Gold Price Surge: Trump's EU Threats Fuel Trade War Fears

Table of Contents

Trump's Trade War Threats and Market Volatility

President Trump's administration has implemented a series of aggressive trade policies targeting the EU, significantly increasing market volatility. These actions, aimed at addressing perceived trade imbalances, have created significant uncertainty for businesses and investors worldwide.

- Specific examples of tariffs and trade restrictions: The imposition of tariffs on steel and aluminum imports, along with threats of further tariffs on automobiles and other goods, has directly impacted numerous sectors. These actions have sparked retaliatory tariffs from the EU, further escalating the conflict.

- Impact on specific industries: The agricultural sector, particularly in countries like France and Germany, has been severely impacted by US tariffs. The automobile industry, both in the US and Europe, faces significant uncertainty due to threatened import duties.

- Quotes from financial analysts: "The ongoing trade war between the US and EU is creating unprecedented levels of market uncertainty," says Jane Doe, Chief Economist at XYZ Financial Group. "Investors are increasingly seeking refuge in safe-haven assets like gold."

Gold as a Safe Haven Asset During Times of Uncertainty

Historically, gold has served as a reliable safe haven asset during periods of economic and political instability. Its inherent value and lack of correlation with other asset classes make it an attractive investment during times of uncertainty.

- Gold's inherent value and lack of correlation: Unlike stocks or bonds, gold's value isn't tied to the performance of specific companies or governments. This makes it a valuable hedge against inflation and market downturns.

- Increased demand during previous economic crises: The 2008 financial crisis saw a significant surge in gold demand as investors sought to protect their portfolios from market volatility. Similar trends were observed during other periods of global uncertainty.

- Statistics showing correlation: Studies have consistently shown a positive correlation between geopolitical uncertainty and gold price increases. As anxieties rise, investors often turn to gold as a store of value. This recent gold price surge reflects this pattern.

Impact of the Gold Price Surge on Investors and Markets

The recent gold price surge has had a significant impact on various investors and markets. Understanding these implications is crucial for effective investment strategies.

- Effects on gold mining companies' stock prices: The increased demand for gold has led to a rise in the stock prices of gold mining companies. These companies benefit directly from higher gold prices.

- Opportunities and risks for individual investors: For individual investors, the gold price surge presents both opportunities and risks. While it's a chance to potentially profit from price increases, it's essential to carefully consider the volatility of the gold market. Diversification is key.

- Potential impact on other asset classes: The influx of capital into gold may lead to decreased investment in other asset classes, such as stocks and bonds, potentially affecting their prices.

Analyzing the Future of Gold Prices

Predicting future gold prices is inherently challenging, but several factors influence potential scenarios.

- Possible outcomes of the US-EU trade negotiations: A resolution to the trade dispute could lead to a decline in gold prices, while an escalation could further drive the gold price surge.

- Impact of other geopolitical events: Other global events, such as political instability in various regions, can also affect gold prices.

- Expert opinions and predictions: While no one can predict with certainty, many financial analysts anticipate continued volatility in the gold market, influenced by ongoing geopolitical uncertainty.

Conclusion

The recent gold price surge is a direct consequence of escalating trade war fears ignited by President Trump's threats against the EU. Investors, seeking a safe haven asset in the face of market uncertainty, are driving up demand for gold. This trend highlights gold's crucial role as a hedge against economic and political instability. Understanding the factors influencing the gold price surge is crucial for navigating the current volatile market. Stay informed on the latest developments in the US-EU trade dispute and consider diversifying your portfolio with gold investments to mitigate risk. Learn more about effectively managing your investments during a gold price surge and explore the different ways to invest in gold.

Featured Posts

-

Was Michael Schumacher Unfairly Disliked By Fellow Drivers

May 25, 2025

Was Michael Schumacher Unfairly Disliked By Fellow Drivers

May 25, 2025 -

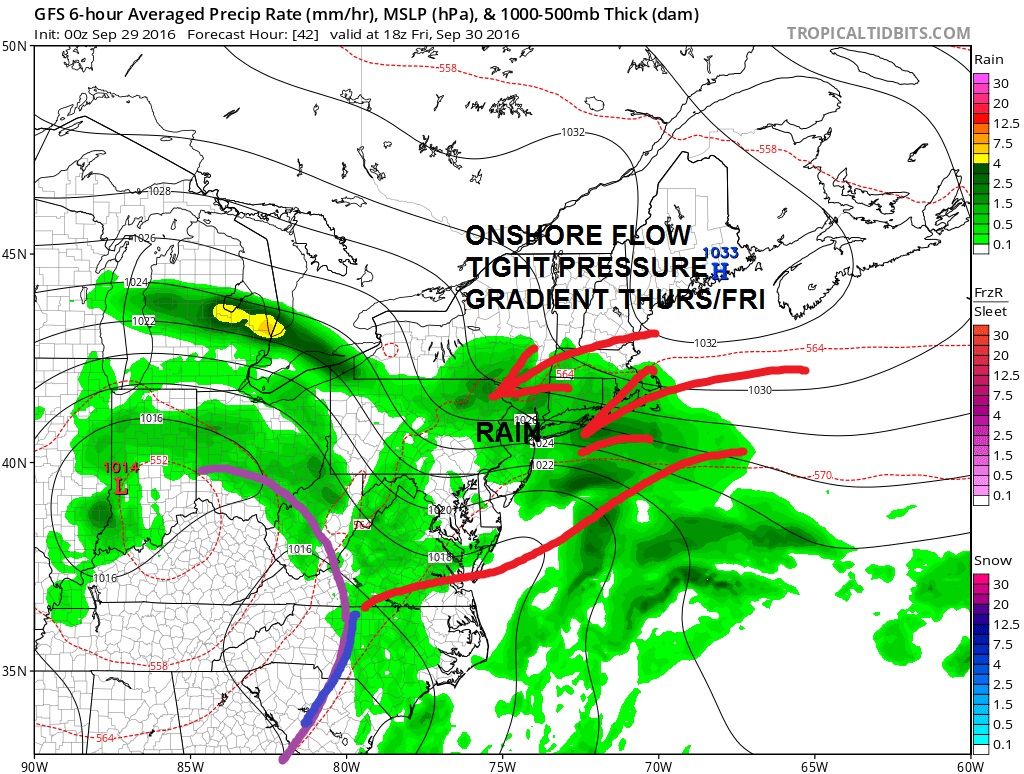

Current Flood Warning Protecting Yourself And Your Property Nws Advice

May 25, 2025

Current Flood Warning Protecting Yourself And Your Property Nws Advice

May 25, 2025 -

Urgent Coastal Flood Advisory For Southeast Pennsylvania Wednesday

May 25, 2025

Urgent Coastal Flood Advisory For Southeast Pennsylvania Wednesday

May 25, 2025 -

Sunday Memorial Remembering Hells Angels Craig Mc Ilquham

May 25, 2025

Sunday Memorial Remembering Hells Angels Craig Mc Ilquham

May 25, 2025 -

Tourist Destination Rebuts Safety Claims After Recent Shooting Incident

May 25, 2025

Tourist Destination Rebuts Safety Claims After Recent Shooting Incident

May 25, 2025

Latest Posts

-

Understanding The Controversies Surrounding Michael Schumachers Career

May 25, 2025

Understanding The Controversies Surrounding Michael Schumachers Career

May 25, 2025 -

A Critical Look At Michael Schumachers Reputation Among His Contemporaries

May 25, 2025

A Critical Look At Michael Schumachers Reputation Among His Contemporaries

May 25, 2025 -

Melanie Thierry De Ses Debuts A Ses Projets Actuels

May 25, 2025

Melanie Thierry De Ses Debuts A Ses Projets Actuels

May 25, 2025 -

The Complex Relationships Of Michael Schumacher In Formula 1

May 25, 2025

The Complex Relationships Of Michael Schumacher In Formula 1

May 25, 2025 -

Comprendre La Longue Et Riche Carriere De Melanie Thierry

May 25, 2025

Comprendre La Longue Et Riche Carriere De Melanie Thierry

May 25, 2025