hinges on the idea that the merger would ultimately benefit consumers.

-

Multi-Platform Commitment: Microsoft insists that making Activision Blizzard titles, especially Call of Duty, exclusive to Xbox would be financially unwise and that they are committed to releasing these games across multiple platforms, including PlayStation and Nintendo Switch.

-

Increased Competition and Innovation: Microsoft argues that the merger will foster greater competition and innovation, leading to a more diverse and vibrant gaming market. They highlight potential synergies that could lead to more games, enhanced features, and better experiences for gamers.

-

Proposed Remedies: To address the FTC's concerns, Microsoft may offer concessions, such as long-term licensing agreements to ensure Call of Duty remains available on competing platforms. These remedies aim to demonstrate their commitment to maintaining a competitive marketplace.

H3: The Role of Other Regulatory Bodies

The FTC isn't the only regulatory body scrutinizing the Microsoft Activision Blizzard buyout. The EU and the UK's Competition and Markets Authority (CMA) are also conducting their own investigations. This highlights the global implications and the importance of international competition law in the matter.

-

EU and CMA Investigations: The decisions of the EU and the CMA will be crucial. A negative ruling from either body could derail the entire merger, regardless of the FTC’s decision.

-

International Precedent: The outcome of these international reviews could set a significant precedent for future mergers and acquisitions in the tech industry, shaping how such deals are evaluated globally.

H2: Potential Outcomes and Implications

The legal battle surrounding the Microsoft Activision Blizzard buyout could last for months, or even years. Several potential outcomes exist, each with significant implications for the gaming industry’s future.

-

Merger Approval or Block: The most likely outcomes are either full approval of the merger or a complete block of the acquisition. A partial approval with conditions is also a possibility.

-

Impact on Gamers: The ultimate decision will have far-reaching consequences for gamers, impacting game availability, pricing, and the overall competitive landscape of the gaming market. A blocked merger could mean less innovation or a slower pace of development.

-

Market Consolidation: The success or failure of this merger will heavily influence the level of consolidation within the gaming industry, potentially setting a precedent for future mergers and acquisitions in this increasingly lucrative sector.

Conclusion:

The FTC's challenge to Microsoft's acquisition of Activision Blizzard is a watershed moment for the gaming industry. The legal battle will determine the fate of this massive merger and profoundly impact the future of gaming competition and the very definition of fair competition. The outcome will establish a crucial precedent for future mega-mergers in the tech sector and will have a lasting effect on gamers worldwide. Stay informed about the ongoing developments in this crucial case regarding the Microsoft Activision Blizzard buyout and its implications for the future of gaming. Understanding the complexities of this antitrust challenge is essential for anyone interested in the future of the gaming industry.

Featured Posts

-

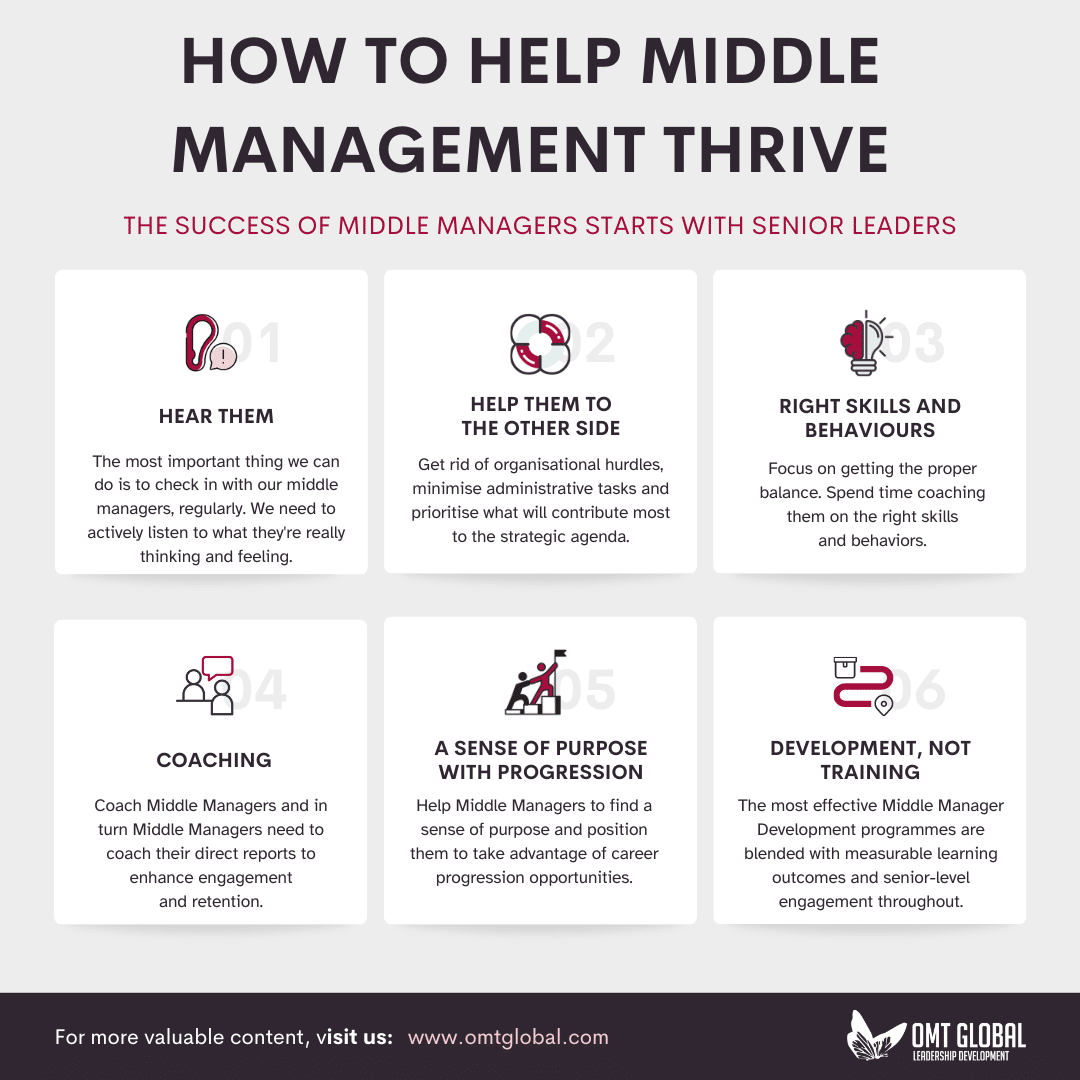

Understanding The Value Of Middle Management In Todays Workplace

May 05, 2025

Understanding The Value Of Middle Management In Todays Workplace

May 05, 2025 -

Global Cocaine Crisis Potent Powder And The Rise Of Narco Submarines

May 05, 2025

Global Cocaine Crisis Potent Powder And The Rise Of Narco Submarines

May 05, 2025 -

Obsuzhdenie Reform Vo Frantsii Plany Provedeniya Referenduma

May 05, 2025

Obsuzhdenie Reform Vo Frantsii Plany Provedeniya Referenduma

May 05, 2025 -

Post Split Trip Sydney Sweeney Enjoys African Safari With Friends

May 05, 2025

Post Split Trip Sydney Sweeney Enjoys African Safari With Friends

May 05, 2025 -

Is This Thing On Exclusive Photos Of Bradley Cooper And Will Arnett Filming In Nyc

May 05, 2025

Is This Thing On Exclusive Photos Of Bradley Cooper And Will Arnett Filming In Nyc

May 05, 2025

Latest Posts

-

Game 5 Celtics Vs Magic Date Time And Streaming Details

May 06, 2025

Game 5 Celtics Vs Magic Date Time And Streaming Details

May 06, 2025 -

Celtics Vs Heat Game Time Tv Schedule And Streaming Options April 2nd

May 06, 2025

Celtics Vs Heat Game Time Tv Schedule And Streaming Options April 2nd

May 06, 2025 -

Celtics Vs Magic Game 5 April 29th Complete Viewing Guide

May 06, 2025

Celtics Vs Magic Game 5 April 29th Complete Viewing Guide

May 06, 2025 -

Celtics Vs Magic Game 5 Date Time Tv Channel And Live Stream

May 06, 2025

Celtics Vs Magic Game 5 Date Time Tv Channel And Live Stream

May 06, 2025 -

Celtics Vs Magic Playoff Schedule Full Game Dates And Times

May 06, 2025

Celtics Vs Magic Playoff Schedule Full Game Dates And Times

May 06, 2025