Government Rent Freeze: €3 Billion Hit To Housing Sector

Table of Contents

Financial Strain on Landlords and Property Investors

The government rent freeze in Ireland places significant financial strain on landlords and property investors. Reduced rental income directly impacts their ability to meet financial obligations and maintain their properties. Key consequences include:

-

Reduced Landlord Income and Profitability: Rent freezes significantly reduce landlord income, directly impacting their ability to cover mortgage payments, property taxes, insurance, and essential maintenance. This decrease in rental yield makes property ownership less lucrative, potentially forcing some landlords to sell their properties.

-

Impact on Return on Investment (ROI): The diminished rental yield drastically reduces the return on investment for property investors, making Ireland a less attractive market for future investment in the rental sector. This could lead to a significant slowdown in new housing developments.

-

Increased Pressure from Eviction Bans: Eviction bans, often implemented alongside rent freezes, exacerbate the financial strain on landlords. They are left unable to recoup losses from problematic tenants or remove those damaging their properties. This situation creates an unsustainable model for many landlords, further impacting rental availability.

Impact on New Housing Development

The government rent freeze's impact extends beyond existing rental properties, severely impacting the future supply of housing in Ireland. The reduced profitability of rental properties acts as a significant deterrent to new construction and investment in the housing sector.

-

Disincentivizing New Construction: The diminished return on investment (ROI) from rental properties discourages both individual investors and larger construction companies from undertaking new housing developments. This directly contributes to the existing housing shortage.

-

Exacerbating the Housing Shortage: A slowdown or complete halt in new housing construction will inevitably exacerbate the already severe housing shortage in Ireland. This will put further pressure on the rental market, potentially leading to even higher rents once the freeze is lifted.

-

Impact on Affordable Housing Initiatives: The financial risk associated with rental property development will disproportionately affect initiatives aimed at providing affordable housing. Reduced investor confidence in this sector will severely limit the construction of much-needed affordable rental units.

Economic Ripple Effects and Government Response

The estimated €3 billion loss to the housing sector due to the government rent freeze will have widespread economic ripple effects. These impacts extend beyond the housing sector itself, affecting various aspects of the Irish economy.

-

Reduced Tax Revenue: The decreased profitability in the rental sector will inevitably lead to a reduction in government tax revenue from property taxes and related sources. This adds further strain on public finances.

-

Increased Government Spending: The government may need to increase spending on social welfare programs to mitigate the negative social consequences of the housing crisis, such as homelessness and increased reliance on rental assistance.

-

Inflationary Pressures: Landlords may attempt to recoup losses from the rent freeze through increased charges for services, or by raising the prices of other rental-related offerings, potentially contributing to inflationary pressures.

Tenant Perspectives and Affordability

While the government rent freeze offers immediate relief to tenants, it fails to address the root causes of the housing affordability crisis. The long-term implications for tenants also need consideration:

-

Short-Term Relief, Long-Term Issues: The freeze provides temporary relief from rising rents but does not tackle the underlying issues of inadequate housing supply and escalating rental costs. The longer-term solutions lie in increasing the supply of social housing and implementing sustainable rental market regulations.

-

Impact on Housing Quality: Reduced landlord income may lead to deferred maintenance and reduced investment in property upkeep. This negatively impacts the quality of rental properties available to tenants.

-

Sustainability of the Freeze: A prolonged rent freeze could create long-term instability in the rental market, potentially leading to a drastic reduction in available rental properties and further exacerbating the crisis.

Conclusion

The Irish government's rent freeze, while well-intentioned, carries significant economic consequences, potentially resulting in a €3 billion loss to the housing sector. The impact on landlords, investors, and the overall construction industry necessitates a thorough evaluation of the policy's long-term effects. While offering temporary relief for tenants, it does not address the fundamental problems of housing affordability and supply. A comprehensive and sustainable approach to tackling Ireland’s housing crisis, moving beyond short-term measures like a rent freeze, is crucial. The government needs to explore long-term solutions that encourage investment in the housing sector and ensure affordable and sustainable housing for all. Understanding the full impact of the government rent freeze and its broader implications on the Irish economy is vital for future policymaking. Developing effective strategies to address the complex issues surrounding affordable rental housing in Ireland is paramount for the nation’s economic and social well-being.

Featured Posts

-

Malis Attempt To Seize Barrick Gold Mine Lack Of Legal Basis Cited

May 28, 2025

Malis Attempt To Seize Barrick Gold Mine Lack Of Legal Basis Cited

May 28, 2025 -

Manchester City Transfer Target Serie A Leaders Future Uncertain Amidst Napoli Interest

May 28, 2025

Manchester City Transfer Target Serie A Leaders Future Uncertain Amidst Napoli Interest

May 28, 2025 -

San Diego Padres Pregame Notes Arraez Absent Sheets Starts In Left

May 28, 2025

San Diego Padres Pregame Notes Arraez Absent Sheets Starts In Left

May 28, 2025 -

Ronaldo Portekiz Kampinda Neler Yasadi Fenerbahce Heyecani

May 28, 2025

Ronaldo Portekiz Kampinda Neler Yasadi Fenerbahce Heyecani

May 28, 2025 -

Hailee Steinfelds Life A 20 Question Interview

May 28, 2025

Hailee Steinfelds Life A 20 Question Interview

May 28, 2025

Latest Posts

-

Trump Plays Down New Russia Sanctions Threat

May 30, 2025

Trump Plays Down New Russia Sanctions Threat

May 30, 2025 -

Global Tariffs Struck Down A Trade Court Victory

May 30, 2025

Global Tariffs Struck Down A Trade Court Victory

May 30, 2025 -

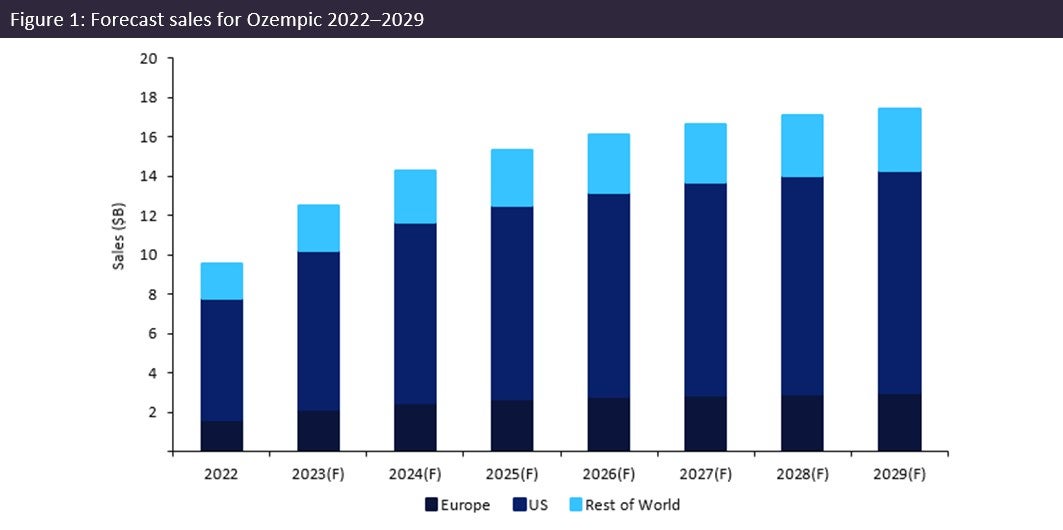

Weight Loss Drugs Novo Nordisks Ozempic And The Competitive Landscape

May 30, 2025

Weight Loss Drugs Novo Nordisks Ozempic And The Competitive Landscape

May 30, 2025 -

Late Diagnosis Of Autism In Adults Benefits And Resources

May 30, 2025

Late Diagnosis Of Autism In Adults Benefits And Resources

May 30, 2025 -

Elon Musk Vs Sam Altman Exclusive Details On The Blocked Middle East Ai Deal

May 30, 2025

Elon Musk Vs Sam Altman Exclusive Details On The Blocked Middle East Ai Deal

May 30, 2025