Grayscale's XRP ETF Filing Acknowledged By SEC: Impact On XRP And Bitcoin Prices

Table of Contents

The Significance of SEC Acknowledgment

The SEC's acknowledgment of Grayscale's XRP ETF filing is a crucial development. While not an approval, it signifies that the SEC is actively processing the application, rather than summarily rejecting it. This is a significant departure from previous approaches to cryptocurrency ETF applications and holds immense weight for the future of digital asset regulation.

- Positive Market Sentiment: This acknowledgment is a positive sign for XRP and the broader crypto market. It suggests a growing openness within the SEC towards cryptocurrencies and their potential for inclusion within traditional financial markets.

- Considering Crypto ETF Approval: The SEC's processing of the application demonstrates its willingness to consider the possibility of approving a cryptocurrency ETF, a milestone that could legitimize and normalize cryptocurrency investment for institutional investors.

- Boosting Investor Confidence: The move instills increased investor confidence in the regulatory landscape surrounding cryptocurrencies. It signals a potential reduction in regulatory uncertainty, a major barrier to broader adoption.

- Regulatory Clarity: The SEC’s engagement with the Grayscale XRP ETF filing is a step toward greater regulatory clarity in the cryptocurrency space. This clarity can encourage more institutional investment and further development of the crypto market.

Potential Impact on XRP Price

The news of the SEC's acknowledgment is likely to significantly affect XRP's price, creating both short-term and long-term effects.

- Short-Term Price Surge: We can anticipate a short-term price surge driven by increased buying pressure and speculation. Traders and investors are likely to react positively to the perceived increased likelihood of ETF approval.

- Long-Term Price Appreciation (Conditional): If the SEC ultimately approves the Grayscale XRP ETF, a substantial long-term price appreciation for XRP is highly probable. This approval would significantly increase the accessibility and liquidity of XRP for mainstream investors.

- Increased Trading Volume: Expect a significant increase in XRP trading volume as investors rush to capitalize on the potential price increase. Higher trading volumes usually indicate increased interest and market activity.

- Institutional Investment: Approval of the ETF would likely attract significant institutional investment in XRP, further driving up its price and solidifying its position in the market.

- Risk of Price Correction: Conversely, if the SEC rejects the ETF application, a price correction is likely, potentially leading to a significant downturn. This highlights the inherent risk associated with cryptocurrency investments.

Ripple Effect on Bitcoin Price

The impact of Grayscale's XRP ETF filing extends beyond XRP; it could indirectly affect Bitcoin's price due to the interconnectedness of the cryptocurrency market.

- Positive Market Sentiment: Positive sentiment generated by the SEC acknowledgment might spill over into the broader crypto market, boosting Bitcoin's price. A positive development for one major cryptocurrency can generally uplift the entire sector.

- Increased Institutional Interest: Increased interest in cryptocurrencies resulting from the Grayscale filing could lead to greater institutional investment in Bitcoin as well, as investors seek diversification within the crypto space.

- Safe-Haven Asset: Bitcoin's role as a safe-haven asset may become more prominent as investors seek less volatile options amidst the excitement surrounding the XRP ETF.

- Price Correlation: It's important to note the historical correlation between XRP and Bitcoin price movements. A significant price change in XRP is likely to affect Bitcoin’s price to some extent, although the degree of correlation varies.

Regulatory Landscape and Future Outlook

The Grayscale XRP ETF filing and the SEC's response have significant implications for the broader regulatory landscape and the future of cryptocurrencies.

- Wave of ETF Filings: We might see a wave of similar ETF filings from other cryptocurrency firms, encouraged by the SEC's acknowledgment of Grayscale's application. This could accelerate the mainstream adoption of cryptocurrencies.

- SEC's Approach to Crypto Regulation: The SEC's approach to this filing will set a precedent for how it handles future cryptocurrency ETF applications, influencing the regulatory landscape for years to come.

- Impact on Investor Confidence: A positive outcome could significantly enhance investor confidence in the overall cryptocurrency market, attracting more investment and innovation. Conversely, rejection could dampen market enthusiasm.

- The Future of Crypto ETFs: The success or failure of the Grayscale XRP ETF will likely shape the future trajectory of cryptocurrency ETFs and their role in the financial world.

Conclusion

Grayscale's XRP ETF filing acknowledgment by the SEC represents a significant development for the cryptocurrency market. While the ultimate outcome remains uncertain, the acknowledgment itself has already created positive market sentiment, potentially influencing XRP's price and indirectly impacting Bitcoin. The SEC's decision will be pivotal in shaping the future of crypto ETFs and investor confidence. Stay informed about developments regarding Grayscale's XRP ETF filing and the broader crypto regulatory landscape. Continue researching the potential of the Grayscale XRP ETF and its impact on the cryptocurrency market. Monitor XRP and Bitcoin prices closely.

Featured Posts

-

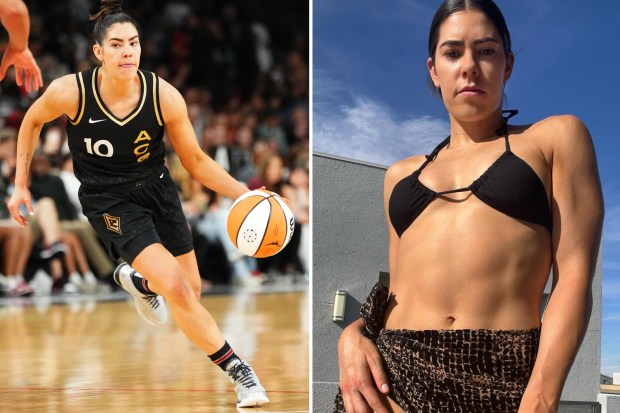

Kelsey Plum And Kate Martin A Wholesome Courtside Moment

May 07, 2025

Kelsey Plum And Kate Martin A Wholesome Courtside Moment

May 07, 2025 -

Cooperacion Administrativa Y Graduacion De Paises Menos Adelantados Retos Y Oportunidades

May 07, 2025

Cooperacion Administrativa Y Graduacion De Paises Menos Adelantados Retos Y Oportunidades

May 07, 2025 -

Navigating The Deception A Guide To The Glossy Mirage

May 07, 2025

Navigating The Deception A Guide To The Glossy Mirage

May 07, 2025 -

Royal Air Maroc And Mauritania Airlines Expand Cooperation With New Partnership

May 07, 2025

Royal Air Maroc And Mauritania Airlines Expand Cooperation With New Partnership

May 07, 2025 -

Navrat Svetoveho Pohara V Hokeji Nhl Oznamila Turnaj Na Rok 2028

May 07, 2025

Navrat Svetoveho Pohara V Hokeji Nhl Oznamila Turnaj Na Rok 2028

May 07, 2025

Latest Posts

-

Duesen Kripto Piyasasinda Yatirimci Davranislari Satislar Artti

May 08, 2025

Duesen Kripto Piyasasinda Yatirimci Davranislari Satislar Artti

May 08, 2025 -

Kripto Para Yatirimlarinda Gerileme Ve Satislar

May 08, 2025

Kripto Para Yatirimlarinda Gerileme Ve Satislar

May 08, 2025 -

Sermaye Piyasasi Kurulu Ndan Kripto Duezenlemesi Platformlar Icin Yeni Sartlar

May 08, 2025

Sermaye Piyasasi Kurulu Ndan Kripto Duezenlemesi Platformlar Icin Yeni Sartlar

May 08, 2025 -

The Lasting Legacy Of Counting Crows Saturday Night Live Appearance

May 08, 2025

The Lasting Legacy Of Counting Crows Saturday Night Live Appearance

May 08, 2025 -

Kripto Duesuesue Satis Baskisinin Ardindaki Nedenler

May 08, 2025

Kripto Duesuesue Satis Baskisinin Ardindaki Nedenler

May 08, 2025