Goldman Sachs Analyzes Trump's Social Media For Clues On Oil Price Outlook

Table of Contents

Goldman Sachs's Methodology: Unpacking the Social Media Analysis

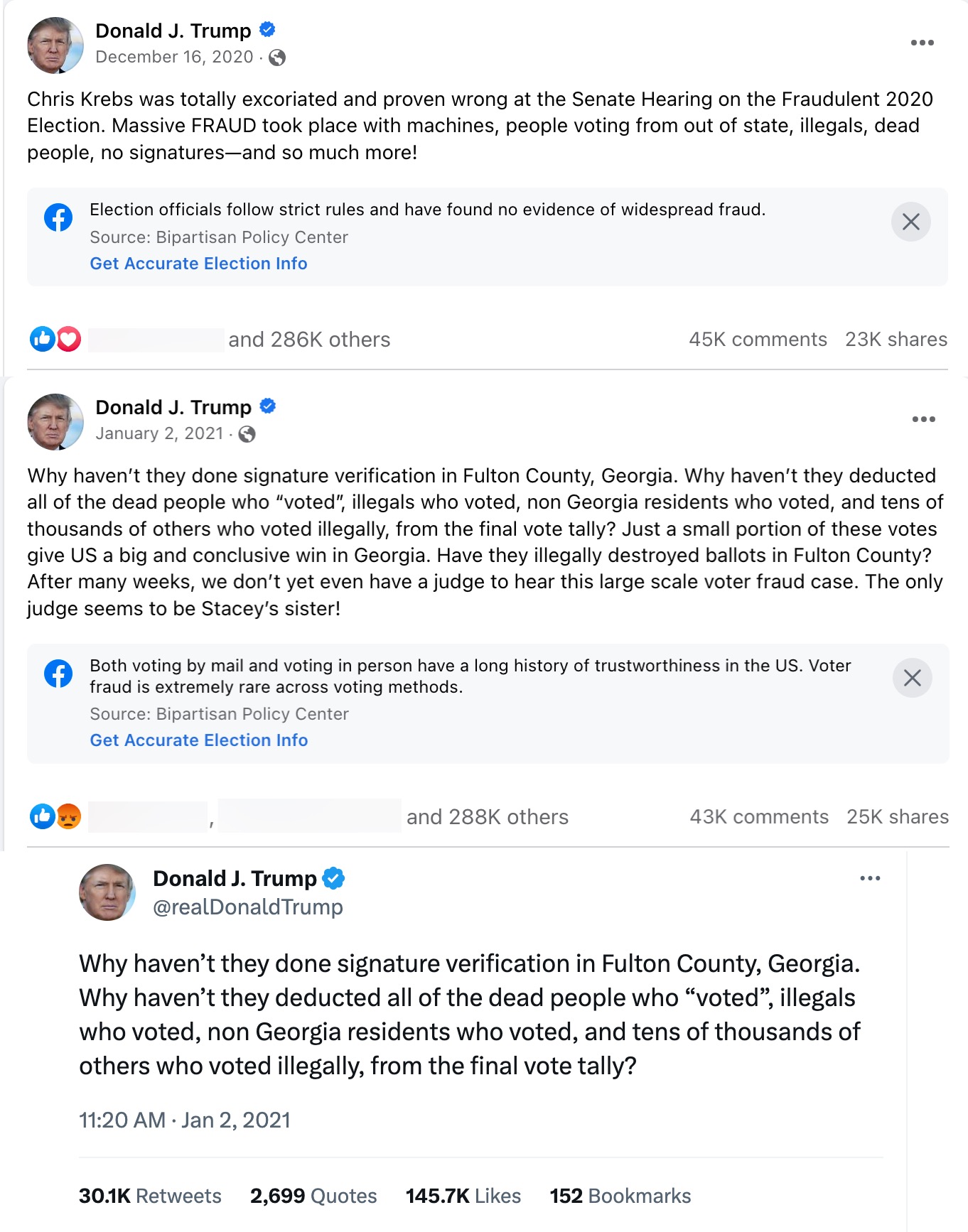

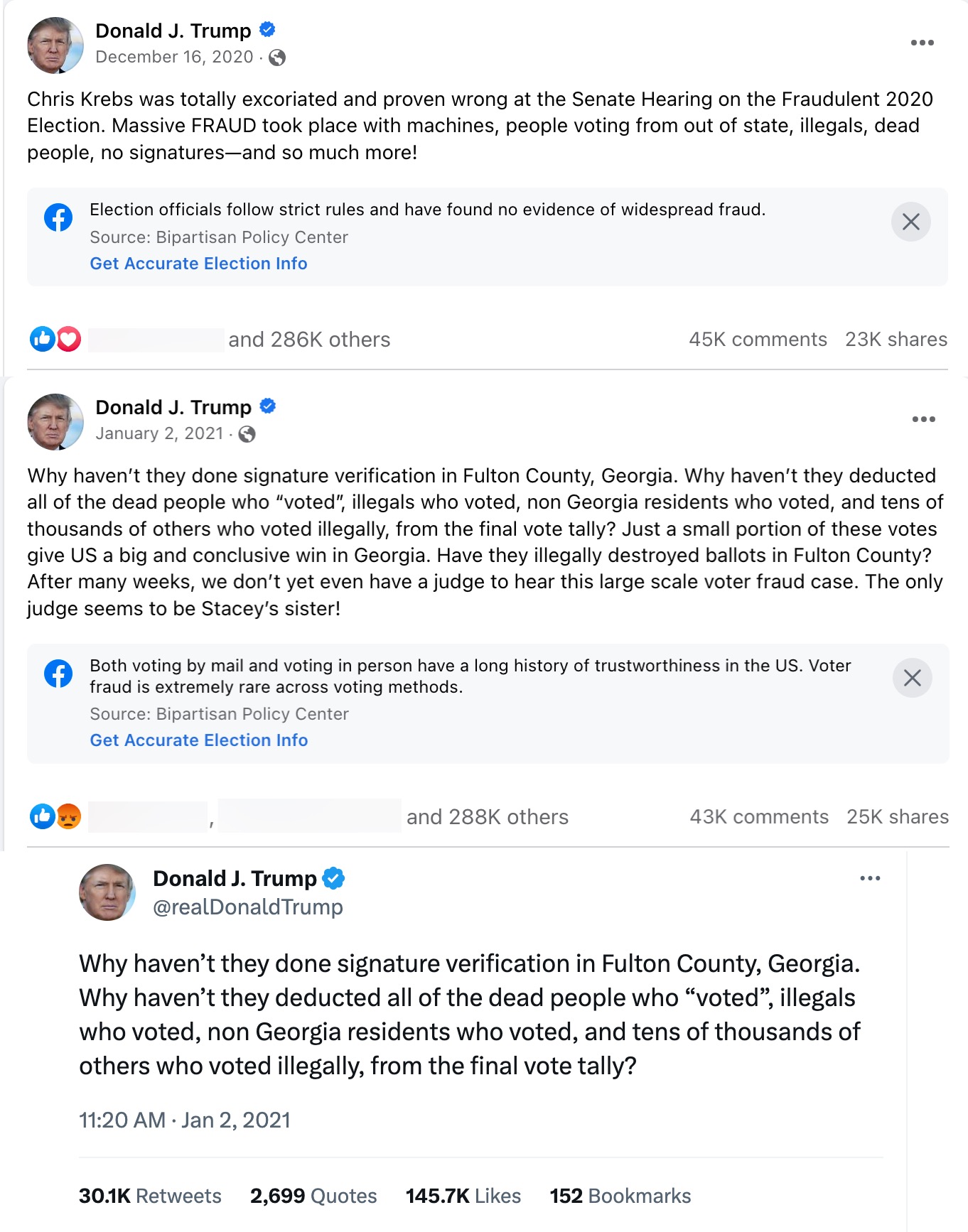

Goldman Sachs's rationale for using Trump's social media presence as a data source stems from the former President's significant influence on energy policy and international relations—both key drivers of oil price fluctuations. The reasoning is that his pronouncements on these matters, even if seemingly offhand, could impact market sentiment and subsequently, oil prices.

The analysis encompassed various platforms, including Twitter and Truth Social, known for Trump's frequent and often impactful messaging. Goldman Sachs employed sophisticated quantitative methods, including natural language processing (NLP) and sentiment analysis, to sift through vast quantities of text data. These techniques were likely combined with proprietary algorithms and statistical models designed to identify correlations between Trump's statements and subsequent oil price movements.

- Specific Examples: Goldman Sachs likely examined instances where Trump commented on OPEC policies, sanctions on specific oil-producing nations, or even his general opinions on the energy sector. A positive sentiment expressed towards a particular policy might have been correlated with rising oil prices, for instance. Conversely, negative commentary or criticism could have been associated with price drops.

- Limitations: The methodology is not without its limitations. Interpreting social media sentiment can be subjective, and the sheer volume of data introduces the possibility of noise and spurious correlations. The analysis likely needed careful consideration to distinguish between genuine market-moving statements and mere rhetorical flourishes.

Key Findings and Interpretations: What did Goldman Sachs Discover?

While the specific details of Goldman Sachs's internal report remain confidential, we can speculate on potential findings. The analysis may have revealed statistically significant correlations between specific types of Trump's social media activity and subsequent oil price movements. For example, a surge in negative sentiment surrounding international relations, potentially expressed in tweets, might have coincided with a period of oil price volatility or decline.

- Significant Correlations: The findings might have identified specific keywords, phrases, or even emotional tones consistently preceding particular price shifts.

- Attributing Price Movements: It’s crucial to understand that correlation does not equal causation. Any identified links would need careful interpretation to avoid assuming direct causality. External factors also heavily influence oil prices.

- Caveats and Limitations: Goldman Sachs undoubtedly acknowledged limitations in their report, emphasizing that social media analysis should be considered alongside more traditional forecasting methods. Other geopolitical factors and market forces were undoubtedly also at play.

Implications for the Oil Market: The Broader Context

Goldman Sachs's unconventional approach to oil price prediction holds significant implications for the oil market and finance in general. It highlights the growing importance of alternative data sources in market forecasting. The ability to quantitatively analyze social media sentiment could fundamentally change how investors and analysts assess market risk and opportunities.

- Impact on Oil Price Volatility: The ability to anticipate market reactions to specific political pronouncements could help in mitigating risk associated with unexpected price swings.

- Potential Changes to Investment Strategies: Investors might adjust their strategies based on social media sentiment analysis, potentially leading to more informed trading decisions.

- Ethical Concerns and Potential Biases: Using social media data for financial prediction raises ethical questions regarding data privacy and potential algorithmic biases. Transparency and careful consideration of these issues are paramount. The potential for manipulation of social media sentiment to influence markets also needs consideration.

Conclusion: Goldman Sachs and the Future of Oil Price Prediction via Social Media

Goldman Sachs's foray into using social media analysis, specifically focusing on Trump's posts, to predict oil prices represents a pioneering effort in applying unconventional data sources to financial forecasting. While the specifics remain undisclosed, the implications are far-reaching. The study highlighted the potential for leveraging social media sentiment analysis, but also underscored the need for careful interpretation and acknowledgement of inherent limitations.

The increasing availability of big data and advancements in quantitative methods like NLP make it clear that unconventional data analysis is here to stay. Exploring this new frontier offers exciting possibilities for refining oil price forecasting and enhancing predictive models across other commodities and markets. We encourage readers to delve deeper into this emerging field; explore Goldman Sachs's reports (when publicly available) and other research on predicting oil prices using social media sentiment analysis. The future of oil price forecasting may well lie in harnessing the power of social media analytics, although careful consideration of ethical implications and limitations remain crucial for responsible application.

Featured Posts

-

Menendez Brothers Resentencing A Possibility Following Judges Decision

May 16, 2025

Menendez Brothers Resentencing A Possibility Following Judges Decision

May 16, 2025 -

May 8th Mlb Dfs Sleeper Picks Hitter To Avoid And Lineup Strategy

May 16, 2025

May 8th Mlb Dfs Sleeper Picks Hitter To Avoid And Lineup Strategy

May 16, 2025 -

Warriors Kings Game Draymond Greens Frank Remarks About Jimmy Butler

May 16, 2025

Warriors Kings Game Draymond Greens Frank Remarks About Jimmy Butler

May 16, 2025 -

Dominate Your Mlb Dfs Lineups On May 8th Expert Picks

May 16, 2025

Dominate Your Mlb Dfs Lineups On May 8th Expert Picks

May 16, 2025 -

Analyzing The Impact Of Jacob Wilson And Max Muncys Reunion On 2025 Opening Day

May 16, 2025

Analyzing The Impact Of Jacob Wilson And Max Muncys Reunion On 2025 Opening Day

May 16, 2025

Latest Posts

-

Bvg Mitarbeiter Drohen Mit Streik Die Situation Nach Gescheiterten Verhandlungen

May 16, 2025

Bvg Mitarbeiter Drohen Mit Streik Die Situation Nach Gescheiterten Verhandlungen

May 16, 2025 -

Bombay Hc Upholds Dial 108 Ambulance Contract In Mumbai

May 16, 2025

Bombay Hc Upholds Dial 108 Ambulance Contract In Mumbai

May 16, 2025 -

Mumbai News Bombay Hc Decision On Dial 108 Ambulance Contract

May 16, 2025

Mumbai News Bombay Hc Decision On Dial 108 Ambulance Contract

May 16, 2025 -

Bvg Streikgefahr Verhandlungen Nach Schlichtung Gescheitert

May 16, 2025

Bvg Streikgefahr Verhandlungen Nach Schlichtung Gescheitert

May 16, 2025 -

Pastrnak Och Kanadensiska Stjaernor Nyckeln Till Vm Framgang Foer Tjeckien Och Andra Lag

May 16, 2025

Pastrnak Och Kanadensiska Stjaernor Nyckeln Till Vm Framgang Foer Tjeckien Och Andra Lag

May 16, 2025