FTC's Appeal Could Delay Or Block Microsoft-Activision Merger

Table of Contents

The FTC's Case Against the Merger

The FTC's antitrust lawsuit against the Microsoft-Activision merger centers on concerns about reduced competition and potential anti-competitive practices. Their core arguments revolve around several key points:

- Market Dominance and Monopoly Concerns: The FTC argues that the merger would give Microsoft undue control over the video game market, potentially creating a monopoly or near-monopoly situation. This dominance could stifle innovation and harm consumers.

- Call of Duty Exclusivity: A major sticking point is the future of Call of Duty. The FTC fears Microsoft could make Call of Duty exclusive to its Xbox ecosystem, harming competitors like PlayStation and potentially harming consumers who prefer those platforms. This exclusivity could significantly impact market share and competition.

- Stifling Innovation: The FTC's case suggests the merger could stifle innovation by reducing the competitive pressure on Microsoft to develop new and innovative games. A lack of competition could lead to less choice and higher prices for consumers.

- Evidence and Expert Testimony: The FTC's case relies on extensive market analysis, expert testimony from economists and gaming industry professionals, and internal Microsoft documents to support their claims of anti-competitive behavior.

Microsoft's Response and Counterarguments

Microsoft has vigorously defended the merger, offering counterarguments to the FTC's claims. Their defense strategy includes:

- Competitive Gaming Landscape: Microsoft argues that the gaming market is highly competitive, with numerous significant players beyond Microsoft and Activision Blizzard. They contend that the merger won't create a monopoly.

- Proposed Remedies and Concessions: To address the FTC's concerns, Microsoft has offered several concessions, including long-term licensing agreements to ensure Call of Duty remains available on PlayStation and other platforms. These licensing agreements are intended to maintain a competitive landscape.

- Cloud Gaming Investment: Microsoft highlights its substantial investment in cloud gaming, arguing that this will benefit consumers by increasing accessibility and choice. They believe this investment promotes competition rather than hindering it.

- Regulatory Compliance: Microsoft maintains its commitment to regulatory compliance and emphasizes its efforts to work with regulators to address their concerns.

Potential Outcomes of the FTC's Appeal

The FTC's appeal could lead to several outcomes:

- Merger Delay: Even if the appeal is unsuccessful, the legal proceedings will likely cause significant delays in the merger's closing, potentially extending the process for months or even years. This uncertainty creates instability for both companies.

- Blocked Merger: The most significant outcome would be the court siding with the FTC and blocking the merger entirely. This would have monumental ramifications for both Microsoft and Activision Blizzard.

- Legal Battle and Uncertainty: The appeal sets the stage for a protracted legal battle, creating significant regulatory uncertainty within the gaming industry. This uncertainty can affect investment decisions and business planning for other companies.

- Impact on Employees and Shareholders: A successful appeal and blocked merger would significantly impact Activision Blizzard employees and shareholders, potentially affecting job security, stock prices, and overall business stability.

Impact on the Gaming Industry and Consumers

The outcome of the FTC's appeal will have far-reaching implications for the gaming industry and consumers:

- Game Prices and Availability: If the merger proceeds, concerns exist about potential price increases for games and a reduction in the availability of certain titles. Conversely, a blocked merger could lead to a different competitive landscape, also impacting pricing.

- Console Wars and Subscription Services: The merger's outcome will likely influence the ongoing "console wars" between Xbox and PlayStation, as well as the dynamics of the growing subscription service market in gaming.

- Game Development and Innovation: The level of competition, directly impacted by the merger's fate, will have long-term implications for the pace of game development, innovation, and the overall quality of games available to consumers.

Conclusion

The FTC's appeal regarding the Microsoft-Activision merger presents significant uncertainty for the gaming industry. The outcome will have a substantial impact on competition, game prices, and the availability of popular titles. The legal battle is likely to be protracted, leaving the future of the merger hanging in the balance. The implications extend far beyond the two companies involved, impacting the entire gaming ecosystem.

Call to Action: Stay informed about the latest developments in the FTC's appeal against the Microsoft-Activision merger. Continue to follow this crucial case to understand how it could reshape the future of gaming. Regularly check back for updates on this significant Microsoft-Activision merger case and its potential impact on the gaming industry.

Featured Posts

-

Greenland Under Scrutiny Pentagons Proposed Command Transfer And The Trump Administrations Influence

May 11, 2025

Greenland Under Scrutiny Pentagons Proposed Command Transfer And The Trump Administrations Influence

May 11, 2025 -

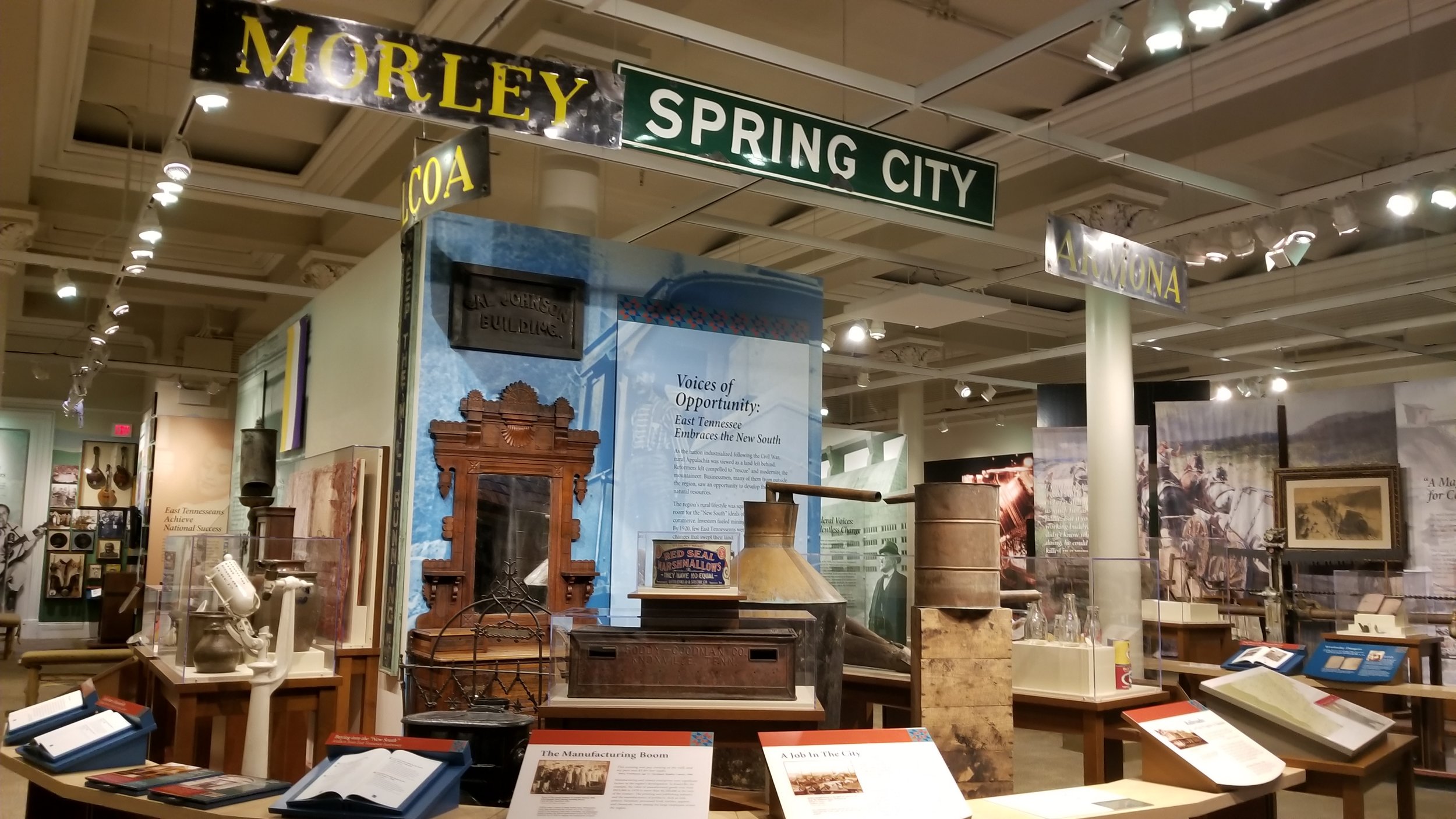

East Tennessee History Center Showcases Baseball History Before Covenant Health Park Opening

May 11, 2025

East Tennessee History Center Showcases Baseball History Before Covenant Health Park Opening

May 11, 2025 -

James O Keefes Latest Scoop Prince Andrew Faces New Allegations

May 11, 2025

James O Keefes Latest Scoop Prince Andrew Faces New Allegations

May 11, 2025 -

Young Rory Mc Ilroy Fan Makes Putt At Augusta Jowhar Report

May 11, 2025

Young Rory Mc Ilroy Fan Makes Putt At Augusta Jowhar Report

May 11, 2025 -

Payton Pritchards Playoff Performance Analysis Of His Game 1 Contribution

May 11, 2025

Payton Pritchards Playoff Performance Analysis Of His Game 1 Contribution

May 11, 2025