GPB Capital Ponzi Scheme: Founder David Gentile Receives 7-Year Sentence

Table of Contents

The GPB Capital Ponzi Scheme: A Deep Dive

The GPB Capital Ponzi scheme represents a sophisticated and devastating example of investment fraud. Its scale and impact on numerous investors highlight the critical need for robust investor protection and diligent due diligence.

The Scheme's Mechanics

Gentile and his associates masterfully orchestrated a classic Ponzi scheme, using fraudulent investments and false representations to lure investors. The scheme primarily focused on:

- Misappropriation of Funds: Instead of investing in legitimate ventures as promised, the funds were largely misappropriated, used to pay earlier investors and enrich the perpetrators.

- False Representations: GPB Capital marketed investments in auto dealerships and waste management companies, promising exceptionally high returns that were entirely unsustainable. These returns were, in fact, paid using the money from new investors.

- Unsustainable Returns: The promised returns far exceeded what could realistically be generated through legitimate investments, a key red flag often associated with Ponzi schemes. This lured investors with the allure of quick and easy profits, masking the underlying fraudulent activity.

- Lack of Transparency: Investors lacked access to comprehensive financial information, hindering their ability to independently verify the legitimacy of the purported investments.

The Victims of the GPB Capital Fraud

The GPB Capital fraud inflicted significant financial and emotional hardship on numerous investors. Thousands of individuals and institutions lost substantial sums of money, with total losses estimated in the hundreds of millions of dollars. Many investors, often retirees relying on their investments for retirement income, suffered devastating financial losses.

- Investor Losses: The sheer scale of investor losses underscores the destructive nature of large-scale investment fraud and the need for stronger regulatory oversight.

- Emotional Distress: Beyond the financial losses, many victims experienced significant emotional distress, including anxiety, depression, and feelings of betrayal.

- Regulatory Response: While regulatory bodies investigated the scheme, the slow response highlights challenges in detecting and preventing sophisticated Ponzi schemes.

David Gentile's Conviction and Sentencing

David Gentile faced numerous criminal charges related to his role in the GPB Capital Ponzi scheme.

The Charges and Trial

Gentile was charged with conspiracy to commit securities fraud, securities fraud, and wire fraud, among other serious offenses. The prosecution presented substantial evidence detailing Gentile's fraudulent activities, including internal documents, witness testimonies, and financial records. The trial illuminated the intricacies of the scheme and the deliberate actions taken to deceive investors.

- Specific Charges: The charges reflected the wide-ranging nature of the fraudulent activities, covering various aspects of the scheme's operation.

- Co-Conspirators: While Gentile received the most significant sentence, several other individuals involved in the scheme also faced criminal charges and convictions, receiving varying prison sentences.

The 7-Year Sentence: Implications and Analysis

The seven-year sentence handed down to David Gentile sends a strong message about the consequences of orchestrating large-scale investment fraud. While sentences for white-collar crime can vary, this sentence reflects the severity of the crime and the significant harm inflicted on victims.

- Sentencing Guidelines: The sentence aligns with sentencing guidelines for similar cases of securities fraud and Ponzi schemes, providing a benchmark for future cases.

- Further Legal Proceedings: While the sentencing concludes a significant chapter, the possibility of appeals or further legal actions remains.

- Regulatory Implications: The case highlights the need for enhanced regulatory oversight of investment firms and more robust mechanisms to detect and prevent fraudulent activities.

Lessons Learned from the GPB Capital Ponzi Scheme

The GPB Capital Ponzi scheme serves as a stark reminder of the importance of investor vigilance and due diligence.

Protecting Yourself from Investment Fraud

Protecting yourself from investment fraud requires a proactive and informed approach. Here are some key steps:

- Investment Due Diligence: Always conduct thorough research before investing in any opportunity, verifying the legitimacy of the investment and the individuals or firms involved.

- Red Flags of Fraud: Be wary of unusually high returns, promises of guaranteed profits, pressure to invest quickly, and a lack of transparency.

- Investor Protection Resources: Utilize resources from the Securities and Exchange Commission (SEC) and other regulatory bodies to learn about fraud prevention and report suspected scams.

- Ask Questions: Before investing, ask pointed questions about the investment strategy, fee structure, risk factors, and past performance.

Conclusion:

The GPB Capital Ponzi scheme and David Gentile's seven-year sentence represent a significant development in the fight against investment fraud. The devastating consequences for victims underscore the critical need for increased investor awareness and stronger regulatory mechanisms. To avoid becoming a victim of a GPB Capital-like Ponzi scheme or other investment fraud, always conduct thorough due diligence, be wary of red flags, and utilize available resources to protect your investments. Learn to recognize the signs of investment fraud and protect your financial future. Remember, if an investment sounds too good to be true, it probably is.

Featured Posts

-

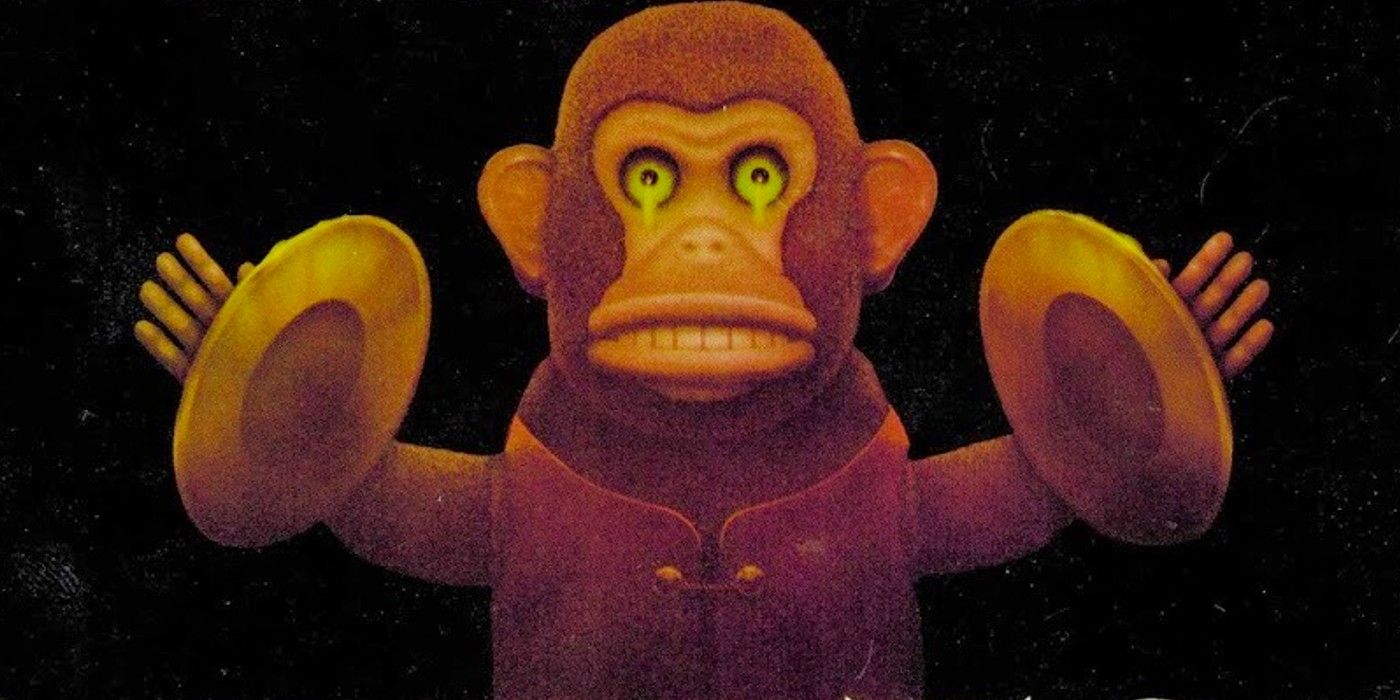

2025 Will The Monkey Be Stephen Kings Worst Film Adaptation

May 10, 2025

2025 Will The Monkey Be Stephen Kings Worst Film Adaptation

May 10, 2025 -

The Joanna Page Wynne Evans Bbc Show Feud A Detailed Look

May 10, 2025

The Joanna Page Wynne Evans Bbc Show Feud A Detailed Look

May 10, 2025 -

Whoops Broken Promises User Anger Over Free Upgrades

May 10, 2025

Whoops Broken Promises User Anger Over Free Upgrades

May 10, 2025 -

Palantir Stock Buy Before May 5th Wall Streets Near Unanimous Opinion

May 10, 2025

Palantir Stock Buy Before May 5th Wall Streets Near Unanimous Opinion

May 10, 2025 -

Floridai Transznemu No Letartoztatasa Illegalis Noi Mosdohasznalat Kormanyepueletben

May 10, 2025

Floridai Transznemu No Letartoztatasa Illegalis Noi Mosdohasznalat Kormanyepueletben

May 10, 2025