G-7 To Discuss Lowering Tariffs On Chinese Goods: Impact On Businesses

Table of Contents

Potential Economic Benefits of Reduced Tariffs

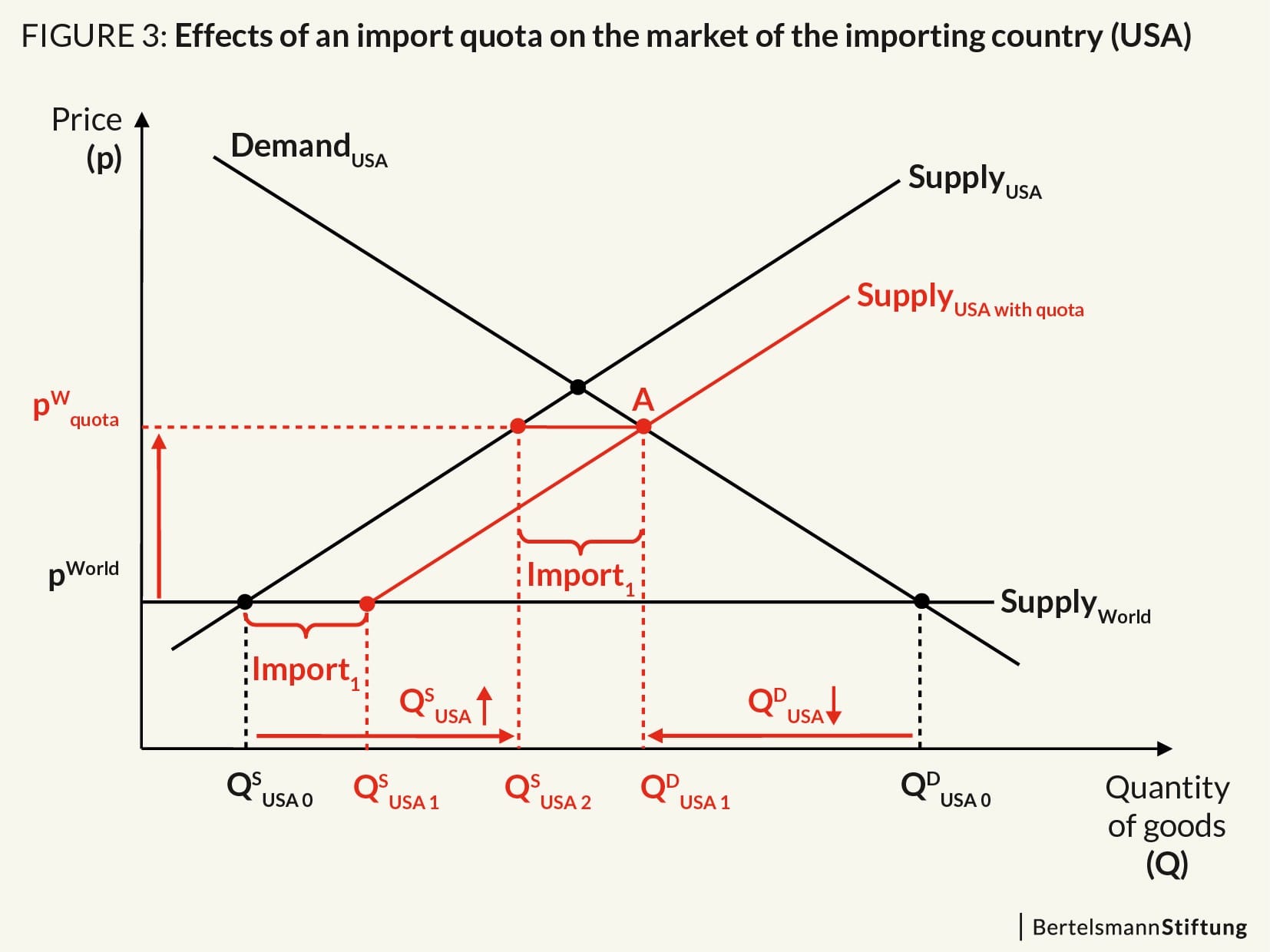

Lowering tariffs on Chinese goods could unlock significant economic benefits. These benefits, however, are not uniformly distributed and need careful consideration.

Lower Prices for Consumers

Reduced tariffs directly translate to lower import costs for businesses, which, in turn, can lead to lower retail prices for consumers. This increase in purchasing power could stimulate consumer spending, boosting economic growth.

- Examples of affected goods: Electronics (smartphones, laptops), textiles (clothing, home furnishings), and furniture are just a few examples of goods that could see price reductions.

- Increased consumer demand: Lower prices generally lead to increased demand, benefiting both consumers and retailers. This increased demand could also spur further economic activity. The impact on the consumer price index (CPI) would be a key metric to monitor.

Increased Business Competitiveness for G-7 Companies

For G-7 companies that utilize Chinese-made components or finished goods in their production processes, reduced tariffs could significantly enhance their global competitiveness. Lower manufacturing costs mean greater profitability and a stronger position in the global marketplace.

- Industries to benefit: The automotive industry, which relies heavily on imported parts, and the technology sector, reliant on Chinese manufacturing for electronics, are prime examples.

- Increased exports and job creation: Lower production costs could lead to increased exports and potentially stimulate job creation within the G-7, particularly in industries that utilize Chinese-sourced materials. This could offset some potential negative consequences.

Potential Risks and Challenges Associated with Tariff Reductions

While the potential benefits are attractive, lowering tariffs on Chinese goods also presents several risks and challenges.

Concerns Regarding Fair Trade Practices

Concerns exist about China's trade practices, including allegations of dumping (selling goods below market value) and intellectual property theft. These practices can harm G-7 businesses and distort fair competition.

- Negative impacts on specific industries: Industries with strong domestic production could face significant challenges if they're unable to compete with unfairly priced Chinese imports.

- Robust trade monitoring and enforcement: To mitigate these risks, robust trade monitoring and effective enforcement mechanisms, including anti-dumping duties, are crucial. Addressing trade imbalances is also paramount.

Impact on Domestic Industries

Lower tariffs could negatively impact domestic industries competing with cheaper Chinese imports, potentially leading to job displacement and economic hardship in certain sectors.

- Industries facing challenges: Manufacturing and agriculture are sectors particularly vulnerable to increased competition from cheaper Chinese imports.

- Government support and retraining: Governments may need to implement support programs, such as retraining initiatives, to help workers transition to new jobs and mitigate the social and economic consequences of job displacement. Economic diversification strategies are also essential.

Strategic Implications for Businesses Operating in the G-7 and China

The potential changes necessitate strategic adjustments for businesses operating within the G-7 and China.

Adapting Supply Chains

Businesses need to proactively adapt their supply chains to navigate the potential changes brought about by tariff reductions. This might involve a reassessment of global sourcing strategies.

- Strategies for businesses: Supply chain diversification, by sourcing from multiple countries, and relocating production to reduce reliance on Chinese manufacturing are key strategies. Effective risk management is crucial.

Investment Decisions

Investment decisions, especially regarding foreign direct investment (FDI) in China and vice-versa, will be significantly impacted. Businesses must carefully weigh the risks and rewards.

- Impacts on FDI: The potential for increased market access in China might attract more FDI, but the risk of unfair competition could deter some investors. Careful consideration of business risk is necessary.

Conclusion: Navigating the Future of Lowering Tariffs on Chinese Goods

Lowering tariffs on Chinese goods presents a complex scenario with both potential benefits and risks. While lower prices for consumers and increased competitiveness for some G-7 businesses are possible outcomes, concerns regarding fair trade practices and the impact on domestic industries must be addressed. Businesses must carefully consider the implications of these potential changes for their operations. Proactive assessment of exposure to these developments and the development of strategies to mitigate risks and capitalize on opportunities presented by the lowering of tariffs on Chinese goods are crucial. Conduct thorough research on the topic and consult with relevant experts to make informed decisions about your business strategy in this evolving trade environment.

Featured Posts

-

Wtt Star Contender Chennai Oh Jun Sung Secures Championship Title

May 22, 2025

Wtt Star Contender Chennai Oh Jun Sung Secures Championship Title

May 22, 2025 -

The Goldbergs The Impact Of The Show On Television Comedy

May 22, 2025

The Goldbergs The Impact Of The Show On Television Comedy

May 22, 2025 -

The Rich And Robust Flavors Of C Cassis Blackcurrant Liqueur

May 22, 2025

The Rich And Robust Flavors Of C Cassis Blackcurrant Liqueur

May 22, 2025 -

Peppa Pigs Mum Announces Babys Sex Fans React To The News

May 22, 2025

Peppa Pigs Mum Announces Babys Sex Fans React To The News

May 22, 2025 -

Funko Pops The Dexter Collection Is Here

May 22, 2025

Funko Pops The Dexter Collection Is Here

May 22, 2025

Latest Posts

-

York County Pa Firefighters Battle Two Alarm Blaze Property Loss And Investigation

May 22, 2025

York County Pa Firefighters Battle Two Alarm Blaze Property Loss And Investigation

May 22, 2025 -

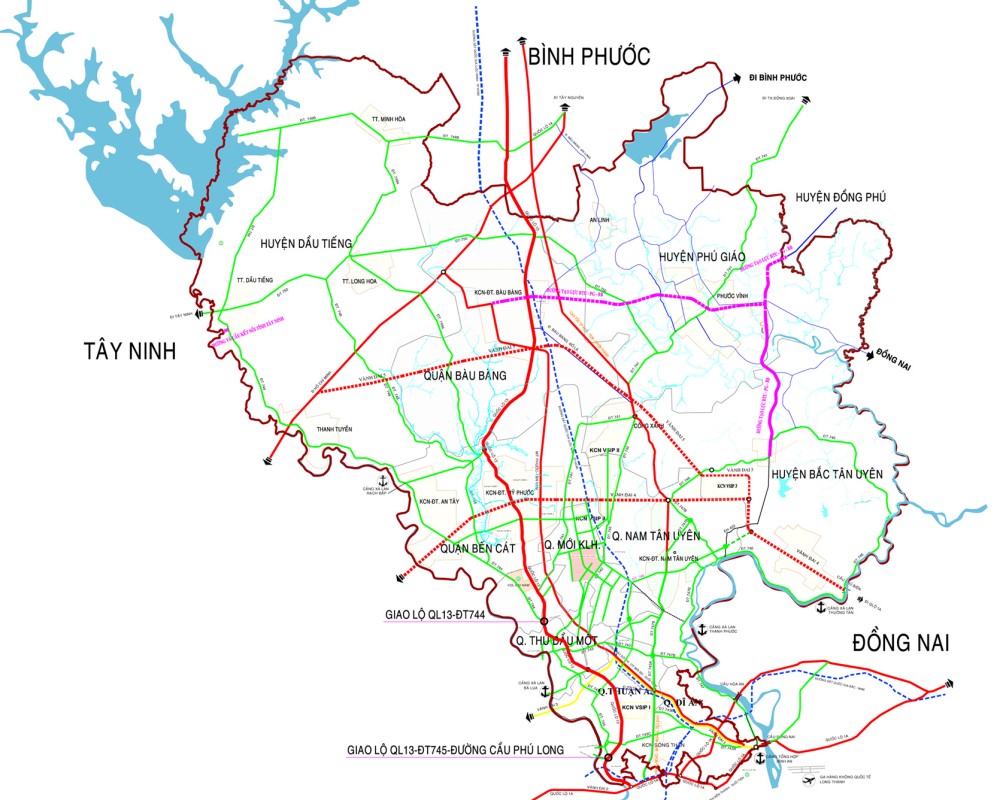

Thach Thuc Va Co Hoi Tu Cac Du An Ha Tang Tp Hcm Binh Duong

May 22, 2025

Thach Thuc Va Co Hoi Tu Cac Du An Ha Tang Tp Hcm Binh Duong

May 22, 2025 -

Cac Du An Ha Tang Khoi Thong Giao Thong Tp Hcm Binh Duong

May 22, 2025

Cac Du An Ha Tang Khoi Thong Giao Thong Tp Hcm Binh Duong

May 22, 2025 -

Ha Tang Giao Thong Tp Hcm Binh Duong Thuc Trang Va Trien Vong

May 22, 2025

Ha Tang Giao Thong Tp Hcm Binh Duong Thuc Trang Va Trien Vong

May 22, 2025 -

Dau Tu Ha Tang Tp Hcm Binh Duong Tac Dong Den Giao Thong Vung

May 22, 2025

Dau Tu Ha Tang Tp Hcm Binh Duong Tac Dong Den Giao Thong Vung

May 22, 2025