High Stock Market Valuations: BofA's Analysis And Investor Guidance

Table of Contents

BofA's Assessment of Current High Stock Market Valuations

BofA's stance on current market valuations tends to be cautiously optimistic, acknowledging the elevated levels but also pointing to factors that could support continued growth. However, they consistently emphasize the importance of careful risk management given the current environment.

- Key metrics BofA uses to assess valuations: BofA utilizes a range of metrics, including the Price-to-Earnings ratio (P/E ratio), the Shiller PE ratio (CAPE ratio, which considers inflation-adjusted earnings), and various sector-specific valuation ratios. These metrics help to gauge whether the market is trading at historically high or low levels relative to earnings.

- BofA's predictions for future market performance: BofA's predictions often incorporate a range of scenarios, reflecting the inherent uncertainty in the market. Their projections usually account for potential impacts from inflation, interest rate changes, and geopolitical events. They typically emphasize the importance of a diversified approach rather than making definitive market predictions.

- Specific sectors highlighted by BofA: BofA's analysis often highlights specific sectors that appear overvalued or undervalued based on their valuation metrics and growth prospects. For example, they might point to technology stocks as potentially overvalued in a period of rising interest rates, while identifying value opportunities in sectors less sensitive to interest rate changes. Their reports usually delve into these sector-specific analyses in detail.

SEO Keywords: BofA stock market analysis, high valuation stocks, stock market valuation metrics, PE ratio analysis, CAPE ratio, Shiller PE.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current high stock market valuations. Understanding these factors is crucial for navigating the market effectively.

- Low interest rates: Historically low interest rates make borrowing cheaper for corporations, leading to increased investment and potentially higher earnings. This, in turn, can support higher stock prices. However, this also decreases the attractiveness of fixed-income investments, pushing more money into the stock market.

- Quantitative easing (QE): QE programs, implemented by central banks to stimulate economic growth, increase the money supply, which can contribute to higher asset prices, including stocks. However, this can also lead to inflation if not managed properly.

- Strong corporate earnings growth: In periods of economic expansion, many companies experience strong earnings growth, supporting higher stock valuations. This is a key driver when analyzing stock market performance.

- Geopolitical factors: Geopolitical events and uncertainty can significantly impact market sentiment, leading to either increased risk aversion (potentially lowering valuations) or a flight to safety (potentially pushing valuations higher, depending on the perceived safety of certain sectors).

SEO Keywords: Macroeconomic factors, interest rates, quantitative easing, corporate earnings, geopolitical risks, stock market drivers, economic expansion.

Investor Strategies in a High-Valuation Market

BofA's analysis often suggests a cautious but not necessarily bearish approach to investing in a high-valuation market. The key is to adopt strategies that mitigate risk while still participating in potential market gains.

- Diversification strategies: Diversification across different asset classes (stocks, bonds, real estate, etc.) and sectors is paramount to reduce overall portfolio risk. This helps to mitigate the impact of any single sector or asset class underperforming.

- Sector-specific investment recommendations: Based on BofA's analysis, investors might consider overweighting sectors that appear undervalued or less sensitive to interest rate changes, while being more cautious with sectors deemed overvalued.

- Long-term investing vs. short-term trading: A long-term investment horizon allows investors to ride out market fluctuations and benefit from the long-term growth potential of the market. Short-term trading, on the other hand, is significantly riskier in a high-valuation environment.

- Consideration of alternative investments: Alternative investments like real estate, private equity, or commodities can offer diversification benefits and potentially less correlation with traditional stock markets.

SEO Keywords: Investment strategies, diversification, risk management, long-term investing, alternative investments, sector allocation, asset allocation.

Managing Risk in a High Valuation Environment

Managing risk is crucial in a high-valuation market. Understanding potential downsides is key to protecting your investment.

- Due diligence and thorough research: Conduct thorough due diligence on any investment before committing capital, focusing on the company's fundamentals, competitive landscape, and potential risks.

- Realistic expectations and loss management: Set realistic expectations for returns and develop a plan to manage potential losses, including stop-loss orders or other risk mitigation techniques.

- Strategies to protect against market corrections: Consider hedging strategies to protect your portfolio against potential market corrections. This could include options strategies or allocating a portion of your portfolio to less volatile assets.

SEO Keywords: Risk management, due diligence, market correction, hedging strategies, portfolio protection, stop-loss orders.

BofA's Recommendations and Future Outlook

BofA's overall recommendations typically advocate for a balanced approach, acknowledging the risks associated with high stock market valuations while also recognizing the potential for continued growth in specific sectors.

- Key takeaways from BofA's analysis: A common theme is the importance of a long-term perspective, diversification, and careful risk management.

- Predicted market trajectory: BofA's predictions vary depending on the specific report and the prevailing economic conditions. They usually outline different scenarios, highlighting potential risks and opportunities.

- Suggested actions for investors: Recommendations often involve maintaining a diversified portfolio, carefully evaluating individual investments, and considering hedging strategies to protect against market downturns. Specific advice regarding "buy, hold, or sell" signals often depends on individual investment goals and risk tolerance.

SEO Keywords: BofA recommendations, market outlook, investment advice, portfolio management, financial planning.

Conclusion

High stock market valuations present both opportunities and challenges for investors. BofA's analysis provides valuable insights into the current market dynamics, emphasizing the importance of diversification, thorough research, and a long-term investment strategy. Understanding the factors driving high valuations and carefully considering risk management strategies are crucial for navigating this complex environment.

Call to Action: Stay informed on the latest developments regarding high stock market valuations by regularly reviewing BofA's reports and other credible financial news sources. Develop a robust investment plan that addresses the challenges posed by high valuations to effectively manage your portfolio and achieve your financial goals. Learn more about mitigating the risks associated with high stock market valuations and make informed investment decisions today.

Featured Posts

-

The Countrys Top New Business Locations A Geographic Analysis

May 15, 2025

The Countrys Top New Business Locations A Geographic Analysis

May 15, 2025 -

Analyzing United Healths Leadership Change Assessing Hemsleys Chances For Success

May 15, 2025

Analyzing United Healths Leadership Change Assessing Hemsleys Chances For Success

May 15, 2025 -

Stocks Surged Sensex Soars Top Bse Gainers Up Over 10

May 15, 2025

Stocks Surged Sensex Soars Top Bse Gainers Up Over 10

May 15, 2025 -

De Npo En Het Herstel Van Vertrouwen De Rol Van Het College Van Omroepen

May 15, 2025

De Npo En Het Herstel Van Vertrouwen De Rol Van Het College Van Omroepen

May 15, 2025 -

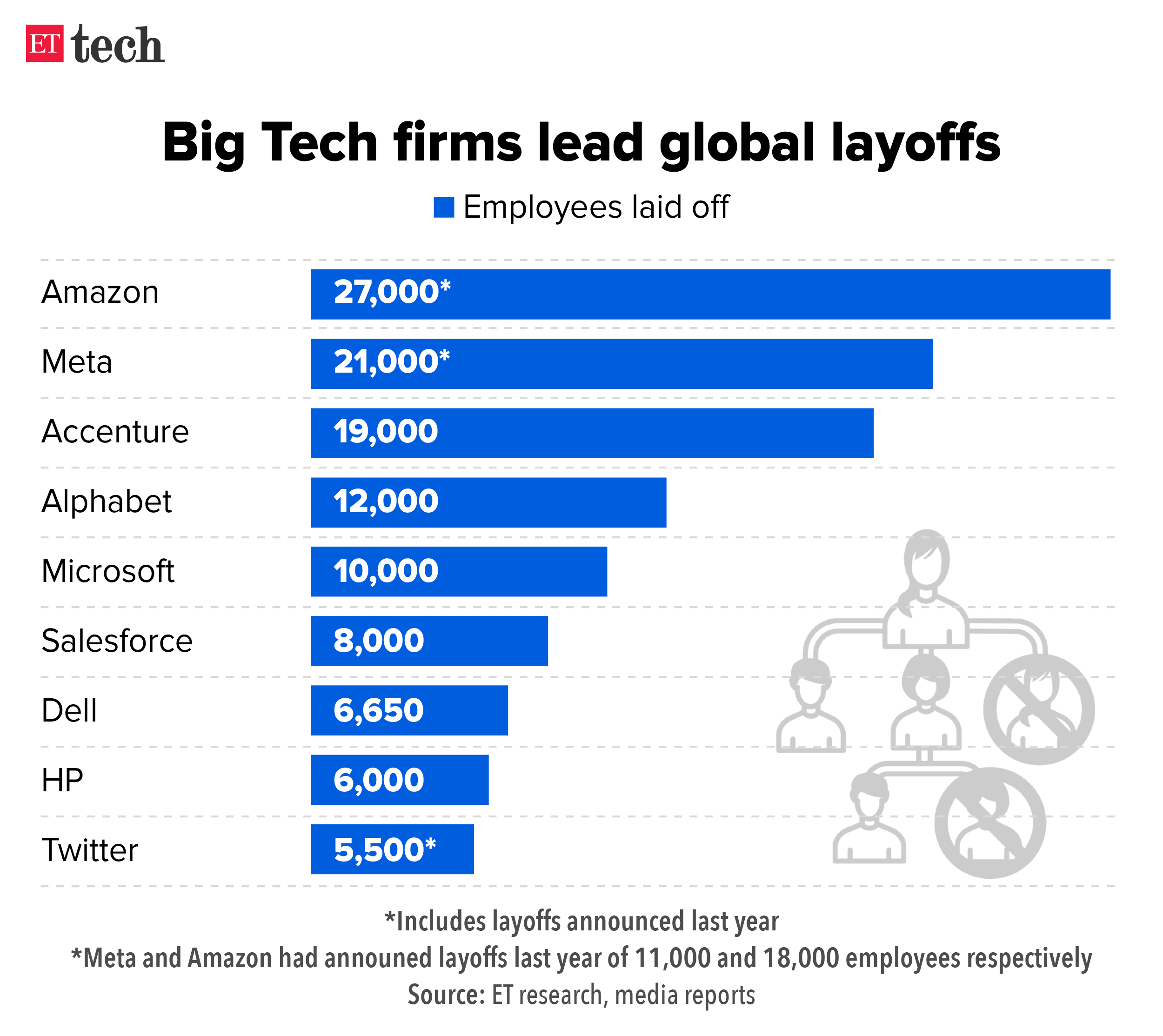

Microsofts 6 000 Employee Layoffs What We Know

May 15, 2025

Microsofts 6 000 Employee Layoffs What We Know

May 15, 2025

Latest Posts

-

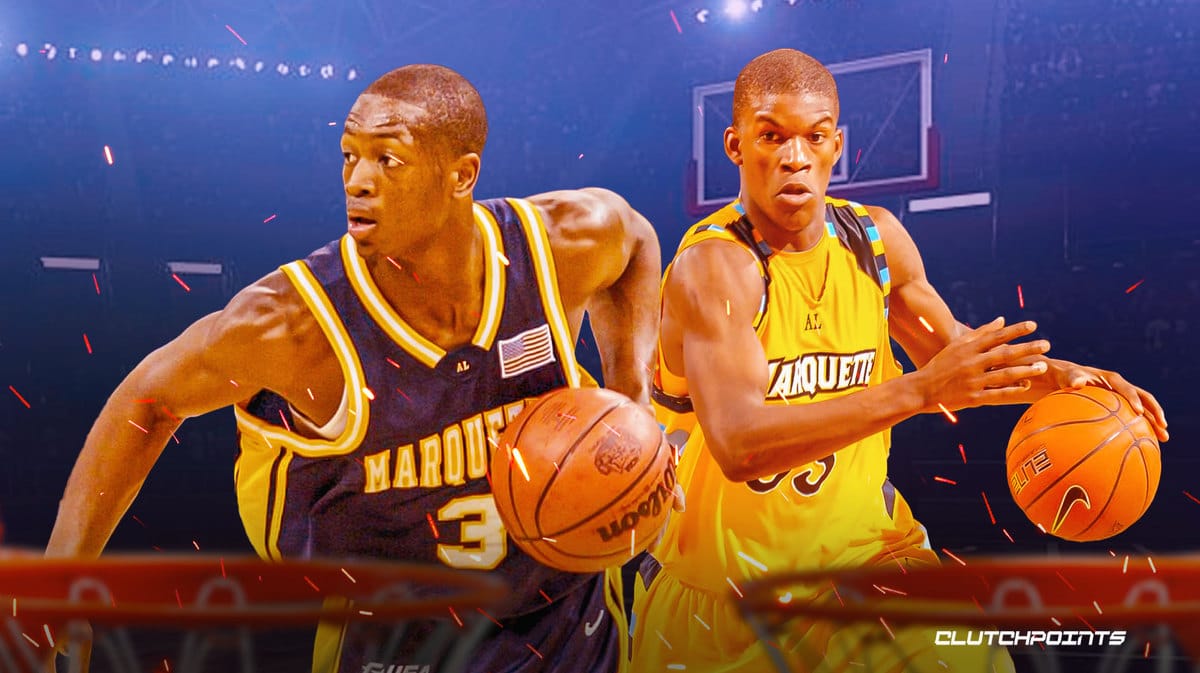

The Warriors Need Jimmy Butler Not Another Kevin Durant

May 15, 2025

The Warriors Need Jimmy Butler Not Another Kevin Durant

May 15, 2025 -

Analysis Dwyane Wades Perspective On Jimmy Butler Leaving Miami Heat

May 15, 2025

Analysis Dwyane Wades Perspective On Jimmy Butler Leaving Miami Heat

May 15, 2025 -

Why Jimmy Butler Not Kevin Durant Is The Perfect Fit For The Golden State Warriors

May 15, 2025

Why Jimmy Butler Not Kevin Durant Is The Perfect Fit For The Golden State Warriors

May 15, 2025 -

Dwyane Wade On Jimmy Butlers Miami Heat Departure His Thoughts

May 15, 2025

Dwyane Wade On Jimmy Butlers Miami Heat Departure His Thoughts

May 15, 2025 -

Jimmy Butler The Missing Piece The Warriors Need Not Kevin Durant

May 15, 2025

Jimmy Butler The Missing Piece The Warriors Need Not Kevin Durant

May 15, 2025