Guaranteed Approval Tribal Loans: Best Options For Bad Credit

Table of Contents

Understanding Guaranteed Approval Tribal Loans

Tribal loans are short-term loans offered by lenders affiliated with Native American tribes. These loans operate under tribal sovereignty, which means they are often subject to different regulations than traditional loans offered by banks or credit unions. The term "guaranteed approval" is a significant marketing point, but it's crucial to understand what it actually means. While the approval process for these loans is often less stringent than for traditional bad credit loans, it doesn't mean automatic acceptance. You will still need to meet some criteria, such as demonstrating a verifiable income source.

The unique aspect of tribal lending stems from the legal framework of tribal sovereignty. Tribal nations have the authority to regulate their own affairs, including financial institutions operating within their jurisdiction. This can lead to different lending practices and regulations compared to state or federal laws.

Advantages of Tribal Loans for Bad Credit

- Higher approval rates: Tribal lenders often have higher approval rates for individuals with bad credit compared to traditional banks or credit unions, making them a potential lifeline for those struggling to secure financing elsewhere.

- Less stringent credit checks: While a credit check might still be performed, it's often not as thorough or weighted as heavily as with traditional lenders. Your credit score might not be the sole determining factor.

- Potential for faster funding: The application and approval process can sometimes be faster than with traditional lenders, providing quicker access to needed funds.

- Flexible repayment options: Some tribal lenders may offer flexible repayment options; however, it's vital to carefully review the terms and conditions as these vary widely and can lead to unforeseen difficulties if not understood thoroughly.

Disadvantages of Tribal Loans for Bad Credit

- Higher interest rates: Be prepared for significantly higher interest rates compared to conventional loans. These high rates can quickly escalate your debt if not managed carefully. This is a significant drawback that needs careful consideration.

- Potential for predatory lending practices: Unfortunately, some unscrupulous lenders may engage in predatory practices. Thorough research and due diligence are essential to avoid such lenders.

- Stricter repayment schedules: Missing payments can result in hefty penalties and fees, potentially creating a debt cycle that is difficult to escape.

- Limited loan amounts: The loan amounts offered by tribal lenders are typically smaller compared to traditional loans.

Finding Reputable Tribal Lenders

Navigating the world of tribal lenders requires caution. Many illegitimate lenders operate online, preying on individuals desperate for financial assistance. Protecting yourself from scams is paramount.

- Check online reviews and ratings: Thoroughly research potential lenders using independent review sites. Look for patterns of complaints regarding high fees, aggressive collection practices, or difficulty contacting the lender.

- Verify tribal affiliation and licensing: Confirm the lender's genuine affiliation with a Native American tribe and ensure they possess the necessary licenses and permits to operate legally.

- Look for transparency in fees and terms: Avoid lenders who are vague or obscure about fees, interest rates, and repayment terms. Transparency is a key indicator of legitimacy.

- Avoid lenders promising "guaranteed approval" without any qualification: A truly reputable lender will be upfront about the requirements for loan approval.

Using comparison websites can help you find lenders with competitive rates and terms, but always conduct your own independent research before committing to any loan.

Factors Affecting Loan Approval

Even with the often-easier approval process of guaranteed approval tribal loans, several factors still influence the lender's decision:

- Income verification: You will need to provide proof of income to demonstrate your ability to repay the loan.

- Employment history: A stable employment history increases your chances of approval.

- Debt-to-income ratio: Lenders assess your current debt obligations to determine your capacity to handle additional debt.

- Bank account information: Providing access to your bank account allows lenders to verify your financial stability and process payments.

Providing accurate and complete information is crucial to maximizing your chances of approval.

Alternatives to Tribal Loans for Bad Credit

While tribal loans can be an option, exploring alternatives is always wise.

- Credit unions: Credit unions often offer more favorable terms than traditional banks, especially for members with bad credit.

- Peer-to-peer lending platforms: These platforms connect borrowers directly with individual lenders, potentially offering competitive rates.

- Secured loans: Secured loans require collateral, reducing the lender's risk and potentially leading to better terms.

- Bad credit personal loans from banks: Some banks offer personal loans specifically designed for individuals with bad credit, although these may be more difficult to obtain.

Carefully weigh the pros and cons of each option before making a decision. Consider the interest rates, fees, repayment terms, and the overall cost of borrowing.

Responsible Borrowing Practices

Securing a loan is only half the battle; responsible borrowing is crucial to avoid spiraling into further debt.

- Creating a budget: Develop a detailed budget to track income and expenses, ensuring you can comfortably afford loan repayments.

- Prioritizing debt repayment: Prioritize loan repayments to avoid late payments and penalties. Consider debt consolidation strategies if overwhelmed by multiple debts.

- Seeking debt counseling if needed: If you're struggling to manage your debt, seeking professional debt counseling can provide invaluable support and guidance.

Defaulting on a loan can have severe consequences, including damage to your credit score, legal action, and further financial difficulties.

Conclusion: Making Informed Decisions with Guaranteed Approval Tribal Loans

Guaranteed approval tribal loans can be a viable solution for individuals with bad credit seeking financial assistance. However, understanding the advantages and disadvantages, including the potential for high interest rates and predatory lending, is crucial. Finding a reputable lender, verifying their legitimacy, and carefully reviewing loan terms are essential steps. Remember to explore alternative options, prioritize responsible borrowing, and consider seeking professional advice if needed. Find the best guaranteed approval tribal loan for your needs by carefully researching reputable lenders and comparing loan terms. Remember, responsible borrowing is key to achieving your financial goals.

Featured Posts

-

Economisez Sur Le Samsung Galaxy S25 256 Go 699 90 E

May 28, 2025

Economisez Sur Le Samsung Galaxy S25 256 Go 699 90 E

May 28, 2025 -

Impact Of Rent Regulation Changes On Tenants An Interest Groups Perspective

May 28, 2025

Impact Of Rent Regulation Changes On Tenants An Interest Groups Perspective

May 28, 2025 -

Angels Vs Dodgers A Game Defined By Missing Shortstops

May 28, 2025

Angels Vs Dodgers A Game Defined By Missing Shortstops

May 28, 2025 -

Arsenal Vs Psv Eindhoven Head To Head Record Last 5 Matches

May 28, 2025

Arsenal Vs Psv Eindhoven Head To Head Record Last 5 Matches

May 28, 2025 -

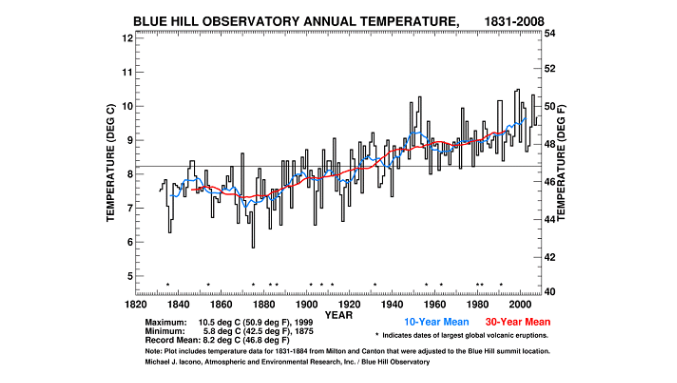

Increased Precipitation In Western Massachusetts A Climate Change Analysis

May 28, 2025

Increased Precipitation In Western Massachusetts A Climate Change Analysis

May 28, 2025

Latest Posts

-

Aeroport De Bordeaux Manifestation Contre Le Maintien De La Piste Secondaire

May 30, 2025

Aeroport De Bordeaux Manifestation Contre Le Maintien De La Piste Secondaire

May 30, 2025 -

A69 Decisions Politiques Et Implications Judiciaires Du Projet Autoroutier

May 30, 2025

A69 Decisions Politiques Et Implications Judiciaires Du Projet Autoroutier

May 30, 2025 -

Gouvernement Annonce L Augmentation Des Tests Antidrogue Pour Les Conducteurs De Cars Scolaires

May 30, 2025

Gouvernement Annonce L Augmentation Des Tests Antidrogue Pour Les Conducteurs De Cars Scolaires

May 30, 2025 -

Prevoir Vos Deplacements Situation De La Greve Sncf Du 8 Mai

May 30, 2025

Prevoir Vos Deplacements Situation De La Greve Sncf Du 8 Mai

May 30, 2025 -

Plus De Controles Antidrogue Pour Les Chauffeurs De Cars Scolaires

May 30, 2025

Plus De Controles Antidrogue Pour Les Chauffeurs De Cars Scolaires

May 30, 2025