FTC's Appeal Of Microsoft-Activision Merger: Implications For The Gaming Industry

Table of Contents

The FTC's Arguments Against the Merger

The FTC's opposition to the merger rests on several key concerns about its potential impact on competition within the gaming market.

Concerns about Competition in the Console Market

The FTC argues that the merger would significantly reduce competition in the console gaming market, particularly harming PlayStation's ability to compete with Xbox. Their concerns include:

- Reduced Competition: The merger would give Microsoft control over immensely popular franchises like Call of Duty, World of Warcraft, and Candy Crush, potentially leading to reduced competition and less innovation.

- Exclusive Titles: Microsoft could make key Activision Blizzard titles exclusive to Xbox, severely impacting PlayStation's market share and potentially forcing players to switch platforms. This is especially concerning given Call of Duty's immense popularity and broad appeal across multiple platforms.

- Market Dominance: The combined market power of Microsoft and Activision Blizzard would create an environment where Microsoft could dictate pricing, features, and distribution terms to the detriment of competitors and consumers. The FTC points to the potential for higher prices and less choice for gamers.

- Antitrust Concerns: The merger raises serious antitrust concerns by creating a highly concentrated market, hindering innovation and potentially stifling the emergence of new competitors.

Concerns Regarding Cloud Gaming

The FTC also expresses concern about Microsoft’s potential dominance in the rapidly growing cloud gaming market. Their worries include:

- Cloud Gaming Exclusivity: Microsoft could leverage Activision Blizzard's vast library of games to make them exclusive to its cloud gaming platform, effectively locking out competitors like Google Stadia and Amazon Luna.

- Market Stifling: This exclusivity could stifle innovation and prevent smaller cloud gaming providers from gaining a foothold in the market.

- Subscription Lock-in: The combined entity could use bundled subscriptions and exclusive content to lock in customers, making it difficult for rivals to compete effectively.

- Long-term Effects: The FTC fears this would lead to a less competitive and less dynamic cloud gaming ecosystem in the long term.

Impact on Game Developers and Publishers

The FTC also considers the impact on smaller game developers and publishers. The merger could:

- Reduce Competition: The increased market power of Microsoft could negatively affect the negotiating power of smaller developers and publishers, forcing them to accept less favorable licensing agreements and payment terms.

- Hinder Innovation: Less competition could decrease innovation as Microsoft might prioritize its own studios and titles over external partners.

- Increase Licensing Fees: Microsoft could significantly increase the cost of licensing popular Activision Blizzard technology and intellectual property, making it harder for smaller studios to create games.

Microsoft's Defense of the Merger

Microsoft vigorously defends the merger, arguing it will benefit gamers and foster fair competition.

Microsoft's Commitment to Fair Competition

Microsoft counters the FTC's claims by emphasizing its commitment to fair competition and offering various concessions:

- Cross-Platform Availability: Microsoft has pledged to continue making Activision Blizzard games available on PlayStation and other platforms, ensuring that gamers aren't locked into the Xbox ecosystem.

- Long-term Agreements: They've proposed long-term agreements to ensure Call of Duty remains available on PlayStation for many years.

- Regulatory Compliance: Microsoft asserts its commitment to complying with all regulatory requirements and addressing the FTC's concerns through negotiation and compromise.

- Increased Content: The merger, Microsoft claims, will lead to a broader portfolio of games and enhanced gaming experiences for players across all platforms.

Benefits of the Merger for Consumers

Microsoft highlights several potential consumer benefits:

- More Game Content: Access to a wider library of games from Activision Blizzard's extensive catalog.

- Improved Gaming Experiences: Potential investments in game development and enhanced gaming technologies resulting in better gaming experiences.

- Potential Price Reductions: Increased competition and economies of scale could potentially lead to lower prices for some games.

- Expanded Access: The merger may allow more players to access games through cloud gaming and broader subscription services.

Potential Outcomes and Implications

The FTC's appeal could lead to several outcomes:

Scenarios Following the Appeal

- FTC Victory: The FTC could successfully block the merger, forcing Microsoft to abandon its acquisition of Activision Blizzard. This would set a significant precedent for future mergers in the tech industry.

- Microsoft Victory: A court could overturn the FTC's appeal, allowing the merger to proceed. This would solidify Microsoft's position in the gaming market and potentially lead to further consolidation in the industry.

- Negotiated Settlement: Microsoft and the FTC might reach a negotiated settlement involving concessions from Microsoft to address the FTC's competitive concerns. This might involve promises to keep specific games multiplatform or other commitments.

This case sets a crucial precedent for future mergers and acquisitions in the tech industry, impacting not only the gaming industry but also other sectors with similar dynamics. The legal battle surrounding the FTC's appeal of the Microsoft-Activision merger highlights the complexities of regulating large tech mergers and their influence on competition and consumer choice.

Conclusion

The FTC's appeal of the Microsoft-Activision merger is a defining moment for the gaming industry. The outcome will significantly shape the competitive landscape, impacting innovation, consumer choice, and the overall gaming experience. Understanding the nuances of this legal battle and its implications is critical for anyone interested in the future of gaming. Stay informed about further developments in this case concerning the FTC's appeal of the Microsoft-Activision merger and its profound implications for the gaming landscape. Continued research on the FTC's arguments and Microsoft's counterarguments is vital for a comprehensive understanding of this critical issue.

Featured Posts

-

Cp Music Productions A Father And Son Musical Duo

May 13, 2025

Cp Music Productions A Father And Son Musical Duo

May 13, 2025 -

Is Olympus Has Fallen Worth Watching A Critical Analysis

May 13, 2025

Is Olympus Has Fallen Worth Watching A Critical Analysis

May 13, 2025 -

Lywnardw Dy Kabryw Hl Anthk Qaedt Almwaedt Alkhast Bh

May 13, 2025

Lywnardw Dy Kabryw Hl Anthk Qaedt Almwaedt Alkhast Bh

May 13, 2025 -

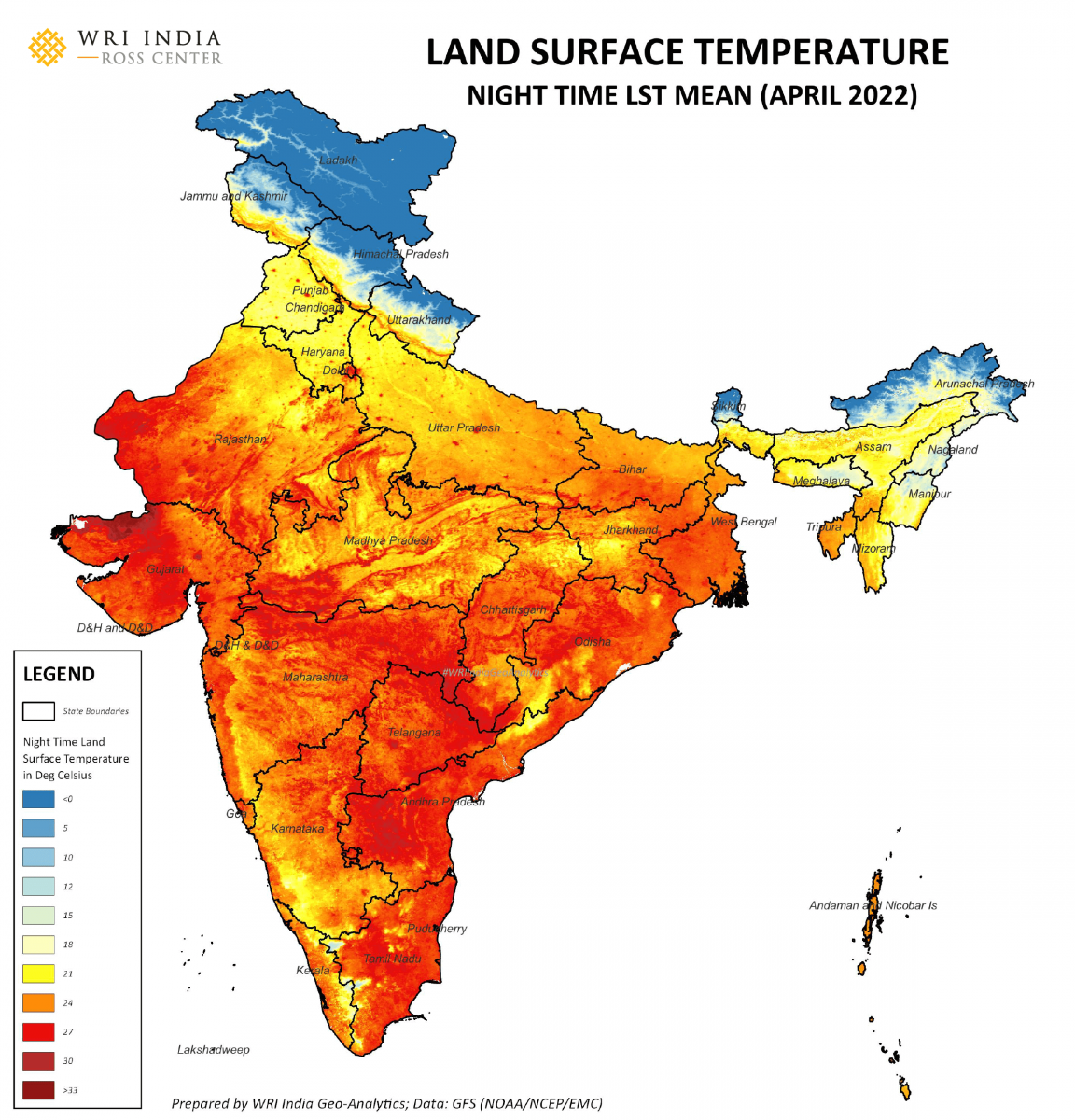

India Heatwave Central Government Issues Alert States On High Alert

May 13, 2025

India Heatwave Central Government Issues Alert States On High Alert

May 13, 2025 -

Eva Longorias Miami Birthday Bash Latino Culture And Celebration

May 13, 2025

Eva Longorias Miami Birthday Bash Latino Culture And Celebration

May 13, 2025

Latest Posts

-

Sinner Makes Italian Open Last 16 Osakas Tournament Ends

May 14, 2025

Sinner Makes Italian Open Last 16 Osakas Tournament Ends

May 14, 2025 -

Sabalenka Dominates Ending Paolinis Dubai Run

May 14, 2025

Sabalenka Dominates Ending Paolinis Dubai Run

May 14, 2025 -

Italian Open Sinner Reaches Last 16 Osaka Eliminated

May 14, 2025

Italian Open Sinner Reaches Last 16 Osaka Eliminated

May 14, 2025 -

Paolinis Dubai Defense Crumbles Against Sabalenka

May 14, 2025

Paolinis Dubai Defense Crumbles Against Sabalenka

May 14, 2025 -

Sinner Through To Italian Open Last 16 Osakas Early Exit

May 14, 2025

Sinner Through To Italian Open Last 16 Osakas Early Exit

May 14, 2025