Gibraltar Industries (ROCK) Q[Quarter] 2024 Earnings: A Detailed Preview

![Gibraltar Industries (ROCK) Q[Quarter] 2024 Earnings: A Detailed Preview Gibraltar Industries (ROCK) Q[Quarter] 2024 Earnings: A Detailed Preview](https://hirschfeld-kongress.de/image/gibraltar-industries-rock-q-quarter-2024-earnings-a-detailed-preview.jpeg)

Table of Contents

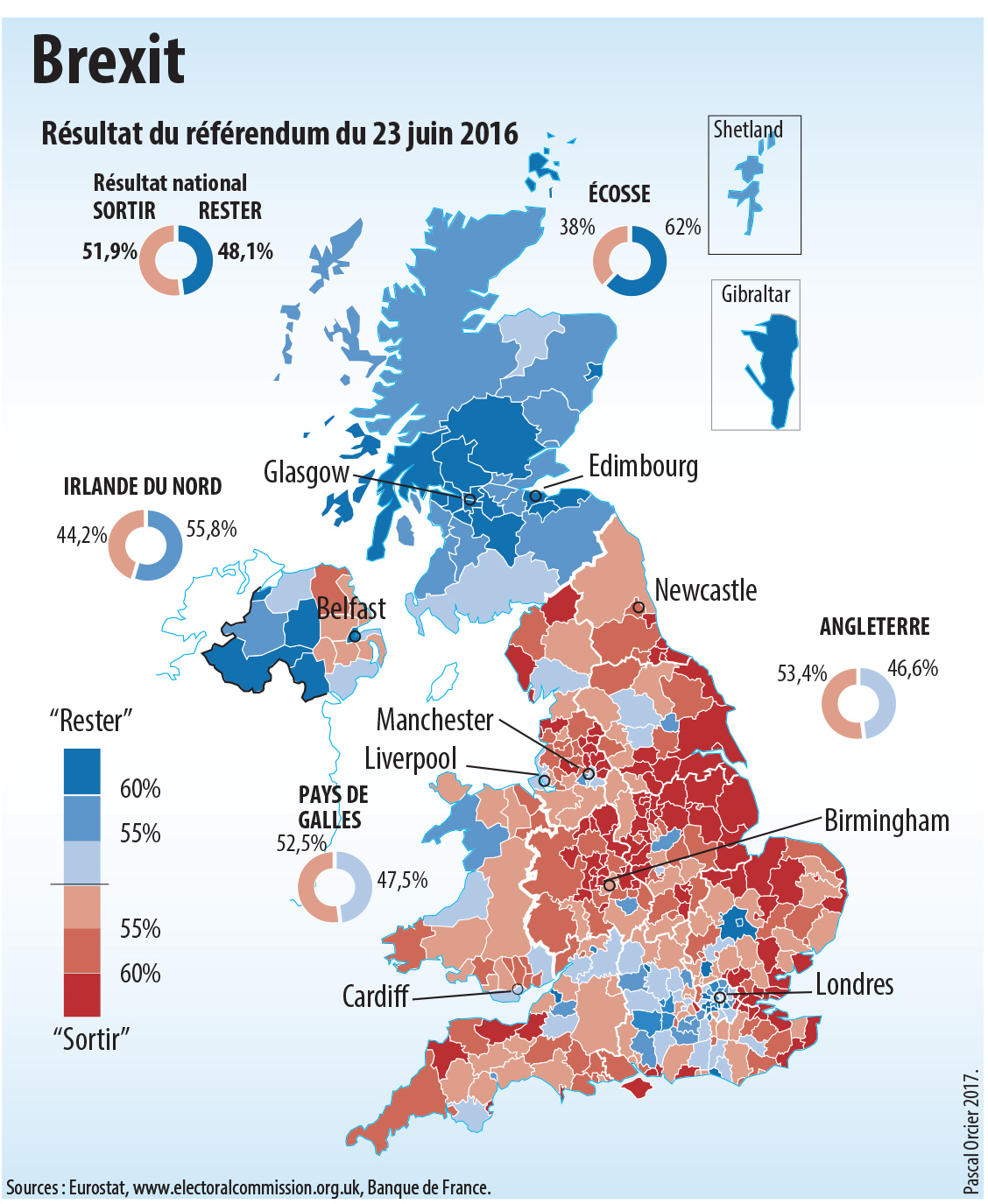

Analyzing Gibraltar Industries' Recent Performance (ROCK Stock Performance)

Review of Q1 2024 Results:

Gibraltar Industries' Q1 2024 earnings report provided a mixed bag for investors. While certain segments showed promising growth, others faced headwinds. Let's examine the key takeaways:

- Revenue: Total revenue was reported at [Insert Q1 2024 Revenue Figure], representing a [Percentage]% change compared to Q1 2023. This was [higher/lower] than analyst expectations of [Analyst Expectation Figure].

- Earnings Per Share (EPS): EPS came in at [Insert Q1 2024 EPS Figure], compared to [Q1 2023 EPS Figure]. This indicates [positive/negative] growth.

- Gross Margin: The gross margin stood at [Insert Q1 2024 Gross Margin Figure]%, reflecting [positive/negative] pressure from [mention specific factors like material costs].

A significant news event impacting ROCK's performance during Q1 was [mention specific event, e.g., a major contract win or a supply chain disruption]. This event likely contributed to [positive/negative] performance in [mention specific segment].

Industry Trends and Market Conditions:

The building products industry continues to experience a dynamic environment. Several factors will likely influence Gibraltar Industries' Q2 2024 performance:

- Material Costs: Inflation and supply chain constraints continue to impact material costs, potentially squeezing margins.

- Construction Activity: The overall level of residential and non-residential construction activity is a key driver of demand for Gibraltar Industries' products. Current indicators suggest [positive/negative/neutral] trends.

- Competition: Gibraltar Industries faces competition from [mention key competitors]. Their strategies and market share will impact ROCK's performance.

- Economic Indicators: Rising interest rates and potential economic slowdowns could dampen demand for new construction, impacting Gibraltar Industries’ sales.

Key Factors to Watch in Gibraltar Industries' Q2 2024 Earnings Report (ROCK Earnings Expectations)

Revenue Growth and Projections:

Analysts are projecting revenue growth for Gibraltar Industries in Q2 2024, but the extent of this growth remains uncertain. Several factors will determine the outcome:

- Analyst Projections: The average analyst projection for Q2 2024 revenue is [Insert Analyst Revenue Projection].

- Company Guidance: Gibraltar Industries' own guidance for Q2 2024 revenue is [Insert Company Revenue Guidance, if available].

- Key Product Segments: The performance of key product segments such as [mention specific segments] will significantly influence overall revenue growth.

Profitability and Margins:

Profitability is a critical metric for assessing Gibraltar Industries' financial health. Investors will be closely watching:

- Gross Margin: The gross margin is expected to be [Insert Projection/Range for Gross Margin]%, impacted by material costs and pricing strategies.

- Operating Margin: The operating margin is projected at [Insert Projection/Range for Operating Margin]%, reflecting the company's efficiency and cost control measures.

- Net Income: Net income projections range from [Insert Projection/Range for Net Income].

Guidance for the Remainder of 2024:

Management's outlook for the rest of 2024 will provide valuable insights into the company's future performance. Key areas to monitor include:

- Full-Year Revenue Projections: The company is likely to provide updated guidance for full-year revenue.

- Capital Expenditures: Any changes in capital expenditure plans will signal strategic shifts.

- Potential Risks: Management might highlight potential risks, such as economic slowdowns or unforeseen supply chain disruptions.

Investment Implications and Potential Risks for ROCK Investors

Valuation and Stock Price Analysis:

Gibraltar Industries' current valuation should be considered alongside its potential future performance.

- P/E Ratio: The current P/E ratio is [Insert Current P/E Ratio], indicating [overvalued/undervalued/fairly valued] compared to industry peers.

- Price-to-Sales Ratio: The price-to-sales ratio stands at [Insert Current Price-to-Sales Ratio].

- Price Catalysts: Positive catalysts for price appreciation include exceeding revenue expectations and improved margins. Negative catalysts could include a weaker-than-expected economic outlook.

Risk Factors to Consider:

Investing in Gibraltar Industries carries certain risks that investors should carefully consider:

- Competition: Intense competition within the building products industry could pressure margins.

- Economic Downturn: A significant economic downturn could negatively impact demand for building materials.

- Supply Chain Disruptions: Further supply chain disruptions could increase costs and delay projects.

- Regulatory Changes: Changes in building codes or environmental regulations could impact product demand.

Gibraltar Industries (ROCK) Q2 2024 Earnings: Final Thoughts and Call to Action

The Gibraltar Industries (ROCK) Q2 2024 earnings report is poised to offer valuable insights into the company's performance and future prospects. While positive growth is anticipated in some areas, investors should closely monitor the actual results, particularly regarding revenue growth, profitability, and management's guidance for the remainder of 2024. The impact of these results on the ROCK stock price will be significant. Stay informed about the Gibraltar Industries (ROCK) Q2 2024 Earnings release and continue following the company’s performance. For further resources and in-depth analysis of Gibraltar Industries and its stock, consider consulting reputable financial news sources and investment research platforms. Understanding the Gibraltar Industries (ROCK) Q2 2024 earnings is crucial for navigating the complexities of the building products market.

![Gibraltar Industries (ROCK) Q[Quarter] 2024 Earnings: A Detailed Preview Gibraltar Industries (ROCK) Q[Quarter] 2024 Earnings: A Detailed Preview](https://hirschfeld-kongress.de/image/gibraltar-industries-rock-q-quarter-2024-earnings-a-detailed-preview.jpeg)

Featured Posts

-

Elsbeth Sneak Peek Uncovering Details At David Alan Griers Funeral Home

May 13, 2025

Elsbeth Sneak Peek Uncovering Details At David Alan Griers Funeral Home

May 13, 2025 -

Accord Post Brexit A Gibraltar Perspectives Et Defis

May 13, 2025

Accord Post Brexit A Gibraltar Perspectives Et Defis

May 13, 2025 -

Deja Kellys Leadership Oregon Tournament Preview

May 13, 2025

Deja Kellys Leadership Oregon Tournament Preview

May 13, 2025 -

A Career In Fine Arts The Professorship And Spatial Theory

May 13, 2025

A Career In Fine Arts The Professorship And Spatial Theory

May 13, 2025 -

All 5 Upcoming Leonardo Di Caprio Movies Explained

May 13, 2025

All 5 Upcoming Leonardo Di Caprio Movies Explained

May 13, 2025

Latest Posts

-

Analisis Permainan Jay Idzes Venezia Seri Lawan Atalanta Dampaknya Bagi Timnas Indonesia

May 13, 2025

Analisis Permainan Jay Idzes Venezia Seri Lawan Atalanta Dampaknya Bagi Timnas Indonesia

May 13, 2025 -

Performa Jay Idzes Di Venezia Vs Atalanta Implikasi Untuk Timnas Indonesia

May 13, 2025

Performa Jay Idzes Di Venezia Vs Atalanta Implikasi Untuk Timnas Indonesia

May 13, 2025 -

Liverpool Transfers Reds And Chelsea Vie For Lookman

May 13, 2025

Liverpool Transfers Reds And Chelsea Vie For Lookman

May 13, 2025 -

Pertandingan Venezia Vs Atalanta Berakhir Imbang 0 0 Jay Idzes Main Penuh

May 13, 2025

Pertandingan Venezia Vs Atalanta Berakhir Imbang 0 0 Jay Idzes Main Penuh

May 13, 2025 -

Idzes Tampil Apik Venezia Tahan Imbang Atalanta Harapan Baru Timnas Indonesia

May 13, 2025

Idzes Tampil Apik Venezia Tahan Imbang Atalanta Harapan Baru Timnas Indonesia

May 13, 2025