Growth Investor's Bold Bitcoin Prediction: A 1,500% Surge

Table of Contents

The Investor's Rationale Behind the 1,500% Bitcoin Price Prediction

The unnamed investor (for confidentiality reasons) bases their prediction on a confluence of factors pointing towards a significant Bitcoin price appreciation. Their argument hinges on several key pillars:

-

Market Adoption and Growing Institutional Investment: Institutional investors, such as large corporations and hedge funds, are increasingly allocating assets to Bitcoin, viewing it as a hedge against inflation and a potential store of value. This increased institutional demand is expected to drive significant price appreciation.

-

Technological Advancements and Network Effects: Bitcoin's underlying technology continues to evolve, with ongoing developments improving scalability and transaction speed. The network effect—where the value of the network increases with each new user—also contributes to Bitcoin's long-term growth potential.

-

Macroeconomic Factors Influencing Bitcoin's Value: Global inflation, geopolitical instability, and the potential devaluation of fiat currencies are all factors that could significantly boost Bitcoin's appeal as a safe haven asset and drive demand.

-

Comparison to Historical Bitcoin Price Surges and Cycles: The investor points to historical Bitcoin price cycles, highlighting the significant gains following previous halving events (when the rate of Bitcoin mining is reduced). This historical precedent suggests a potential for another major price surge.

-

Specific Metrics and Data Points: The investor utilizes on-chain metrics like transaction volume, active addresses, and miner behavior to substantiate their prediction. These data points, while not publicly available for confidentiality, supposedly show a sustained upward trend aligning with their projection.

Key Arguments Summarized:

- Increased institutional adoption driving demand.

- Halving events historically leading to price appreciation.

- Growing scarcity of Bitcoin as a deflationary asset.

- Positive macroeconomic factors boosting investor confidence.

- Strong on-chain metrics indicating sustained growth.

Potential Risks and Challenges to Reaching a 1,500% Bitcoin Increase

While the potential upside is substantial, it's crucial to acknowledge the significant risks associated with Bitcoin investment and the challenges to achieving such a dramatic price increase.

-

Regulatory Hurdles and Government Intervention: Governments worldwide are grappling with how to regulate cryptocurrencies. Increased regulatory scrutiny or outright bans could significantly impact Bitcoin's price.

-

Market Manipulation and Volatility: The cryptocurrency market is notoriously volatile and susceptible to manipulation. Sudden price crashes are a possibility, potentially wiping out significant investment gains.

-

Competition from Alternative Cryptocurrencies: The cryptocurrency landscape is constantly evolving, with new and innovative cryptocurrencies emerging. Competition from altcoins could divert investor interest away from Bitcoin.

-

Economic Downturns Affecting Investor Sentiment: A major economic downturn could trigger a risk-off sentiment among investors, leading to a sell-off in even the most established cryptocurrencies like Bitcoin.

Key Risks Outlined:

- Regulatory uncertainty could dampen investor enthusiasm.

- Market crashes are a possibility, especially in volatile markets.

- Competition from altcoins could fragment the market.

- Economic downturns could negatively impact investor sentiment.

Analyzing the Investor's Track Record and Credibility

While the investor's identity remains undisclosed, their past investment performance in other high-growth sectors speaks volumes. Their history indicates a strong aptitude for identifying and capitalizing on disruptive technologies, demonstrating a keen understanding of market trends. However, it's important to remember that past performance does not guarantee future results. Detailed analysis of their past investments and market commentaries would enhance the credibility assessment further.

Investing in Bitcoin: Strategies and Considerations

Investing in Bitcoin, or any cryptocurrency, carries inherent risks. It is crucial to proceed with caution and implement effective risk management strategies.

- Diversification: Don't put all your eggs in one basket. Diversify your investment portfolio across different asset classes to mitigate risk.

- Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of price fluctuations, to reduce the impact of volatility.

- Thorough Research: Before making any investment decisions, conduct thorough research and understand the risks involved.

- Secure Storage: Use secure wallets to store your Bitcoin and protect against theft or loss.

- Regulatory Compliance: Stay informed about relevant regulations and ensure compliance.

Responsible Investment Strategies Summarized:

- Diversify your portfolio to mitigate risk.

- Only invest what you can afford to lose.

- Conduct thorough research before making any investment decisions.

- Utilize secure storage methods for your crypto assets.

- Stay updated on relevant regulations and laws.

Conclusion: Should You Believe the Growth Investor's Bold Bitcoin Prediction?

The growth investor's prediction of a 1,500% Bitcoin price surge is certainly bold, driven by a combination of factors including increasing institutional adoption, technological advancements, and macroeconomic conditions. However, significant risks remain, including regulatory uncertainty, market volatility, and competition from other cryptocurrencies. Therefore, whether you find the prediction plausible depends on your own risk tolerance and investment strategy. While a 1,500% surge is a significant target, understanding the factors behind this Growth Investor's Bold Bitcoin Prediction – and the inherent risks involved – is paramount. Continue your research into this prediction and make informed choices aligned with your financial goals. Remember to always consult with a financial advisor before making any significant investment decisions.

Featured Posts

-

Papal Conclave Cardinals Evaluate Candidate Dossiers

May 08, 2025

Papal Conclave Cardinals Evaluate Candidate Dossiers

May 08, 2025 -

User Trust At Risk Googles Response To Dojs Proposed Search Engine Changes

May 08, 2025

User Trust At Risk Googles Response To Dojs Proposed Search Engine Changes

May 08, 2025 -

Stephen Kings Underrated Novel Gets The Horror Treatment First Trailer Released

May 08, 2025

Stephen Kings Underrated Novel Gets The Horror Treatment First Trailer Released

May 08, 2025 -

Champions League Inter Milan Defeats Barcelona In Dramatic Final

May 08, 2025

Champions League Inter Milan Defeats Barcelona In Dramatic Final

May 08, 2025 -

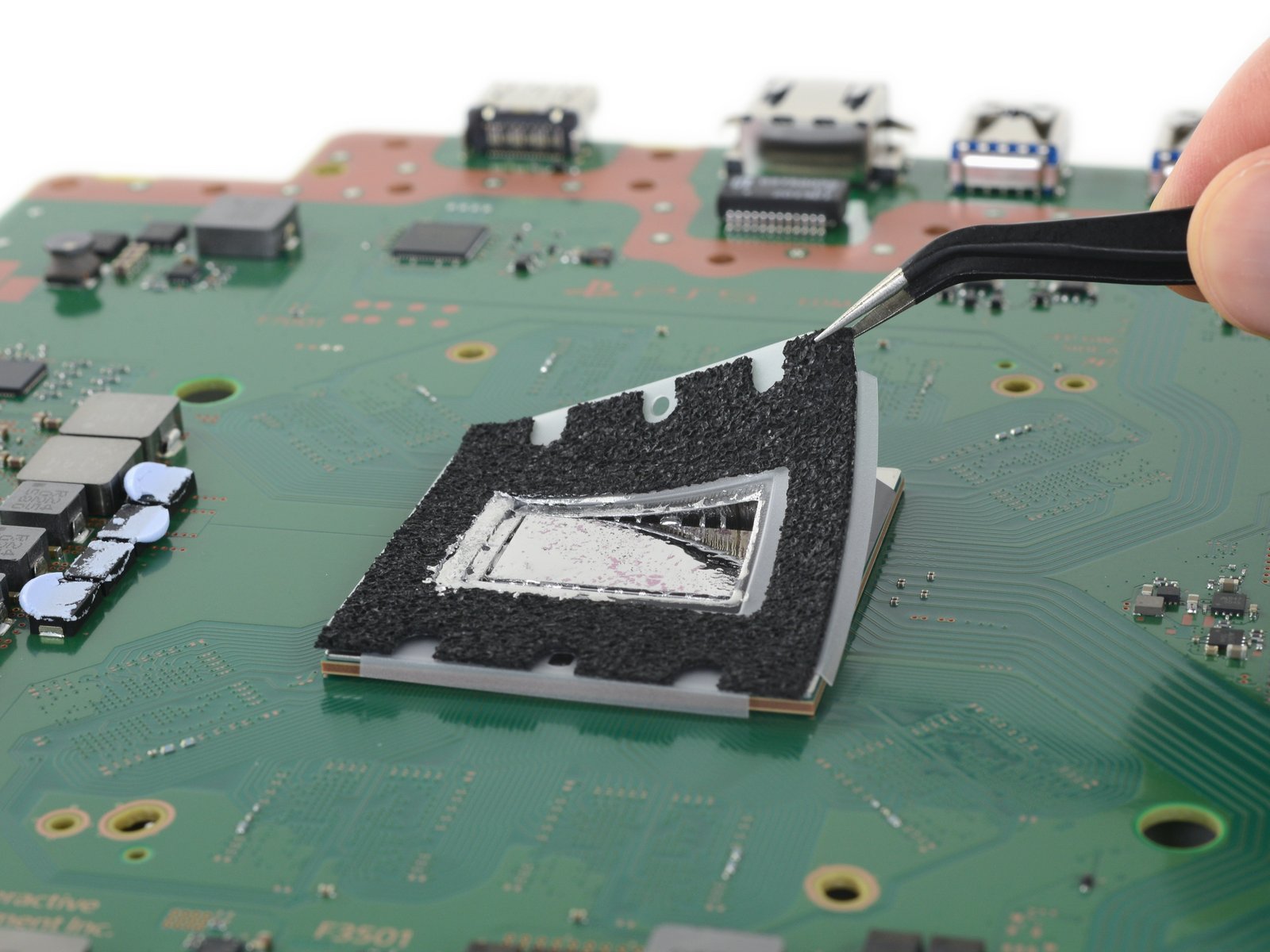

Sony Ps 5 Pro Teardown Liquid Metal Cooling System Revealed

May 08, 2025

Sony Ps 5 Pro Teardown Liquid Metal Cooling System Revealed

May 08, 2025