Gold Price Dips: First Consecutive Weekly Losses Of 2025

Table of Contents

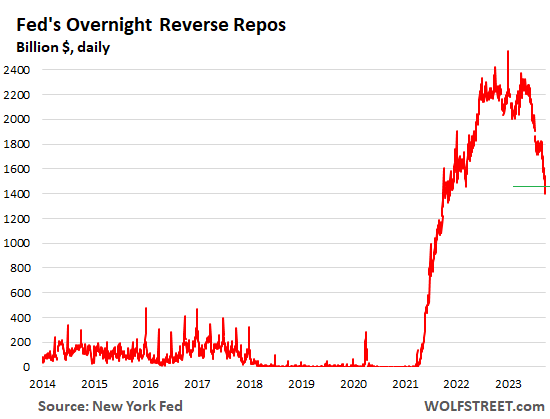

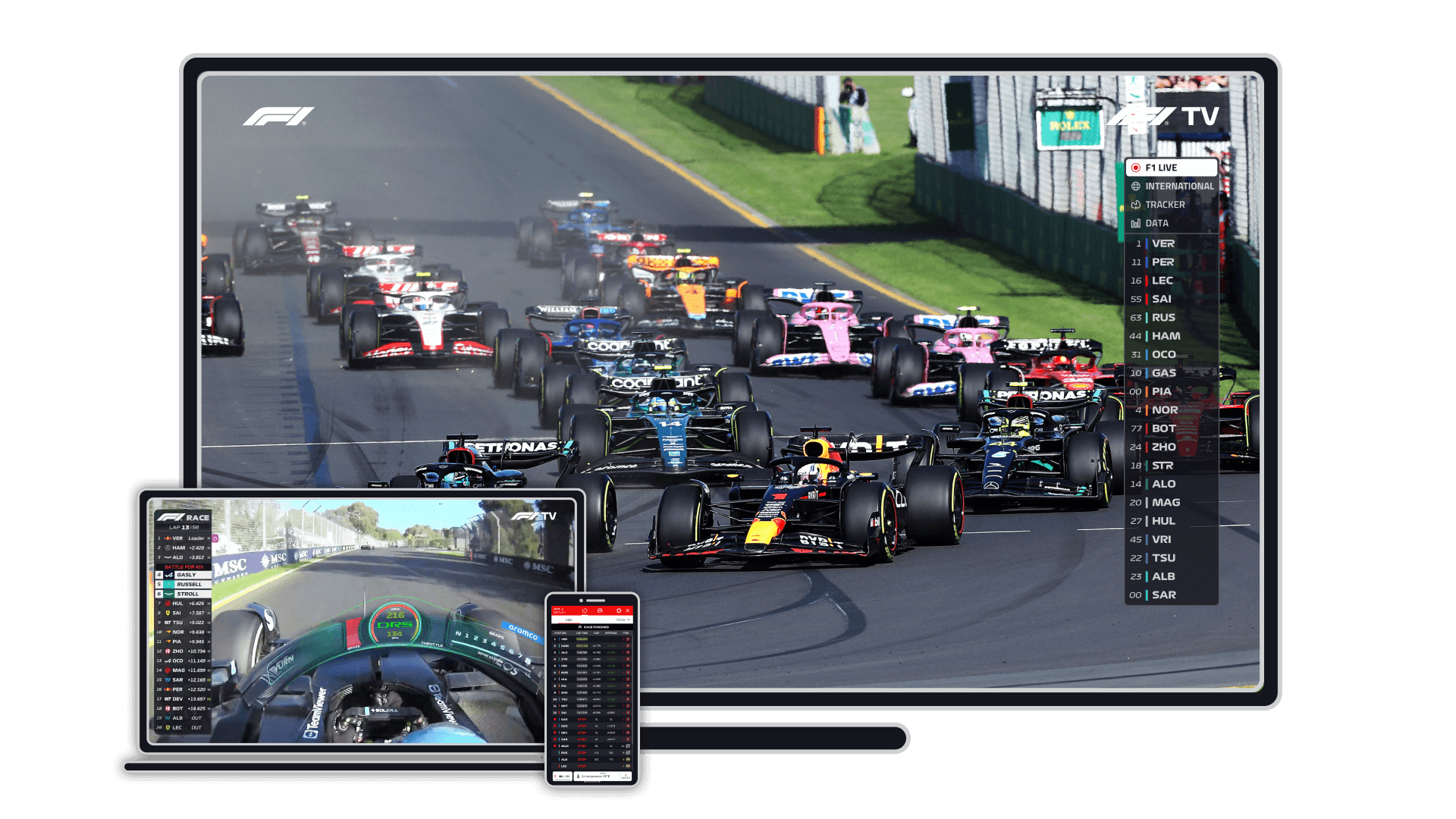

The Impact of Rising Interest Rates on Gold Prices

The inverse relationship between interest rates and gold prices is well-established. As interest rates rise, the opportunity cost of holding non-yielding assets like gold increases. This is because higher rates make bonds and other interest-bearing investments more attractive, diverting investment capital away from gold. The Federal Reserve's recent monetary policy tightening, marked by several interest rate hikes throughout late 2024 and early 2025, has significantly influenced this trend.

- Higher interest rates make bonds more attractive, diverting investment from gold. Investors seeking returns find government bonds increasingly appealing compared to the non-interest-bearing gold.

- Increased borrowing costs impact businesses, potentially reducing gold demand. Higher interest rates curb business investment and expansion, leading to decreased demand for industrial gold applications.

- Stronger dollar often accompanies rising interest rates, putting downward pressure on gold (priced in USD). A stronger dollar makes gold more expensive for holders of other currencies, impacting global demand. Specific interest rate hikes of 0.25% in January and February 2025, for example, correlated directly with observed drops in the gold price.

Geopolitical Factors and their Influence on Gold's Performance

Geopolitical uncertainty typically drives investors towards safe-haven assets like gold. However, the current gold price dip suggests a more nuanced situation. While some geopolitical tensions persist, recent developments have, surprisingly, not fueled a surge in gold demand.

- Unexpected de-escalation of conflicts can reduce safe-haven demand for gold. A perceived decrease in global risk can lessen the appeal of gold as a safe haven.

- Positive economic news from key regions might decrease gold's appeal. Stronger-than-expected economic data from major economies can shift investor sentiment towards riskier, higher-return assets.

- Changes in international relations can impact investor confidence. Improved diplomatic relations between nations, for example, can lead to a reduction in perceived geopolitical risk, thus decreasing the demand for gold. The unexpected easing of tensions in the [mention a specific geopolitical area] region in early 2025 is a case in point.

Technical Analysis: Chart Patterns and Trading Signals

Technical analysis provides valuable insights into price trends. Examination of recent gold price charts reveals significant downward pressure.

- Mention specific technical indicators pointing to the recent decline (e.g., moving averages, RSI). The 50-day moving average crossed below the 200-day moving average, a bearish signal indicating a potential sustained downturn. The Relative Strength Index (RSI) also dropped below 30, signaling oversold conditions but not necessarily a guaranteed price reversal.

- Discuss potential breakout levels or reversal patterns. Support levels around [mention specific price points] have been tested, with the potential for further price drops if these levels are broken. Reversal patterns like head and shoulders or double bottoms could signal a potential upturn, but further confirmation is needed.

- Explain the implications of these patterns for short-term and long-term gold price predictions. Short-term forecasts suggest continued volatility with a downside bias, while long-term predictions remain uncertain and depend on the interplay of macroeconomic factors.

The State of Gold Investment and Demand in 2025

The current gold price dip impacts various aspects of gold investment and demand. Let's look at the trends:

- Are investors reducing their gold holdings? Recent data suggests a decrease in gold ETF holdings, indicating some investors are taking profits or shifting their portfolios.

- What is the current outlook for physical gold demand? While physical gold demand for jewelry remains relatively stable in some regions, overall demand has softened reflecting the price movements.

- How are central banks reacting to the gold price dip? Some central banks are likely taking advantage of the lower prices to increase their gold reserves, while others may maintain a wait-and-see approach.

Conclusion: Navigating the Shifting Sands of the Gold Market

The consecutive weekly gold price losses in 2025 are attributable to a confluence of factors: rising interest rates reducing gold's attractiveness, a less volatile geopolitical landscape reducing safe-haven demand, and technical indicators signaling bearish sentiment. This unexpected dip underscores the dynamic nature of the gold market and highlights the importance of staying informed. While the future direction of gold prices remains uncertain, understanding these influential elements is critical for informed investment decisions. Stay updated on the latest gold price movements to make informed decisions about your gold investments in 2025 and consult with a financial advisor for personalized guidance. Don't miss out – continue monitoring gold price trends to optimize your precious metals portfolio.

Featured Posts

-

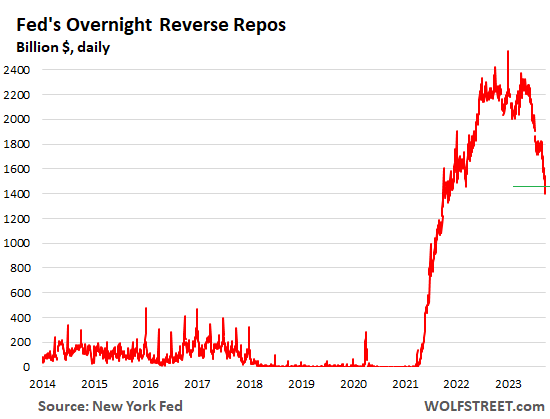

Mothers Role Questioned In 16 Year Olds Torture Murder Case

May 05, 2025

Mothers Role Questioned In 16 Year Olds Torture Murder Case

May 05, 2025 -

All Caps 2025 Capitals Playoff Strategy And Vanda Pharmaceuticals Inc Collaboration

May 05, 2025

All Caps 2025 Capitals Playoff Strategy And Vanda Pharmaceuticals Inc Collaboration

May 05, 2025 -

Grand Theft Auto Vi Key Details From The Official Trailer Revisited

May 05, 2025

Grand Theft Auto Vi Key Details From The Official Trailer Revisited

May 05, 2025 -

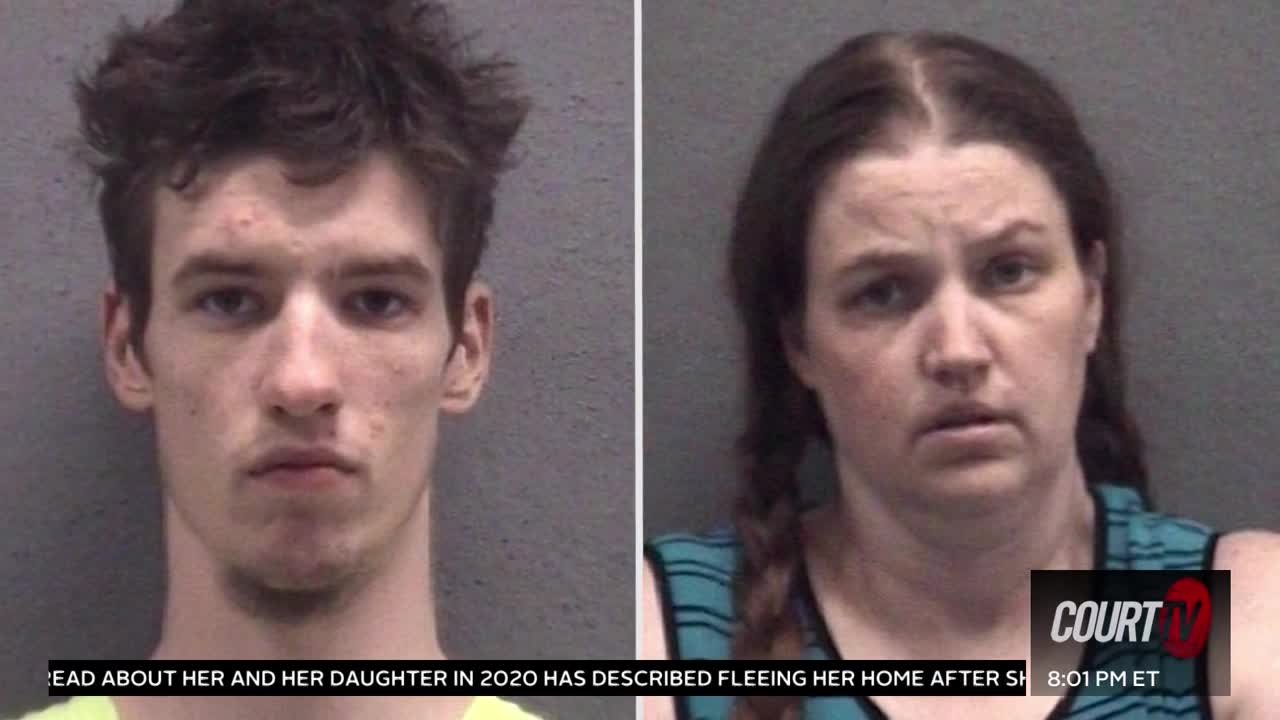

Indy Car On Fox A New Era Of Racing

May 05, 2025

Indy Car On Fox A New Era Of Racing

May 05, 2025 -

Analyst Chris Fallica Slams Trumps Putin Policy

May 05, 2025

Analyst Chris Fallica Slams Trumps Putin Policy

May 05, 2025

Latest Posts

-

Cult Members Jailed In Disturbing Child Death Case

May 05, 2025

Cult Members Jailed In Disturbing Child Death Case

May 05, 2025 -

Joint Forces Bring Depraved Paedophile To Justice

May 05, 2025

Joint Forces Bring Depraved Paedophile To Justice

May 05, 2025 -

Cops Cage Depraved Child Sex Offender Following Extensive Investigation

May 05, 2025

Cops Cage Depraved Child Sex Offender Following Extensive Investigation

May 05, 2025 -

Woman Dead In Raiwaqa House Fire

May 05, 2025

Woman Dead In Raiwaqa House Fire

May 05, 2025 -

Chicago Med Brian Tees Return In Season 10 Episode 14

May 05, 2025

Chicago Med Brian Tees Return In Season 10 Episode 14

May 05, 2025