Harvard's Tax-Exempt Status: President's Statement On Potential Revocation

Table of Contents

The President's Statement and its Implications

President Bacow's official response to the growing scrutiny surrounding Harvard's tax-exempt status was a carefully worded attempt to address concerns while defending the university's mission. The statement acknowledged the considerable size of Harvard's endowment and the ongoing national conversation about tax fairness and the role of non-profit institutions. However, it strongly defended Harvard's commitment to its charitable mission, emphasizing its substantial contributions to research, financial aid, and community engagement.

- Main arguments: The statement highlighted Harvard's extensive financial aid programs, its groundbreaking research contributions, and its commitment to public service.

- Concerns addressed: The statement indirectly acknowledged concerns about the perception of wealth concentration within the university and its impact on accessibility.

- Impact on fundraising: The uncertainty surrounding Harvard's tax-exempt status could negatively impact future fundraising efforts, potentially hindering the university's ability to support its vital programs.

- Legal ramifications: A revocation would trigger extensive legal challenges and could set a significant precedent for other non-profit institutions with substantial endowments.

Arguments for Maintaining Harvard's Tax-Exempt Status

Harvard's continued tax-exempt status is defended on the grounds of its significant contributions to society, far outweighing any concerns about its substantial endowment. The university's supporters argue that its tax exemption is justified by its commitment to public good.

- Substantial financial aid: Harvard provides generous financial aid packages, making a Harvard education accessible to students from diverse socioeconomic backgrounds, regardless of their ability to pay.

- Groundbreaking research: Harvard's faculty and researchers have made countless contributions to scientific advancement, driving innovation and benefiting society as a whole.

- Community engagement: The university engages actively with local communities through various outreach programs, contributing significantly to the social fabric of the surrounding area.

- Quantifiable public benefit: Beyond individual programs, Harvard’s overall contribution to society, measured in research output, educated graduates, and charitable giving, significantly justifies its non-profit status.

Arguments for Revoking Harvard's Tax-Exempt Status

Critics argue that Harvard's massive endowment—one of the largest in the world—undermines its claim to tax exemption. They contend that this immense wealth calls into question the institution's commitment to its charitable mission, particularly in the face of affordability issues.

- Endowment size and potential misuse: The sheer size of Harvard's endowment raises concerns about potential mismanagement and the possibility that funds could be used for purposes inconsistent with its charitable mission.

- Accessibility and affordability: Critics point to the high cost of attendance, arguing that despite financial aid, Harvard remains inaccessible to many low-income students, contradicting its purported charitable mission.

- Tax fairness: Many argue that it's unfair for a wealthy institution like Harvard to receive a tax exemption while ordinary citizens bear the burden of taxes.

- Legal precedents: While precedent for revoking tax-exempt status for such a large and established institution is limited, the argument highlights the potential need for reform in tax regulations for non-profits.

The Legal Framework and IRS Scrutiny

Harvard's tax-exempt status is governed by the Internal Revenue Code Section 501(c)(3), which mandates that organizations operate exclusively for charitable purposes. Increased IRS scrutiny is likely given the ongoing national debate and could lead to significant legal challenges.

- 501(c)(3) criteria: Maintaining 501(c)(3) status requires rigorous demonstration of charitable purpose, transparency in financial management, and adherence to strict guidelines.

- Revocation process: The IRS can revoke tax-exempt status through a complex legal process, potentially involving audits, investigations, and legal proceedings.

- Legal precedents and court cases: While few direct precedents exist for revoking the tax-exempt status of universities with similarly large endowments, past cases involving other non-profits provide a framework for potential legal challenges.

Conclusion

The debate surrounding Harvard's tax-exempt status is far from settled. President Bacow's statement, while attempting to address concerns, has only amplified the ongoing discussion regarding tax fairness, the responsibilities of non-profit institutions, and the future of higher education funding. The arguments for and against revocation highlight complex issues with far-reaching implications. Understanding the legal framework and the intricacies of the arguments is crucial.

Call to Action: Follow the debate on Harvard's tax exemption and learn more about the implications of Harvard's potential tax-exempt status revocation by researching relevant IRS regulations and Harvard's official statements. Stay informed and engage in constructive dialogue to shape the future of higher education and tax policy.

Featured Posts

-

Keir Starmers New Immigration Plan A Response To Farages Influence

May 05, 2025

Keir Starmers New Immigration Plan A Response To Farages Influence

May 05, 2025 -

Shaun T Addresses Lizzos Ozempic Use His Honest Opinion

May 05, 2025

Shaun T Addresses Lizzos Ozempic Use His Honest Opinion

May 05, 2025 -

Kolkata To Sizzle Temperature Forecast Above 30 C In March

May 05, 2025

Kolkata To Sizzle Temperature Forecast Above 30 C In March

May 05, 2025 -

Indy Cars 2024 Season A Look At The Fox Broadcast

May 05, 2025

Indy Cars 2024 Season A Look At The Fox Broadcast

May 05, 2025 -

The Enduring Appeal Of Fleetwood Macs Most Popular Songs

May 05, 2025

The Enduring Appeal Of Fleetwood Macs Most Popular Songs

May 05, 2025

Latest Posts

-

Simone Biles At The Kentucky Derby A Riders Up Moment

May 05, 2025

Simone Biles At The Kentucky Derby A Riders Up Moment

May 05, 2025 -

Simone Biles Kentucky Derby Appearance Riders Up Call

May 05, 2025

Simone Biles Kentucky Derby Appearance Riders Up Call

May 05, 2025 -

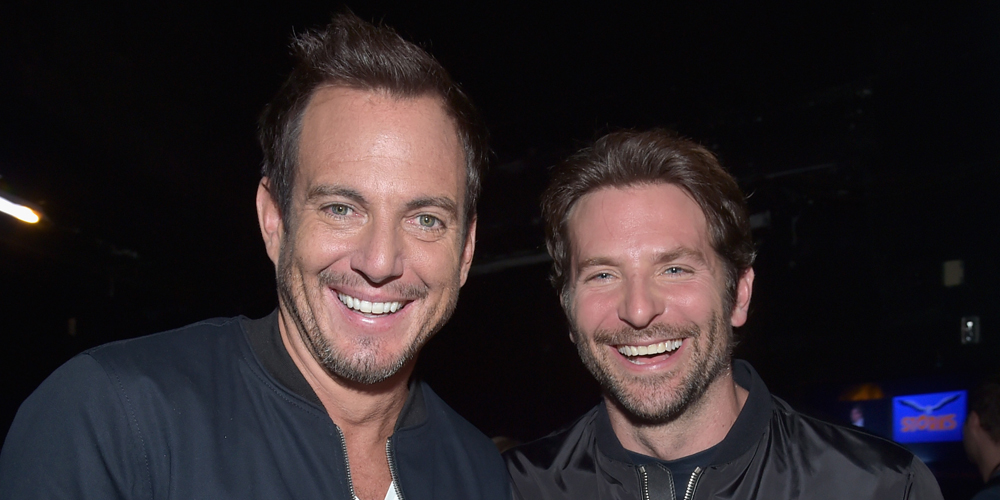

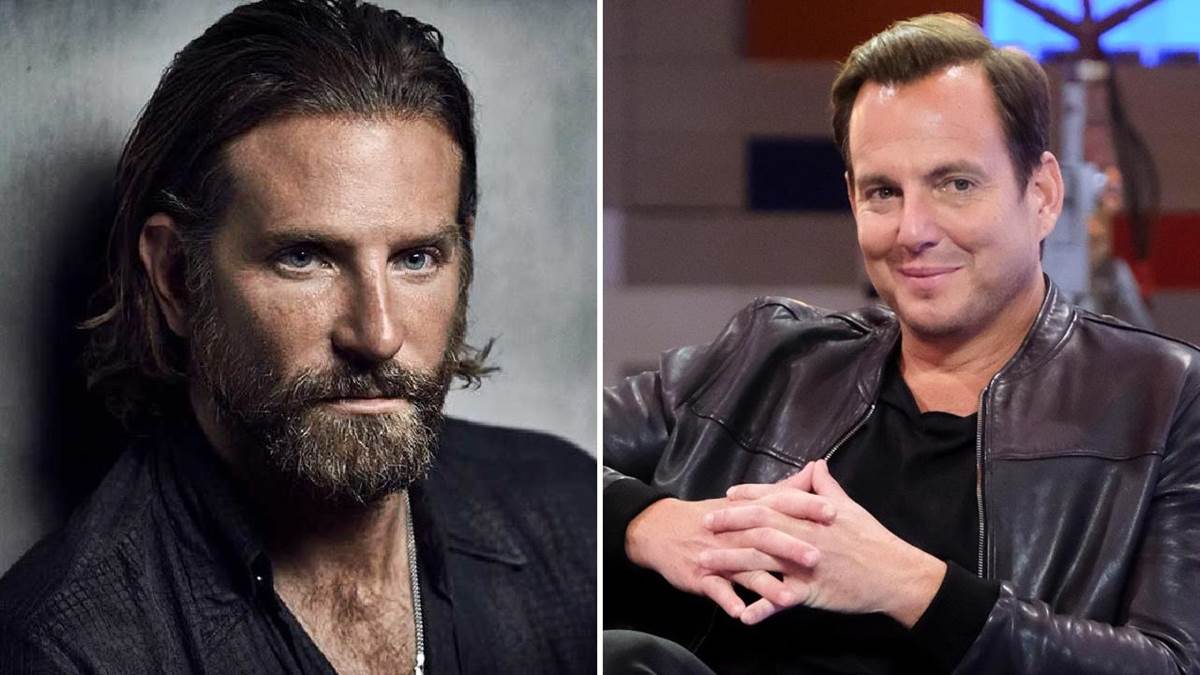

Is This Thing On Production New Photos Of Bradley Cooper And Will Arnett Filming In Nyc

May 05, 2025

Is This Thing On Production New Photos Of Bradley Cooper And Will Arnett Filming In Nyc

May 05, 2025 -

Nyc Filming Bradley Cooper Directs Will Arnett For Is This Thing On Photo 5133892

May 05, 2025

Nyc Filming Bradley Cooper Directs Will Arnett For Is This Thing On Photo 5133892

May 05, 2025 -

Bradley Cooper And Will Arnett Behind The Scenes Photos From Is This Thing On Set

May 05, 2025

Bradley Cooper And Will Arnett Behind The Scenes Photos From Is This Thing On Set

May 05, 2025