Gibraltar Industries (ROCK) Earnings Preview: What To Expect

Table of Contents

Gibraltar Industries (ROCK), a leading provider of building products and infrastructure solutions, is poised to release its Q3 earnings report. This preview delves into the key factors likely to shape the results, providing investors with a comprehensive outlook on ROCK stock. We will analyze recent market trends, the company's performance, and analyst predictions to offer a well-rounded perspective on what to expect from Gibraltar Industries' upcoming financial announcement.

Recent Market Trends and Their Impact on Gibraltar Industries (ROCK)

Construction Industry Outlook

The construction industry's health significantly influences Gibraltar Industries' performance. Current trends show a mixed picture. While certain sectors, such as residential construction in specific regions, exhibit robust growth, others face challenges.

- Economic Indicators: Recent data suggests a slowdown in housing starts in some areas, potentially impacting demand for Gibraltar's roofing products. Conversely, increased infrastructure investment, fueled by government spending, could positively affect demand for its infrastructure solutions. Construction spending data will be crucial in assessing overall sector health.

- Impact on Gibraltar Industries' Product Lines: Strong growth in renewable energy initiatives could boost demand for Gibraltar's solar mounting systems. Conversely, fluctuations in lumber and steel prices directly impact the profitability of its roofing and other building product lines.

Competition and Market Share

Gibraltar Industries operates in a competitive landscape with established players and emerging competitors. Understanding its market positioning is crucial for evaluating its future prospects.

- Competitive Strengths and Weaknesses: Gibraltar Industries benefits from a diversified product portfolio and established distribution networks. However, intense competition requires ongoing innovation and efficient cost management to maintain market share.

- Market Share Analysis: Recent reports suggest a relatively stable market share for Gibraltar Industries, though monitoring any shifts against key competitors is vital. Future projections depend heavily on the company's success in launching new products and penetrating new markets.

Raw Material Prices and Supply Chain Dynamics

Fluctuating raw material prices and supply chain disruptions pose significant challenges for Gibraltar Industries.

- Material Costs: Steel and aluminum prices have experienced considerable volatility recently, impacting production costs and profitability. These price swings directly affect the company's margins.

- Supply Chain Mitigation Strategies: Gibraltar Industries likely employs strategies such as hedging, long-term contracts, and diversification of sourcing to mitigate these risks. The effectiveness of these strategies will directly impact their Q3 results.

Gibraltar Industries (ROCK) Q3 Earnings Expectations

Revenue Projections

Analyst estimates for Gibraltar Industries' Q3 revenue vary, but generally reflect a cautious optimism. Projections often incorporate expectations of continued demand for certain product lines while acknowledging potential headwinds from others.

- Comparison to Previous Quarters: Comparing Q3 projections to previous quarters and the same quarter last year will reveal growth trends and highlight any significant changes in revenue streams.

- Product Demand Shifts: Observing any significant shifts in demand for specific product lines, particularly roofing versus solar mounting systems, will provide insights into market trends impacting the company's performance.

Earnings Per Share (EPS) Forecast

Analyst predictions for Gibraltar Industries' Q3 EPS incorporate various factors, including revenue projections, cost management, and potential one-time expenses.

- Impact of Cost-Cutting Measures: Successful cost-cutting initiatives could positively influence the EPS forecast, potentially exceeding initial predictions.

- Year-over-Year Comparison: Comparing the Q3 EPS forecast to previous quarters and the same quarter last year will help determine whether the company is on track with its growth trajectory.

Guidance for the Future

Management's guidance for future quarters will be a critical element of the earnings report. This guidance will provide insights into the company's outlook on various factors.

- Revenue Growth Expectations: Management's assessment of future revenue growth will offer valuable clues about their confidence in the market and their ability to navigate current challenges.

- Long-Term Strategy Implications: Any significant shifts in the company's long-term strategy, such as expanding into new markets or investing in new technologies, will impact the ROCK stock price.

Analyzing Key Performance Indicators (KPIs) for Gibraltar Industries (ROCK)

Gross Margin Analysis

Analyzing Gibraltar Industries' gross profit margin will reveal insights into its pricing strategies and cost control effectiveness. Trends in this KPI will provide crucial information on its profitability.

Operating Margin Analysis

The operating margin shows the company's operational efficiency. Factors like production costs, sales and marketing expenses, and administrative overhead significantly affect this KPI.

Debt-to-Equity Ratio

Evaluating the company’s debt-to-equity ratio helps assess its financial leverage and risk profile. A high ratio indicates increased financial risk.

Conclusion

This Gibraltar Industries (ROCK) earnings preview offers a comprehensive look at what to expect from the upcoming Q3 report. Analyzing market trends, company performance, and analyst predictions provides valuable insights into the potential performance of ROCK stock. While this forecast is useful, remember that all investments carry risk. Thorough research and consultation with a financial advisor are crucial before investing in Gibraltar Industries (ROCK) or any other stock. Stay updated on the official earnings release and continue to monitor Gibraltar Industries' performance to make well-informed decisions about your ROCK stock investments.

Featured Posts

-

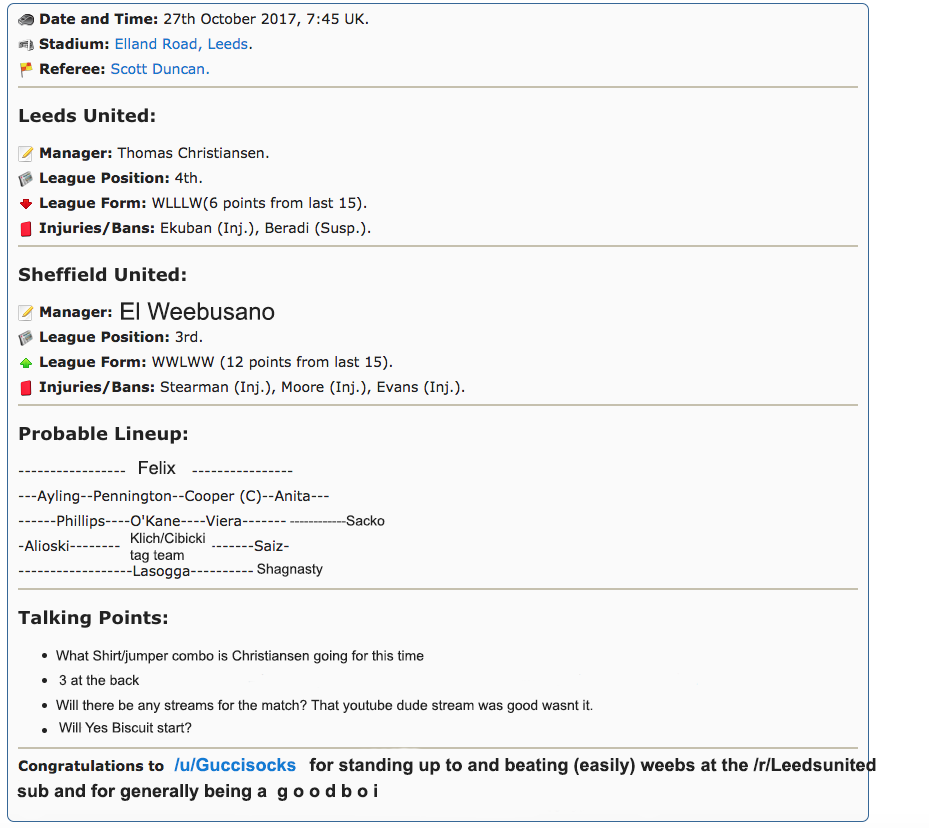

Leeds United Vs Sheffield United Red Card Controversy Sparks Debate

May 13, 2025

Leeds United Vs Sheffield United Red Card Controversy Sparks Debate

May 13, 2025 -

Byd A Evropa Analyza Neuspesneho Startu A Budouciho Potencialu

May 13, 2025

Byd A Evropa Analyza Neuspesneho Startu A Budouciho Potencialu

May 13, 2025 -

Aryna Sabalenkas Controversial Photo Challenge At Stuttgart Open

May 13, 2025

Aryna Sabalenkas Controversial Photo Challenge At Stuttgart Open

May 13, 2025 -

Athlitikes Metadoseis Serie A Odigos Gia Toys Agones

May 13, 2025

Athlitikes Metadoseis Serie A Odigos Gia Toys Agones

May 13, 2025 -

The Impact Of Wildfires On The Uks Rarest Wildlife

May 13, 2025

The Impact Of Wildfires On The Uks Rarest Wildlife

May 13, 2025

Latest Posts

-

South Africa The New Top Apple Exporter

May 13, 2025

South Africa The New Top Apple Exporter

May 13, 2025 -

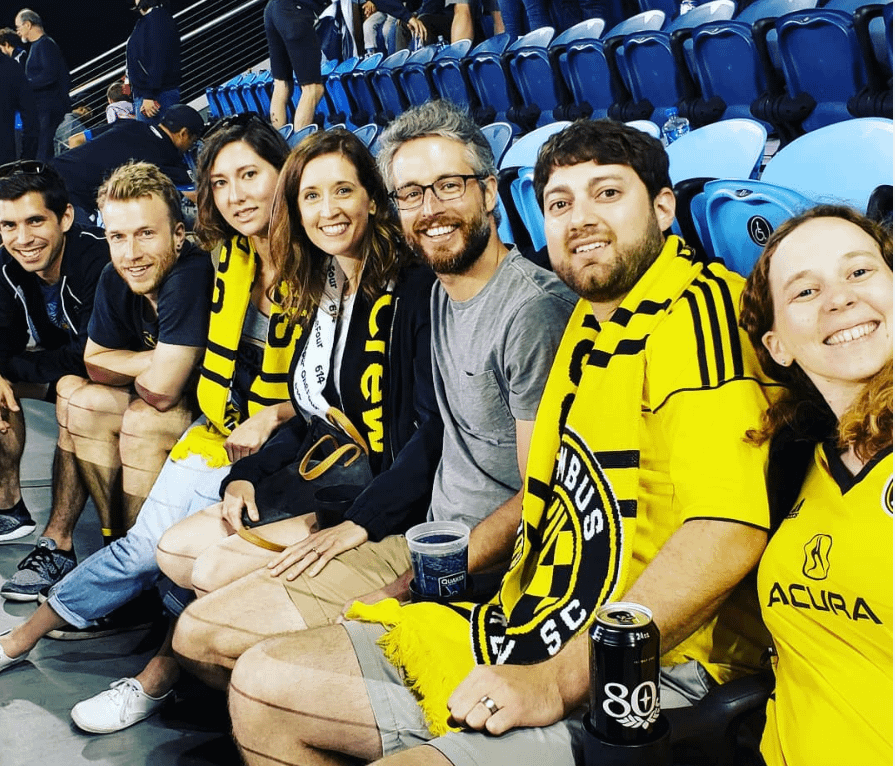

Columbus Crew Secures 2 1 Win Against San Jose Earthquakes

May 13, 2025

Columbus Crew Secures 2 1 Win Against San Jose Earthquakes

May 13, 2025 -

New Zealands Apple Export Crown Taken By South Africa

May 13, 2025

New Zealands Apple Export Crown Taken By South Africa

May 13, 2025 -

2 1 Win For Columbus Crew Overcoming The Earthquakes

May 13, 2025

2 1 Win For Columbus Crew Overcoming The Earthquakes

May 13, 2025 -

Columbus Crew Defeats San Jose Earthquakes 2 1 Ending Losing Streak

May 13, 2025

Columbus Crew Defeats San Jose Earthquakes 2 1 Ending Losing Streak

May 13, 2025