FTC Challenges Microsoft's Activision Deal: The Appeal Explained

Table of Contents

<p>The Federal Trade Commission (FTC) has challenged Microsoft's proposed acquisition of Activision Blizzard, a landmark deal shaking the gaming industry. This FTC Microsoft Activision deal has ignited a fierce legal battle, raising significant concerns about competition and market dominance. This article dissects the FTC's appeal, Microsoft's defense, and the potential ramifications for gamers and the future of gaming.</p>

<h2>The FTC's Core Concerns Regarding the Microsoft Activision Deal</h2>

<h3>Anti-competitive Practices</h3>

The FTC's central argument revolves around the potential for anti-competitive practices stemming from the merger. The acquisition, they contend, could significantly reduce competition, particularly impacting the fate of beloved franchises like Call of Duty.

- Reduced consumer choice: Microsoft might make Call of Duty exclusive to its Xbox ecosystem, limiting player access on PlayStation and other platforms. This would significantly reduce consumer choice and potentially force gamers to switch consoles to continue playing.

- Elimination of competition: This acquisition could stifle competition from other platforms like PlayStation and Steam, hindering innovation and potentially leading to higher prices for gamers. The absence of a strong competitor could lead to less innovation in game development and features.

- Harm to rival game developers: The merger could create an uneven playing field, harming smaller game developers who rely on a competitive market to succeed. Microsoft’s increased market power could make it difficult for smaller studios to compete, impacting the overall diversity of the gaming landscape.

<h3>Market Domination</h3>

The FTC also argues that the merger would grant Microsoft undue control over key game markets, leading to higher prices and fewer choices for consumers.

- Combined market share: Microsoft already holds a substantial share of the cloud gaming market. Activision Blizzard’s dominance in console and PC gaming, when combined with Microsoft's existing power, would create a near-monopoly.

- Past acquisitions: The FTC's assessment likely considers Microsoft's history of acquisitions and their impact on competition within the tech industry. Past mergers and their effects on market dynamics provide crucial context for evaluating the current proposal.

- Market definition: The definition of relevant markets (e.g., console gaming, PC gaming, cloud gaming) is crucial to determining Microsoft's market power. The FTC's analysis will carefully delineate these markets to support their claim of anti-competitive behavior.

<h2>Microsoft's Defense Against the FTC's Claims</h2>

<h3>Commitment to Fair Competition</h3>

Microsoft counters the FTC's claims by asserting that the acquisition will actually boost competition and benefit consumers through increased game access and innovation.

- Maintaining Call of Duty availability: Microsoft has pledged to keep Call of Duty available on PlayStation and other platforms, aiming to address the FTC's concerns about reduced consumer choice. They’ve proposed long-term licensing agreements to guarantee its continued availability.

- Technological synergy: Microsoft argues that integrating Activision Blizzard's technology and studios with its existing infrastructure will foster innovation and lead to better games for all players. This integration could lead to advancements in game development and potentially lower costs.

- Expanding cloud gaming access: Microsoft highlights its commitment to expanding cloud gaming, making games more accessible to a broader audience. This increased accessibility is presented as a significant benefit to consumers, regardless of the platform used.

<h3>Addressing Antitrust Concerns</h3>

Microsoft is attempting to preemptively address the FTC's antitrust concerns through various concessions and proposed solutions.

- Licensing agreements: Microsoft offers licensing agreements to ensure Call of Duty remains available on competing platforms, mitigating concerns about exclusivity and reduced choice for gamers.

- Investment in competitors: Microsoft may choose to invest in competing game studios to encourage a more diversified and competitive gaming market, aiming to demonstrate its commitment to fair competition.

- Highlighting consumer benefits: Microsoft’s defense emphasizes the overall benefits of the merger for game developers and consumers, such as improved game development and technological advancements.

<h2>The Appeal Process and Potential Outcomes</h2>

<h3>Legal Proceedings</h3>

The FTC Microsoft Activision deal is currently entangled in legal proceedings, involving court hearings and potential appeals.

- Legal arguments: Both the FTC and Microsoft will present their legal arguments, backed by evidence and expert testimony, aiming to sway the court's decision.

- Evidence presentation: The FTC and Microsoft will present substantial evidence supporting their respective claims, including market analyses, consumer surveys, and internal documents. This evidence will be meticulously reviewed by the court.

- Timeline and outcomes: The legal process is expected to unfold over a considerable period, with multiple stages of hearings and potential appeals. The eventual outcome could significantly impact the future of the gaming industry.

<h3>Implications for the Gaming Industry</h3>

The ruling on the FTC Microsoft Activision deal holds immense significance for the future of the gaming industry and the broader tech landscape.

- Mergers and acquisitions: The outcome of this case will set a precedent for future mergers and acquisitions within the tech industry, impacting how such deals are evaluated and regulated.

- Potential scenarios: Possible outcomes include full approval of the deal, complete rejection, or a modified deal with conditions imposed to address anti-competitive concerns.

- Impact on gaming market: The decision will have a substantial influence on console sales, game pricing, and the overall gaming landscape, potentially affecting competition and the availability of games for years to come.

<h2>Conclusion</h2>

The FTC's challenge to the Microsoft Activision Blizzard acquisition is a pivotal moment for the gaming industry. The arguments concerning anti-competitive practices, market dominance, and the overall future of gaming are intricate and fiercely debated. Staying informed about the FTC Microsoft Activision deal's progress is crucial for anyone interested in the future of interactive entertainment. For continuing in-depth analysis and updates on this landmark case, follow our coverage and stay tuned for further developments.

Featured Posts

-

Schimbari In Sistemul De Taxare In 2025 Informatii De La Expertii Pw C

Apr 29, 2025

Schimbari In Sistemul De Taxare In 2025 Informatii De La Expertii Pw C

Apr 29, 2025 -

Fhi Adhd Medisin Begrenset Effekt Pa Skoleprestasjoner

Apr 29, 2025

Fhi Adhd Medisin Begrenset Effekt Pa Skoleprestasjoner

Apr 29, 2025 -

Celebrity Family Fun Goldblums At The Como 1907 Vs Torino Match

Apr 29, 2025

Celebrity Family Fun Goldblums At The Como 1907 Vs Torino Match

Apr 29, 2025 -

Donald Trump Mlbs Pete Rose Ban Is A Shame Pardon Promised

Apr 29, 2025

Donald Trump Mlbs Pete Rose Ban Is A Shame Pardon Promised

Apr 29, 2025 -

Khazna Data Center Saudi Arabia Expansion Strategy

Apr 29, 2025

Khazna Data Center Saudi Arabia Expansion Strategy

Apr 29, 2025

Latest Posts

-

De Impact Van Adhd Op De Levensverwachting Bij Volwassenen

Apr 29, 2025

De Impact Van Adhd Op De Levensverwachting Bij Volwassenen

Apr 29, 2025 -

Skoleprestasjoner Og Adhd Er Medisinering Losningen Ifolge Fhi

Apr 29, 2025

Skoleprestasjoner Og Adhd Er Medisinering Losningen Ifolge Fhi

Apr 29, 2025 -

The Impact Of Adhd On Driving Safety Research Findings And Practical Tips

Apr 29, 2025

The Impact Of Adhd On Driving Safety Research Findings And Practical Tips

Apr 29, 2025 -

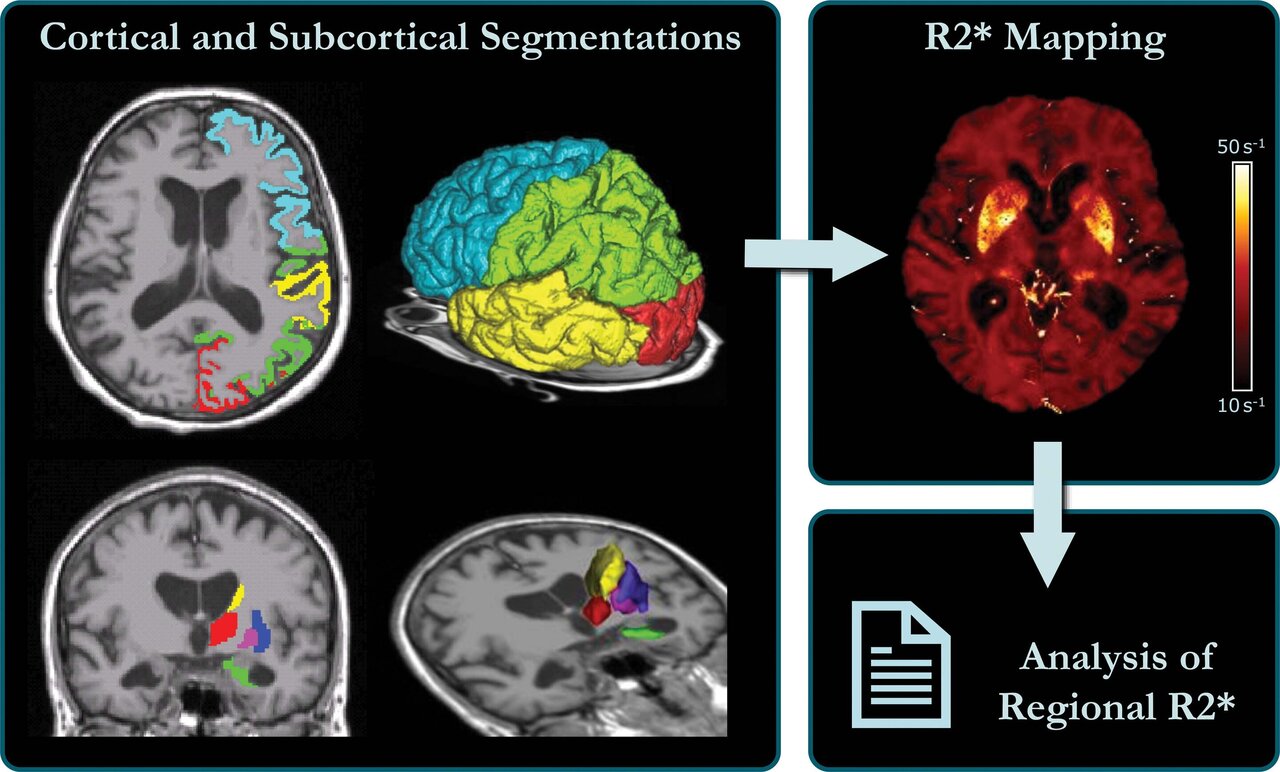

The Influence Of Brain Iron On Adhd And Cognitive Decline In Aging Adults

Apr 29, 2025

The Influence Of Brain Iron On Adhd And Cognitive Decline In Aging Adults

Apr 29, 2025 -

Adhd Heeft Het Invloed Op De Levensverwachting

Apr 29, 2025

Adhd Heeft Het Invloed Op De Levensverwachting

Apr 29, 2025