Gold Slumps: Facing Back-to-Back Weekly Declines In 2025

Table of Contents

Macroeconomic Factors Driving the Gold Slump

Several significant macroeconomic factors contributed to the unexpected gold price decline and the resulting gold slumps. These factors interacted to create a perfect storm that pressured gold prices downwards.

Rising Interest Rates and their Impact on Gold Prices

Gold, unlike interest-bearing assets, does not generate income. Therefore, rising interest rates create an increased opportunity cost of holding gold. When interest rates rise, investors are incentivized to shift their investments towards higher-yielding assets like bonds and treasury bills.

- Increased opportunity cost of holding non-yielding assets like gold: Higher interest rates make it more attractive to invest in instruments offering returns, reducing the appeal of gold.

- Stronger dollar making gold more expensive for international buyers: A stronger US dollar, often correlated with rising interest rates, makes gold more expensive for those holding other currencies, dampening international demand.

- Impact of quantitative tightening policies: Central banks reducing their balance sheets (quantitative tightening) can lead to higher interest rates and a stronger dollar, further impacting gold prices.

Strengthening US Dollar and its Effect on Gold Demand

The US dollar's strength played a crucial role in the gold price decline. The dollar is considered a safe-haven asset itself, and its appreciation often comes at the expense of gold.

- Increased dollar strength impacting gold prices denominated in USD: As the dollar strengthens, the gold price (denominated in USD) falls, even if demand in other currencies remains stable.

- Impact on international gold investment due to currency fluctuations: Fluctuations in exchange rates impact the profitability of international gold investments, leading to reduced demand.

- Specific economic indicators that support dollar strength: Strong economic data from the US, indicating robust growth and a healthy economy, can bolster the dollar's value, negatively impacting gold.

Geopolitical Stability and its Influence on Gold's Safe-Haven Status

Gold often serves as a safe-haven asset during times of geopolitical uncertainty. However, periods of relative stability can lead to decreased demand for gold.

- Examples of reduced geopolitical tensions influencing gold prices: Reduced tensions in specific regions or improved international relations can diminish the perceived need for gold as a safe haven.

- Discussion of investor sentiment shifts towards riskier assets: With reduced geopolitical risk, investors may shift their focus towards higher-return, riskier assets.

- Impact of positive economic news on gold demand: Positive global economic news can also reduce investor anxiety, lowering the demand for safe-haven assets like gold.

Technical Analysis of the Gold Price Decline

Technical analysis provides further insight into the gold slumps of 2025. Examining chart patterns and trading volume helps understand the price movements.

Chart Patterns and Indicators Suggesting a Downturn

Technical indicators confirmed the downward trend during the gold price decline.

- Specific chart patterns observed during the gold slump (e.g., head and shoulders, bearish engulfing candles): These classic bearish patterns signaled a potential price reversal.

- Key technical indicators supporting the downward trend: Moving averages, Relative Strength Index (RSI), and other technical indicators all pointed towards a bearish trend.

- Mention support and resistance levels: Key support levels were broken, confirming the bearish momentum.

Trading Volume and Investor Sentiment

Trading volume and investor sentiment provided further evidence of the downward pressure on gold prices.

- Analysis of gold trading volumes during the slump: High trading volume during the decline indicated strong selling pressure.

- Indication of investor sentiment through market data (e.g., ETF flows): Outflows from gold ETFs demonstrated a shift in investor sentiment away from gold.

- Correlation between trading volume and price movement: High volume accompanying price declines confirmed the bearish momentum and the severity of the gold slumps.

Impact of Gold Slumps on Investors and the Market

The gold slumps of 2025 had significant implications for investors and the broader market.

Implications for Gold Investors and Portfolio Diversification

The price decline affected gold investors' portfolios, highlighting the importance of risk management.

- Strategies for mitigating losses during gold price declines: Diversification, stop-loss orders, and hedging strategies are essential for managing risk during gold price declines.

- Importance of diversification for managing risk: Diversifying investment portfolios across different asset classes is crucial to mitigate the impact of gold price volatility.

- Advice on rebalancing portfolios: Rebalancing portfolios to maintain the desired asset allocation can help manage risk and capitalize on market opportunities.

Wider Market Effects of the Gold Price Drop

The gold price drop had ripple effects on other markets and investor sentiment.

- Potential ripple effects on other precious metals and commodities: The decline in gold prices often impacts other precious metals like silver and platinum.

- Impact on inflation expectations: Lower gold prices can influence inflation expectations and central bank policies.

- Overall effect on market sentiment and investor confidence: The gold slumps contributed to a more cautious market sentiment and impacted overall investor confidence.

Conclusion: Navigating Future Gold Slumps and Market Volatility

The back-to-back weekly gold slumps of 2025 were driven by a confluence of macroeconomic factors, including rising interest rates, a strengthening US dollar, and reduced geopolitical uncertainty. Technical analysis reinforced the downward trend, while the impact on investors highlighted the importance of portfolio diversification. Understanding the factors that contribute to gold slumps is crucial for investors. Stay informed about gold market trends and consider professional financial advice to develop a robust investment strategy to navigate future market volatility and mitigate potential future "gold slumps."

Featured Posts

-

Ufc 314 Card Suffers Blow Highly Anticipated Fight Cancelled

May 04, 2025

Ufc 314 Card Suffers Blow Highly Anticipated Fight Cancelled

May 04, 2025 -

Transportation Department Announces May Workforce Reductions

May 04, 2025

Transportation Department Announces May Workforce Reductions

May 04, 2025 -

Hollywood Premiere Blake Lively And Anna Kendrick Address Feud Rumors

May 04, 2025

Hollywood Premiere Blake Lively And Anna Kendrick Address Feud Rumors

May 04, 2025 -

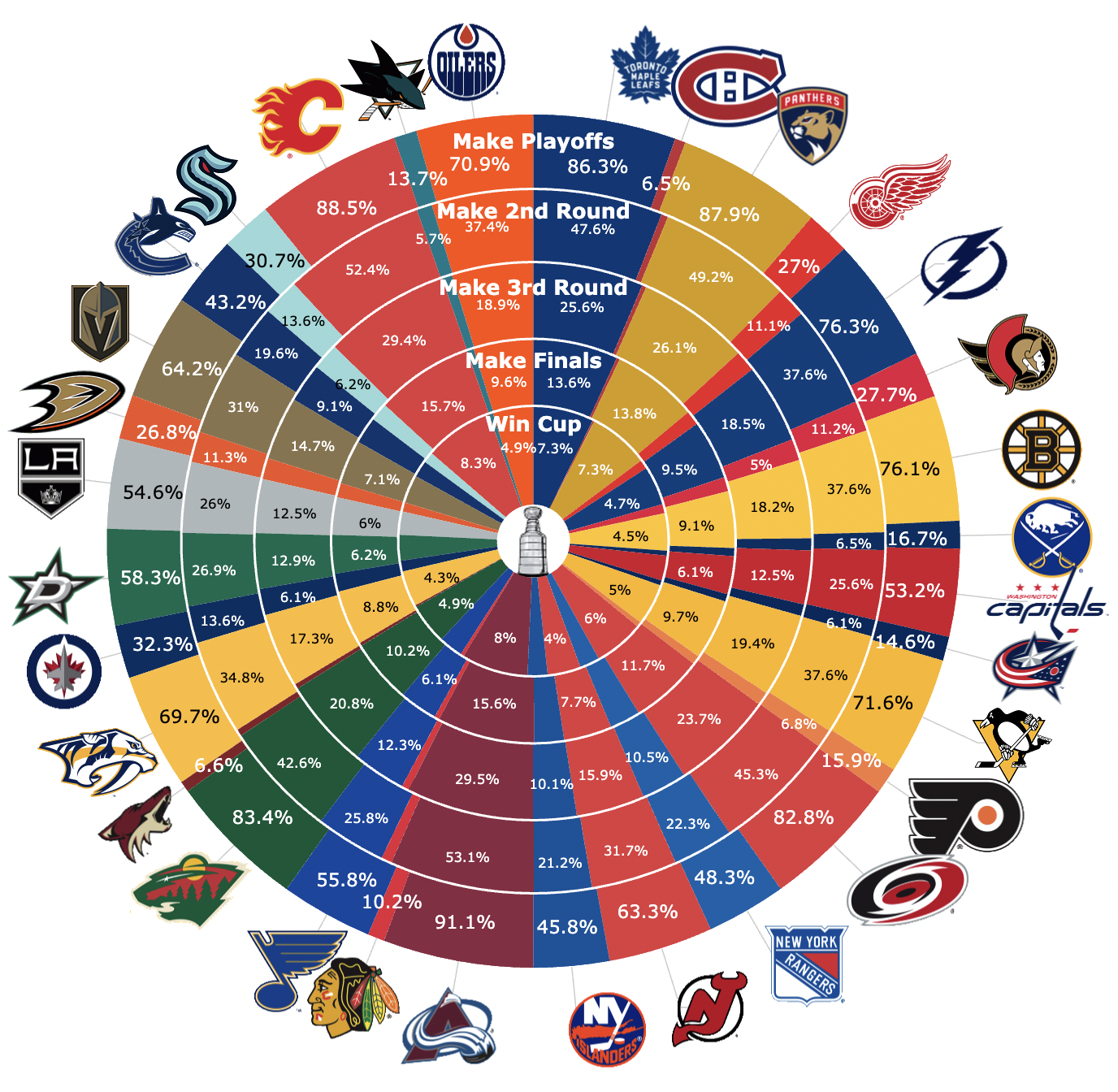

Nhl Playoffs 2024 Who Will Win The Stanley Cup

May 04, 2025

Nhl Playoffs 2024 Who Will Win The Stanley Cup

May 04, 2025 -

Kivinin Kabugu Yenir Mi Besin Degerleri Ve Tueketim Oenerileri

May 04, 2025

Kivinin Kabugu Yenir Mi Besin Degerleri Ve Tueketim Oenerileri

May 04, 2025

Latest Posts

-

Watch The Chicago Cubs Vs La Dodgers Mlb Tokyo Series Online A Streaming Guide

May 04, 2025

Watch The Chicago Cubs Vs La Dodgers Mlb Tokyo Series Online A Streaming Guide

May 04, 2025 -

Fox Bolsters Streaming Ambitions With Peter Distad Hire

May 04, 2025

Fox Bolsters Streaming Ambitions With Peter Distad Hire

May 04, 2025 -

Volkanovski Vs Lopes Ufc 314 Main Event Betting Odds And Expert Insights

May 04, 2025

Volkanovski Vs Lopes Ufc 314 Main Event Betting Odds And Expert Insights

May 04, 2025 -

No Cable No Problem How To Stream Fox Shows And Sports

May 04, 2025

No Cable No Problem How To Stream Fox Shows And Sports

May 04, 2025 -

Foxs Direct To Consumer Streaming Strategy Peter Distads Appointment

May 04, 2025

Foxs Direct To Consumer Streaming Strategy Peter Distads Appointment

May 04, 2025