Gold Fields' $3.7 Billion Acquisition Of Gold Road Resources

Table of Contents

Deal Details and Financial Implications

Gold Fields' acquisition of Gold Road Resources finalized at a staggering $3.7 billion. The transaction involved a combination of cash and shares, offering a substantial premium over Gold Road's pre-announcement share price, reflecting Gold Fields' confidence in the value and potential of Gold Road's assets. This Gold Fields acquisition significantly impacts the company's financial standing. Increased debt levels are anticipated, along with some equity dilution. However, Gold Fields believes the long-term benefits outweigh these short-term costs.

- Acquisition Price: $3.7 billion (combination of cash and shares)

- Premium Offered: A significant premium over Gold Road's pre-announcement share price.

- Financial Implications for Gold Fields: Increased debt, potential equity dilution, but expected positive long-term ROI.

- Projected Return on Investment (ROI): Gold Fields' projections indicate a strong ROI, driven by increased production and cost synergies. (Specific figures would need to be sourced from official company statements).

Synergies and Operational Benefits

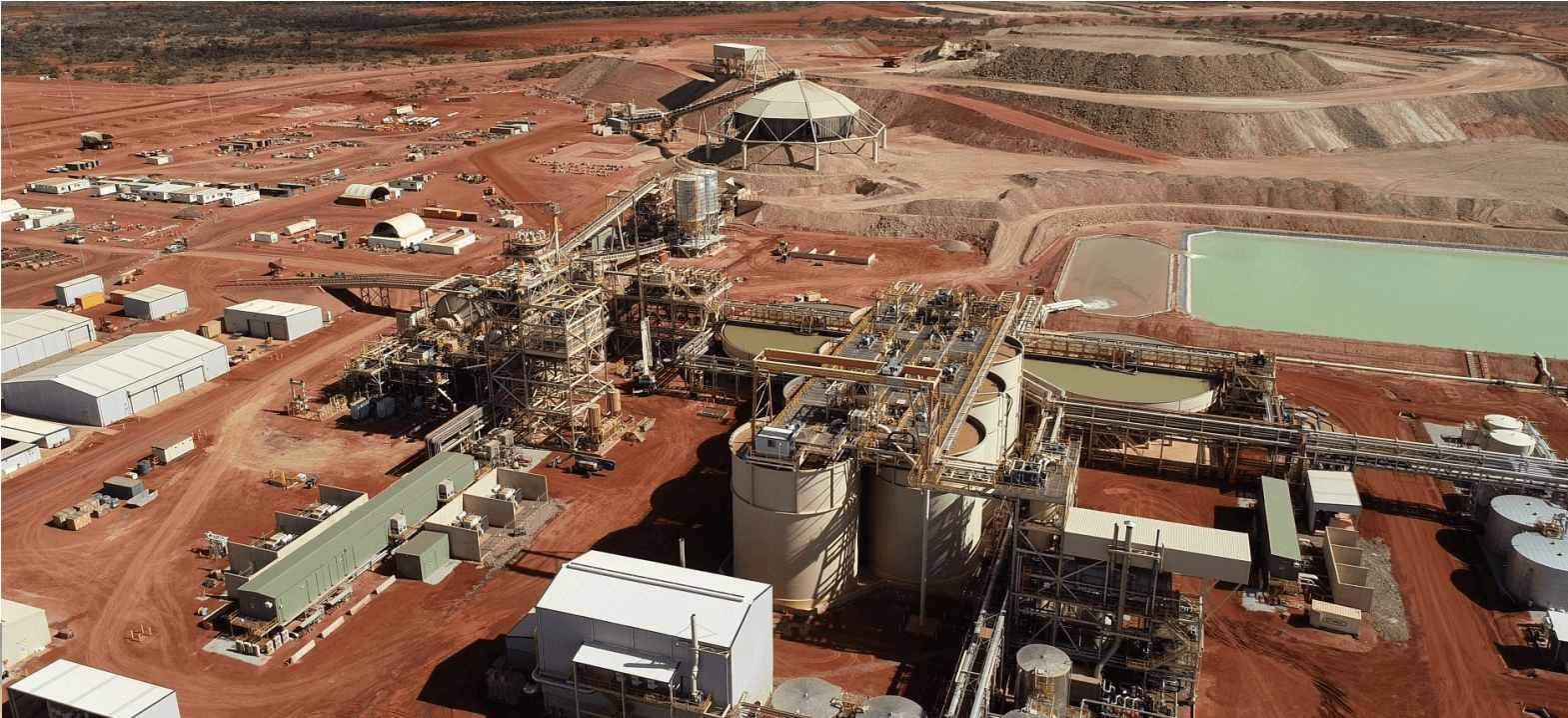

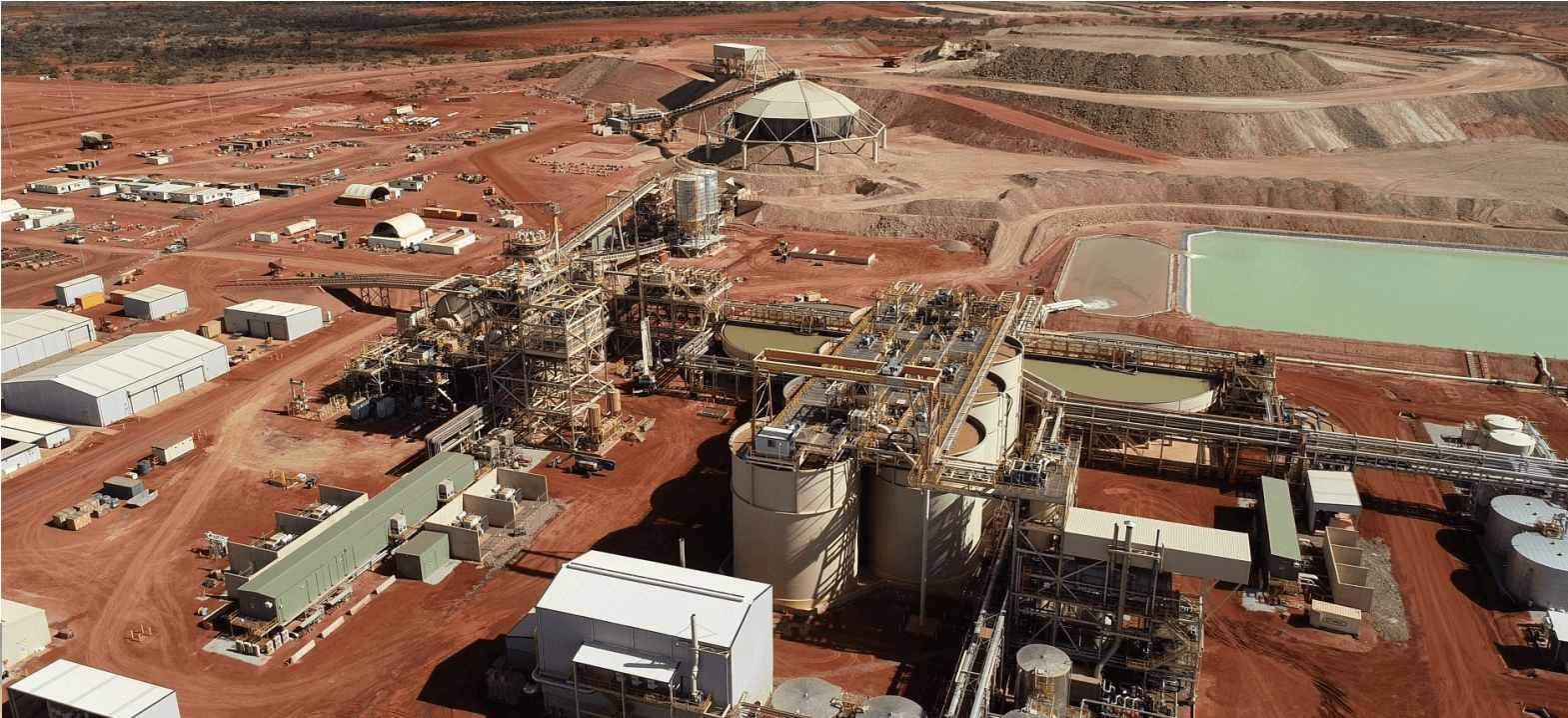

The merger between Gold Fields and Gold Road Resources is expected to yield substantial operational synergies. Combining operations will lead to streamlined management structures, reduced overhead costs, and improved operational efficiency. The integration of Gold Road's assets, including its flagship Gruyere gold mine, strengthens Gold Fields' existing portfolio and expands its production capacity.

- Improved Operational Efficiency: Streamlined processes and optimized resource allocation.

- Streamlined Management: Consolidation of overlapping functions and reduced administrative costs.

- Reduced Overhead Costs: Economies of scale across operations.

- Increased Gold Production: Access to Gold Road's high-quality gold assets contributes to significantly increased gold output.

Strategic Rationale Behind the Acquisition

Gold Fields' acquisition of Gold Road Resources aligns perfectly with its strategic growth objectives. The deal provides access to high-quality gold assets, significantly expanding Gold Fields' gold reserves and production capacity. This Gold Road Resources takeover also enhances geographical diversification, mitigating risk associated with focusing on single regions.

- Access to New High-Quality Gold Assets: Strengthening Gold Fields' resource base and future production.

- Strengthening Market Position: Increased market share and enhanced competitive advantage.

- Long-Term Growth Strategy: A key component of Gold Fields' long-term vision for expansion and profitability.

- Geographical Diversification: Reducing reliance on specific regions and mitigating geopolitical risks.

Market Reactions and Analyst Opinions

The announcement of the Gold Fields acquisition was met with mixed reactions in the market. Initial stock price movements reflected a blend of optimism and caution. Many analysts view this Gold Road Resources takeover as a positive strategic move for Gold Fields, citing potential for significant long-term value creation. However, some expressed concerns about integration challenges and the impact on debt levels.

- Stock Price Performance Following Announcement: Initial volatility followed by a generally positive trend (Specific data would require referencing market data).

- Positive Analyst Comments: Emphasis on strategic synergies, long-term growth potential, and improved market position.

- Negative Analyst Comments: Concerns about integration complexities, debt levels, and the impact of fluctuating gold prices.

- Forecasts for Future Gold Prices: Analyst predictions vary, but generally reflect a cautious optimism about gold price trends.

Potential Challenges and Risks

While the Gold Fields acquisition holds substantial promise, several potential challenges and risks must be acknowledged. Integration of two distinct operational structures can be complex. Regulatory approvals may present hurdles, and unforeseen geological issues at Gold Road's assets cannot be entirely ruled out. The global economic situation and fluctuations in gold prices also pose inherent risks.

- Integration Difficulties: Merging different company cultures, operational systems, and personnel.

- Regulatory Approvals: Securing necessary permits and approvals from relevant authorities.

- Geological Uncertainties: Unforeseen challenges related to the geology of Gold Road's assets.

- Operational Risks: Unexpected disruptions or inefficiencies during the integration process.

- Impact of Gold Price Fluctuations: Gold price volatility can significantly impact profitability.

Gold Fields' Acquisition of Gold Road Resources: A Look Ahead

The Gold Fields acquisition of Gold Road Resources marks a significant turning point in the gold mining industry. The strategic rationale, potential synergies, and market reactions all point towards a potentially transformative deal for Gold Fields. While challenges exist, the long-term benefits – increased gold production, enhanced market position, and geographical diversification – appear substantial. This Gold Fields acquisition, and the subsequent Gold Road Resources takeover, will be closely watched as it unfolds.

Stay informed about the unfolding impact of this significant Gold Fields acquisition and its implications for the future of gold mining.

Featured Posts

-

Ufc 314 Mitchell Silva Press Conference Marked By Accusation Of Profanity

May 05, 2025

Ufc 314 Mitchell Silva Press Conference Marked By Accusation Of Profanity

May 05, 2025 -

Fleetwood Macs Musical Influence The Legacy Of Their Hit Records

May 05, 2025

Fleetwood Macs Musical Influence The Legacy Of Their Hit Records

May 05, 2025 -

Revised Fight Order For Ufc 314 Pay Per View Event

May 05, 2025

Revised Fight Order For Ufc 314 Pay Per View Event

May 05, 2025 -

Latest Weather News Temperature Drop In West Bengal

May 05, 2025

Latest Weather News Temperature Drop In West Bengal

May 05, 2025 -

Ufc 314 Fight Card Volkanovski Vs Lopes Ppv Event Details

May 05, 2025

Ufc 314 Fight Card Volkanovski Vs Lopes Ppv Event Details

May 05, 2025

Latest Posts

-

Celtics Playoff Schedule Dates And Times For Magic Series Announced

May 06, 2025

Celtics Playoff Schedule Dates And Times For Magic Series Announced

May 06, 2025 -

Find The Celtics Vs Suns Game Time Tv Channel And Streaming Options April 4th

May 06, 2025

Find The Celtics Vs Suns Game Time Tv Channel And Streaming Options April 4th

May 06, 2025 -

Celtics Vs Suns Basketball Game Date Time Tv Channel And Streaming Details April 4th

May 06, 2025

Celtics Vs Suns Basketball Game Date Time Tv Channel And Streaming Details April 4th

May 06, 2025 -

Celtics Vs Knicks Prediction Game 1 Playoffs Betting Preview And Picks

May 06, 2025

Celtics Vs Knicks Prediction Game 1 Playoffs Betting Preview And Picks

May 06, 2025 -

Nba Playoffs 2024 Knicks Vs Celtics Game 1 Predictions And Picks

May 06, 2025

Nba Playoffs 2024 Knicks Vs Celtics Game 1 Predictions And Picks

May 06, 2025