Goldman Sachs Deciphers Trump's Ideal Oil Price: $40-$50 Range

Table of Contents

Goldman Sachs' Rationale Behind the $40-$50 Oil Price Prediction

Goldman Sachs' prediction of an ideal $40-$50 oil price range under the Trump administration wasn't arbitrary. It stemmed from a complex interplay of economic factors meticulously considered by their analysts. Understanding these factors is crucial to grasping the significance of this price point.

-

US Shale Oil Production: The boom in US shale oil production significantly increased the global oil supply. Goldman Sachs factored in the continued, albeit potentially fluctuating, output from shale producers, influencing the overall supply-demand equilibrium. Increased production, even with price volatility, could help keep prices within the projected range.

-

Global Demand Projections and Economic Growth Forecasts: Global economic growth forecasts directly impact oil demand. Goldman Sachs' analysis likely incorporated projections for global GDP growth, anticipating the corresponding increase or decrease in energy consumption. A moderate growth scenario would align with their $40-$50 prediction, suggesting a balance between supply and consumption.

-

OPEC's Role and Potential Production Adjustments: The Organization of the Petroleum Exporting Countries (OPEC) plays a pivotal role in influencing global oil prices through production adjustments. Goldman Sachs' assessment likely incorporated predictions about OPEC's actions, considering their potential responses to market conditions and their own production targets. A stable OPEC production policy could support the $40-$50 range.

-

Geopolitical Factors Influencing Oil Prices: Geopolitical events, such as sanctions, conflicts, or political instability in oil-producing regions, can dramatically affect oil prices. Goldman Sachs would have incorporated geopolitical risk assessments into their model, considering potential disruptions to supply chains or market sentiment. A relatively stable geopolitical landscape would contribute to the predicted price range's feasibility.

While specific data from internal Goldman Sachs reports is often proprietary, publicly available analyses from the period support the general factors mentioned above as relevant considerations in oil price forecasting.

Implications of a $40-$50 Oil Price for the US Economy

A sustained $40-$50 oil price range would have had multifaceted implications for the US economy, bringing both positive and negative consequences.

-

Impact on Consumer Spending (Gas Prices): Lower oil prices translate to lower gasoline prices, boosting consumer purchasing power and potentially stimulating economic activity. This could lead to increased consumer spending in other sectors.

-

Effect on Energy Sector Profits and Investments: While beneficial for consumers, lower oil prices can squeeze profit margins for energy companies, impacting investment in exploration and production. This could lead to reduced job creation in the energy sector.

-

Influence on Inflation and Economic Growth: Lower oil prices generally exert a downward pressure on inflation, contributing to overall economic stability. This can support moderate economic growth, benefiting consumers and businesses alike.

-

Consequences for the US Trade Balance: Lower oil import costs can improve the US trade balance, reducing the deficit. This is because less money would flow out of the country to purchase oil.

The precise impact on specific sectors would depend on their exposure to oil price fluctuations and their ability to adapt to changing market conditions.

Comparing the Goldman Sachs Prediction to Other Analyses

It's essential to compare Goldman Sachs' prediction with other analyses to gain a comprehensive perspective on oil price forecasts. While specific numbers vary depending on the period, many analysts generally agree that the $40-$50 range represents a band of stability.

-

Other Major Investment Banks and Their Price Predictions: Other major investment banks, such as JP Morgan Chase and Morgan Stanley, also published their own oil price forecasts during the same period. While their exact predictions might have differed slightly, the general consensus reflected a sense of price stability.

-

Discrepancies and Reasons for Differences: Discrepancies in predictions arise from differing methodologies, assumptions about future economic growth, and variations in assessing geopolitical risks. These differences highlight the inherent uncertainty in the oil market.

-

Range of Predictions and Uncertainty: The range of predictions from different analysts reflects the inherent uncertainty in forecasting commodity prices. Unforeseen events, from natural disasters to unexpected policy changes, can significantly impact oil prices, making accurate long-term forecasts challenging.

[Insert links to reputable sources for supporting data and analyses here]

The Trump Administration's Energy Policy and its Influence

The Trump administration's energy policy likely played a role in Goldman Sachs' assessment. Policies promoting domestic energy production could have influenced their outlook on supply and price stability.

-

Impact of Deregulation on Shale Oil Production: Deregulation of the energy sector could encourage increased shale oil production, boosting domestic supply and potentially influencing prices downward.

-

Effects of Trade Policies on Energy Imports and Exports: Trade policies, such as tariffs or trade agreements, could influence energy imports and exports, impacting the overall supply and demand balance.

-

Role of the Administration in Influencing OPEC Decisions: While indirect, the Trump administration's diplomatic efforts and relationships with OPEC nations could potentially have influenced their production decisions, which in turn affect global oil prices.

Further research into specific policy measures and their documented impact on oil production levels would clarify the influence.

Conclusion

Goldman Sachs' assessment of an ideal $40-$50 oil price range under the Trump administration resulted from a careful consideration of various economic and geopolitical factors. This price range presented a complex scenario with both benefits and drawbacks for the US economy, influencing consumer spending, energy sector investments, inflation, and the trade balance. Comparing this prediction with other analyses reveals the inherent uncertainties in commodity price forecasting. The Trump administration's energy policies likely contributed to the model's assumptions about domestic supply and price stability.

Key Takeaways: Understanding Goldman Sachs' analysis highlights the sensitivity of the US and global economy to oil price fluctuations and the critical role of various factors in shaping these prices. The $40-$50 range, while representing a potential zone of stability, is just one perspective among many in the complex oil market.

Call to Action: Stay informed about oil price fluctuations and their broader impact. Conduct further research using terms like "Goldman Sachs oil price forecast," "Trump administration energy policy," or "ideal oil price for the US economy" to gain a deeper understanding of the dynamics driving this crucial commodity's price and its influence on our globalized world. Understanding these dynamics is paramount to navigating the complexities of the modern energy market and making informed decisions.

Featured Posts

-

Ledra Pal Carsamba Dijital Veri Tabani Ile Isguecue Piyasasi Rehberi

May 15, 2025

Ledra Pal Carsamba Dijital Veri Tabani Ile Isguecue Piyasasi Rehberi

May 15, 2025 -

Is A Week Long Everest Climb Using Anesthetic Gas Too Dangerous

May 15, 2025

Is A Week Long Everest Climb Using Anesthetic Gas Too Dangerous

May 15, 2025 -

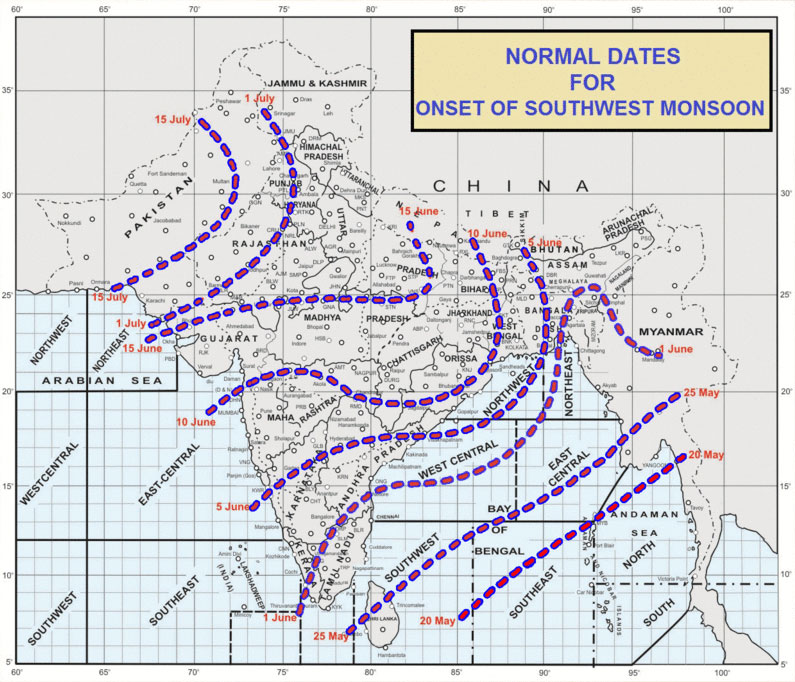

Monsoon Prediction Good News For Indian Farm Sector Growth And Consumption

May 15, 2025

Monsoon Prediction Good News For Indian Farm Sector Growth And Consumption

May 15, 2025 -

Leeflang Affaire Bruins Eist Spoedoverleg Met Npo

May 15, 2025

Leeflang Affaire Bruins Eist Spoedoverleg Met Npo

May 15, 2025 -

Miami Heat Playoffs Assessing Jimmy Butlers Need For Support

May 15, 2025

Miami Heat Playoffs Assessing Jimmy Butlers Need For Support

May 15, 2025

Latest Posts

-

San Diego Padres Release 2025 Regular Season Game Broadcast Schedule

May 15, 2025

San Diego Padres Release 2025 Regular Season Game Broadcast Schedule

May 15, 2025 -

Draymond Greens Honest Assessment Of Jimmy Butler Following Warriors Kings Game

May 15, 2025

Draymond Greens Honest Assessment Of Jimmy Butler Following Warriors Kings Game

May 15, 2025 -

The Warriors Need Jimmy Butler Not Another Kevin Durant

May 15, 2025

The Warriors Need Jimmy Butler Not Another Kevin Durant

May 15, 2025 -

Analysis Dwyane Wades Perspective On Jimmy Butler Leaving Miami Heat

May 15, 2025

Analysis Dwyane Wades Perspective On Jimmy Butler Leaving Miami Heat

May 15, 2025 -

Why Jimmy Butler Not Kevin Durant Is The Perfect Fit For The Golden State Warriors

May 15, 2025

Why Jimmy Butler Not Kevin Durant Is The Perfect Fit For The Golden State Warriors

May 15, 2025