GOP Tax Bill: Conservative Demands Could Sink The Legislation

Table of Contents

Conservative Concerns Regarding Tax Cuts for Corporations

The corporate tax provisions within the GOP Tax Bill are at the heart of many conservative concerns. Two primary issues are fueling the internal debate: insufficient corporate tax rate reduction and a perceived lack of focus on deregulation.

Insufficient Corporate Tax Rate Reduction

Conservatives argue that the proposed corporate tax rate reduction, while significant, isn't drastic enough to stimulate the desired economic growth. They advocate for a more aggressive approach, believing deeper cuts are essential.

- Demand for a lower rate: Many conservatives are pushing for a corporate tax rate substantially lower than the currently proposed figure. They point to international competitiveness as a major factor, arguing that a lower rate would attract foreign investment and boost job creation within the United States.

- Concerns about global competitiveness: The argument centers on the need for the US to remain competitive on the global stage. A lower corporate tax rate, they believe, is crucial for attracting businesses and preventing them from relocating to countries with lower tax burdens. This relates to the broader discussion on the economic impact of the GOP Tax Bill.

- Job creation as the primary goal: Conservatives emphasize the belief that significantly lower corporate taxes are a necessary catalyst for substantial job creation. They argue that businesses will reinvest the savings from reduced taxes, leading to expansion and increased employment opportunities.

Lack of Focus on Deregulation

Another significant concern among conservatives is the perceived lack of sufficient deregulation accompanying the proposed tax cuts. They argue that tax cuts alone are insufficient to foster economic growth and that significant deregulation is necessary to create a truly business-friendly environment.

- Reducing regulatory burdens: Conservatives are calling for a substantial reduction in regulatory burdens on businesses. They believe that excessive regulations stifle economic activity and hinder job growth. This is a key part of the broader debate surrounding the size and scope of government.

- Tax cuts and deregulation: a synergistic approach: The core argument emphasizes the synergistic relationship between tax cuts and deregulation. They maintain that both are necessary to unlock the full potential of the US economy. This position frequently appears in conservative economic policy discussions.

- Simplification of the tax code: Many conservatives believe that simplifying the tax code and reducing regulatory complexity will further boost economic growth. They argue that a less burdensome regulatory environment encourages investment and entrepreneurship.

Disagreements Over Individual Tax Provisions

Beyond corporate tax cuts, disagreements also exist regarding the individual tax provisions within the GOP Tax Bill. Two main areas of contention are the standard deduction and the elimination (or lack thereof) of certain tax deductions.

Concerns about the Standard Deduction

Some conservatives express concern that the proposed increase in the standard deduction is too generous. They fear it may reduce overall government revenue more than anticipated, undermining the fiscal goals of the bill.

- Targeted tax cuts: They advocate for a more targeted approach to tax cuts for individuals, focusing on specific groups or income levels rather than a blanket increase in the standard deduction. This reflects a wider debate on the fairness and effectiveness of various tax policies.

- Long-term fiscal implications: Concerns about the long-term fiscal implications are central to this argument. Conservatives emphasize the importance of fiscal responsibility and worry about the potential for increased national debt.

- Fiscally conservative approach: The overarching concern is to ensure the bill aligns with a fiscally conservative approach, prioritizing long-term sustainability over immediate, potentially unsustainable, tax reductions.

Elimination of Certain Tax Deductions

While the bill proposes the elimination of some tax deductions, conservatives argue that further cuts are needed to simplify the tax code and increase revenue.

- Closing tax loopholes: The focus here is on identifying and eliminating deductions that are perceived as loopholes, benefiting specific groups unfairly. This aligns with conservative efforts to promote fairness and efficiency within the tax system.

- Fairness and equity: Concerns about fairness and equity in the tax system are intertwined with the calls for eliminating more deductions. Conservatives argue that a simpler, more equitable tax system is essential for long-term economic health.

- A simpler tax code: The ultimate goal is a simpler, more efficient tax code that reduces complexity and promotes economic growth. This resonates with the broader conservative emphasis on reducing the size and scope of government.

Impact of Conservative Demands on the GOP Tax Bill's Fate

The internal disagreements within the Republican party regarding the GOP Tax Bill could have profound consequences. The potential for legislative gridlock and the implications for the Republican party's agenda are significant.

Potential for Legislative Gridlock

The internal divisions could lead to significant delays, amendments, and ultimately, the complete failure of the bill.

- Prolonged negotiations: Amendments and negotiations could significantly prolong the legislative process, potentially delaying or even preventing the bill’s passage before key deadlines.

- Weakening the bill: Compromises reached to appease dissenting factions could weaken the bill's effectiveness, undermining its intended economic impact.

- Abandonment of the bill: In a worst-case scenario, the internal disagreements could lead to the complete abandonment of the bill.

Implications for the Republican Party's Agenda

Failure to pass the GOP Tax Bill would be a substantial setback for the Republican party, damaging their credibility and potentially impacting their ability to advance their legislative agenda.

- Damage to the party's reputation: Failure to deliver on a key campaign promise would damage the party's reputation and could harm their electability in future elections.

- Loss of momentum: Failure on this major legislative initiative would likely impact the momentum on other Republican priorities.

- Increased political polarization: The internal divisions could further exacerbate political polarization and instability within the Republican party and the broader political landscape.

Conclusion

The GOP Tax Bill faces a critical juncture. Conservative demands for more aggressive tax cuts and deeper deregulation could ultimately sink the legislation, causing significant repercussions for the Republican party and the US economy. The internal divisions within the party highlight the complexities of enacting major tax reform. Understanding these conservative concerns and their potential consequences is crucial for following the ongoing developments of this crucial piece of legislation. Stay informed about the latest developments on the GOP Tax Bill, its potential amendments, and its impact on the economy. Follow the news closely to understand how this important legislation unfolds.

Featured Posts

-

Taran Killam On His Important Relationship With Amanda Bynes

May 18, 2025

Taran Killam On His Important Relationship With Amanda Bynes

May 18, 2025 -

Death Penalty Possible American Basketball Player Arrested In Indonesia On Drug Charges

May 18, 2025

Death Penalty Possible American Basketball Player Arrested In Indonesia On Drug Charges

May 18, 2025 -

Indonesia Drug Smuggling Case American Basketball Player Could Face Execution

May 18, 2025

Indonesia Drug Smuggling Case American Basketball Player Could Face Execution

May 18, 2025 -

New Orleans Jail Escape Video Surfaces On Cnn

May 18, 2025

New Orleans Jail Escape Video Surfaces On Cnn

May 18, 2025 -

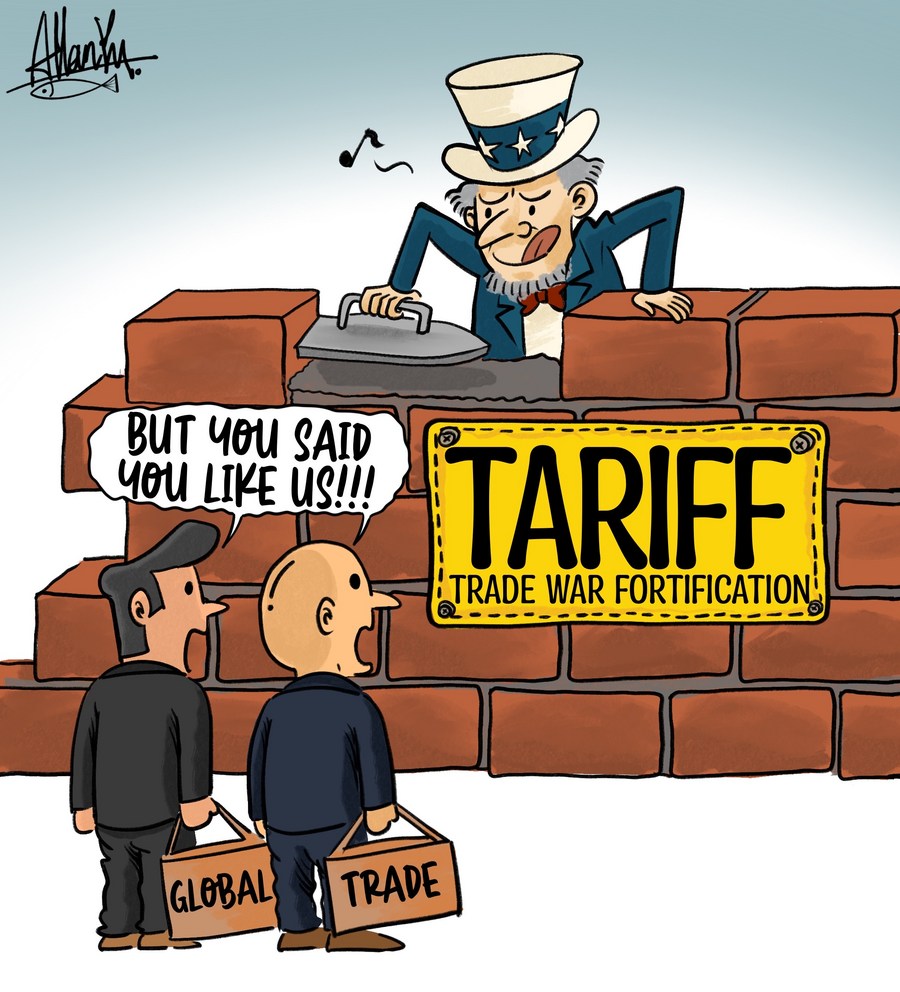

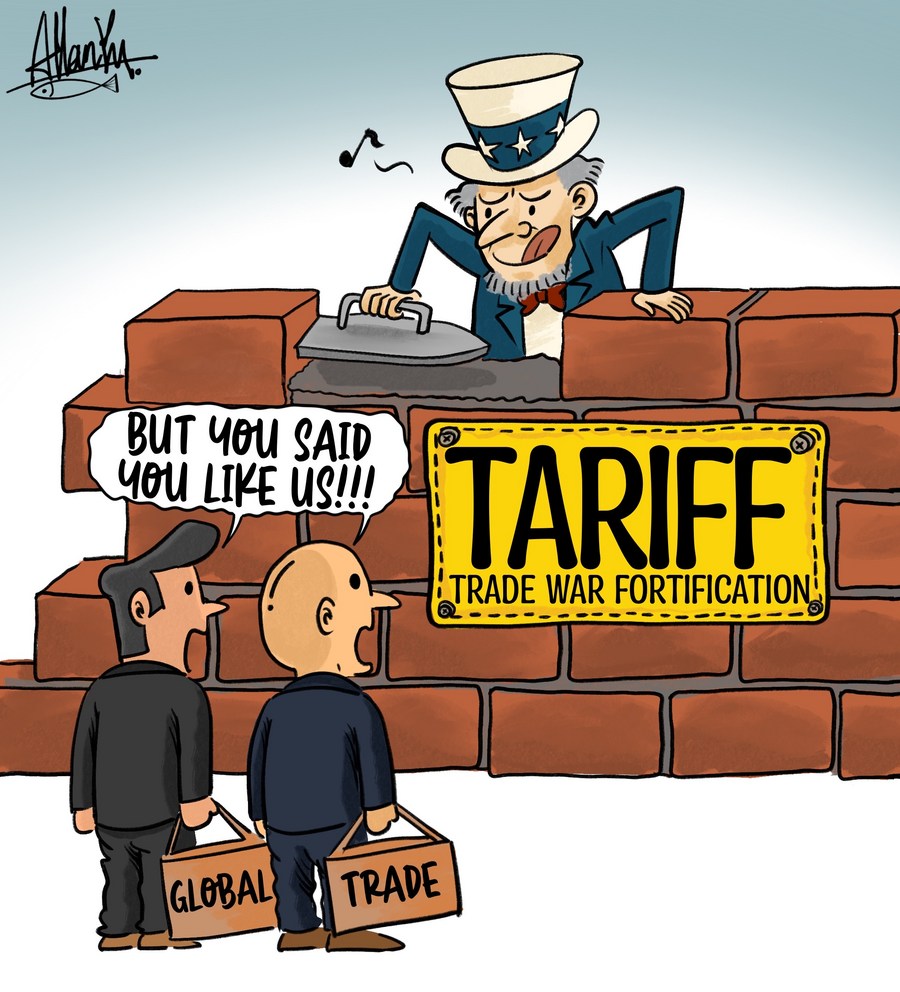

Southwest Washingtons Economic Future Navigating Tariff Uncertainty

May 18, 2025

Southwest Washingtons Economic Future Navigating Tariff Uncertainty

May 18, 2025

Latest Posts

-

Adapting To Change Southwest Washingtons Response To Tariffs

May 18, 2025

Adapting To Change Southwest Washingtons Response To Tariffs

May 18, 2025 -

Are Tariffs The New Normal Southwest Washingtons Economic Outlook

May 18, 2025

Are Tariffs The New Normal Southwest Washingtons Economic Outlook

May 18, 2025 -

Southwest Washingtons Economic Future Navigating Tariff Uncertainty

May 18, 2025

Southwest Washingtons Economic Future Navigating Tariff Uncertainty

May 18, 2025 -

The Impact Of Tariffs On Southwest Washingtons Economy

May 18, 2025

The Impact Of Tariffs On Southwest Washingtons Economy

May 18, 2025 -

A Study On The Economic Impact Of A Successful Rave

May 18, 2025

A Study On The Economic Impact Of A Successful Rave

May 18, 2025