Gold Hits $3,500 Amidst Tariff And Fed Concerns: Stock Market Analysis

Table of Contents

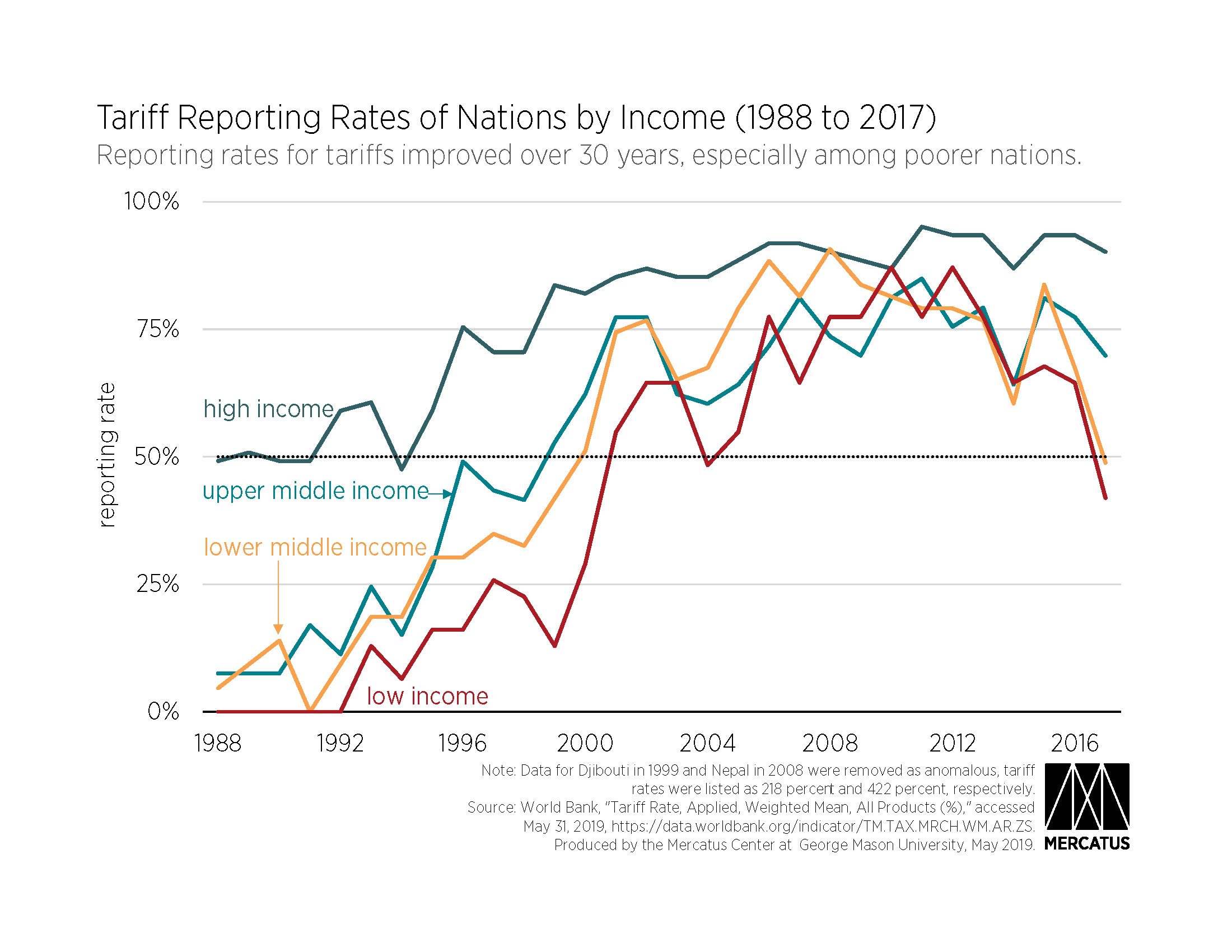

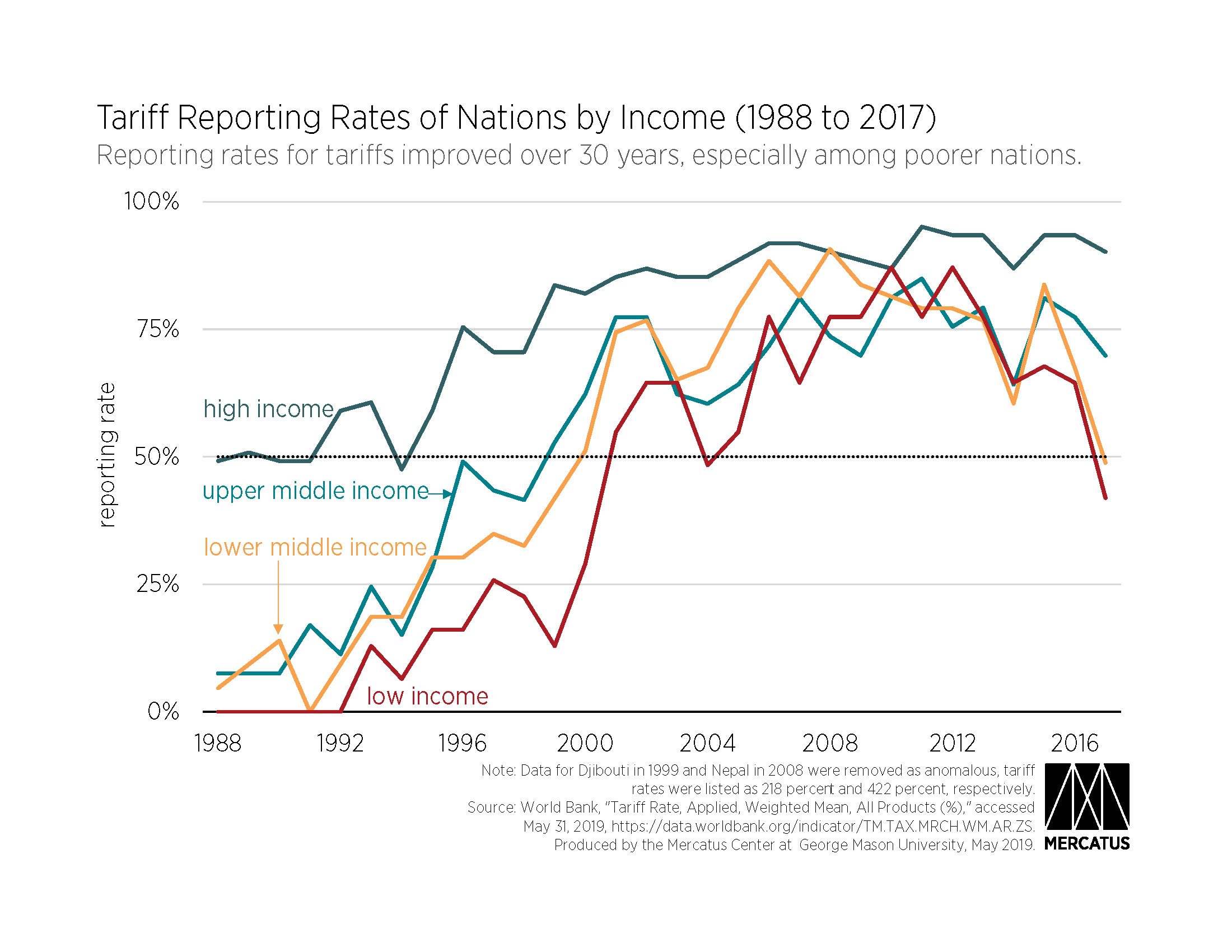

The Role of Escalating Tariffs in the Gold Price Surge

Increased trade tensions and the implementation of new tariffs have created a climate of significant uncertainty in the global economy. This uncertainty directly correlates with the recent gold price surge. Investors, fearing economic instability and potential downturns, often seek safe-haven assets.

- Increased uncertainty leads to a flight to safety: When economic prospects look bleak, investors move their capital away from riskier assets like stocks and bonds and into more stable assets like gold. This "flight to safety" significantly increases demand for gold, driving up its price.

- Gold is a traditional safe-haven asset during economic turmoil: Gold's inherent value and historical stability make it a preferred refuge during periods of market uncertainty. Its limited supply further contributes to its appeal as a store of value.

- Tariffs disrupt global supply chains, impacting economic growth: Imposition of tariffs disrupts established trade routes and increases the cost of goods, potentially slowing economic growth. This negative impact on economic outlook fuels investor anxiety and boosts demand for gold.

- Examples of specific tariffs and their impact on market sentiment: The recent imposition of tariffs on [insert example, e.g., steel imports from country X] sent shockwaves through the market, immediately impacting investor confidence and pushing gold prices higher. A similar pattern was observed with tariffs on [insert another example].

[Insert a chart or graph here visually demonstrating the correlation between tariff announcements and gold price movements. Clearly label axes and data sources.]

The Federal Reserve's Monetary Policy and its Influence on Gold

The Federal Reserve's monetary policy plays a crucial role in influencing gold prices. Potential interest rate changes and quantitative easing (QE) directly impact investor behavior and the value of the dollar, both of which have a substantial influence on the gold price surge.

- Lower interest rates generally benefit gold as it doesn't pay interest: When interest rates are low, the opportunity cost of holding non-interest-bearing assets like gold decreases, making it more attractive to investors.

- Quantitative easing increases money supply, potentially leading to inflation – a positive for gold: QE programs increase the money supply, potentially leading to inflation. Gold is often seen as a hedge against inflation, as its value tends to rise when the purchasing power of fiat currencies declines.

- Analyze recent Fed statements and their market interpretation: Recent statements from the Federal Reserve regarding [mention specific policy decisions or statements, e.g., future interest rate hikes or tapering of QE] have been interpreted by the market as [explain market reaction – e.g., positive or negative for gold].

- Discuss the potential for future Fed actions and their predicted impact on gold: Analysts predict that [mention expert predictions on future Fed actions and their likely impact on gold prices – e.g., further rate cuts could boost gold prices].

“[Insert expert quote here about the Fed’s policy and its impact on gold prices from a reputable financial analyst.]”

Analyzing the Stock Market's Reaction to the Gold Price Spike

The recent gold price surge has had a noticeable impact on various sectors of the stock market. The relationship between the soaring gold price and stock market performance is complex and sector-specific.

- Discuss how different sectors (e.g., technology, financials, commodities) react differently to gold price changes: The technology sector, often considered growth-oriented, may experience some downturn during a gold price surge, while commodity-related stocks may see increased activity. Financial institutions also react differently depending on their holdings and exposure to gold-related investments.

- Explore the concept of portfolio diversification in light of the gold price surge: The gold price surge highlights the importance of portfolio diversification. Holding gold can help mitigate risk associated with other asset classes.

- Analyze stock market indices (e.g., S&P 500, Dow Jones) performance in relation to the gold price: The performance of major stock market indices like the S&P 500 and Dow Jones Industrial Average often shows an inverse correlation with gold price movements during periods of uncertainty.

- Mention any sector-specific opportunities or risks: [mention specific opportunities or risks for certain sectors based on the gold price surge - e.g., gold mining stocks could benefit, while technology stocks might face headwinds].

[Insert a table here comparing the performance of major stock market indices (S&P 500, Dow Jones, etc.) alongside gold price movements over a specific period.]

Predicting Future Gold Price Movements and Investment Strategies

Predicting future gold price movements is inherently speculative, but considering ongoing geopolitical and economic factors can help form informed opinions.

- Discuss potential catalysts for further gold price increases or decreases: Factors such as further escalation of trade wars, unexpected changes in monetary policy, or geopolitical instability could all influence future gold prices. Conversely, a resolution of trade disputes or a strengthening US dollar could put downward pressure on gold prices.

- Offer advice on hedging strategies using gold in investment portfolios: Gold can act as a hedge against inflation and market volatility. Including a percentage of gold in a diversified portfolio can help reduce overall risk.

- Explain different ways to invest in gold (physical gold, ETFs, mining stocks): Investors can access the gold market through various avenues including purchasing physical gold, investing in gold ETFs (exchange-traded funds), or buying shares in gold mining companies. Each method has its own advantages and disadvantages.

- Highlight potential risks associated with gold investment: While gold can be a valuable asset, it's important to understand the risks involved. Gold prices can fluctuate significantly, and it doesn't generate income like dividend-paying stocks or bonds.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Investment decisions should be made based on your own research and risk tolerance.

Conclusion

The recent gold price surge to $3,500 is a complex event driven by a confluence of factors, primarily escalating tariffs leading to increased uncertainty and the Federal Reserve's monetary policy. This gold price surge has had a noticeable, albeit varied, impact across different sectors of the stock market. Understanding the interplay between geopolitical uncertainty, monetary policy, and market sentiment is crucial for navigating these turbulent times.

The unprecedented rise of the gold price surge presents both challenges and opportunities for investors. Stay informed about the latest developments in stock market analysis and explore diverse investment strategies to manage risk effectively. Continue to monitor the gold price surge and its ramifications on the global economy.

Featured Posts

-

Allemagne Legislatives 2024 Derniers Preparatifs Et Enjeux

Apr 23, 2025

Allemagne Legislatives 2024 Derniers Preparatifs Et Enjeux

Apr 23, 2025 -

End Of Ryujinx Nintendo Contact Forces Emulator Shutdown

Apr 23, 2025

End Of Ryujinx Nintendo Contact Forces Emulator Shutdown

Apr 23, 2025 -

Brewers Edge Royals With 11th Inning Walk Off Bunt

Apr 23, 2025

Brewers Edge Royals With 11th Inning Walk Off Bunt

Apr 23, 2025 -

Calendario Laboral 9 Millones De Espanoles Disfrutaran De Puente El 28 F

Apr 23, 2025

Calendario Laboral 9 Millones De Espanoles Disfrutaran De Puente El 28 F

Apr 23, 2025 -

Uncovering The Countrys Next Business Powerhouses A Geographic Overview

Apr 23, 2025

Uncovering The Countrys Next Business Powerhouses A Geographic Overview

Apr 23, 2025