High Stock Market Valuations: Understanding BofA's Optimistic Outlook

Table of Contents

BofA's Bullish Case for High Stock Market Valuations

BofA's optimistic stance on high stock market valuations rests on several key pillars, suggesting that current prices are justified by underlying economic fundamentals and future growth prospects. Their analysis points towards a confluence of factors driving this bullish sentiment.

Strong Corporate Earnings & Profitability

BofA projects robust corporate earnings growth, a key driver underpinning their belief in sustained high stock valuations. This projection is fueled by several factors:

- Resilient Consumer Spending: Despite inflationary pressures, consumer spending remains relatively strong in many sectors, bolstering corporate revenues.

- Technological Innovation Driving Efficiency: Companies are leveraging technology to increase productivity and improve profit margins, leading to stronger earnings. Examples include advancements in AI and automation driving efficiencies across various industries.

- S&P 500 Performance: The S&P 500’s consistent performance, despite geopolitical uncertainties, signals a degree of underlying economic strength and justifies, according to BofA, the current high stock valuations.

Profitability, as measured by profit margins, remains healthy across several key sectors, further supporting BofA's optimistic view. This strong performance, they argue, justifies the currently high price-to-earnings (P/E) ratios observed in the market. The continued robust performance of specific companies within the S&P 500 adds further weight to their argument.

Low Interest Rates and Monetary Policy

The prevailing low interest rate environment plays a significant role in supporting high stock market valuations. Historically low bond yields make equities a more attractive investment, driving capital flows into the stock market and pushing prices higher.

- Quantitative Easing (QE): Past rounds of QE injected significant liquidity into the financial system, further contributing to higher valuations.

- Central Bank Policies: While interest rates are rising, the pace and extent of increases remain a subject of debate, and central banks’ ongoing support has historically helped maintain a relatively supportive environment for stock valuations.

- Historical Context: Comparing current interest rate cycles to historical data offers valuable insights into the relationship between low interest rates and elevated stock valuation multiples.

The interplay between low interest rates and stock valuation multiples forms a cornerstone of BofA's bullish case. The low cost of borrowing encourages companies to invest and expand, boosting future earnings potential and supporting current high stock valuations.

Technological Innovation and Long-Term Growth

BofA highlights the transformative power of technological innovation as a key driver of long-term economic growth and, consequently, high stock market valuations.

- AI and Machine Learning: The rapid advancement of artificial intelligence and machine learning is poised to revolutionize industries and drive significant productivity gains.

- Renewable Energy Transition: The shift towards renewable energy sources presents immense investment opportunities and long-term growth potential.

- Disruptive Technologies: The continuous emergence of disruptive technologies is expected to fuel sustained economic growth and maintain high market valuations for the foreseeable future.

This long-term growth outlook, underpinned by technological advancements, forms a crucial part of BofA's justification for current high stock valuations. Their projections suggest a sustained period of growth, making current prices, in their view, relatively justified.

Counterarguments and Risks Associated with High Stock Market Valuations

While BofA presents a compelling bullish case, it's crucial to acknowledge the counterarguments and risks associated with high stock market valuations.

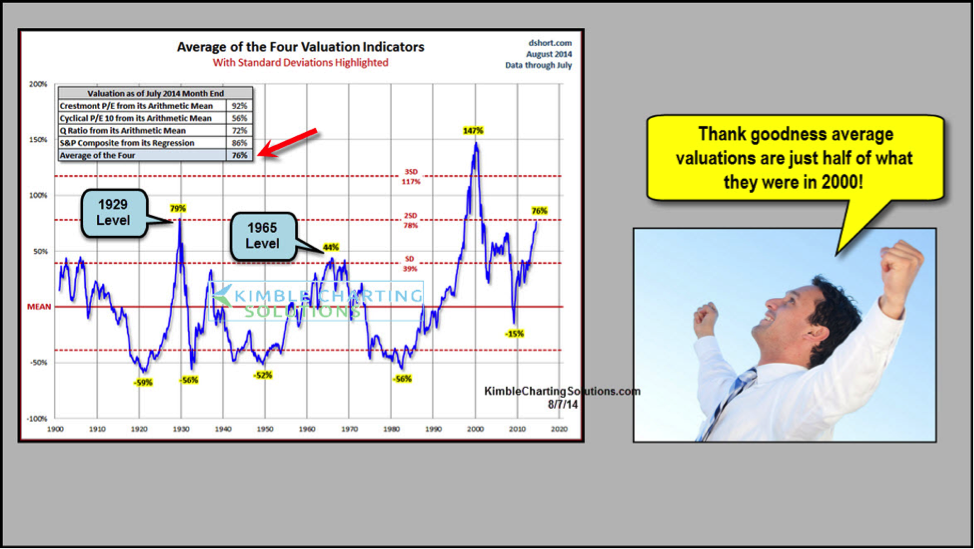

Valuation Metrics and Potential Overvaluation

Several valuation metrics point to potentially inflated market levels.

- High P/E Ratios: Current P/E ratios for many stocks and indices are significantly above historical averages, raising concerns about potential overvaluation.

- Market Bubbles: Some analysts warn of potential market bubbles in specific sectors, driven by speculative trading and excessive optimism.

- Sector-Specific Valuations: A closer look at specific sectors reveals significant variations in valuations, with some sectors displaying considerably higher valuations than others.

The analysis of these valuation metrics is crucial for gaining a comprehensive understanding of the risks associated with high stock valuations. A deep dive into these metrics is necessary before making any significant investment decisions.

Geopolitical and Macroeconomic Risks

External factors pose significant risks to stock valuations.

- Geopolitical Instability: Ongoing geopolitical tensions and conflicts can trigger market volatility and negatively impact investor sentiment.

- Inflationary Pressures: Persistent inflationary pressures can erode corporate profit margins and lead to stock market corrections.

- Recessionary Risks: The possibility of a recession remains a significant concern, potentially leading to a sharp decline in stock prices.

These macroeconomic factors and geopolitical risks underscore the inherent uncertainty in the market and can easily impact investor sentiment and stock valuations. Understanding these risks is crucial for responsible investing.

Conclusion

BofA's optimistic outlook on high stock market valuations rests on strong corporate earnings, low interest rates, and technological innovation driving long-term growth. However, high P/E ratios, potential market bubbles, and significant geopolitical and macroeconomic risks warrant caution. Understanding high stock market valuations requires a balanced perspective, acknowledging both the potential for further growth and the inherent risks. To navigate this complex market landscape effectively, further research is essential. Consider your own investment strategies in the context of high valuation environments and, if needed, seek professional financial advice to manage your portfolio effectively and make informed decisions regarding managing your portfolio in high valuation environments, and navigating high stock market valuations.

Featured Posts

-

Pentrich Brewing At Factory A Comprehensive Guide

Apr 23, 2025

Pentrich Brewing At Factory A Comprehensive Guide

Apr 23, 2025 -

Fdj Monte Apres Ses Resultats Du 17 Fevrier

Apr 23, 2025

Fdj Monte Apres Ses Resultats Du 17 Fevrier

Apr 23, 2025 -

Biotech Receives Boost From Trump Era Fda Actions

Apr 23, 2025

Biotech Receives Boost From Trump Era Fda Actions

Apr 23, 2025 -

Nutriscore Dans Le Morning Retail Qui S Engage Reellement Pour Une Meilleure Nutrition

Apr 23, 2025

Nutriscore Dans Le Morning Retail Qui S Engage Reellement Pour Une Meilleure Nutrition

Apr 23, 2025 -

Easter Sunday And Monday Whats Open And Closed In Pei

Apr 23, 2025

Easter Sunday And Monday Whats Open And Closed In Pei

Apr 23, 2025