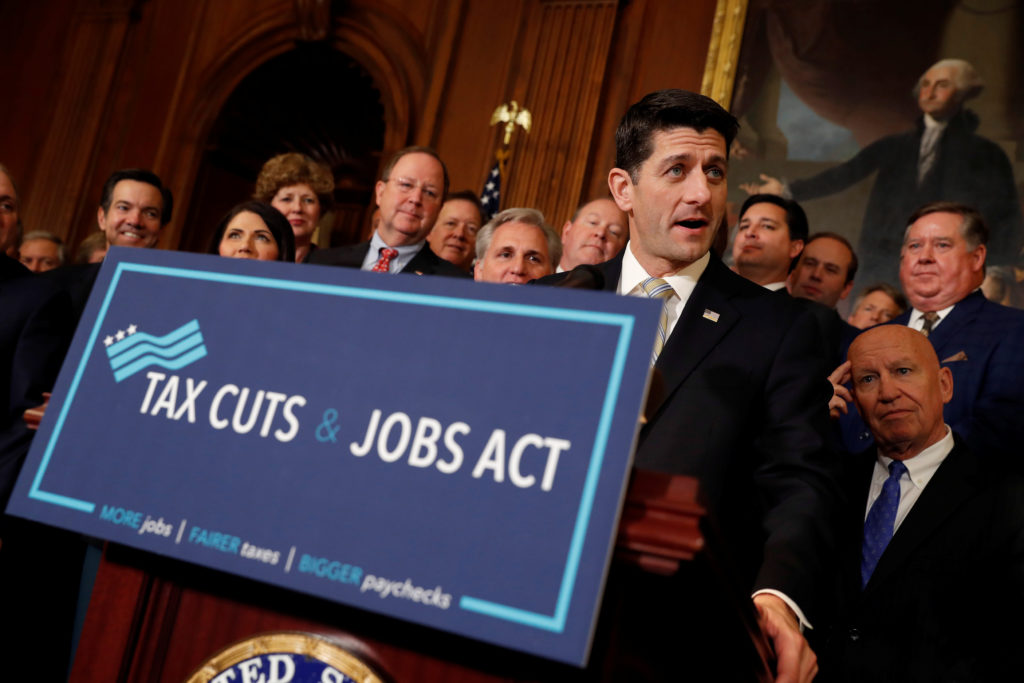

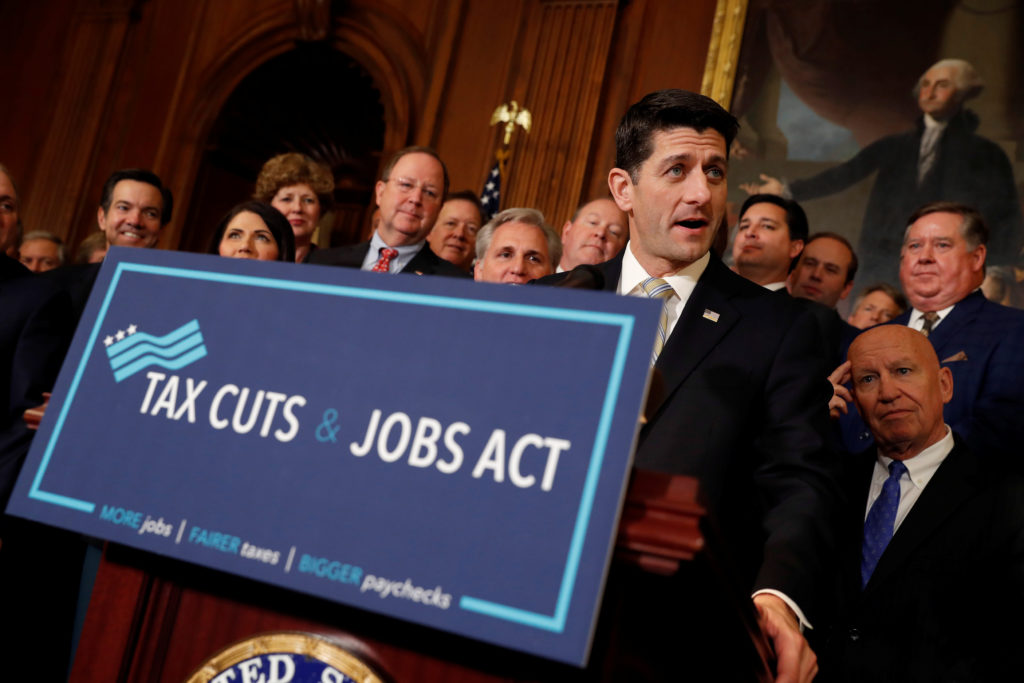

GOP Tax Overhaul Stalled: Conservatives Push For Changes To Medicaid And Green Energy

Table of Contents

Conservative Concerns Regarding Medicaid Expansion

Conservatives within the Republican Party are expressing considerable concern about the current structure of Medicaid expansion under the Affordable Care Act (ACA). Their objections are rooted in deeply held beliefs about the role of government in healthcare and fiscal responsibility. Key keywords associated with this debate include: Medicaid reform, healthcare spending, entitlement programs, budget deficit, and conservative ideology.

- Unsustainable Spending: Conservatives argue that the ACA's Medicaid expansion is fiscally unsustainable, contributing significantly to the national debt. They point to rising healthcare costs and increasing enrollment as evidence of an unsustainable system.

- Stricter Eligibility: A key demand from this group involves implementing stricter eligibility requirements for Medicaid. This could involve reducing the number of individuals eligible for the program, potentially impacting millions of low-income Americans.

- Reduced Federal Funding: Many conservatives advocate for substantial reductions in federal funding for Medicaid, shifting more responsibility to individual states. This shift would likely force states to make difficult choices regarding healthcare access and budget allocation.

- State Budgetary Impacts: The potential impact on state budgets is a major point of contention. States already facing budgetary constraints could be overwhelmed by the increased financial burden of covering a larger share of Medicaid costs.

Potential Consequences of Medicaid Cuts

Reducing Medicaid funding and tightening eligibility requirements could have devastating consequences. Studies suggest that cuts could lead to:

- Reduced Access to Healthcare: Millions of low-income individuals could lose access to vital healthcare services, resulting in poorer health outcomes and increased mortality rates.

- Strain on State Budgets: States would face increased pressure to manage the rising costs of healthcare for those remaining in the system, potentially leading to cuts in other essential state services.

- Economic Impacts: A decline in healthcare access could negatively impact the economy, as individuals are less productive when they are sick and lack access to preventative care. The economic consequences of decreased access to healthcare could be far-reaching.

Opposition to Green Energy Subsidies within the Tax Plan

Another major point of contention within the GOP centers on the tax plan's provisions related to green energy. Conservative lawmakers view tax credits and subsidies for renewable energy as wasteful government spending that distorts the free market. Keywords associated with this issue include: green energy tax credits, renewable energy, climate change, environmental policy, and conservative opposition.

- Market Distortion: Conservatives argue that government subsidies for green energy unfairly favor certain industries and technologies, creating an uneven playing field for energy providers.

- Government Overreach: The opposition often stems from a broader belief in limited government intervention in the economy and the energy sector.

- Elimination of Incentives: The push from conservatives is towards the complete elimination or significant reduction of tax credits and subsidies for renewable energy sources like solar and wind power.

- Ideological Differences: This debate underscores the ongoing tension between fiscally conservative principles and the need to address climate change and promote sustainable energy sources.

Economic and Environmental Implications of Removing Green Energy Incentives

Eliminating green energy incentives could have significant economic and environmental consequences:

- Slowed Renewable Energy Development: The removal of tax credits could stifle investment in renewable energy technologies, hindering the growth of this critical sector.

- Job Losses: The renewable energy sector is a significant job creator. Reduced investment could lead to job losses in manufacturing, installation, and maintenance.

- Increased Carbon Emissions: A slower transition to renewable energy sources could result in increased greenhouse gas emissions and exacerbate the effects of climate change.

The Role of Budget Reconciliation in the Impasse

The GOP's reliance on budget reconciliation to pass the tax overhaul is further complicating the situation. Budget reconciliation allows the Senate to pass certain legislation with a simple majority, bypassing the 60-vote threshold typically required to overcome a filibuster. Keywords relevant to this aspect include: budget reconciliation, Senate rules, legislative process, filibuster, and political compromise.

- Narrow Margin: The Republicans' narrow majority in the Senate makes securing the necessary votes for the tax overhaul incredibly challenging. Any defections could doom the bill.

- Compromise Needed: Significant compromise is needed to address the concerns of various factions within the party and secure the votes required for passage.

- Potential for Gridlock: The ongoing disagreements and the potential for further defections increase the likelihood of legislative gridlock. Failure to pass the tax overhaul could have significant political consequences for the Republican party.

Conclusion

The Republican Party's tax overhaul is teetering on the brink of failure. Deep divisions within the party, particularly concerning Medicaid expansion and green energy subsidies, are creating a dangerous stalemate that threatens to derail the entire legislative effort. The success of this GOP tax overhaul now hinges on the ability of party leaders to bridge these significant ideological gaps and forge a compromise that satisfies enough members to ensure passage. Failure to do so will not only leave the tax code unchanged but will also have profound implications for healthcare, environmental policy, and the broader political landscape. Staying informed about the progress (or lack thereof) of this crucial GOP tax overhaul is vital to understanding its impact on the future of American policy and the upcoming elections. Continue to follow the news for the latest updates on this evolving tax reform debate and its consequences.

Featured Posts

-

Doom The Dark Ages A Review For Casual And Hardcore Gamers

May 18, 2025

Doom The Dark Ages A Review For Casual And Hardcore Gamers

May 18, 2025 -

Weekend Update Chaos Ego Nwodims Snl Performance Leaves Audience Speechless

May 18, 2025

Weekend Update Chaos Ego Nwodims Snl Performance Leaves Audience Speechless

May 18, 2025 -

Alka Yagnk Ke Mdahwn Ky Fhrst Myn Asamh Bn Ladn Ky Ahmyt

May 18, 2025

Alka Yagnk Ke Mdahwn Ky Fhrst Myn Asamh Bn Ladn Ky Ahmyt

May 18, 2025 -

No Fortnite On I Os Explaining The Ongoing Absence

May 18, 2025

No Fortnite On I Os Explaining The Ongoing Absence

May 18, 2025 -

Weekend Update Snl Audiences Unexpected Outburst And Host Reaction

May 18, 2025

Weekend Update Snl Audiences Unexpected Outburst And Host Reaction

May 18, 2025

Latest Posts

-

Amanda Bynes Launches Only Fans With Specific Content Restrictions

May 18, 2025

Amanda Bynes Launches Only Fans With Specific Content Restrictions

May 18, 2025 -

Amanda Bynes Only Fans Debut A New Chapter 15 Years After Quitting Acting

May 18, 2025

Amanda Bynes Only Fans Debut A New Chapter 15 Years After Quitting Acting

May 18, 2025 -

Only Fans And Amanda Bynes A New Chapter After Hollywood

May 18, 2025

Only Fans And Amanda Bynes A New Chapter After Hollywood

May 18, 2025 -

Amanda Bynes Only Fans Strict Disclaimer And Content Details

May 18, 2025

Amanda Bynes Only Fans Strict Disclaimer And Content Details

May 18, 2025 -

Former Child Star Amanda Bynes Returns To Public Eye With 50 Only Fans Subscription

May 18, 2025

Former Child Star Amanda Bynes Returns To Public Eye With 50 Only Fans Subscription

May 18, 2025