FTC To Appeal: Microsoft's Activision Blizzard Acquisition Faces New Hurdle

Table of Contents

The FTC's Arguments Against the Acquisition

The FTC's opposition to the Microsoft Activision Blizzard acquisition rests on several key pillars, all centered around the potential for stifling competition and harming consumers.

Concerns Regarding Competition

The FTC's core argument revolves around the significant impact the merger would have on competition within the gaming market. They argue that Microsoft's acquisition of Activision Blizzard would create an unfair competitive advantage, particularly in the console and cloud gaming sectors. This concern stems from several key factors:

- Domination of Call of Duty: The FTC highlights Call of Duty's immense popularity and market share, arguing that Microsoft could leverage its ownership to create an unfair advantage, potentially making the game exclusive to Xbox or severely limiting its availability on competing platforms like PlayStation.

- Exclusion of Competitors: The FTC worries that Microsoft could use its control over Activision Blizzard's properties to exclude competitors from accessing key platforms like Xbox and its growing Game Pass subscription service. This could stifle innovation and limit consumer choice.

- Anti-competitive Practices: The FTC alleges that the merger could lead to anti-competitive practices, hindering the growth of smaller gaming companies and ultimately hurting consumers.

The Call of Duty Factor

Call of Duty is the elephant in the room. Its massive player base and consistent profitability make it a central point of contention. The FTC fears Microsoft could leverage its ownership to:

- Make Call of Duty exclusive to Xbox, significantly harming PlayStation's market share and potentially driving players to the Xbox ecosystem.

- Offer Call of Duty on PlayStation, but with significantly reduced features, content, or later release dates, thereby disadvantaging Sony.

- Use Call of Duty as a bargaining chip to pressure other game developers into advantageous deals, further restricting competition.

Cloud Gaming Concerns

The rapidly expanding cloud gaming market is another major area of concern for the FTC. They believe that Microsoft's acquisition would further consolidate its already significant position in this arena, leading to:

- Reduced innovation: Less competition could stifle the development of new technologies and services in the cloud gaming space.

- Higher prices: A lack of competition could lead to higher prices for consumers.

- Limited choice: Consumers might have fewer options and less variety in cloud gaming services. Microsoft’s current market share, coupled with Activision Blizzard's assets, would significantly amplify this concern.

Microsoft's Defense and Counterarguments

Microsoft has vigorously defended the acquisition, arguing that it will benefit both gamers and the industry as a whole.

Promises of Continued Multi-Platform Availability

A key element of Microsoft's defense is its repeated promise to keep Call of Duty available on PlayStation and other platforms. They have offered long-term agreements with Sony and others, aiming to alleviate the FTC's competitive concerns. However, the credibility and potential loopholes within these agreements remain a point of contention.

Benefits of the Acquisition for Gamers and the Industry

Microsoft emphasizes potential benefits such as:

- Increased game development resources: The merger would combine significant resources, allowing for larger-scale and more ambitious game development.

- Broader game access: More games could become available through subscription services like Game Pass, potentially benefiting consumers.

- Potential innovation: Increased resources could spur innovation in game design and technology. Microsoft backs this claim with data on past investments and their commitment to fostering a diverse gaming ecosystem.

Legal Challenges and Previous Court Decisions

The FTC's appeal follows a court decision that allowed the acquisition to proceed. However, the FTC argues that this decision overlooked critical aspects of the potential anti-competitive effects of the merger. The legal process is expected to be lengthy and complex, with the FTC relying on existing legal precedents and economic analysis to support its claims.

Implications and Next Steps

The FTC's appeal has significant implications for various stakeholders.

Uncertainty for Activision Blizzard and Investors

The ongoing legal battle creates uncertainty for Activision Blizzard, its investors, and employees. The appeal could impact the company's stock price and its ability to execute its business plans.

The Timeline and Potential Outcomes

The appeals process is expected to take months, possibly even years. Several outcomes are possible:

- The appeal could be successful, resulting in the acquisition being blocked.

- The appeal could fail, allowing the acquisition to proceed.

- A settlement or compromise could be reached between Microsoft and the FTC.

Conclusion: The Future of the Microsoft Activision Blizzard Acquisition Remains Uncertain

The FTC's appeal of the Microsoft Activision Blizzard acquisition represents a major hurdle for the deal. While Microsoft argues for the benefits of the merger, the FTC remains concerned about potential anti-competitive effects. The arguments around Call of Duty's future, the dominance in cloud gaming, and the overall impact on competition will be central to the appeal process. Stay tuned for updates on this crucial development in the gaming world as the FTC's appeal of the Microsoft Activision Blizzard acquisition unfolds. The outcome will significantly shape the future of the gaming industry.

Featured Posts

-

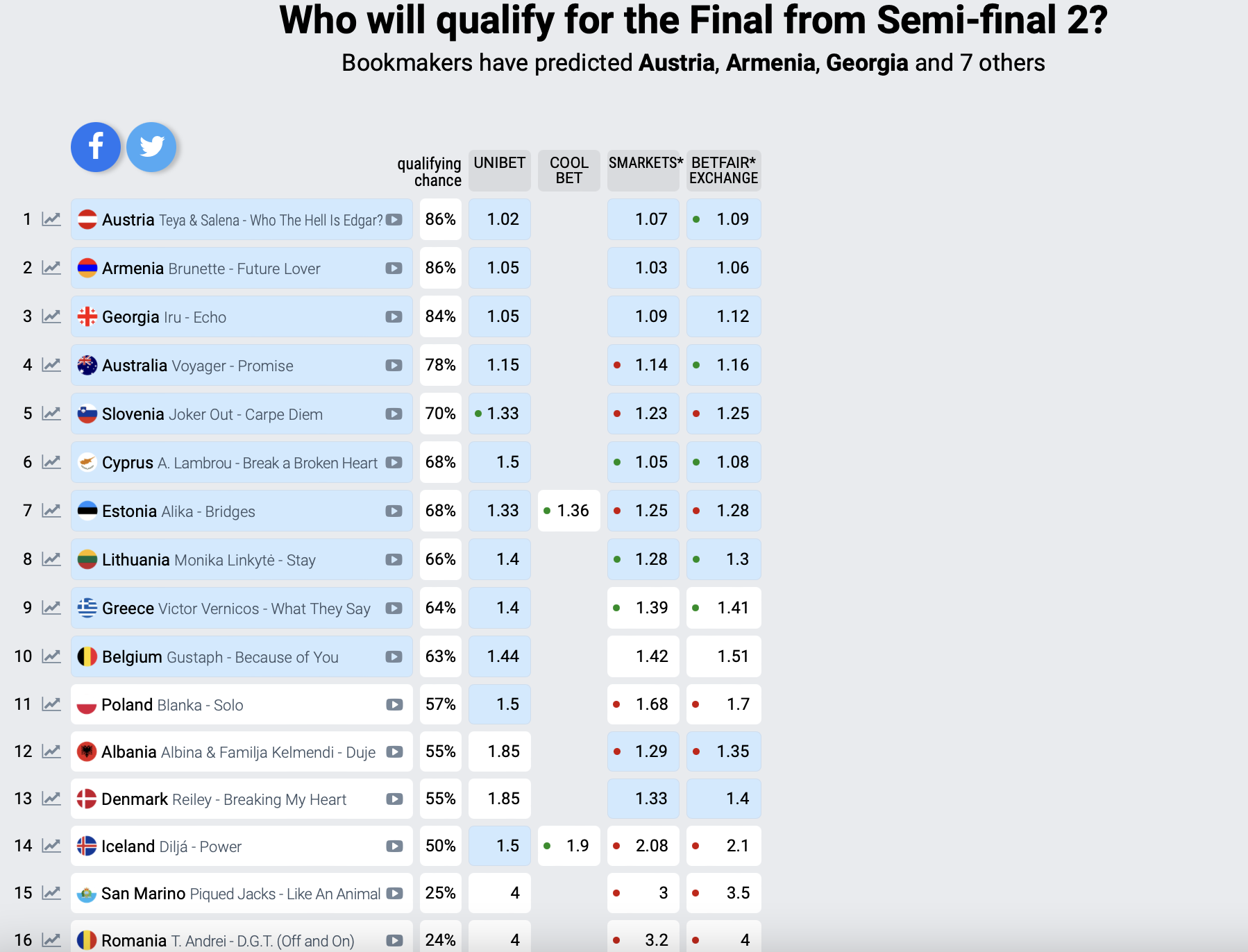

Eurovision 2025 Betting Comprehensive Guide To Odds And Predictions

Apr 30, 2025

Eurovision 2025 Betting Comprehensive Guide To Odds And Predictions

Apr 30, 2025 -

Valur Vs Andstaedingur Horfdu A Leikinn I Dag

Apr 30, 2025

Valur Vs Andstaedingur Horfdu A Leikinn I Dag

Apr 30, 2025 -

Russias Faltering Spring Offensive Can Warmer Weather Turn The Tide

Apr 30, 2025

Russias Faltering Spring Offensive Can Warmer Weather Turn The Tide

Apr 30, 2025 -

Channing Tatums New Girlfriend Inka Williams 25 Year Old Aussie Model

Apr 30, 2025

Channing Tatums New Girlfriend Inka Williams 25 Year Old Aussie Model

Apr 30, 2025 -

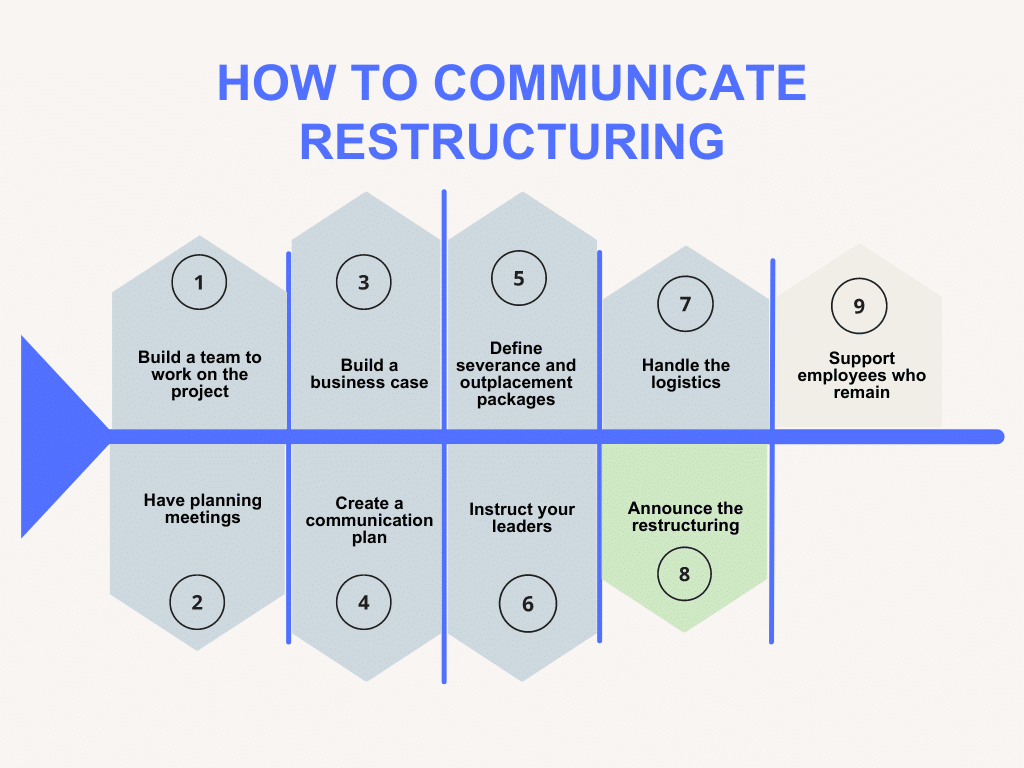

Disneys Restructuring 200 Abc Employees Laid Off 538 Cuts Detailed

Apr 30, 2025

Disneys Restructuring 200 Abc Employees Laid Off 538 Cuts Detailed

Apr 30, 2025