Guaranteed Tribal Loans: Direct Lenders For Bad Credit

Table of Contents

Understanding Guaranteed Tribal Loans

What are Tribal Loans?

Tribal loans are short-term loans offered by lending institutions affiliated with Native American tribes. These tribes operate on sovereign land, allowing them to establish their own lending practices, often with different regulations than state-licensed lenders. This sovereign status can influence the lending process and eligibility requirements.

- Definition of tribal loans: Short-term loans provided by entities associated with Native American tribes.

- Differences from payday loans: While similar in their short-term nature, tribal loans often have different regulatory frameworks and may offer more flexible repayment options than payday loans.

- Regulations and compliance: Tribal lenders are generally subject to tribal laws and regulations, which can differ significantly from state laws governing traditional lenders.

The "Guaranteed" Aspect

The term "guaranteed" in the context of guaranteed tribal loans doesn't imply automatic approval. Instead, it signifies a higher likelihood of approval compared to traditional lenders for those with bad credit. While lenders assess your application, the approval process often considers factors beyond a traditional credit score.

- Factors affecting approval: Income verification, employment history, and debt-to-income ratio are often key considerations.

- Pre-qualification process: Many lenders offer pre-qualification options, allowing you to check your eligibility without impacting your credit score.

- Responsible borrowing: It’s crucial to borrow responsibly and only take out a loan amount you can comfortably repay.

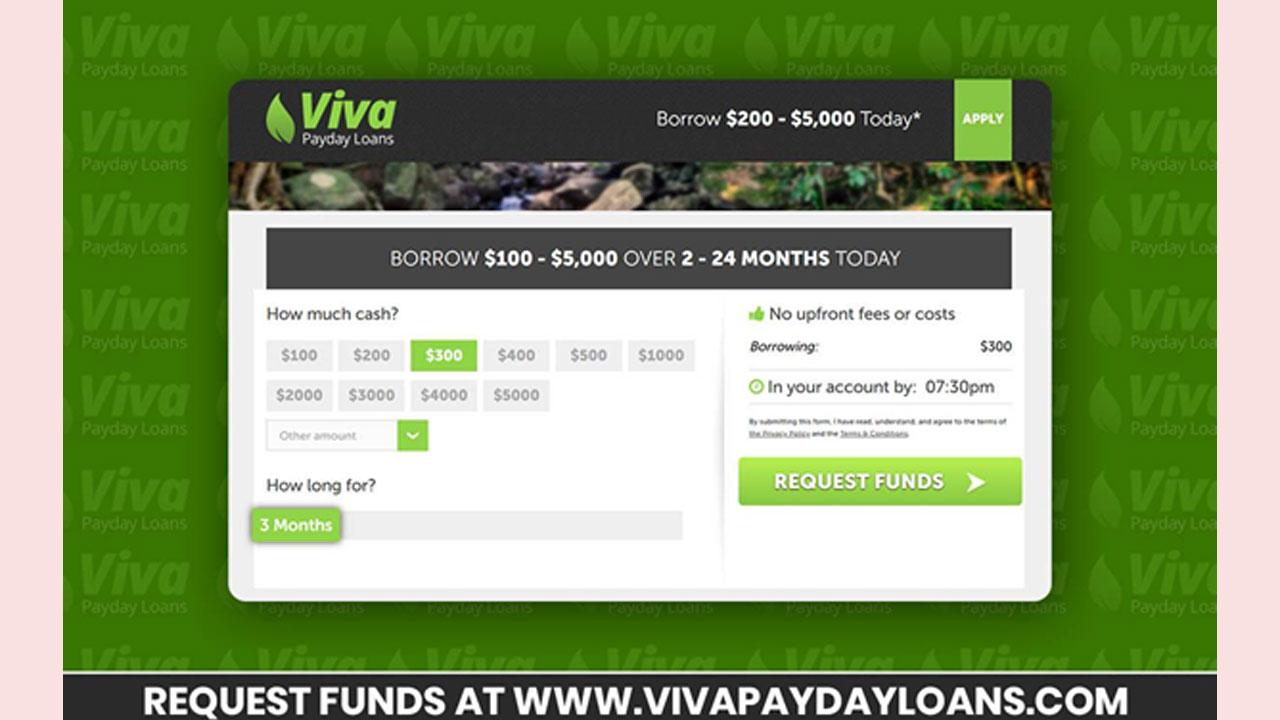

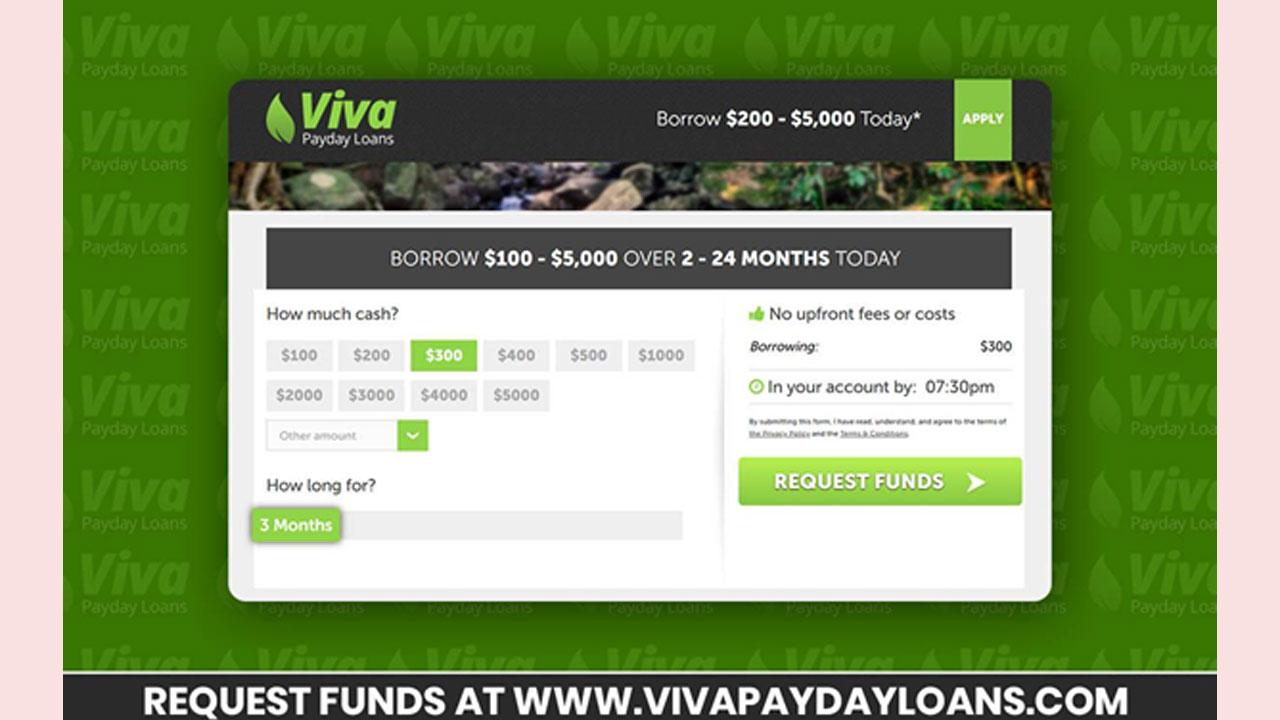

Benefits of Direct Lenders

Applying for a guaranteed tribal loan directly with a lender offers several advantages over using intermediaries.

- Transparency: Direct communication with the lender ensures clarity regarding loan terms and conditions.

- Faster funding: Avoiding intermediaries can often speed up the loan processing and funding time.

- Better interest rates (in comparison to some other lenders): While interest rates vary, dealing directly with a lender can sometimes result in more competitive rates compared to certain other lenders.

- Direct communication: You have direct access to the lender for any questions or concerns.

Finding Reputable Direct Tribal Lenders

Research and Due Diligence

Finding a trustworthy lender is crucial when seeking a guaranteed tribal loan. Thorough research can help you avoid scams and predatory lending practices.

- Check licensing and registration: Verify that the lender is operating legally and is registered with the appropriate tribal authorities.

- Read reviews: Look for independent reviews and testimonials from past borrowers.

- Verify contact information: Confirm that the lender's contact information is accurate and easily accessible.

- Avoid upfront fees: Legitimate lenders typically do not charge upfront fees for loan applications.

Comparing Loan Offers

Once you've identified several potential lenders, carefully compare their loan offers.

- APR (Annual Percentage Rate): Compare the APR to understand the total cost of borrowing.

- Loan amounts: Choose a loan amount that meets your needs without overextending yourself.

- Repayment schedules: Review the repayment terms to ensure you can manage the monthly payments.

- Penalties for late payments: Understand the consequences of late or missed payments.

Online Applications and Security

Many direct tribal lenders offer convenient online application processes. Prioritize security when applying online.

- Secure websites (HTTPS): Ensure the website uses HTTPS encryption to protect your personal information.

- Data encryption: Check the lender's privacy policy to understand how your data is protected.

- Privacy policies: Review the lender's privacy policy to understand how they handle your personal information.

- Avoiding phishing scams: Be cautious of suspicious emails or websites that may attempt to steal your personal data.

Tribal Loans vs. Traditional Bad Credit Loans

Credit Score Impact

How tribal loans affect your credit score depends on the lender and whether they report to credit bureaus.

- Reporting to credit bureaus: Some tribal lenders report to credit bureaus, while others do not. Check with your lender to understand their reporting practices.

- Potential impact on credit score: Responsible repayment can positively affect your credit score, even if the loan itself isn't reported.

- Building credit responsibly: Using tribal loans responsibly can contribute to improving your credit score over time.

Interest Rates and Fees

Interest rates and fees for tribal loans can vary significantly compared to traditional bad credit loans and payday loans.

- APR comparison: Compare the APR of tribal loans with those of traditional bad credit loans and payday loans.

- Loan origination fees: Understand any fees associated with obtaining the loan.

- Prepayment penalties: Check if there are any penalties for repaying the loan early.

Conclusion

Guaranteed tribal loans from direct lenders offer a potential solution for individuals with bad credit seeking financial assistance. They provide a pathway to access funds when traditional options are unavailable. However, remember that responsible borrowing is key. Thoroughly research lenders, compare offers, and understand the terms before committing to a loan. Choose a reputable direct lender to ensure a transparent and fair lending experience. Find the right guaranteed tribal loan for you today! [Link to Lender Directory/Application]

Featured Posts

-

Daywatch The Improbable Homecoming Of Wwii Army Pvt James Loyd

May 28, 2025

Daywatch The Improbable Homecoming Of Wwii Army Pvt James Loyd

May 28, 2025 -

Mendorong Kesuksesan Persemian Gerakan Bali Bersih Sampah Inisiatif Dan Implementasi

May 28, 2025

Mendorong Kesuksesan Persemian Gerakan Bali Bersih Sampah Inisiatif Dan Implementasi

May 28, 2025 -

Is Trump Imposing Sanctions The State Of Us Russia Relations

May 28, 2025

Is Trump Imposing Sanctions The State Of Us Russia Relations

May 28, 2025 -

Research Cuts Spark Staff Revolt At Nih Town Hall Meeting

May 28, 2025

Research Cuts Spark Staff Revolt At Nih Town Hall Meeting

May 28, 2025 -

Comparatif Smartphones Samsung Galaxy S25 Ultra 256 Go Vs Competition

May 28, 2025

Comparatif Smartphones Samsung Galaxy S25 Ultra 256 Go Vs Competition

May 28, 2025

Latest Posts

-

France Et Vietnam Un Partenariat Renforce Pour Une Mobilite Plus Durable

May 30, 2025

France Et Vietnam Un Partenariat Renforce Pour Une Mobilite Plus Durable

May 30, 2025 -

Mobilite Durable Le Partenariat France Vietnam S Intensifie

May 30, 2025

Mobilite Durable Le Partenariat France Vietnam S Intensifie

May 30, 2025 -

Bordeaux Lutte Contre Le Maintien De La Piste Secondaire De L Aeroport

May 30, 2025

Bordeaux Lutte Contre Le Maintien De La Piste Secondaire De L Aeroport

May 30, 2025 -

Cooperation Franco Vietnamienne Vers Une Mobilite Durable

May 30, 2025

Cooperation Franco Vietnamienne Vers Une Mobilite Durable

May 30, 2025 -

Piste Secondaire De L Aeroport De Bordeaux Appel A La Manifestation

May 30, 2025

Piste Secondaire De L Aeroport De Bordeaux Appel A La Manifestation

May 30, 2025