Gold Market Update: Price Decrease Driven By Profit-Taking And Positive Trade Outlook

Table of Contents

Profit-Taking in the Gold Market

Profit-taking is a key factor contributing to the recent gold price decline. This involves investors selling their gold holdings to secure profits after a period of price appreciation. When gold prices have risen significantly, as they have in previous months, investors often take the opportunity to cash in their gains, creating selling pressure that drives the price down. This behavior is a normal part of market dynamics, especially in volatile markets like the gold market. The psychology behind this is straightforward: investors are risk-averse and prefer to secure their profits rather than risk potential losses in a future market downturn.

- Increased gold prices in previous months leading to selling pressure: The sustained rise in gold prices created an environment ripe for profit-taking.

- Investors securing profits after a period of growth: Many investors who bought gold at lower prices saw an opportunity to realize significant gains.

- Hedge funds and large institutional investors reducing their gold holdings: These large players often contribute significantly to market movements, and their selling activity amplified the downward pressure on the gold price.

Understanding the mechanics of profit-taking is essential for navigating the gold market successfully. The influx of gold into the market from profit-taking significantly impacts the supply-demand balance, leading to price corrections.

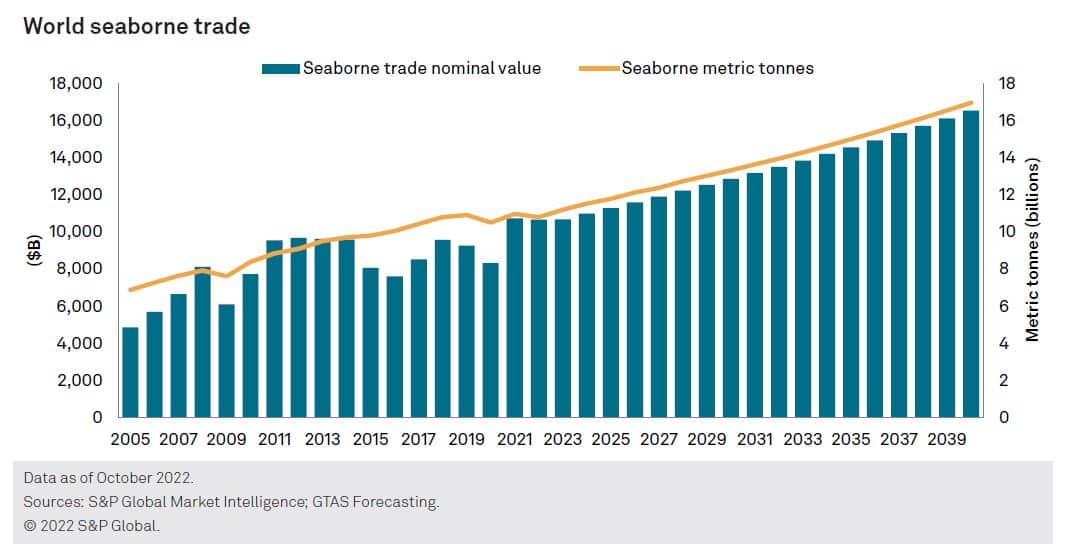

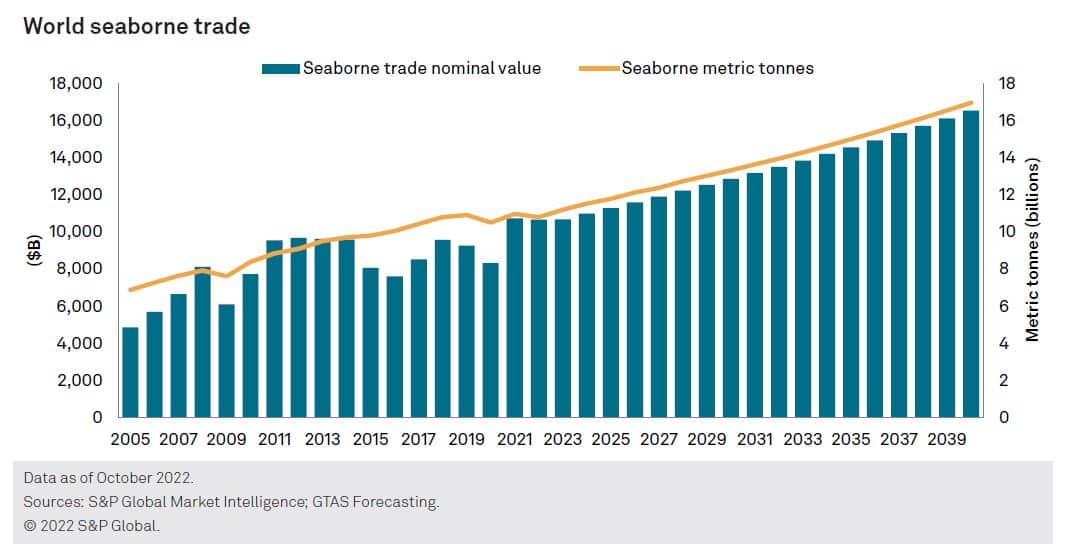

The Influence of a Positive Trade Outlook on Gold Prices

Gold is often considered a safe-haven asset. This means that during times of economic uncertainty, investors flock to gold as a store of value. Conversely, a positive trade outlook generally leads to a decreased demand for gold. Recent improvements in global trade relations have boosted investor confidence and reduced uncertainty, leading to a less risk-averse market sentiment. This positive shift has diminished the appeal of gold as a safe-haven asset, contributing to the price decrease.

- Easing trade tensions between major economies: Reduced trade disputes between major economic powers have increased investor optimism.

- Increased global economic growth forecasts: Positive economic projections reduce the need for investors to seek refuge in safe-haven assets like gold.

- Reduced demand for safe-haven assets like gold: As investor confidence rises, the demand for gold, a traditional safe-haven asset, falls.

The interplay between global trade and the gold price is a complex but crucial relationship for investors to understand when analyzing gold investment strategies.

Other Factors Contributing to the Gold Price Decrease

While profit-taking and a positive trade outlook are the primary drivers, other factors have also influenced the recent gold price decrease. Changes in interest rates, the strength of the US dollar, and inflation expectations all play a role.

- Impact of rising interest rates on gold's attractiveness: Higher interest rates often make gold less attractive, as it doesn't generate interest income.

- The correlation between the US dollar and gold prices: A strong US dollar typically puts downward pressure on gold prices, as gold is priced in US dollars.

- Effect of inflation expectations on investment decisions: While gold is sometimes seen as a hedge against inflation, the current environment might be reducing that perceived benefit, affecting investment decisions.

Conclusion

The recent decrease in the gold price is a multifaceted event primarily driven by profit-taking in the gold market and a more positive global trade outlook. Other factors, such as interest rate changes and the US dollar's strength, have also played a role. Understanding these market dynamics is vital for making informed investment decisions. To successfully navigate the gold market, it's essential to monitor gold price movements, track the gold market closely, and understand gold market dynamics. Analyze gold investment strategies in light of these factors to make well-informed choices. Stay updated on the latest news and analyses to effectively manage your gold investments.

Featured Posts

-

Trump Weighs Indias Offer To Reduce Tariffs On Us Goods

May 18, 2025

Trump Weighs Indias Offer To Reduce Tariffs On Us Goods

May 18, 2025 -

Taylor Swift And Trump The Unexpected Fallout And Maga Response

May 18, 2025

Taylor Swift And Trump The Unexpected Fallout And Maga Response

May 18, 2025 -

Maneskins Jimmy Kimmel Live Performance A Radio 94 5 Recap

May 18, 2025

Maneskins Jimmy Kimmel Live Performance A Radio 94 5 Recap

May 18, 2025 -

Audio Sf Presents Spencer Brown Friday May 2nd 2025

May 18, 2025

Audio Sf Presents Spencer Brown Friday May 2nd 2025

May 18, 2025 -

Conquering The Five Boro Bike Tour Training Gear And Strategies

May 18, 2025

Conquering The Five Boro Bike Tour Training Gear And Strategies

May 18, 2025

Latest Posts

-

Prezydenckie Sondaze Onetu Co Mowia Najnowsze Badania

May 18, 2025

Prezydenckie Sondaze Onetu Co Mowia Najnowsze Badania

May 18, 2025 -

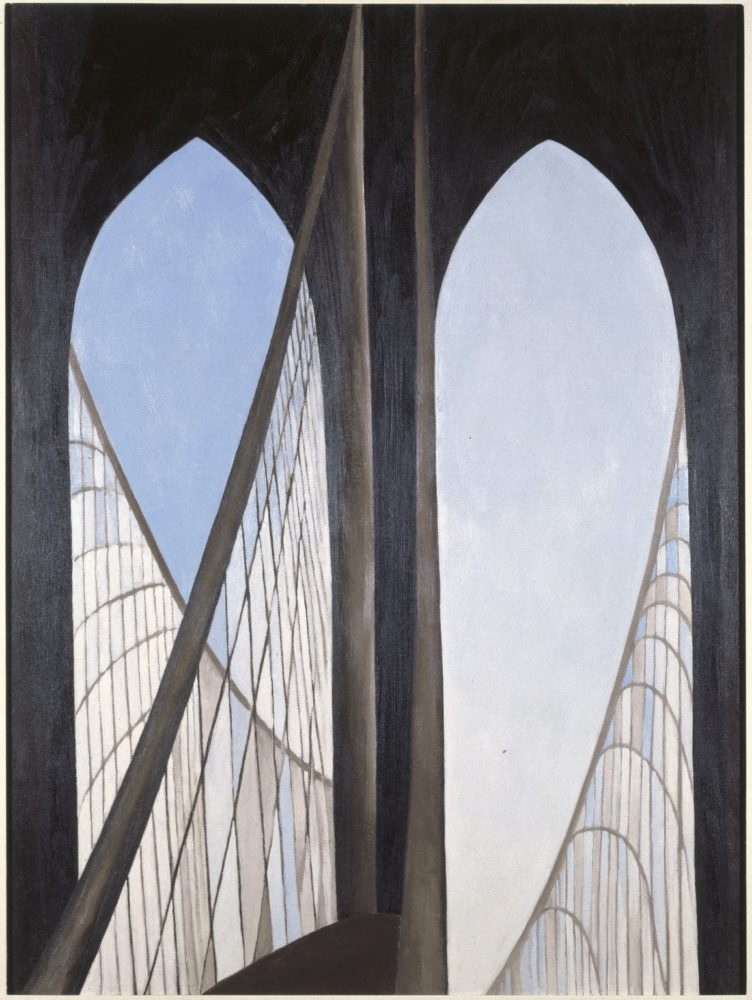

Understanding The Brooklyn Bridge Through Barbara Menschs Narrative

May 18, 2025

Understanding The Brooklyn Bridge Through Barbara Menschs Narrative

May 18, 2025 -

Subskrybuj Podcast Onetu I Newsweeka Aktualnosci Dwa Razy W Tygodniu

May 18, 2025

Subskrybuj Podcast Onetu I Newsweeka Aktualnosci Dwa Razy W Tygodniu

May 18, 2025 -

Onetu I Newsweek Podcast Codzienna Dawka Informacji

May 18, 2025

Onetu I Newsweek Podcast Codzienna Dawka Informacji

May 18, 2025 -

100 And

May 18, 2025

100 And

May 18, 2025