Get More For Less: Practical Tips For Smart Spending

Table of Contents

Planning and Budgeting: The Foundation of Smart Spending

Effective budgeting is the cornerstone of smart spending. Before you can get more for less, you need a clear understanding of where your money is going.

Creating a Realistic Budget

Tracking expenses is the first step. Identifying your spending patterns reveals areas where you can cut back. Use budgeting apps like Mint or YNAB (You Need a Budget), or create a simple spreadsheet. The 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment) or zero-based budgeting (allocating every dollar) are popular methods.

- Expense Categories to Track:

- Housing (rent, mortgage, utilities)

- Transportation (car payments, gas, public transport)

- Food (groceries, eating out)

- Entertainment (movies, concerts, subscriptions)

- Clothing

- Personal Care

- Debt Payments

Call to action: Download a budgeting app or create a spreadsheet today to start tracking your expenses!

Setting Financial Goals

Setting financial goals, both short-term and long-term, is crucial. These goals provide direction and motivation. An emergency fund, a down payment on a house, or a dream vacation are all excellent goals. These goals help you prioritize spending and make saving more meaningful.

- Examples of SMART Financial Goals:

- Specific: Save $1,000 for an emergency fund.

- Measurable: Track savings progress weekly.

- Achievable: Save $50 per week.

- Relevant: This fund will cover unexpected expenses.

- Time-bound: Achieve this goal within 6 months.

Call to action: Write down three financial goals and create a plan to achieve them.

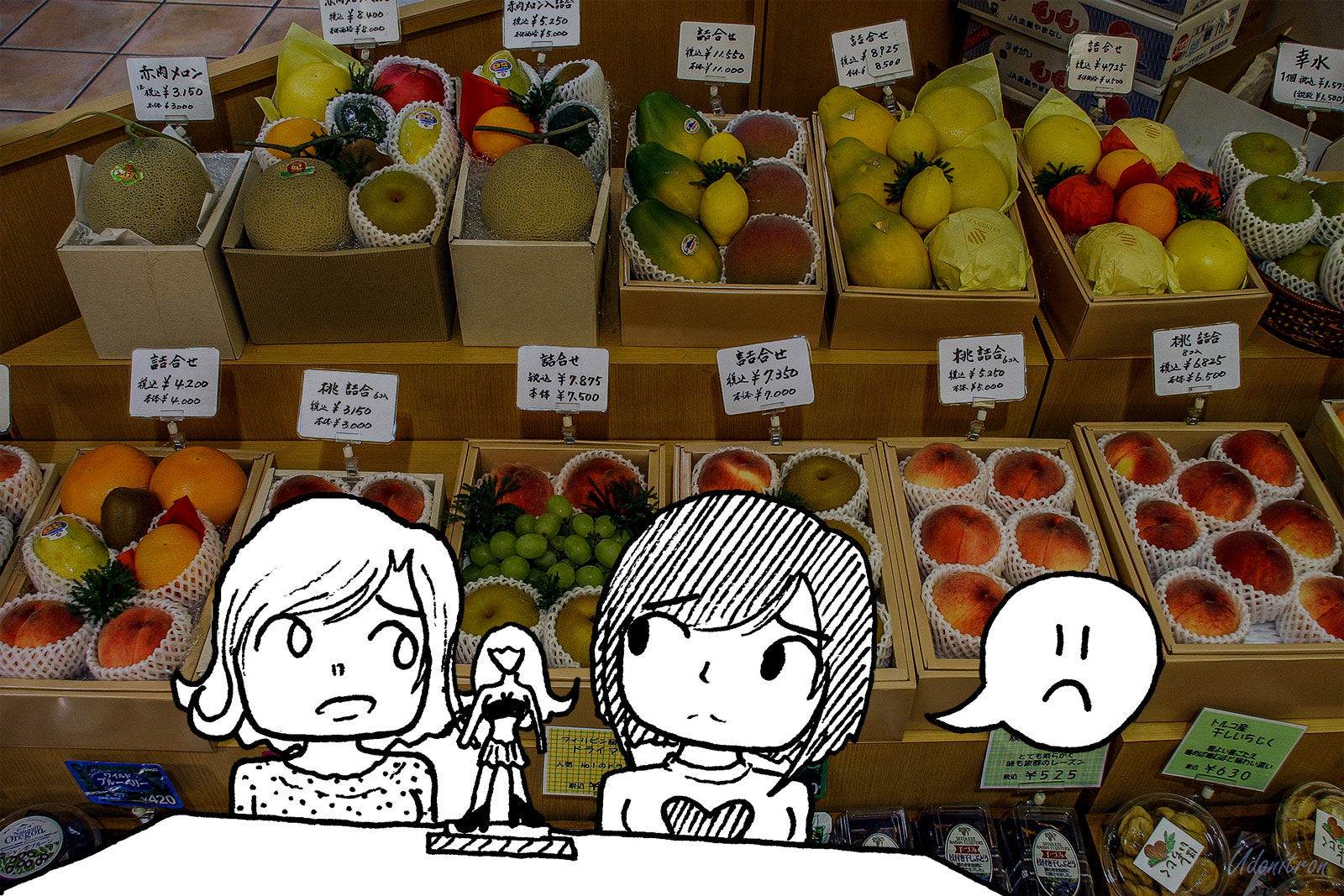

Smart Shopping Strategies: Getting the Best Value for Your Money

Smart shopping is all about maximizing value. It's about getting the most for your money, not necessarily spending the least.

Mastering the Art of Comparison Shopping

Never buy anything without comparing prices. Utilize price comparison websites like Google Shopping and browser extensions like Honey. Don't forget to factor in shipping costs and sales tax.

- Tips for Effective Comparison Shopping:

- Check online reviews.

- Consider warranty options.

- Look for sales and discounts.

- Read the fine print.

Call to action: Compare prices for three items before making your next purchase.

Utilizing Coupons, Discounts, and Loyalty Programs

Coupons, discount codes, and loyalty programs are powerful tools for saving money. Use coupon websites and apps, and sign up for loyalty programs at your favorite stores.

- Examples of Loyalty Program Benefits:

- Rewards points redeemable for discounts.

- Cashback on purchases.

- Exclusive sales and offers.

Call to action: Sign up for at least one loyalty program at a store you frequent.

Avoiding Impulse Purchases

Impulse buys are a major drain on your budget. Implement strategies like the "24-hour rule" (wait 24 hours before making a non-essential purchase) or a waiting list approach (add items to a list and wait a set period before purchasing).

- Tips to Curb Impulse Purchases:

- Unsubscribe from tempting emails.

- Avoid shopping when stressed or hungry.

- Shop with a list.

Call to action: Implement the 24-hour rule for at least one week.

Reducing Recurring Expenses: Saving Money Consistently

Recurring expenses can significantly impact your budget. Finding ways to reduce them leads to consistent savings.

Negotiating Bills and Services

Don't be afraid to negotiate lower rates for your bills. Contact your internet, cable, and insurance providers to see if they're willing to offer a better deal.

- Services to Potentially Negotiate:

- Internet and cable TV

- Home and auto insurance

- Phone bills

Call to action: Contact one service provider to negotiate a lower rate.

Finding Affordable Alternatives

Look for cheaper alternatives for everyday expenses. Meal prepping can save money on groceries, public transport can be cheaper than driving, and there are plenty of free or low-cost entertainment options.

- Examples of Affordable Alternatives:

- Meal prepping instead of eating out.

- Using public transportation or biking.

- Finding free events in your community.

Call to action: Identify one area where you can find a more affordable alternative.

Embracing Smart Spending for a Brighter Financial Future

Mastering the art of "Get More for Less" involves a three-pronged approach: meticulous planning and budgeting, employing smart shopping strategies, and consistently reducing recurring expenses. By adopting these habits, you'll experience greater financial freedom, reduced stress, and a clearer path towards achieving your financial goals. Start implementing these tips today and take control of your finances.

Call to action: Start implementing the strategies discussed in this article to get more for less and achieve your financial goals. Subscribe to our newsletter for more tips on smart spending and budgeting!

Featured Posts

-

Patrik Svarceneger Senka Slavnog Prezimena U Seriji White Lotus

May 06, 2025

Patrik Svarceneger Senka Slavnog Prezimena U Seriji White Lotus

May 06, 2025 -

Third Suspect Involved In Lady Gaga Concert Bomb Plot Say Brazilian Authorities

May 06, 2025

Third Suspect Involved In Lady Gaga Concert Bomb Plot Say Brazilian Authorities

May 06, 2025 -

Surprisingly Good Cheap Stuff Where To Find It

May 06, 2025

Surprisingly Good Cheap Stuff Where To Find It

May 06, 2025 -

Nintendos Action Against Ryujinx Emulator Developer Statement And Future Implications

May 06, 2025

Nintendos Action Against Ryujinx Emulator Developer Statement And Future Implications

May 06, 2025 -

Constitution And Trump I Dont Know Response Explained

May 06, 2025

Constitution And Trump I Dont Know Response Explained

May 06, 2025

Latest Posts

-

The Chris Pratt Patrick Schwarzenegger White Lotus Nude Scene Controversy

May 06, 2025

The Chris Pratt Patrick Schwarzenegger White Lotus Nude Scene Controversy

May 06, 2025 -

Maria Shrivers Comments On Patrick Schwarzenegger And His White Lotus Character

May 06, 2025

Maria Shrivers Comments On Patrick Schwarzenegger And His White Lotus Character

May 06, 2025 -

Chris Pratts Unfiltered Opinion On Patrick Schwarzeneggers White Lotus Appearance

May 06, 2025

Chris Pratts Unfiltered Opinion On Patrick Schwarzeneggers White Lotus Appearance

May 06, 2025 -

The Truth Behind Patrick Schwarzenegger And Abby Champions Wedding Postponement

May 06, 2025

The Truth Behind Patrick Schwarzenegger And Abby Champions Wedding Postponement

May 06, 2025 -

Patrick Schwarzeneggers Wedding Delay The Reason Behind The Postponement

May 06, 2025

Patrick Schwarzeneggers Wedding Delay The Reason Behind The Postponement

May 06, 2025