Hanwha And OCI Capitalize On US Solar Import Duties

Table of Contents

Hanwha Q CELLS' Strategic Advantage

Hanwha Q CELLS, a leading solar energy company, has demonstrated remarkable agility in responding to the import duties. Their strategy centers around increased domestic production and enhanced supply chain resilience.

Increased Domestic Production

Hanwha Q CELLS has significantly expanded its US manufacturing facilities, a crucial move in light of the import tariffs. This strategic expansion has yielded several key benefits:

- Increased Production Capacity: The company has boosted its production capacity, allowing it to meet the soaring demand for domestically manufactured solar panels.

- Job Creation: The expansion has led to the creation of numerous jobs in the US, contributing significantly to local economies.

- Investment in Automation: Hanwha Q CELLS has invested heavily in automation technologies, improving efficiency and competitiveness.

- Lower Transportation Costs: Producing solar panels domestically eliminates the high transportation costs associated with importing, leading to greater profitability.

- Reduced Reliance on Imports: This expansion has significantly reduced Hanwha Q CELLS' dependence on foreign suppliers, making it less vulnerable to global supply chain disruptions.

Specific examples of these expansions include new facilities and capacity increases in various US states (insert specific locations and data on capacity increases here if available). This has translated into a noticeable increase in market share for Hanwha Q CELLS in the US. (Insert data on market share gains here if available).

Supply Chain Resilience

By significantly increasing its US manufacturing footprint, Hanwha Q CELLS has built a more resilient supply chain. This translates to:

- Reduced Dependence on Foreign Suppliers: The company is less susceptible to disruptions in international supply chains.

- Faster Delivery Times: Domestic production enables quicker delivery to customers, improving responsiveness and customer satisfaction.

- Better Inventory Management: Closer proximity to the market allows for better control of inventory levels and reduced storage costs.

- Improved Customer Relations: Faster delivery times and greater reliability strengthen customer relationships and build trust.

Hanwha Q CELLS has also implemented initiatives to secure domestic sources for raw materials, further solidifying its supply chain resilience. (Include details on any such initiatives here).

OCI's Polysilicon Dominance

OCI, a major producer of polysilicon—a crucial raw material for solar panel manufacturing—has also benefited significantly from the import duties.

Rising Polysilicon Prices

The import duties have dramatically reduced competition from foreign polysilicon producers, leading to:

- Increased Demand for Domestically Produced Polysilicon: US solar manufacturers are increasingly relying on domestic sources like OCI.

- Reduced Competition from Foreign Producers: The import duties have effectively shielded OCI from cheaper imports.

- Higher Profit Margins: The reduced competition and increased demand have resulted in significantly higher profit margins for OCI.

- Increased Investment in Polysilicon Production: OCI is investing heavily to expand its polysilicon production capacity, further solidifying its market position.

(Insert data on price increases and market share gains for OCI’s polysilicon here if available).

Strategic Partnerships and Investments

OCI is actively pursuing strategic partnerships and investments to strengthen its position in the US solar market. This includes:

- Joint Ventures: Collaborations with other companies to expand production capacity and market reach.

- Technology Licensing Agreements: Sharing technology to improve efficiency and competitiveness.

- Strategic Acquisitions: Acquiring smaller companies to expand its product portfolio and market share.

- Expansion of Production Facilities: Investing in new facilities to meet the growing demand for polysilicon.

(Mention any specific partners or investments made by OCI here).

Impact on the US Solar Industry

The actions of Hanwha Q CELLS and OCI have had a significant impact on the US solar industry.

Job Growth and Economic Benefits

The increased domestic production by these companies has led to:

- Increased Employment in Manufacturing and Related Industries: Creating jobs throughout the supply chain.

- Economic Stimulus in Local Communities: Boosting local economies through investment and job creation.

- Tax Revenue Generation: Generating increased tax revenue for local, state, and federal governments.

Concerns about Market Concentration

While the growth of Hanwha Q CELLS and OCI has brought significant benefits, there are also concerns about potential market concentration:

- Potential for Price Fixing: The dominance of a few players could lead to anti-competitive pricing practices.

- Reduced Innovation: A lack of competition might stifle innovation and technological advancements.

- The Need for Regulatory Oversight: Regulatory oversight is crucial to ensure fair competition and prevent monopolistic practices.

Conclusion

Hanwha and OCI have masterfully capitalized on US solar import duties, transforming challenges into opportunities. Their strategies, focused on increased domestic production, supply chain resilience, and strategic partnerships, have significantly boosted their market positions and contributed to the growth of the US solar energy sector. The benefits are clear: increased domestic manufacturing, significant job creation, enhanced supply chain security, and substantial economic growth. While concerns about market concentration exist, the overall impact on the US solar industry has been largely positive. Learn more about how Hanwha and OCI are shaping the future of US solar energy and the impact of import duties on the renewable energy sector. Follow our blog for updates on Hanwha and OCI and the US solar market.

Featured Posts

-

Trump Plays Down New Russia Sanctions Threat

May 30, 2025

Trump Plays Down New Russia Sanctions Threat

May 30, 2025 -

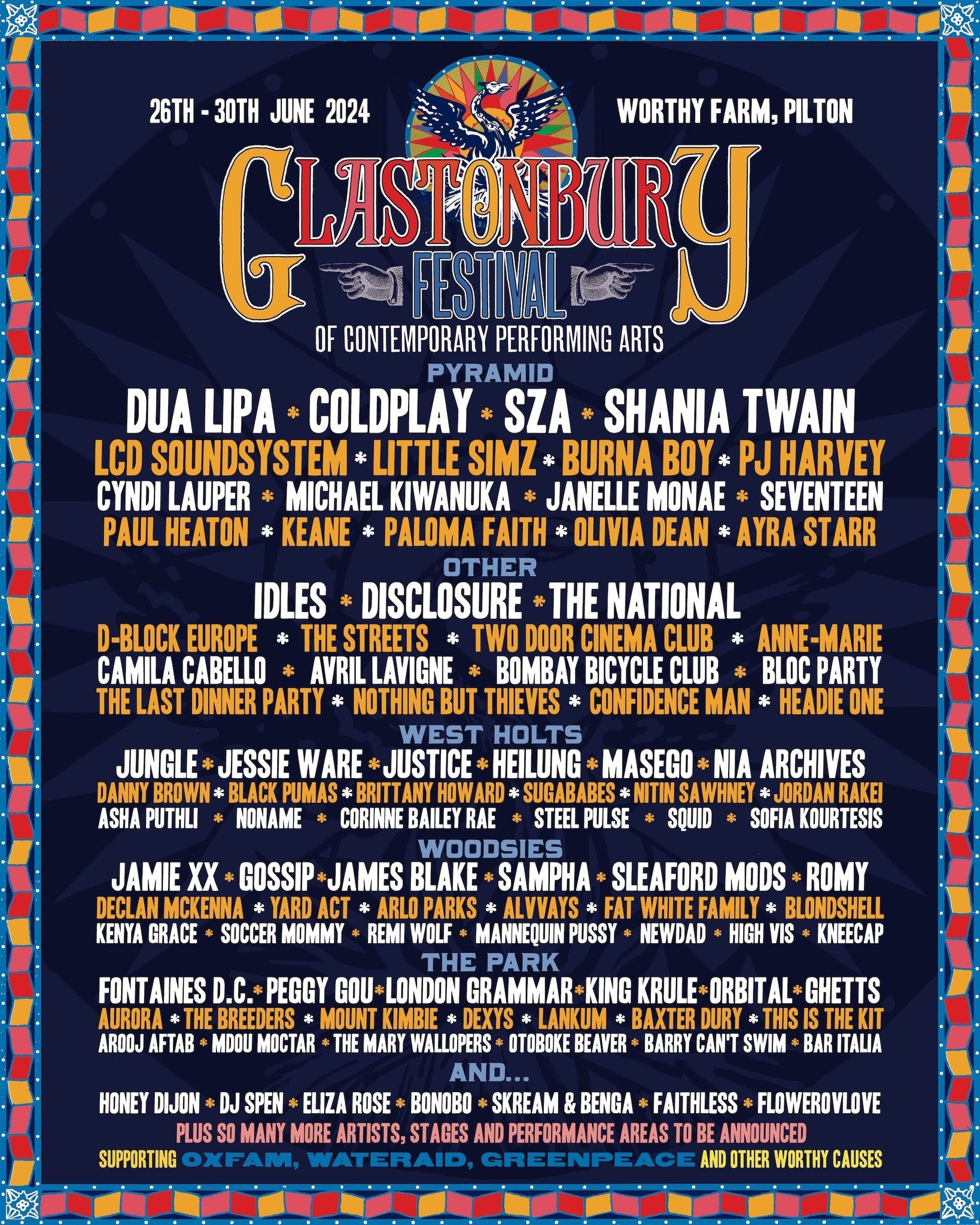

Securing Glastonbury 2025 Tickets The Resale Process Explained

May 30, 2025

Securing Glastonbury 2025 Tickets The Resale Process Explained

May 30, 2025 -

Insults Whistles And Gum The Harsh Reality Faced By Opponents At The French Open

May 30, 2025

Insults Whistles And Gum The Harsh Reality Faced By Opponents At The French Open

May 30, 2025 -

Aspinalls Danger Gustafssons Take On Jones Awareness

May 30, 2025

Aspinalls Danger Gustafssons Take On Jones Awareness

May 30, 2025 -

Dwytshh Bnk Nmw Wtwse Fy Alqtae Almsrfy Alimaraty

May 30, 2025

Dwytshh Bnk Nmw Wtwse Fy Alqtae Almsrfy Alimaraty

May 30, 2025