G-7 Nations Debate De Minimis Threshold For Chinese Goods

Table of Contents

The Current De Minimis Threshold and its Impact

Understanding the De Minimis Threshold

The de minimis threshold is a crucial element of international trade policy. It defines the value below which imported goods are exempt from customs duties and other import taxes. This threshold significantly impacts the cost of imported goods and influences consumer purchasing decisions, as well as the viability of businesses importing smaller quantities of products. Essentially, it acts as a gatekeeper for smaller shipments, determining whether they face the full weight of import regulations or can enter a country with relative ease.

Current Thresholds in G-7 Nations

Current de minimis thresholds for Chinese goods vary significantly across G-7 nations. This disparity creates an uneven playing field for businesses and highlights the need for a more harmonized approach. While precise figures fluctuate and are subject to change, a general overview reveals considerable differences that impact the competitiveness of businesses and the flow of goods. For instance, some nations may have a threshold of $800, while others may have it set at $2000 or even higher. This lack of uniformity is a key driver of the current debate.

- Impact on small businesses importing from China: Lower thresholds disproportionately affect small businesses, increasing their import costs and reducing their competitiveness.

- Impact on consumer prices for Chinese goods: The threshold directly impacts the final price consumers pay for goods imported from China. A higher threshold could lead to lower prices for consumers.

- The role of customs agencies in enforcing these thresholds: Customs agencies play a critical role in ensuring compliance with de minimis regulations and preventing revenue loss and potential abuses of the system.

- Examples of goods affected by the threshold: The threshold affects a wide range of goods, from inexpensive electronics and clothing to more valuable items like certain components for manufacturing.

Arguments for Raising the De Minimis Threshold

Boosting E-commerce and Consumer Choice

Raising the de minimis threshold would significantly benefit e-commerce businesses and consumers alike. A higher threshold would simplify the import process for online retailers selling goods from China, reducing administrative burdens and allowing them to offer a wider range of products at potentially more competitive prices. This increased competition could stimulate market growth and provide consumers with greater choice and value.

Reducing Administrative Burden

A simplified, higher threshold could streamline customs processes, reducing administrative burdens on both businesses and government agencies. This would lead to greater efficiency in processing imports and free up resources that could be allocated elsewhere. The reduction in paperwork and processing time translates to cost savings for businesses and a smoother flow of goods across borders.

- Increased efficiency for small businesses: Small businesses would experience significant cost savings and improved efficiency, making them more competitive.

- Lower shipping costs for consumers: Consumers would likely benefit from lower shipping costs, as smaller shipments become more economically viable for online retailers.

- Reduced processing time for customs declarations: Streamlined procedures would reduce delays and the associated costs of import processing.

- Potential economic growth spurred by increased trade: A higher threshold could unlock greater economic growth by facilitating increased cross-border trade.

Arguments Against Raising the De Minimis Threshold

Concerns about Fair Competition

Raising the threshold without sufficient safeguards could lead to unfair competition from Chinese businesses that may not adhere to the same labor or environmental standards as G-7 businesses. This could harm domestic industries and workers.

Revenue Implications for G-7 Governments

A higher threshold would likely reduce tariff revenue for G-7 governments, potentially impacting public services and government spending. This loss of revenue needs to be carefully considered and potentially offset through alternative mechanisms.

National Security Concerns

Increased imports from China raise concerns about national security, including intellectual property theft, potential dumping of subsidized goods and the risk of strategically sensitive goods entering the supply chain. A thorough risk assessment is essential.

- Potential impact on domestic industries: Domestic industries may face increased competition and potentially job losses.

- Loss of government revenue for public services: Reduced tariff revenue could necessitate cuts to vital public services.

- Risk of increased counterfeit goods entering the market: A higher threshold could facilitate the entry of counterfeit goods, impacting consumers and legitimate businesses.

- Potential for exploitation of labor standards in China: Increased imports could exacerbate concerns about unethical labor practices in China.

Potential Solutions and Compromise

Differentiated Thresholds

Implementing differentiated thresholds based on product categories or country of origin could address some of the concerns raised above. For example, higher thresholds could be applied to low-risk goods while stricter controls remain for sensitive products.

Strengthening Customs Enforcement

Investing in advanced customs technology, enhancing data analytics capabilities, and promoting international cooperation are crucial for effective enforcement, regardless of the de minimis threshold level. This helps ensure that imports comply with all relevant regulations.

- Targeted measures for high-risk goods: More stringent controls could be implemented for goods posing potential security risks.

- Increased investment in customs technology: Modern technology can help customs agencies detect illicit goods and streamline legitimate imports.

- International cooperation to address concerns: Collaboration between G-7 nations and other countries is vital to tackling issues like counterfeiting and intellectual property theft.

- The role of trade agreements in shaping the threshold: Trade agreements and negotiations can play a pivotal role in setting and harmonizing de minimis thresholds.

Conclusion

The G-7 debate over the de minimis threshold for Chinese goods highlights the intricate balancing act between promoting free trade, protecting domestic industries, and addressing national security concerns. Raising the threshold offers benefits to consumers and businesses, but also presents significant risks. Lowering or maintaining the threshold protects domestic industries but could stifle growth in e-commerce. A nuanced approach, potentially incorporating differentiated thresholds and strengthened customs enforcement, is likely required to achieve a satisfactory outcome.

Call to Action: Stay informed about the evolving discussions surrounding the G-7's de minimis threshold policy for Chinese goods. Engage in the debate and let your voice be heard to ensure a fair and effective trade policy that benefits all stakeholders. Follow our updates on the future of the de minimis threshold and its impact on the global economy.

Featured Posts

-

Al Rokers Today Show Fallout Co Host Confrontation After Off Record Reveal

May 23, 2025

Al Rokers Today Show Fallout Co Host Confrontation After Off Record Reveal

May 23, 2025 -

The Demise Of Anchor Brewing Company 127 Years Of History Concludes

May 23, 2025

The Demise Of Anchor Brewing Company 127 Years Of History Concludes

May 23, 2025 -

This Morning Cat Deeley Explains Absence From Mother In Laws Funeral

May 23, 2025

This Morning Cat Deeley Explains Absence From Mother In Laws Funeral

May 23, 2025 -

Todays Show Co Hosts Address Anchors Absence And Offer Prayers

May 23, 2025

Todays Show Co Hosts Address Anchors Absence And Offer Prayers

May 23, 2025 -

Swiss Village Faces Landslide Threat Emergency Livestock Evacuation Underway

May 23, 2025

Swiss Village Faces Landslide Threat Emergency Livestock Evacuation Underway

May 23, 2025

Latest Posts

-

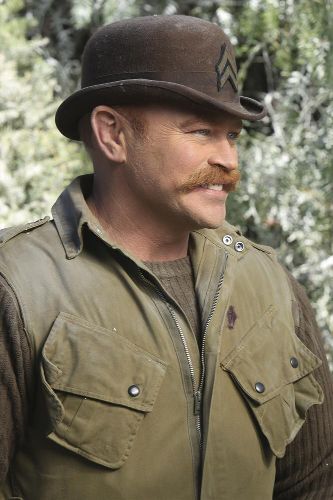

The Last Rodeo Neal Mc Donoughs Risky Role

May 23, 2025

The Last Rodeo Neal Mc Donoughs Risky Role

May 23, 2025 -

Would Damien Darhk Defeat Superman Neal Mc Donoughs Answer

May 23, 2025

Would Damien Darhk Defeat Superman Neal Mc Donoughs Answer

May 23, 2025 -

Memorial Day 2025 Where To Find The Best Sales And Deals

May 23, 2025

Memorial Day 2025 Where To Find The Best Sales And Deals

May 23, 2025 -

Actor Neal Mc Donough Takes On Pro Bull Riding In New Film

May 23, 2025

Actor Neal Mc Donough Takes On Pro Bull Riding In New Film

May 23, 2025 -

Expect Trouble Kevin Pollaks Arrival In Tulsa King Season 3

May 23, 2025

Expect Trouble Kevin Pollaks Arrival In Tulsa King Season 3

May 23, 2025